Reaching financial independence is a math-and-behavior problem you can solve with a clear investing playbook. Here’s the short answer: investing strategies for financial independence boil down to setting a realistic target, choosing a low-cost diversified portfolio, automating contributions, managing taxes and risk, and using a flexible withdrawal plan. If you want a quick, skimmable path, the high-level steps are: define your number, engineer a strong savings rate, set an allocation you can live with, use broad low-cost funds, automate contributions and rebalancing, maximize tax-advantaged accounts, locate assets tax-efficiently, protect against big risks, consider real estate prudently, implement a bond/cash structure, stress-test your plan, and adopt dynamic withdrawal rules. Done well, these strategies compound into time freedom. This article includes a brief, neutral disclaimer: investing involves risk, and personal circumstances vary. Consider consulting a qualified financial professional for personalized advice.

1. Define Your Financial Independence Number and Timeline

Your financial independence (FI) number is the portfolio size that can reasonably support your spending without work being mandatory. Start by clarifying your baseline annual spending on housing, food, healthcare, transportation, and other essentials; then add a lifestyle buffer for travel, hobbies, and surprises. Many investors use a “multiple of spending” approach: multiply your target annual spending by an assumed safe withdrawal rate (SWR) inverse to estimate a portfolio goal. Because markets fluctuate and lifespans vary, treat this as a planning anchor rather than a promise. It is wise to include buffers for healthcare shocks, home repairs, and sequence-of-returns risk (the risk of poor returns early in retirement). Tactically, calculating your FI number converts a vague dream into a measurable target that informs contribution rates, asset allocation, and your desired timeline.

Numbers & guardrails

- A common planning shortcut is the “spending × 25” rule of thumb, which corresponds to an SWR near 4%. If your required spending is 40,000, the target is roughly 1,000,000.

- To be more conservative—especially with a long horizon—use spending × 28–33 (implied SWR ~3–3.6%).

- Include an explicit “unknowns” line item (often 10–20% of spending) for medical, family, or housing variability.

- Consider partial FI: if you plan to earn 10,000 per year in consulting or rental net income, subtract the capital needed to generate that income from your total target.

How to do it

- Track three to six months of real expenses; annualize and add a modest buffer.

- Decide on a target SWR range that suits your risk tolerance.

- Model two or three scenarios (base, cautious, and stretch) to build confidence and flexibility.

- Revisit annually; if spending changes materially, update the goal.

A clear FI number aligns your saving and investing choices with the lifestyle you actually want, reducing noise and increasing follow-through.

2. Engineer a High Savings Rate That Funds Your Plan

The single biggest lever for reaching FI on a reasonable timeline is your savings rate—the share of income you consistently invest. Markets are powerful, but contributions are the fuel. Aim to create a persistent gap between earnings and expenses by trimming non-essentials, optimizing big fixed costs, and raising income through career moves or side projects. Automate transfers on payday so saving is the default, not a decision. A strong savings rate does three things at once: it accelerates compounding, shortens your FI timeline, and lowers the portfolio you need because it builds a habit of living below your means. Many investors underestimate how much agency they have over this component; treating it like a product you are building makes execution much easier.

Numbers & guardrails

- Typical paths to FI often target a 30–50% savings rate while working toward independence; even 15–25% meaningfully changes your trajectory.

- Every additional 10% saved can cut multiple years off your FI path, because you invest more and require less.

- Keep three to six months of core expenses in an emergency fund so market drawdowns never force a sale.

How to do it

- Automate: set recurring transfers to investment accounts on payday.

- Optimize fixed costs: housing, transportation, and insurance usually dominate.

- Increase income: negotiate raises, upskill, or freelance within your expertise.

- Use windfalls: bonuses, refunds, and side-income should flow to investments by default.

- Audit subscriptions: eliminate low-value recurring charges quarterly.

A disciplined savings engine turns the rest of your investment plan from theory into reality by ensuring steady, sizable contributions.

