If you’re about to borrow—whether it’s a mortgage, auto loan, personal loan, or student financing—the fastest way to save thousands is to learn how to shop for the best loan offers. This guide gives you a clear, practical playbook to compare interest rates, APRs, fees, and terms without getting tripped up by fine print. It’s written for first-time borrowers and seasoned shoppers alike. Quick note: this is educational information, not individualized financial advice—loan rules and norms can vary by country and lender. In one line, here’s the core answer: to shop for the best loan, standardize the loan type and term, collect multiple quotes within a short “rate-shopping” window, compare by APR and total cost (not monthly payment), and negotiate using competing offers. For instant skimming, the steps you’ll take are: check your credit and budget, pick the loan type and term, prequalify, gather comparable offers, line up fees and penalties, lock optimally, and close cleanly (with a plan to refinance if better options emerge).

1. Define the loan you actually need (amount, purpose, type, term)

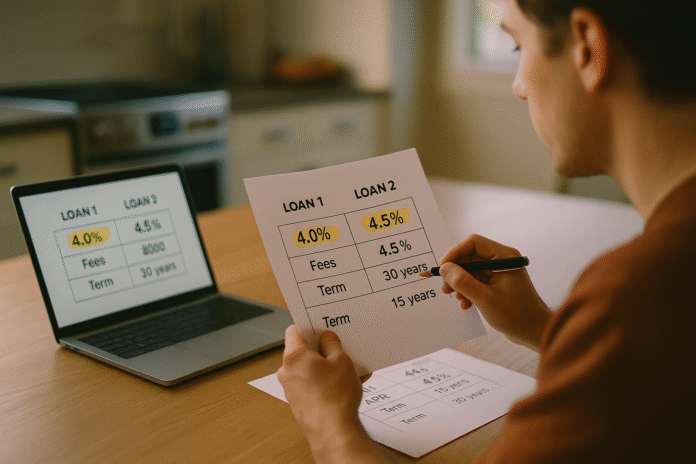

Start by specifying the problem you’re solving, not the product you’re buying. Decide how much you truly need, what the loan is funding (home, car, debt consolidation, tuition, home equity), and the guardrails you won’t cross: maximum monthly payment, total cost, and payoff horizon. Choosing the right loan type—mortgage vs. HELOC vs. personal loan; secured vs. unsecured—shapes everything that follows, including eligibility, documentation, collateral risk, and pricing. Pick a term length that matches your cash flow (shorter terms cost less overall but pay more each month; longer terms do the opposite). Commit to an apples-to-apples comparison: same amount, same term, and the same loan type across all quotes. Finally, list must-have features (e.g., no prepayment penalty, autopay discount) so you don’t “save” on rate only to give it back in fees later.

1.1 Why it matters

Locking the scope prevents “payment shopping,” where low monthly payments hide higher total costs. It also tells lenders you’re a serious shopper, which strengthens your negotiating position.

1.2 How to do it

- Choose a loan amount you can repay with room for emergencies.

- Fix a term (e.g., 36 months for personal loans; 60 months for auto; 15 or 30 years for mortgages).

- Decide fixed vs. variable interest (see Step 4).

- Note deal-breakers: prepayment penalties, mandatory add-ons, or balloon payments.

- Create a one-page “loan spec” to send to every lender.

Mini example: Borrowing $20,000 over 36 months at 11% costs ~$656/month and ~$3,617 total interest; at 60 months the payment drops to ~$435 but total interest rises to ~$6,098. Keeping the term fixed lets you compare lenders on price, not on payment.

Close with this: define your “box” first, and lenders will compete inside it—not the other way around.

