Trust funds and family trusts give you a legally distinct “container” to hold assets, set rules, and guide how wealth supports people and causes over multiple lifetimes. Put simply, a trust lets a trustee manage property for beneficiaries under instructions you define. When thoughtfully designed, trust funds and family trusts can reduce administrative friction, keep sensitive matters private, and align money with values long after you’re gone. This guide offers a practical playbook: what to decide, how to structure it, and which guardrails keep wealth resilient.

At a glance, here’s the path: (1) clarify purpose and beneficiaries, (2) choose the right trust structure, (3) appoint capable trustees and governance, (4) codify distribution rules, (5) create an investment policy, (6) optimize taxes and the trust’s legal home, (7) fund it properly, (8) earmark education/health/housing, (9) add protections, (10) build transparency and learning, (11) stress-test cash flows, (12) maintain with a steady cadence. Follow these steps and you’ll replace anxiety with an operating system for your family’s capital and character. For legal and tax decisions, consult qualified professionals in your jurisdiction; this article is educational, not advice.

1. Define Purpose and Beneficiaries with Precision

Start by writing a clear purpose statement that explains why the trust exists and what “success” means. Do you want to cover core life expenses, seed entrepreneurship, support charity, or preserve a family asset like a home or business? Spell out who qualifies as a beneficiary and under what conditions (birth, adoption, marriage, step-relationships). Clarify whether the trust supports only direct descendants or includes spouses and extended family. The sharper your definitions, the less room for confusion, disputes, or inconsistent trustee decisions later. This is also where you articulate family values that money should express—education, service, stewardship, or innovation.

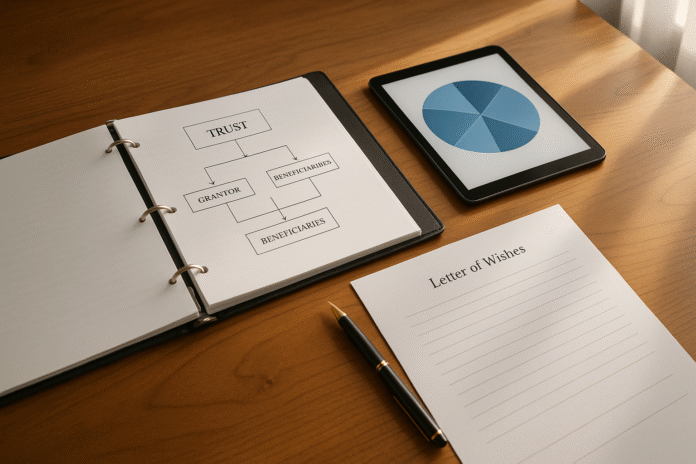

Now translate purpose into eligibility and priorities. A useful trick is drafting two companion documents: the binding trust instrument and a nonbinding “letter of wishes.” The letter of wishes gives trustees context for gray areas—think of it as the family’s “voice” over time. Define “need” and “merit” with examples (medical necessity, credible business plan, accredited degree). State how the trust should balance fairness and flexibility: equal shares, needs-based grants, or milestone-driven awards. Avoid vague verbs like “support” without conditions; pair them with criteria and examples so trustees can act consistently.

Mini-checklist

- Purpose: One paragraph that names outcomes and trade-offs.

- Beneficiaries: Who is in, who isn’t, and how that changes over time.

- Priority order: Essentials (health/education) before lifestyle extras.

- Values: 3–5 principles (e.g., self-reliance, integrity, prudence).

- Letter of wishes: Scenarios, examples, and tone.

Numbers & guardrails

- Define a needs threshold (e.g., the trust helps when emergency reserves fall below 6 months of expenses).

- Cap single disbursements without co-funding (e.g., trust covers up to 70% of a first-home down payment, beneficiary must contribute 30%).

- Require documentation: invoices, acceptance letters, business budgets.

Close by stress-testing your definitions with “hard cases” (addiction, divorce, disability). When your purpose is concrete, trustees can deliver consistent, compassionate decisions that preserve wealth and relationships.