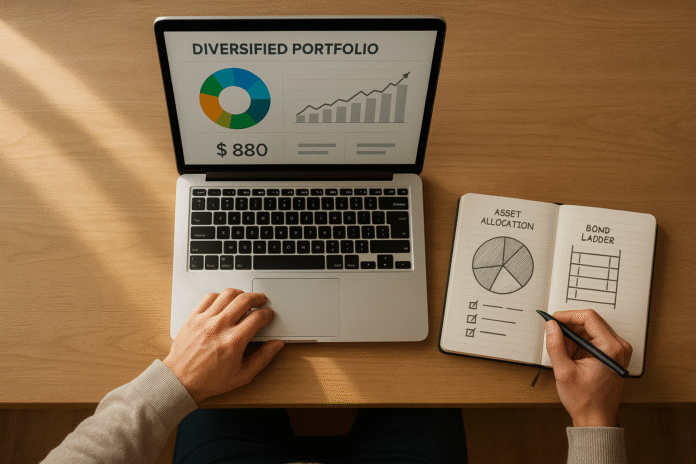

3. Set a Diversified Asset Allocation You Can Live With

Asset allocation—the mix of stocks, bonds, cash, and optionally real assets—drives most long-term portfolio outcomes. Your goal is to choose a risk level that supports growth while keeping you invested through inevitable downturns. Equities provide higher expected returns and volatility; bonds and cash dampen swings and provide liquidity for rebalancing and spending. Global diversification across regions and market caps reduces single-country or sector risks. For many investors, a simple stock/bond split paired with broad diversification is both effective and behaviorally sustainable. The “right” allocation is the one you can hold through deep drawdowns without abandoning your plan.

Numbers & guardrails

- Simple starting points include 80/20 or 70/30 stock/bond allocations while accumulating, trending toward 60/40 or 50/50 as withdrawals begin.

- Use international equities for 20–50% of your stock allocation to reduce home-country bias.

- Keep enough high-quality bonds and cash to cover at least 2–3 years of planned withdrawals once in the drawdown phase.

Common mistakes

- Chasing performance by overweighting last year’s winners.

- Owning too many overlapping funds (unwitting concentration).

- Taking on leverage without a plan for margin calls or rising rates.

- Ignoring currency exposure when investing outside your home country.

How to do it

- Pick a simple core: one total market equity fund plus one total bond fund can be enough.

- Add optional satellites only with a clear reason (e.g., small-cap value tilt).

- Document your target percentages and acceptable ranges; use them to trigger rebalancing.

A clear allocation, chosen deliberately and documented, prevents ad-hoc decision-making and keeps you aligned with your FI timeline.

4. Use Low-Cost Index Funds and ETFs as Your Workhorses

Cost control is a durable edge you fully control, and broad-market index funds or ETFs make it easy. These vehicles deliver diversified exposure at expense ratios that are fractions of a percent. Costs matter because they compound against you, just like returns compound for you. Indexing avoids manager selection risk, reduces turnover (which can lower taxes in taxable accounts), and leaves you with market returns minus modest costs. For most FI seekers, the total-market equity fund plus high-quality bond fund combination is hard to beat for simplicity and reliability. If you prefer ETFs for intraday trading and potential tax efficiency, choose those tracking well-known indexes with ample liquidity.

Numbers & guardrails

- Expense ratios under 0.10% are widely available in equity and bond index funds; many core funds charge around 0.03–0.08%.

- A 1.00% annual fee on a 500,000 portfolio is 5,000 per year; over long horizons that cumulative drag can be six figures.

Tools & examples

- Total U.S. or global stock index fund

- Total international stock index fund

- Total bond market index fund or short-term Treasury fund

- REIT index fund (optional, for real estate exposure)

- ETF equivalents with tight bid-ask spreads and high volume

Common mistakes

- Paying high advisory or fund fees without demonstrable, consistent alpha.

- Over-segmenting into too many narrow ETFs.

- Trading frequently and turning a long-term plan into a timing game.

Low costs, broad diversification, and low turnover create a sturdy baseline that compounds quietly in your favor.

5. Automate Contributions and Dollar-Cost Averaging

Automation converts good intentions into consistent action. Dollar-cost averaging (DCA) simply means investing a set amount on a fixed schedule, regardless of market levels. This habit reduces the stress of trying to time entries, smooths the experience of volatility, and keeps your plan on track even during scary headlines. Paired with automatic payroll deductions or bank transfers, DCA also protects you from lifestyle creep by moving money to investments before you can spend it. While lump-sum investing often has a higher expected return if you happen to have a large cash pile, most people build wealth through recurring income, and DCA is naturally aligned to that reality.