2. Set a safe budget using DTI and cash buffers

The best offer is affordable in bad months, not just good ones. A practical way to judge affordability is debt-to-income ratio (DTI): your monthly debt payments divided by gross monthly income. Mortgage programs often look for DTIs around the mid-30s to mid-40s, but lower is safer; auto and personal lenders vary. Keep a separate emergency fund so debt doesn’t crowd out essentials. Also plan for non-rate costs—auto insurance, property taxes and homeowners insurance, or origination and title fees—because they affect your real monthly outlay even if they’re not in the quoted payment. If you’re close to the edge, downsize the loan amount or extend the term modestly (accepting higher total cost) rather than stretching beyond your comfort zone.

2.1 Numbers & guardrails

- Aim to keep DTI in a range you can sustain; many mortgages evaluate DTIs roughly in the 36–45% band, though exact thresholds vary by program and lender.

- Remember that APR captures rate plus many fees (see Step 7), and total cost matters more than just monthly payment.

2.2 Mini-checklist

- Calculate current monthly debts plus the new payment.

- Stress-test: could you still pay if income dropped 10% for three months?

- Leave room for insurance, taxes, and maintenance (homes/cars).

- Keep an emergency fund (3–6 months’ expenses).

If the math is tight now, it won’t get easier after closing; adjust scope before you shop quotes.

3. Check—and strengthen—your credit before lenders check you

Your credit reports and scores drive pricing. Pull your credit reports and fix errors before you apply; as of October 2023, you can access free weekly reports at AnnualCreditReport.com. Dispute inaccuracies, pay every bill on time, and lower credit utilization (balances ÷ limits) on revolving cards; under 30% is acceptable, under 10% is optimal for scores. Avoid opening other new credit while shopping. If your score is borderline, even 20–40 points of improvement can move you into a better rate tier, saving thousands over the life of a loan.

3.1 How to do it

- Get reports weekly for free from Equifax, Experian, and TransUnion via AnnualCreditReport.com.

- Target low utilization (ideally single digits) and pay down balances before statements close.

- Fix errors early; they can take 30–45+ days to resolve.

- Pause new credit applications to limit hard inquiries.

3.2 Mini case

Dropping card utilization from 55% to 10% before applying can materially improve pricing on many loan types; combine that with spotless recent payment history to present your best profile.

Clean reports and healthy utilization make every quote better—before you negotiate a single dollar.

4. Choose fixed vs. variable rate and the right term—for your risk

Start with a direct answer: if you need payment stability and plan to keep the loan for years, a fixed-rate loan is simpler and safer; if you expect to repay or refinance quickly and can handle variability, a variable/adjustable rate can start cheaper but carries reset risk. For mortgages, adjustable-rate mortgages (ARMs) add complexity: an index + margin sets your fully indexed rate after the intro period, with caps that limit per-adjustment and lifetime increases. Shorter terms (e.g., 15-year mortgages) typically have lower rates and much lower total interest but higher monthly payments. Pick term + rate type before you solicit quotes so all offers are comparable.

4.1 Tools & terms to know

- Index + margin = your ARM’s future rate; caps limit jumps; read the AIR table and disclosures.

- ARM risks: payment shock when rates rise; understand worst-case caps before choosing.

4.2 Numeric example

If a 5/1 ARM starts at 6.25% (margin 3%, index 3.25%) with 2/1/5 caps, the rate could rise to 8.25% at first reset, 9.25% the next year, and never above 11.25% lifetime—numbers that may overwhelm a tight budget when rates are rising.

Match the structure to your time horizon and risk tolerance, then hold that choice constant across lenders.

5. Prequalify to see ranges, then request standardized, comparable offers

Open with the simple rule: start with prequalification (soft inquiry) to gauge likely rates and terms; when you’re ready, submit full applications to multiple lenders within a short window to collect firm offers. For mortgages, ask each lender for a Loan Estimate (LE)—a standardized, three-page disclosure you must receive shortly after applying—so you can compare side by side. For auto loans, use an independent lender preapproval before visiting the dealership; understanding retail installment contracts helps you compare dealer financing vs. direct loans.

5.1 What to ask for (by product)

- Mortgage: Loan Estimates from several lenders for the same loan specs; you’ll also get a Closing Disclosure at least three business days before closing.

