If you’ve compared “debt snowball” and “debt avalanche,” you already know both can work. The avalanche minimizes interest by attacking the highest APR first; the snowball builds motivation by wiping out the smallest balance first. Choose debt snowball over avalanche when motivation, simplicity, and emotional momentum matter more for you than squeezing out every dollar of interest savings—especially if your APRs are clustered.

Quick definition: Snowball means you pay minimums on all debts, then put extra toward the smallest balance until it’s gone, rolling freed-up dollars to the next smallest. Avalanche directs extra money to the highest interest rate first. Both are recognized by the CFPB; the “right” choice depends on what keeps you consistent.

Brief, important note: This article is educational, not individualized financial advice. If your debt feels unmanageable, consider a nonprofit credit counselor for a personalized plan.

1. You’re Motivated by Quick Wins and Visible Progress

Choose snowball when you need fast, visible wins to stay engaged. Many people stall on long projects without early rewards; the snowball deliberately creates those rewards by zeroing out small balances quickly. Behavioral research shows that effort often accelerates as a goal draws near (the “goal-gradient” effect), and that even a sense of head start—the “endowed progress” effect—increases persistence. Translating this to debt: shutting down a $180 store card this month can feel like a concrete victory, energizing you to tackle the next balance. That motivational boost can outweigh the modest extra interest you might pay compared with avalanche, particularly if your APRs are bunched within a few percentage points.

1.1 Why it works (the psychology)

- Goal-gradient: We work harder as we get closer to finishing, so clearing a small debt can turbo-charge effort for the next one.

- Endowed progress: Feeling “already underway” increases follow-through; a closed account is a potent form of visible progress.

- Framing wins: A zero balance is a discrete milestone your brain celebrates more than “$71 less interest projected,” which is abstract.

1.2 How to do it today

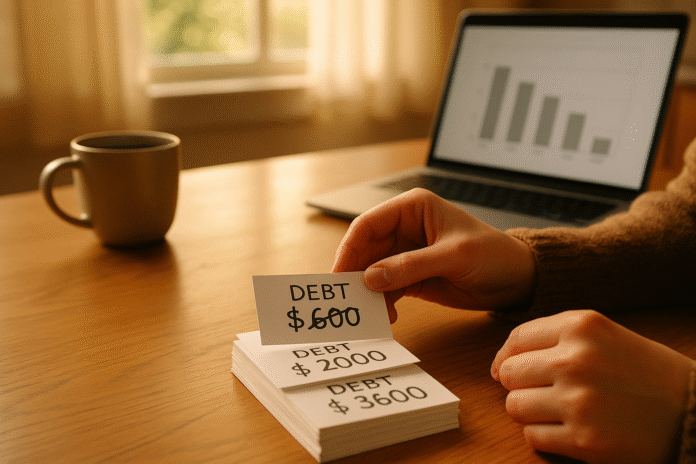

- List debts by balance (ignore APR for now).

- Pay minimums on all; target the smallest with every extra dollar.

- When it hits $0, roll that entire payment to the next smallest.

- Track victories visibly (index cards, a whiteboard, or an app).

- Re-check the plan every 90 days; if motivation is strong, keep going.

Mini case: Suppose you have four debts: $180 (22% APR), $620 (21%), $1,450 (18%), $2,100 (24%), and $350/month to allocate. With snowball, month one erases the $180, and next month you’re attacking $620 with $350. That “one down” scoreboard effect is immediate; many people stick with the plan because they feel movement. (Evidence for motivation mechanics summarized above.)

Bottom line: If you know you’re momentum-driven, snowball’s early milestones can keep you in the game long enough to finish.

2. You Struggle with Procrastination or Present Bias

Choose snowball if you tend to procrastinate or lose steam when results are slow. Humans often overweight “right now” costs (like sending a big payment) and underweight future benefits (interest saved months from today). Economists call this present bias; it reliably predicts delays on unpleasant tasks and inertia even when people “know better.” Snowball reduces the psychological cost of starting because it converts a large, vague goal (“get out of debt”) into an immediately rewarding micro-goal (“clear this $230 balance”). That first easy win helps overcome friction so you keep showing up next month. econweb.ucsd.eduAmerican Economic Association

2.1 Numbers & guardrails

- If your APR spread is narrow (e.g., most are 18%–23%), the interest penalty of not doing avalanche is usually modest; sticking with any plan beats dropping an optimal one.

- Automate the payment on your current “target debt” so skipping it becomes harder than doing it (a commitment device).

- Use a payoff calculator monthly to see time-to-zero; visibility reduces procrastination.

2.2 Tools & habits that help

- Automation: Schedule the extra payment the day after payday.

- Temptation bundling: Only watch your favorite show while reconciling your payoff tracker.

- Public accountability: Share monthly progress with a friend or a support forum.

- Reframing: Call it your “debt finish line,” not “minimums + extra”—words matter.

Why this section matters: The research base on present-biased preferences and procrastination is robust; designs that create immediate rewards (like crossing off a balance) increase follow-through. Snowball builds those rewards in by design.