How to do it

- Set up automatic transfers to your investment accounts on payday.

- Pre-specify where each deposit goes based on your target allocation.

- Turn on automatic dividend reinvestment (DRIP) to compound holdings.

- Use contribution “step-ups” to increase investment amounts after raises.

Numbers & guardrails

- A simple structure: 60% of each contribution to equities, 40% to bonds until your allocation target is met; then use rebalancing rules.

- If you receive a large windfall, consider a staged approach (e.g., third over three months) to reduce regret risk while still deploying capital quickly.

Common mistakes

- Pausing contributions during downturns (the best forward returns often follow declines).

- Letting cash accumulate idly for long periods without a specific purpose.

Automation keeps the plan humming in the background, freeing you to focus on work, health, and life while compounding does its job.

6. Maximize Tax-Advantaged Accounts Before Taxable Investing

Tax-advantaged accounts can materially increase your after-tax return, accelerating your FI date. Employer plans and individual retirement accounts often allow pre-tax or tax-free growth; in some regions, health savings accounts (HSAs) and individual savings accounts (ISAs) add further benefits. Prioritize employer matches—they are effectively instant returns on contributions—then consider pre-tax versus tax-free options based on your current and expected future tax brackets. When these accounts are full, turn to taxable accounts with a tax-efficient fund lineup. The overarching idea is to place as much of your long-term compounding as possible where taxes won’t interrupt it each year.

Region-specific notes

- United States: workplace retirement plans and IRAs offer pre-tax or Roth (tax-free growth) structures; HSAs may provide triple tax advantages if used for qualified medical expenses.

- United Kingdom: ISAs allow tax-free growth and withdrawals up to defined allowances; pensions provide tax relief on contributions with rules around withdrawal ages.

- Other regions: many countries offer employer pension schemes or tax-deferred personal plans; check local allowances, matching rules, and withdrawal conditions.

How to do it

- Capture the full employer match first.

- Weigh pre-tax versus Roth-style contributions using your marginal rate today versus expected in retirement.

- Contribute to HSAs or similar accounts if eligible and invest balances for long-term growth.

- After maximizing tax-advantaged space, invest in taxable accounts with tax-efficient funds.

Common mistakes

- Leaving an employer match on the table.

- Holding high-turnover, tax-inefficient funds in taxable accounts.

- Forgetting that withdrawal rules differ among account types.

Prioritizing tax-advantaged accounts lets compounding run with fewer frictions, often pulling FI meaningfully closer.

7. Place Assets Tax-Efficiently and Use Tax-Smart Tactics

Asset location—placing specific assets in specific accounts for tax reasons—improves after-tax returns without changing your overall risk. In general, tax-inefficient assets (like higher-yielding bonds) fit better in tax-deferred accounts, while tax-efficient stock index funds often fit well in taxable accounts. Beyond location, tax-loss harvesting and capital gains harvesting in taxable accounts can reduce tax drag and manage future brackets. The goal is to keep your net, after-tax compounding as close as possible to your gross market return.

Quick reference table

| Account type | Typical use | Tax treatment | Often best for |

|---|---|---|---|

| Tax-deferred (e.g., workplace plan) | Growth, later withdrawals | Contributions may reduce taxable income; withdrawals taxed as ordinary income | Bonds, REITs, high-turnover funds |

| Tax-free growth (e.g., Roth-style) | Growth for long horizon | Contributions taxed upfront; qualified withdrawals tax-free | Highest-growth equities |

| Taxable brokerage | Flexible access | Dividends/interest taxed annually; capital gains when realized | Broad index funds, ETFs, municipal bonds (region-dependent) |

Numbers & guardrails

- Placing a 2%-yield bond fund in a tax-deferred account can avoid annual tax on interest; holding a 0.06% expense-ratio total market ETF in taxable minimizes ongoing tax drag.

- Tax-loss harvesting typically pairs similar but not “substantially identical” funds; maintain market exposure while realizing losses to offset gains or income (subject to local rules).