- Auto: Compare independent bank/credit union offers with dealer financing; know what a retail installment sales contract is. Consumer Financial Protection Bureau

- Personal loan: Confirm fees (origination, late, potential prepayment fee) and true APR.

5.2 Quick definitions

- Prequalification vs. preapproval: Both signal likely financing; processes vary and neither is a guarantee, but preapproval is usually more rigorous.

Collect like-for-like quotes on the same day when possible; it’s the fastest way to surface the best deal.

6. Shop smart within the credit “rate-shopping” window

The direct answer: submit multiple loan applications of the same type within a focused window so credit scoring models count them as one. With newer FICO® versions, similar inquiries within 45 days are treated as a single event; many models also ignore the last 30 days to let you shop. Auto, mortgage, and student loan inquiries benefit from this logic; credit cards do not. Use prequalification to narrow candidates first, then cluster hard-pull applications.

6.1 How to minimize score impact

- Time full applications tightly—ideally same week—to fit the 30- to 45-day logic.

- Remember that responsible rate shopping has little to no score impact compared to the benefit of a better loan.

- Keep other new credit to zero during this period.

6.2 Region note

Exact scoring models vary by lender and country; U.S. guidance above reflects FICO®/CFPB materials as of now.

Cluster your applications and you’ll protect your score while extracting real competition.

7. Compare by APR and total cost (not just the rate or payment)

Here’s the rule: use APR for apples-to-apples comparisons across lenders because it incorporates many fees in addition to the nominal interest rate; then confirm the total cost (interest + fees) over the life of the loan. For mortgages, APR typically includes points and many closing costs; for personal loans, APR often includes origination fees. Beware “low-rate, high-fee” loans where the APR reveals the truth. Use an amortization or loan-comparison calculator to estimate lifetime interest.

7.1 What APR includes

- APR reflects the interest rate plus many fees and charges; it’s a broader cost measure than the rate.

7.2 Practical workflow

- Gather APRs and fees from each LE or lender quote.

- Compute monthly payment and total interest for your fixed term.

- Reject quotes that change your loan spec (term/amount/type).

- If two APRs are close, choose the one with lower total fees and better features.

Numeric example: Two $300,000 30-year mortgages: 6.625% with $0 points (APR 6.70%) vs. 6.375% with 1 point ($3,000) (APR 6.58%). The second has a lower APR and total cost if you keep the loan long enough to break even on the point; your LE will show the breakeven “in years.” Use that to decide. Consumer Financial Protection Bureau

Let APR steer your comparison; let total cost confirm you’re actually saving.

8. Audit fees, penalties, and add-ons—then strip out what you don’t need

Many loans include costs beyond the rate. Origination fees on personal loans are common (often 1%–10%), though some lenders charge none; mortgages may have points and third-party closing costs; auto financing can include add-ons (service contracts, etch, VIN theft insurance) that may offer little value for the price. Watch for prepayment penalties, which are limited or banned on certain loan types but still appear in some contracts.

8.1 What to look for

- Personal loans: origination fee range and whether it’s deducted from proceeds; confirm any prepayment penalty.

- Mortgages: whether a prepayment penalty exists (restricted under U.S. rules) and how points/fees affect APR.

- Auto loans: avoid paying for add-ons with no benefit; dealers must obtain express, informed consent and avoid misrepresentations.

8.2 Mini-checklist

- Is there any prepayment penalty? If yes, under what conditions?

- Are fees rolled into the loan or paid up front—and how does that change APR?

- For autos, get out-the-door price and line-item any add-on; decline those you don’t want. Consumer Financial Protection Bureau

Cutting one unnecessary fee or add-on can beat a tiny rate discount—scrutinize everything.

9. Negotiate: use competing offers, fee waivers, and autopay discounts

Lenders expect negotiation—especially when you present written quotes. Ask for rate matches or buydowns (e.g., reduced points), origination fee reductions, or a lender credit to offset closing costs. Ask about autopay discounts (often 0.25% on student loans; many personal lenders also offer them). Time your rate lock strategically; typical lock periods are 30/45/60 days, with longer locks sometimes available for a fee.