3. You Need Simplicity and Closure Across Too Many Accounts

Choose snowball when juggling multiple balances itself causes stress or mistakes. People often feel a strong urge to “close an account” even if it’s not mathematically optimal—a pattern known as debt account aversion. Rather than fight that psychology, snowball harnesses it: you fully zero small balances first, pruning the list and reducing cognitive load. Fewer open balances mean fewer due dates to monitor and fewer places to slip up. This simplicity can be a bigger win than incremental interest savings if late fees or missed payments are part of your struggle.

3.1 Credit score notes (handle with care)

- Utilization matters: Lowering balances can help your credit utilization ratio—a key factor in many scoring models. Lower is generally better; many sources suggest staying below ~30%, and even under ~10% if possible.

- Don’t rush to close cards: Paying to $0 helps; closing the account can raise your utilization and reduce average age of credit, potentially lowering your score. Keep cards open unless there’s a fee or a behavioral reason to close.

3.2 Mini-checklist to simplify fast

- Put all due dates on one calendar and enable autopay for minimums.

- Order balances by dollars owed; star 2–3 that can be cleared in 60–90 days.

- Create a one-page “debt roster” with balance, limit, APR, due date.

- Each time you hit $0, archive that line and roll the payment forward.

- Review quarterly to ensure the plan still fits your cash flow.

Why it works: Reducing the number of active debts shortens your mental to-do list and harnesses the satisfaction of closure—a psychological lever validated in lab settings and observed in real debt behavior.

4. Your APRs Are Clustered, So the “Math Penalty” Is Tiny

Choose snowball when most of your rates live in the same neighborhood and balances differ widely. Avalanche is unbeatable in theory because it attacks interest first; in practice, when APRs cluster (say 18%–22%), the interest you save by fine-tuning may be marginal—especially over a short horizon—while motivation gains from quick zeros are real. If the total extra interest you’d pay using snowball is smaller than a single month’s payment (or ~1%–2% of principal), the behavioral benefits can easily dominate.

4.1 A simple numeric example

Imagine two debts and $300/month to throw at them:

- Card A: $900 at 20% APR

- Card B: $1,800 at 22% APR

Avalanche (B first) vs Snowball (A first) will finish within a similar timeframe; the dollar interest gap over the life of payoff may be tens of dollars, not hundreds, because rates are close and you’re aggressively rolling payments. When the reward of erasing Card A in ~3–4 months keeps you engaged, that minor difference is an acceptable “fee” for sticking with the plan. (Run your own numbers with a payoff calculator.)

4.2 Guardrails so math still matters

- If you have a true outlier APR (e.g., a 29.99% retail card), prioritize that early even within a mostly snowball plan.

- Recalculate projected interest every 90 days; if spreads widen (promos expire), adapt.

- Consider a hybrid: snowball the first 1–2 debts, then flip to avalanche once motivation is locked in.

Takeaway: When differences are small, choose the method that maximizes adherence. Consistency beats theoretical optimality you won’t maintain.

5. Your Income Is Irregular and You Need Momentum Plus Flexibility

Choose snowball if your cash flow swings (gig work, commissions, seasonal work) and you need quick reductions in required minimums. Clearing one or two small balances early can lower your monthly obligation floor (the sum of minimum payments), giving you breathing room during lean months. That buffer reduces the risk of missed payments, fees, and credit damage, and it creates a reinforcing loop: lower required outflows make it easier to keep attacking the next debt when income spikes.

5.1 How to structure a flexible snowball

- Baseline: Cover all minimums from your average “low month” income.

- Target smalls: Pick debts whose minimums total $25–$50 each—perfect candidates to eliminate quickly.

- Surge rule: On high-income months, pre-schedule extra payments to the current target within 48 hours of payday.

- Down month script: If income dips, you’re still current because the minimum-payment floor has fallen.

5.2 Example you can model

Assume five debts with combined minimums of $370. Two are small ($210 and $360) with $25 and $35 minimums. With $400–$650 variable monthly capacity, snowball can eliminate those in 2–3 months, reducing your minimums by $60. That drop gives you more stability in lean months (and reduces delinquency risk), while you keep the momentum for larger balances. Use a calculator to forecast timelines and interest, and document your “high/low” month plan.

Why it helps: Lowering mandatory outflows is a practical way to keep accounts current during volatility; snowball achieves that quickly by design, and the CFPB’s guidance supports picking the strategy that best fits your motivation and situation.

6. You Thrive on Gamification, Social Accountability, and Visual Tracking

Choose snowball if streaks, badges, and visible milestones light you up. Turning debt payoff into a series of “levels” works because each cleared balance delivers a burst of accomplishment that fuels the next push. A snowball roadmap—sticky notes on a wall, a kanban column that moves cards from “Active” to “Paid,” or a progress bar that fills with every zeroed account—keeps the journey tangible and shareable. When you involve a buddy or community, the social nudge makes missed payments feel like breaking a streak, which many people work hard to avoid.

6.1 Practical gamification ideas

- Progress board: One card per debt; move cards to a “Paid” column the day you hit $0.