Mini-checklist

- Map each holding to its most tax-appropriate account.

- Use ETFs or low-turnover index funds in taxable accounts.

- Document a like-kind pair list for harvesting (e.g., two different total market ETFs).

- Be mindful of wash-sale rules when harvesting losses.

Tax-smart placement and tactics are “free alpha” you can capture with a one-time setup and periodic maintenance.

8. Rebalance with Rules and Manage Big Risks

Rebalancing keeps your portfolio aligned with your risk target by trimming overweight assets and adding to underweight ones. Doing so systematically both controls risk and enforces a buy-low/sell-high discipline. Choose either time-based rebalancing (e.g., semiannual) or band-based triggers (e.g., when an asset class drifts more than a set percentage from its target). Alongside rebalancing, address non-market risks that can derail FI—insufficient emergency savings, inadequate insurance for catastrophic events, or concentration in employer stock. Risk management isn’t about predicting storms; it’s about making sure your plan remains seaworthy when they arrive.

Numbers & guardrails

- Common rebalancing bands: ±5 percentage points per asset class or ±20% of the target weight (whichever is larger).

- Keep 3–12 months of core expenses in cash, depending on job stability and upcoming known expenses.

- Cap employer stock exposure to a modest slice (commonly <10%) to avoid concentration risk.

How to do it

- Document target weights and bands; check quarterly or semiannually.

- Use contributions and dividends to nudge back toward targets before selling.

- Rebalance inside tax-advantaged accounts when possible to avoid realizing taxable gains.

- Review insurance (health, disability, liability, property) annually as a portfolio risk hedge.

A rules-based rebalancing and risk framework keeps your plan resilient without turning investing into a part-time job.

9. Use Real Estate Intelligently (Direct or REITs)

Real estate can contribute income, diversification, and inflation sensitivity—but it requires clear-eyed analysis. Public real estate investment trusts (REITs) provide liquid, diversified exposure without landlord duties, while direct property ownership can offer control and potential tax advantages alongside operational complexity. Evaluate deals using cash-on-cash return, cap rate, and realistic expense assumptions; stress-test with higher vacancy and maintenance. Avoid speculative plays that depend on perfect appreciation or unrealistic rent growth. If you prefer simplicity, a low-cost REIT index fund can add real-asset characteristics to a portfolio without leverage or management overhead.

Numbers & guardrails

- For rentals, pro-forma with 5–10% vacancy, 8–12% property management, and a “1% of property value per year” maintenance reserve as a starting point.

- Conservative minimums: aim for positive cash flow after financing, property taxes, insurance, and all reserves.

- For REITs, note that distributions are often less tax-efficient and may fit better in tax-advantaged accounts.

How to do it

- Build a deal checklist: neighborhood comps, inspection, realistic rent, full expense load, financing terms, exit options.

- Model worst-case scenarios (lower rent, longer vacancy, higher repairs).

- Decide upfront whether you’re pursuing appreciation, income, or a balance, and match financing and management accordingly.

- If using REITs, size the allocation modestly within your overall equity bucket.

Thoughtful real estate exposure can complement your core index portfolio, but only when underwritten with conservative, verifiable numbers.

10. Build a Bond Ladder or Cash Bucket for Stability

Fixed income and cash are your ballast, especially as you approach or enter drawdown. A bond ladder—owning bonds that mature at regular intervals—creates predictable cash flows for spending and rebalancing. Alternatively, a “bucket” system holds near-term spending in cash or short-term instruments, with medium-term needs in intermediate bonds and long-term growth in equities. The purpose is the same: reduce the odds you’ll be a forced seller of stocks during a downturn. Choose high-quality issuers and keep durations aligned with your spending horizon; avoid stretching for yield at the cost of credit risk you don’t need.

Numbers & guardrails

- A common approach holds 1–3 years of expected withdrawals in cash-like instruments, 3–7 years in high-quality bonds, and the rest in equities.

- A simple three-rung ladder might mature every 12 months; as one bond matures, you spend it and roll the ladder forward.

- Favor government or top-quality investment-grade bonds for the “defense” role.

Mini-checklist

- Define your annual withdrawal need and multiply to size your cash bucket.

- Choose ladder length based on risk comfort and income sources (e.g., pensions, annuity-like cash flows).