9.1 Tactics that work

- Share a better competitor LE/offer and ask for a match or improvement.

- Request fee waivers or credits; small credits can erase third-party costs.

- Enroll in autopay for a rate reduction when available.

- Lock the rate when you’re confident in the property/vehicle and closing timeline; confirm lock length and cost.

9.2 Quick example

If Lender A offers 11.49% with a 5% origination fee and Lender B offers 12.24% with 0% fee on a $20,000 personal loan, B’s APR may be lower—use that math to ask A to cut the fee to win your business.

Competing quotes are leverage—use them politely but firmly.

10. Understand collateral, LTV, and cosigners (if applicable)

Secured loans (mortgages, auto, secured personal loans) are priced partly on loan-to-value (LTV) and collateral risk. Lower LTVs, higher down payments, and stronger collateral typically earn better rates. If your profile is thin, a cosigner can help you qualify or reduce pricing—but understand the cosigner is fully responsible if you miss payments. Beware negative equity (e.g., long auto terms with small down payments) and consider GAP coverage only if LTV risk is truly high—not as a default add-on.

10.1 How to evaluate

- Ask how LTV or collateral value is assessed (appraisal, book value).

- Model worst-case depreciation on vehicles; don’t finance add-ons that push LTV > 100%.

- If considering a cosigner, agree on repayment plans and exit options.

10.2 Why it matters

High LTVs and weak collateral increase your rate, fees, or both—sometimes more than any credit score tweak could offset. In borderline cases, a larger down payment can beat months of credit tinkering.

Choose security terms with eyes open; collateral risk is price risk.

11. Time the application and rate lock; avoid avoidable delays

Markets move. You can’t control rates, but you can control timing. Keep your documents tidy so you can apply, compare, and lock quickly once you find a winner. Rate locks typically run 30–60 days (sometimes longer), and you’ll receive a Closing Disclosure three business days before closing—use that window to validate every number. If a lock extension is needed, ask the lender to share or waive the extension cost if delays are on their side.

11.1 Practical timeline (mortgage)

- Day 0–3: apply to multiple lenders; receive Loan Estimates.

- Day 7–21: choose lender, lock, and provide documents. Typical lock 30/45/60 days; verify terms.

- ≥3 business days before close: receive Closing Disclosure; compare with LE and resolve discrepancies.

11.2 Pro tip

Some lenders auto-lock when issuing an LE; others don’t—check page 1 of your LE to confirm your lock status and expiration.

Align your lock with a realistic close date, and you’ll avoid rush fees and unpleasant surprises.

12. Close cleanly and know your post-closing rights (and refinance plan)

At signing, match each number to your final disclosure. Set up autopay to capture any discount and prevent missed payments. For certain U.S. loans—refinances and HELOCs on your primary residence—you have a three-business-day right to rescind after closing; purchases generally don’t have this right. Keep an eye on the market; refinancing can make sense if you can recover costs within your expected time in the loan. For personal loans, many lenders do not charge prepayment penalties, but a minority still do—check before paying off early.

12.1 After you sign

- Store all disclosures, the note, and the servicing contact info.

- Confirm autopay is active; diarize the first due date.

- If eligible, know your right of rescission window and how to exercise it.

- Re-quote annually or when rates shift materially; refinance if math clears breakeven.

12.2 Student loan note

Federal student loans often offer a 0.25% autopay reduction; many private lenders mirror this. Check your servicer’s terms and enroll as soon as you can. Consumer Financial Protection Bureau

A clean close and a simple monitoring routine can save you extra basis points without extra stress.

FAQs

1) What’s the fastest way to compare mortgage offers?

Request Loan Estimates from at least three lenders for the same loan type, amount, and term, then compare APR, rate, and total cash to close. Use the Closing Disclosure (delivered three business days before closing) to verify final figures match what you chose. If they don’t, ask why and renegotiate or switch. Consumer Financial Protection Bureau

2) Will multiple applications wreck my credit score?