2. Choose the Right Trust Structure for the Job

The structure determines control, tax treatment, and flexibility. A revocable living trust is primarily an ownership wrapper while you’re alive; you can change it, and it often streamlines estate administration. An irrevocable trust trades flexibility for protection and potential tax benefits; you generally cannot pull assets back. A discretionary trust gives trustees latitude to meet beneficiaries’ needs rather than locking in automatic payouts. Spendthrift provisions can shield assets from a beneficiary’s creditors and prevent premature dissipation. For multigenerational planning, a dynasty trust can preserve assets over many generations, subject to local perpetuity rules. Match the tool to the job, not vice versa.

Use a simple decision lens: What must be flexible, and what must be protected? If asset protection and long-horizon compounding matter most, lean irrevocable and discretionary with clear standards. If simplifying probate and continuity is your priority, a revocable trust might be the hub that later “pours over” into irrevocable sub-trusts. Consider special-purpose trusts for disabled beneficiaries, charitable goals, or business continuity. Finally, pick a legal home (situs) that aligns with your objectives and the trustee you plan to use.

Quick comparison table

| Trust type | Best for | Flexibility | Typical protections |

|---|---|---|---|

| Revocable | Administration, continuity | High while grantor lives | Minimal asset protection |

| Irrevocable (discretionary) | Protection, long-term compounding | Lower, by design | Creditor/divorce resistance, tax features |

| Dynasty | Multi-generation planning | Moderate via trustee discretion | Continuity, rules against premature spend |

Common mistakes

- Choosing structure before defining purpose.

- Assuming every jurisdiction treats trusts the same.

- Over-automating distributions (guaranteed allowances) that undermine incentives.

A structure that fits your aims reduces friction, withstands life’s messiness, and keeps wealth aligned with intent.

3. Select a Competent Trustee and Build Governance That Works

Trustees execute your instructions, manage assets, and make judgment calls. Start by deciding among an individual trustee (family member or friend), a professional/corporate trustee, or a hybrid model with both. Individuals can offer insight and empathy; professional trustees bring continuity, systems, regulation, and conflict management. A committee with voting rules can blend strengths and dilute biases. Document how vacancies are filled and when a trustee can be removed or replaced, and consider appointing a trust protector with specific oversight powers.

Set expectations in writing: standards of care (fiduciary duty), decision processes, conflict-of-interest policies, and documentation norms. Require periodic reviews, minutes for key decisions, and formal acknowledgement of the letter of wishes. Outline escalation paths: when must the trustee consult outside experts (tax, legal, investment)? Establish service level basics: response times, annual reporting, and beneficiary communications. Clarity up front prevents drift and resentment.

Numbers & guardrails

- Quorum/votes: For a 3-person committee, require 2 votes for routine matters and unanimity for structural changes.

- Response times: Acknowledge requests within 10 business days; resolve routine distributions within 30.

- Compensation bands: Define trustee fees or reference an external schedule to avoid surprises.

Tools/Examples

- Trustee charter (one-page role statement).

- Conflict-of-interest disclosure form.

- Annual calendar: audit, investment review, beneficiary meetings.

A thoughtful governance design anchors trustworthiness—literally. It ensures human relationships don’t derail financial stewardship.

4. Draft Airtight Distribution Rules with Incentives and Safeguards

Distribution language drives day-to-day outcomes. Start with the HEMS standard—health, education, maintenance, support—which gives trustees latitude tied to defined needs. Then layer incentive provisions that reward constructive behaviors without becoming punitive. For example, the trust might match earned income up to a ceiling, co-fund credible business ventures, or contribute to a first-home down payment. Build safety valves: hardship exceptions, addiction treatment pathways, and mechanisms to pause payments if a beneficiary is impaired or endangered.

Avoid “allowances” that entrench dependency. Instead, design tiered support: essentials first; co-funded opportunities second; luxuries last and limited. Specify documentation requirements and time windows (e.g., submit a tuition invoice before the term starts). Protect trustees with process language: if they document what they reviewed and how they applied the standard, their decision stands absent bad faith.

Numeric mini case

Suppose the trust targets 4% real annual spending. A beneficiary requests a $60,000 distribution for graduate school. The trustee validates enrollment and approves tuition and books ($48,000), offers a $6,000 stipend conditioned on part-time work or research assistantship, and defers a $6,000 relocation request until updated budgets arrive. This keeps total support aligned with the spending rule and ties extras to initiative.

Mini-checklist

- Define HEMS with examples.

- Set caps: single payout limits and annual ceilings.

- Add co-funding ratios (e.g., trust 70% / beneficiary 30%).