- Keep the structure simple; complexity rarely adds value in the safety sleeve.

A disciplined bond or cash structure turns volatility into a feature—providing dry powder and peace of mind when equities wobble.

11. Stress-Test Your Plan Against Bad Sequences

A great plan anticipates rough patches. Sequence-of-returns risk—the danger of poor returns at the start of retirement—can damage portfolio longevity even when the long-run average is fine. Stress testing examines whether your spending and allocation can survive adverse sequences without derailing your FI goals. Use historical back-tests, forward-looking simulations, and conservative what-ifs: higher inflation, lower returns, job loss, or major medical costs. Build “if-then” playbooks so responses are pre-decided rather than improvised. The point isn’t to become a fortune teller; it’s to ensure your plan is robust across a range of plausible futures.

How to do it

- Back-test your allocation and withdrawal plan across multiple market histories.

- Run Monte Carlo simulations to gauge probability of success at different spending levels.

- Create contingency actions: pause inflation adjustments, temporarily reduce withdrawals, or pick up part-time income if a prolonged slump hits.

- Track leading indicators like valuation extremes only as context, not timing tools.

Numbers & guardrails

- Many dynamic plans pre-commit guardrails: if your portfolio falls below a certain real value threshold, reduce withdrawals by a fixed percentage until it recovers.

- Keep a modest buffer in cash or short-term bonds to avoid selling equities to fund living costs during drawdowns.

Testing and pre-committing responses turns scary markets into actionable playbooks rather than panicked guesswork.

12. Adopt a Flexible Withdrawal Strategy That You Can Live With

Your withdrawal policy is the capstone of an FI plan. A fixed percentage, an inflation-adjusted dollar amount, or guardrail-based rules each has trade-offs in spending stability versus portfolio durability. Flexibility often wins: spending a bit less after poor returns and a bit more after strong returns can meaningfully improve sustainability. Pair your withdrawal method with the bond/cash structure so regular income needs are met without forced equity sales. Consider taxes, required distributions, and the order of account withdrawals to minimize lifetime tax drag and preserve optionality. The best plan is both mathematically sound and behaviorally comfortable.

Numbers & guardrails

- A starting SWR near 3–4% with willingness to make small, rules-based adjustments can balance sustainability and lifestyle stability.

- Guardrail examples: decrease withdrawals by 10% if the portfolio drops below a preset band; resume normal withdrawals after recovery.

- Coordinate withdrawals to fill lower tax brackets first, then draw from tax-advantaged accounts as rules and goals dictate.

How to do it

- Choose a baseline method (percentage, dollar amount, or hybrid).

- Write rules for upward and downward adjustments.

- Map withdrawal order: taxable accounts, then tax-deferred or tax-free, depending on your goals and bracket management.

- Reassess annually; life changes, and your policy should reflect that.

A flexible, rules-based withdrawal strategy reduces regret, matches cash flows to markets, and keeps your plan resilient for the long haul.

FAQs

How do I pick between pre-tax and tax-free (Roth-style) contributions?

Compare your current marginal tax rate with your expected rate during withdrawals. If today’s rate is higher, pre-tax contributions may provide more value; if future rates are likely higher, tax-free contributions can be appealing. Many investors split contributions to diversify tax exposure. Revisit this decision as income, region, and account rules change, and coordinate with your asset location plan.

What expense ratio is “low” for long-term index funds?

For broad equity and bond index funds, expense ratios well under 0.10% are common. The difference between 0.05% and 0.50% compounds massively across decades. Evaluate the total cost of ownership, including trading spreads for ETFs and any platform fees. Prioritize widely followed indexes with ample liquidity and consistent tracking.

How often should I rebalance?

Use a schedule or drift bands—and write them down. Many people check semiannually and only act when an asset class deviates by ±5 percentage points or ±20% of its target weight. Rebalancing within tax-advantaged accounts reduces tax friction; in taxable accounts, use new contributions and dividends first to move toward targets before selling positions that may realize gains.

Should I focus on dividend income or total return?

Total return—price appreciation plus dividends and interest—is usually the more flexible framework. Dividends are neither guaranteed nor inherently superior; they’re just one way companies return cash. A total-return approach lets you set an allocation for risk and harvest cash from the best source at the time, supported by your cash/bond structure and withdrawal rules.