No—if you time them correctly. For mortgages, autos, and student loans, newer FICO® models treat multiple inquiries within 45 days as one and ignore inquiries in the last 30 days when scoring, so cluster your applications. Credit cards don’t get this treatment.

3) Is APR always higher than the interest rate? Why should I care?

Typically yes, because APR adds many fees to the interest rate. Comparing APR across like-for-like loans helps you spot “low-rate, high-fee” offers that cost more overall. Then verify the total cost over the life of the loan to ensure it aligns with your budget.

4) How big are personal-loan origination fees?

It depends on the lender and your profile, but ranges of 1%–10% are common; some lenders charge 0%. Check whether the fee is deducted from your proceeds (so you receive less cash than you borrow), and let APR reflect the true cost.

5) What’s a rate lock, and how long do I need?

A rate lock keeps your mortgage rate from changing for a set period while you close—commonly 30, 45, or 60 days, with longer options available at a cost. Confirm in writing when you lock and when it expires; if your closing slips, ask about extensions or credits.

6) How can I improve my loan pricing quickly?

Fix report errors, pay down revolving balances to keep utilization below 30% (ideally <10%), and avoid new credit until after closing. Even modest score gains can move you into better pricing tiers.

7) What’s the difference between prequalification and preapproval?

Both estimate what a lender might lend you, but processes vary and neither is a guarantee. Preapproval is usually more document-heavy and credible with sellers (mortgages). Treat either as a starting point—not a promise.

8) Are prepayment penalties still a thing?

They’re limited or banned on certain loans (e.g., many mortgages and federal student loans), but they still exist in some contracts—especially outside mortgages. Always check the “Prepayment Penalty” line on your disclosures and ask for a no-penalty option. Consumer Financial Protection Bureau

9) I’m buying a car—how do I avoid dealership finance traps?

Secure an outside preapproval first, negotiate the vehicle price separately from financing, and scrutinize add-ons (decline those without clear value). New FTC rules target misrepresentations and ban add-ons with no benefit; you must give express, informed consent for charges.

10) Do I have any “cooling-off” rights after closing?

For refinances and HELOCs on a primary home (U.S.), you generally have a three-business-day right to cancel; purchases typically don’t. Know the exact timeline and process before you leave the closing table.

Conclusion

Shopping for the best loan is less about finding a magical low rate and more about running a disciplined process. You define the loan you need, set an affordability guardrail, and strengthen your credit so lenders see their lowest risk version of you. Then you collect multiple standardized quotes inside a rate-shopping window, compare them by APR and total cost, and negotiate—openly and respectfully—using the numbers. You audit fees and penalties so nothing sneaks through in the fine print, time your rate lock to your closing, and know your post-closing rights. The result isn’t just a better monthly payment; it’s a safer, cheaper borrowing plan that holds up under stress. Ready to put this into action? Take 20 minutes to write your loan spec and pull your latest credit reports—then request three like-for-like quotes and let the lenders compete.

Copy-ready CTA: Start your loan spec now, then request three comparable quotes this week.

References

- What is the difference between a loan interest rate and the APR? Consumer Financial Protection Bureau (Jan 30, 2024). https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-a-loan-interest-rate-and-the-apr-en-733/

- What is the difference between a mortgage interest rate and an APR? Consumer Financial Protection Bureau (Aug 30, 2023). https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-a-mortgage-interest-rate-and-an-apr-en-135/

- Explore interest rates (mortgages). Consumer Financial Protection Bureau (Apr 1, 2025). https://www.consumerfinance.gov/owning-a-home/explore-rates/

- What’s a lock-in or a rate lock on a mortgage? Consumer Financial Protection Bureau (May 3, 2023). https://www.consumerfinance.gov/ask-cfpb/whats-a-lock-in-or-a-rate-lock-en-143/