- Build pause/rehab provisions for impairment.

- Require receipts, budgets, and timelines.

Tight but humane rules reduce conflict, preserve capital, and help beneficiaries grow into responsibility.

5. Create a Trust Investment Policy Statement (TIPS) and Asset Allocation

Your investment policy translates purpose into portfolio design and behavior. Start by specifying objectives (preserve purchasing power, fund education, back entrepreneurship), risk tolerance, time horizon, and liquidity needs. Decide the base asset mix—public equities, high-quality bonds, cash reserves, and alternatives where appropriate. Define rebalancing bands, manager selection criteria, and cost controls. If the trust owns a concentrated asset (private business, real estate), document how to manage concentration risk and succession options. Include spending policy mechanics—percentage of market value, smoothed formula, or needs-based draws.

Set reporting standards: benchmark selections, performance measurement frequency, and how to evaluate managers net of fees. Clarify permissible instruments and what requires additional approval (derivatives, leverage, illiquid commitments). A good TIPS is one to three pages—short enough to use, concrete enough to guide.

Numbers & guardrails

- Liquidity reserve: 12–24 months of expected distributions in cash-like instruments.

- Rebalancing bands: ±20% of target weight (e.g., 60% equities → rebalance at 48% or 72%).

- Fee ceiling: Aim to keep all-in costs under a defined threshold (e.g., under 0.80% for a primarily passive mix).

- Spending rule: 3.5%–4.0% of a trailing average market value for long-horizon trusts.

Tools/Examples

- Core allocation: global equity index funds, investment-grade bonds, short-term reserves.

- For concentrated business holdings: dividend policy, buy-sell agreement triggers, independent valuation cadence.

A crisp TIPS prevents improvisation under stress and keeps investments aligned with mission, not moods.

6. Optimize Taxes and Choose the Right Situs (Legal Home)

Trust taxation and legal rules vary by jurisdiction, so the aim is to select a situs that supports your goals and to structure the trust—grantor or non-grantor, revocable or irrevocable—accordingly. A grantor trust often treats income as if earned by the grantor, simplifying filings and allowing tax “burn” to preserve trust principal. A non-grantor trust may pay its own taxes, potentially at different brackets, with distributions carrying out income to beneficiaries. Situs can influence creditor protection standards, trustee powers, perpetuity limits, and administrative costs. Align these factors with your purpose and the types of assets you hold.

Plan distributions with tax character in mind: ordinary income, qualified dividends, capital gains, and tax-exempt income may be treated differently for beneficiaries. Consider whether certain assets (like tax-deferred accounts or primary residences) belong inside or outside the trust to avoid unintended tax outcomes. For cross-border families, coordinate with counsel to avoid double taxation, unexpected reporting, or harmful withholding. When philanthropy is part of the plan, compare donor-advised funds, charitable trusts, and direct gifts.

Numbers & guardrails

- Bracket awareness: Trusts can hit top brackets at relatively low income levels; distributions may shift tax to beneficiaries at their rates.

- Capital gains planning: Decide whether to allocate gains to principal or income in the trust’s accounting policy.

- Withholding: For cross-border beneficiaries, specify who bears foreign withholding and how to claim credits.

Mini-checklist

- Choose situs aligned with protection and administration needs.

- Decide grantor vs. non-grantor based on tax and control.

- Map distribution types to beneficiary circumstances.

- Document cross-border protocols and reporting duties.

Thoughtful tax and situs choices increase net outcomes without compromising the trust’s protective purpose.

7. Fund the Trust Effectively and Document Transfers

A beautifully drafted trust is powerless until you fund it. Retitle accounts, update deeds, and execute assignment documents for business interests and personal property. Coordinate beneficiary designations on life insurance and retirement accounts so they point to the trust (or an appropriate sub-trust) when that fits the plan. Keep a funding checklist and a shared evidence folder containing account confirmations, deeds, valuations, and transfer letters. Work in phases: liquid accounts first, then real property and closely held assets that require more paperwork.

Sequence matters. Consider liquidity: if the trust must make distributions soon, move cash and marketable securities first. For private business equity, pair transfers with governance documents—buy-sell agreements, voting trusts, and management succession plans. For real estate, check mortgage and insurance implications when ownership changes. Maintain an assets register that lists what the trust owns, where it’s held, and who to contact.