How much cash should I hold while accumulating?

Hold enough for emergencies and known near-term expenses, then invest the rest according to your allocation. Typical emergency fund guidance ranges from three to six months of core expenses, adjusted for job stability and household complexity. Excess cash beyond your risk buffer creates drag; put it to work through automated, scheduled contributions.

What if markets drop right before I plan to leave my job?

This is the classic sequence-of-returns challenge. Activate your contingency plan: pause inflation adjustments, lean on your cash/bond bucket for spending, and consider part-time income to reduce withdrawals temporarily. Guardrail rules can help you scale spending down and then back up as markets recover, protecting long-term sustainability without overreacting.

Is paying off my mortgage “better” than investing?

It depends on your interest rate, risk tolerance, and desire for flexibility. Paying down a high-rate mortgage is a risk-free, after-tax return equal to the rate, while investing offers higher expected return with volatility. Many people split the difference: prioritize tax-advantaged investing and maintain steady extra principal payments, especially as FI approaches.

Do I need alternative assets like commodities or crypto?

They’re optional satellites, not core requirements. Alternatives can diversify certain risks but may add volatility, complexity, or regulatory considerations. If you include them, cap the allocation modestly, document your thesis, and ensure they don’t crowd out your core low-cost equity and bond positions. Simplicity often improves adherence and outcomes.

How do I handle investing if I earn in one currency and retire in another?

Match assets and liabilities where possible. If future spending is denominated in a different currency, consider partial hedging or holding assets tied to that currency to reduce mismatch risk. Monitor costs of hedged products and keep the solution simple; over-engineering currency moves can introduce more noise than benefit.

Can I reach FI if I start later or have higher family expenses?

Yes, with focused execution and a longer horizon. Increase your savings rate through income moves and spending audits, extend the timeline, and use low-cost diversified funds to compound steadily. Plan for education and childcare explicitly in your FI number, and choose a risk level you can stick with. Progress compounds—even modest improvements make a meaningful difference.

Conclusion

Financial independence is the cumulative result of a dozen durable behaviors that are fully within your control: know your number, power your savings engine, choose an allocation you can live with, buy broad low-cost funds, automate contributions and rebalancing, maximize tax-advantaged space, place assets tax-efficiently, manage big risks, use real estate thoughtfully, build a stable bond/cash structure, stress-test your plan, and withdraw with flexible rules. None of these steps require forecasting or heroic timing; they reward patience, clarity, and consistency. As you apply this playbook, expect to iterate. Your life, job, family, and interests will evolve. That’s normal—your plan can evolve too. Start with the next concrete action you can take this week, and keep stacking small, correct moves. If you’re ready to turn intention into motion, pick one strategy above—automate a contribution, document your allocation, or set rebalancing bands—and implement it today.

References

- “Compound Interest and Your Money,” Investor.gov (U.S. Securities and Exchange Commission). https://www.investor.gov/introduction-investing/investing-basics/compound-interest-your-money

- “Asset Allocation,” Investor.gov (U.S. Securities and Exchange Commission). https://www.investor.gov/introduction-investing/investing-basics/asset-allocation

- “Principles for Investing Success,” Vanguard. https://investor.vanguard.com/investor-resources-education/article/principles-for-investing-success

- “Bogleheads® Investment Philosophy,” Bogleheads Wiki. https://www.bogleheads.org/wiki/Bogleheads®_investment_philosophy

- “Rebalancing,” Bogleheads Wiki. https://www.bogleheads.org/wiki/Rebalancing

- “Bond Basics,” FINRA. https://www.finra.org/investors/learn-to-invest/types-investments/bonds

- “Safe Withdrawal Rates,” Morningstar Research. https://www.morningstar.com/lp/retirement-income

- “Traditional and Roth IRAs,” Internal Revenue Service. https://www.irs.gov/retirement-plans/traditional-and-roth-iras

- “Individual Savings Accounts,” HM Revenue & Customs. https://www.gov.uk/individual-savings-accounts

- “What Is a Real Estate Investment Trust (REIT)?” Nareit. https://www.reit.com/what-reit