- Review your Loan Estimates. Consumer Financial Protection Bureau (Dec 12, 2024). https://www.consumerfinance.gov/owning-a-home/compare/review-loan-estimates/

- Closing Disclosure explainer. Consumer Financial Protection Bureau (2023). https://www.consumerfinance.gov/owning-a-home/closing-disclosure/

- TILA-RESPA Integrated Disclosure FAQs (three-day Closing Disclosure timing). Consumer Financial Protection Bureau (Jan 25, 2019). https://www.consumerfinance.gov/compliance/compliance-resources/mortgage-resources/tila-respa-integrated-disclosures/tila-respa-integrated-disclosure-faqs/

- What’s the difference between a prequalification letter and a preapproval letter? Consumer Financial Protection Bureau (Dec 12, 2023). https://www.consumerfinance.gov/ask-cfpb/whats-the-difference-between-a-prequalification-letter-and-a-preapproval-letter-en-127/

- How will shopping for an auto loan affect my credit? Consumer Financial Protection Bureau (Jan 30, 2024). https://www.consumerfinance.gov/ask-cfpb/how-will-shopping-for-an-auto-loan-affect-my-credit-en-763/

- How to Rate Shop and Minimize the Impact to Your FICO® Score. myFICO (Jul 5, 2023). https://www.myfico.com/credit-education/blog/rate-shop

- Do Credit Inquiries Lower Your FICO Score? myFICO (2018, updated). https://www.myfico.com/credit-education/credit-reports/does-checking-credit-score-lower-it

- What Is a Credit Utilization Rate? Experian (Nov 5, 2023). https://www.experian.com/blogs/ask-experian/credit-education/score-basics/credit-utilization-rate/

- 5 Ways to Keep Your Credit Utilization Low. Experian (Sep 4, 2025). https://www.experian.com/blogs/ask-experian/ways-to-keep-credit-utilization-low/

- Do personal installment loans have fees? Consumer Financial Protection Bureau (Sep 4, 2024). https://www.consumerfinance.gov/ask-cfpb/do-personal-installment-loans-have-fees-en-2120/

- Personal loan origination fees (range). Bankrate (Aug 11, 2025). https://www.bankrate.com/loans/personal-loans/personal-loan-origination-fees/

- Right of rescission (12 CFR §1026.23) & FAQ. Consumer Financial Protection Bureau (Aug 30, 2023). https://www.consumerfinance.gov/rules-policy/regulations/1026/23 and https://www.consumerfinance.gov/ask-cfpb/how-long-do-i-have-to-rescind-when-does-the-right-of-rescission-start-en-187/

- You now have permanent access to free weekly credit reports. Federal Trade Commission (Jan 4, 2024). https://consumer.ftc.gov/consumer-alerts/2023/10/you-now-have-permanent-access-free-weekly-credit-reports

- CARS Rule (Combating Auto Retail Scams). Federal Trade Commission Final Rule & summary (2024). https://www.ftc.gov/system/files/ftc_gov/pdf/p204800_cars_rule.pdf and https://www.ftc.gov/system/files/ftc_gov/pdf/FTCCARSRuleInfographic_web.pdf

- ARM basics: index, margin, and caps. Consumer Financial Protection Bureau (Apr 26, 2024; Jan 21, 2025). https://www.consumerfinance.gov/ask-cfpb/for-an-adjustable-rate-mortgage-arm-what-are-the-index-and-margin-and-how-do-they-work-en-1949/ and https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-a-fixed-rate-and-adjustable-rate-mortgage-arm-loan-en-100/

- Student loans autopay interest rate reduction (0.25%). Federal Student Aid (accessed Sep 2025). https://studentaid.gov/help-center/answers/article/automatic-debit-reduction

- Understand the different kinds of loans (mortgage term & rate type). Consumer Financial Protection Bureau (Dec 12, 2024). https://www.consumerfinance.gov/owning-a-home/explore/understand-the-different-kinds-of-loans-available/