Numeric mini case

A family intends to fund the trust with $5,000,000: $2,500,000 in a brokerage account, $1,500,000 real estate equity, and a $1,000,000 minority interest in a family company. They migrate the brokerage in week one, schedule real-estate retitling and insurance updates by week four, and complete the business transfer after an independent valuation and a board consent. Within 60 days, the trust has diversified liquidity plus long-term holdings, and the trustee has a complete documentation trail.

Mini-checklist

- Account retitling letters and confirmations.

- Deeds, assignments, and valuations.

- Updated beneficiary designations where appropriate.

- Centralized assets register with contact info.

Funding is the bridge between “paper plan” and real-world impact; finish it methodically and your trust can start working.

8. Plan for Education, Housing, and Healthcare with Purpose-Built Carve-Outs

The most common and emotionally charged requests touch education, housing, and health. Create sub-trusts or budget carve-outs with clear criteria so trustees can act fairly and quickly. For education, define eligible programs, academic progress standards, and covered costs (tuition, fees, books, modest living). For housing, decide whether the trust will co-own property, provide down-payment assistance, or offer time-limited rent support. For healthcare, establish policies for insurance premiums, out-of-pocket care, and long-term support needs, including disability accommodations.

Balance generosity with sustainability. Pair grants with co-funding to keep beneficiaries engaged and budgets realistic. Use caps and one-time lifetime maximums for large items like housing grants, and require independent quotes for medical procedures beyond routine care. Include a review mechanism for exceptional circumstances to avoid harsh outcomes in edge cases.

Numeric mini case

Assume the trust targets $200,000 per beneficiary across these themes: $120,000 for education (tuition-first policy), $60,000 for housing (down-payment assistance at 2:1 matching), and $20,000 for healthcare deductibles and premiums during early career years. The trustee tracks each bucket and communicates remaining eligibility annually. This keeps support visible, equitable, and finite.

How to implement

- Define eligible expenses and documentation for each category.

- Use lifetime caps and matching ratios.

- For housing, prefer equity participation or secured loans over outright gifts when appropriate.

- Build an appeals process for exceptional needs.

Well-designed carve-outs meet real needs without turning the trust into a bottomless wallet, preserving capital and family harmony.

9. Protect Against Creditors, Divorce, and Spendthrift Risks

Asset protection is a core reason to use trusts. Combine legal provisions with practical processes. Spendthrift clauses can restrict a beneficiary’s ability to assign interests to creditors. Trustee discretion and the absence of enforceable rights to specific distributions strengthen protection. Add conditions that suspend distributions during bankruptcy, litigation, or documented impairment. For high-risk professions or entrepreneurial beneficiaries, consider distributing support in kind (tuition paid to the institution, medical bills paid to providers) to avoid cash being swept by creditors.

Bolster legal drafting with behavioral safeguards: educate beneficiaries about not commingling trust distributions with marital property where that matters, and encourage or require prenuptial or postnuptial agreements before large discretionary support. Build a queue of vetted advisors (legal, tax, counseling) the trustee can activate quickly when a beneficiary is in a vulnerable situation. Document every decision; process is a defense.

Numbers & guardrails

- Suspension triggers: automatic pause on discretionary distributions if a beneficiary is subject to garnishment or files bankruptcy; review every 90 days.

- In-kind ratio: for at-risk beneficiaries, aim for 80% of support paid directly to providers.

- Reinstatement test: require evidence of changed circumstances (e.g., court orders lifted, debt plan agreed).

Mini-checklist

- Spendthrift clause and trustee discretion language.

- In-kind payment procedures.

- Distribution pause and review mechanics.

- Communication templates for sensitive cases.

Protection features buy time and options, allowing wealth to survive storms and continue serving its purpose.

10. Build Transparency, Reporting, and Beneficiary Education

Silence breeds suspicion; transparency, done well, builds trust in the trust. Establish a reporting rhythm: annual letters summarizing investment performance, distributions, and remaining eligibility in key buckets; a plain-English explanation of the spending policy; and a preview of the coming year’s focus. Provide age-appropriate education: basic budgeting and investing for teens and young adults; decision rights and responsibilities for those closer to receiving distributions; and introductions to trustees and advisors. When beneficiaries understand the why and how, they participate constructively rather than feeling controlled.

Create a simple beneficiary portal or shared folder with past reports, the investment policy, and request forms. Offer workshops or recommend courses that build financial literacy and life skills. Encourage beneficiaries to propose projects that align with the trust’s values—service grants, internships, or business ideas with learning goals. Transparency should not mean full financial exposure to minors or sensitive details; calibrate depth by age and role.

Tools/Examples

- Annual one-pager: returns, distributions, and key decisions.

- “How the trust works” explainer with a glossary (HEMS, principal vs. income, discretion).

- Request template requiring purpose, budget, timeline, and measures of success.

Numeric mini case

An annual report shows a 6.2% net portfolio return, $180,000 in total distributions across categories, and an updated 3.8% spending rate. Beneficiaries see how their requests fit into a system rather than a mystery. The result is fewer ad-hoc calls and more thoughtful, timely requests.

Good reporting lowers friction and keeps the culture of stewardship alive, which is essential for long-term wealth.

11. Stress-Test Scenarios and Run Multi-Decade Cash Flows

Longevity, market swings, and life surprises can upend even strong plans. Build a habit of scenario analysis. Project inflows, outflows, investment returns, and inflation over multiple decades, with conservative assumptions and safety margins. Model worst-case paths: lower returns, higher inflation, or multiple beneficiaries drawing heavily at once. Test edge events like the sale of a concentrated asset, a large medical need, or an early liquidation request. Use results to adjust spending rates, asset allocation, or distribution policies.

Pair numbers with narratives. What happens if two beneficiaries pursue graduate school simultaneously? If rental income drops for two years? If a business distribution is delayed? Decide ahead of time which levers you’ll pull: pause discretionary grants, sell noncore assets, or temporarily tilt the portfolio defensive. Document thresholds and the sequence of actions; the plan should be a playbook, not a panic button.

Numbers & guardrails

- Return assumptions: use conservative real returns (e.g., equities 4%–5%, bonds 0%–2%) for stress tests.

- Buffer: maintain 2 years of expected distributions in low-volatility reserves.

- Spending glidepath: reduce spending by 10%–20% following two consecutive down years unless metrics recover.

Mini case

A trust with $10,000,000 targets 3.8% spending ($380,000). Under a stress path with –15% equity drawdown and flat income for a year, reserves cover distributions while spending drops to $304,000. Rebalancing and a modest recovery restore the target the following year without selling core assets at a loss.

Stress testing turns a static document into a resilient system that can hold course through turbulence.

12. Maintain, Amend, and Review with a Clear Cadence

Trusts are living systems of people, assets, and rules. Even irrevocable trusts often allow limited changes through decanting, powers of appointment, or protector actions within defined bounds. Establish a maintenance cadence: annual reviews for investments and distributions; periodic legal and tax check-ins; and generational transitions where roles shift from parents to adult children or professionals. Keep the letter of wishes current and aligned with reality—new babies arrive, careers change, and priorities evolve.

Create a calendar that spaces the work: investment review in the first quarter; education and housing grants assessed in the second; governance and trustee evaluations in the third; beneficiary town hall and reporting in the fourth. Maintain vendor diligence for custodians, administrators, and advisors. Track documents in a shared repository with version control and clear naming conventions. When change is required, document rationale and process so future stewards understand the “why,” not just the “what.”

Mini-checklist

- Annual investment and spending review.

- Legal/tax scan for relevant changes.

- Trustee composition and performance check.

- Update letter of wishes and beneficiary education plan.

Numeric mini case

On a 12-month cycle, the trustee completes four formal reviews, logs 20+ routine decisions with minutes, and publishes one consolidated annual report. A minor decanting consolidates two sub-trusts with overlapping aims into one, cutting administrative costs by an estimated 0.15% of assets. The trust stays nimble without drifting from its purpose.

A reliable cadence is the simplest way to keep the trust alive to the people it serves and faithful to the mission it was built for.

FAQs

What is the difference between a trust fund and a family trust?

A trust is the legal arrangement; a trust fund refers to the assets inside it. A “family trust” is simply a trust designed to benefit family members under rules you set. In practice, people use the phrases interchangeably, but it helps to remember that you’re building both the rulebook and the pool of assets. Thinking in those two layers clarifies decisions about funding, distribution, and governance.

Do I need a lawyer to set up trust funds and family trusts?

Yes, you should work with qualified counsel. Trusts implicate property law, tax, and fiduciary duties that vary by jurisdiction. Templates can help you think, but drafting and funding require precision. A lawyer coordinates deeds, assignments, beneficiary designations, and alignment with your goals. The cost is small relative to the risk of an invalid or ineffective plan.

Who should be my trustee?

Choose someone (or a firm) with competence, integrity, and staying power. Many families use a hybrid: an individual who knows the family plus a corporate trustee for process and continuity. Define voting rules, removal mechanics, and compensation up front. If you anticipate complex decisions, appoint a trust protector to handle oversight without mixing roles.

How much money do I need to justify a trust?

There’s no single threshold. Families create trusts to hold a home, a business, or liquid portfolios from modest to very large. The real question is complexity: Do you want rules for how assets are used, protection from risks, or smoother administration? If the answer is yes, a trust can be warranted regardless of the headline number.

Can beneficiaries be trustees?

They can, but balance control with safeguards. A beneficiary-trustee can create conflicts if distributions benefit themselves. Use co-trustees, independent directors, or require an independent vote for decisions that affect the beneficiary-trustee. Document processes and keep minutes so decisions can be defended if challenged.

What goes into a letter of wishes?

Context, not commands. Explain your values, priorities, and examples of good decisions. Address thorny areas—entrepreneurship funding, addiction treatment, or divorce—and how you’d like trustees to weigh them. Update it as life evolves. Though not legally binding, it’s invaluable for consistent, human decisions.

How do trusts invest differently from individuals?

Trusts invest according to purpose, time horizon, and spending policy defined in a TIPS. They often hold a liquidity reserve to fund distributions and may use more conservative assumptions to protect purchasing power. Concentrated assets require special handling—dividend policy, valuation cadence, and contingency plans—to align with the trust’s obligations.

Are trust distributions taxable to beneficiaries?

It depends on the trust and the character of income. Some distributions carry out taxable income to beneficiaries, while others are treated differently. Coordinate with tax advisors so distributions land where they’re most efficient and compliant. Trustees should communicate the tax character of payments in annual reports.

What if beneficiaries disagree with trustee decisions?

Disagreements happen. Your documents should define discretion, standards, and processes, including how beneficiaries can appeal or request reconsideration. Transparent reporting, clear eligibility criteria, and a documented rationale for decisions reduce conflict. In persistent disputes, independent mediation can resolve issues without damaging relationships.

How often should a trust be reviewed?

Annually at minimum, with topic-specific reviews during the year. Investments, distributions, governance, and legal/tax items each deserve a slot on the calendar. Big life events—births, deaths, marriages, business sales—should trigger immediate check-ins. A steady rhythm keeps the trust tuned to reality.

Conclusion

Trust funds and family trusts are not just legal documents—they are operating systems for values, relationships, and resources. When you define purpose clearly, select structures and trustees that fit, and codify distribution and investment rules with guardrails, you create a durable framework that supports people without enabling dependency. Layer in education, transparency, and stress-testing, and you get a living system that can flex with markets and life while still honoring its mission. The twelve strategies above give you a step-by-step playbook to move from good intentions to dependable outcomes. If you’re ready to translate intent into action, gather your purpose statement, call your advisors, and start building the trust that will carry your legacy forward.

Call to action: Align your values and resources—draft your purpose statement today, then use this guide to build the trust that sustains your family’s future.

References

- Grantor Type Trusts — Internal Revenue Service. https://www.irs.gov/individuals/international-taxpayers/grantor-trusts

- Trusts and Taxes — HM Revenue & Customs. https://www.gov.uk/trusts-taxes

- Uniform Trust Code — Uniform Law Commission. https://www.uniformlaws.org/committees/community-home

- Investor Bulletin: Information for Investors About Trusts and Trustees — U.S. Securities and Exchange Commission. https://www.sec.gov/oiea/investor-alerts-and-bulletins

- Investment Policy Statement Guidance — CFA Institute. https://www.cfainstitute.org

- Family Trusts: Guidance and Best Practices — Society of Trust and Estate Practitioners (STEP). https://www.step.org

- Common Reporting Standard: Trusts and Beneficial Ownership — Organisation for Economic Co-operation and Development. https://www.oecd.org/tax/automatic-exchange/common-reporting-standard/