- Milestone rewards: Build tiny, low-cost rewards at each payoff (e.g., a picnic, a library movie night).

- Monthly scoreboard: Track number of accounts at $0; try to increase that count every quarter.

- Public check-ins: Share a one-line update with a trusted friend on the same day each month.

6.2 Mini-checklist (keep it healthy)

- Keep rewards free/cheap; avoid “celebration spending.”

- Use automation so streaks aren’t manual.

- If you feel obsessive, dial back gamification and do a quarterly review instead.

- Reconcile totals monthly against your statements.

Key point: Snowball aligns perfectly with habit-forming design: frequent, salient wins and progress you can see. That structure keeps many people on track longer than abstract projections of interest saved.

7. You’re Managing Stress or Decision Fatigue and Want Emotional Relief

Choose snowball if your goal is relief—less worry, fewer moving pieces, and a clearer path. Anxiety thrives on ambiguity; many small balances with different due dates feel chaotic. Snowball gives you a simple, repeatable routine and lets you retire “nagging” debts quickly. That emotional lift isn’t trivial: less stress can improve decision quality, reduces the odds of late fees, and makes room for other good habits (like building a starter emergency fund). If stress is high or bills are already slipping, a nonprofit credit counselor can help you triage and choose a plan you can live with.

7.1 Steps to lower stress now

- One-page plan: Write down balances and minimums; star the smallest 2–3.

- Autopay minimums: Prevent accidental late fees.

- Snowball extra: Send every extra dollar to the smallest until it’s gone.

- Ask for help: If you’re struggling, talk to a counselor or your lender about hardship options.

7.2 Where to find reputable help

- CFPB guidance explains what credit counseling is and how it works.

- NFCC can connect you with certified nonprofit agencies in your area.

- DOJ list shows approved agencies by state (useful if you’re considering bankruptcy counseling requirements).

Bottom line: If stress or decision fatigue is your bottleneck, snowball’s simplicity plus early relief may be the difference between finishing and flaming out.

FAQs

1) Which pays less interest: snowball or avalanche?

Avalanche almost always wins on interest math because it attacks the highest APR first. Snowball can cost a bit more, but if it keeps you consistent, the real-world outcome (finishing) can be better—especially when APRs are close together. The CFPB recognizes both methods; pick the one you’ll follow.

2) How do I know if my APRs are “clustered” enough for snowball?

Run a quick calculator scenario for both methods with your balances and rates. If the total interest difference is small relative to your monthly payment (e.g., less than one month’s payment or ~1%–2% of principal), behavioral fit may matter more. Use an online payoff calculator to compare timelines and totals.

3) Can I mix methods—start with snowball, then switch to avalanche?

Yes. Many people snowball the first 1–2 tiny balances to lock in momentum and simplicity, then flip to avalanche to optimize interest once their list is shorter. This hybrid approach respects psychology without abandoning math.

4) Will paying off small cards first help my credit?

Paying balances down lowers your credit utilization, which can help many credit scores. But don’t automatically close paid-off cards—closing can increase utilization and shorten credit history. Keep zero-balance accounts open unless fees or spending habits argue otherwise.

5) What if a single card has a very high APR (like 29.99%)?

Make an exception. Even if you’re mostly snowballing, it’s reasonable to prioritize a genuine outlier APR early because the interest drag is severe. This is functionally a hybrid plan: behavioral momentum with targeted optimization.

6) Is there an official recommendation from a regulator?

The CFPB outlines both highest-interest-rate (avalanche) and snowball methods and suggests choosing the one that matches your motivation and situation. It also provides worksheets and tools to plan your approach.

7) I’m a chronic procrastinator—what else should I add to snowball?

Automate extra payments, set calendar holds for a 15-minute “money check-in” each payday, and tie a small, no-spend reward to each payoff. These tactics counter present bias by making the first step easy and the reward immediate.

8) Does snowball work outside credit cards (e.g., personal or student loans)?

Yes. The principle—clear the smallest balances to free cash flow and boost motivation—applies to most non-mortgage debts. Just verify there are no prepayment penalties and watch for promotional APRs that might expire.

9) I’m overwhelmed—where can I get trustworthy help fast?

Look for nonprofit credit counseling through the NFCC’s agency finder or check the U.S. Department of Justice list of approved counseling agencies. These services offer budgeting help, debt management plans, and guidance—often at low or no cost. NFCC

10) Could avalanche be better for me, psychologically?

For some, the knowledge of paying the least interest is itself motivating. If seeing projected savings light you up, avalanche can be your “win.” The key is to test both in a calculator, pick one, and automate the plan you’ll keep.

Conclusion

Debt payoff is both math and mindset. Avalanche optimizes interest; snowball optimizes adherence by engineering early wins and reducing complexity. If your biggest hurdles are procrastination, stress, or too many moving pieces, snowball meets you where you are: it lets you close accounts quickly, simplify your finances, and build a streak you’re proud to protect. When APRs are bunched, the “interest penalty” is often small; by contrast, the cost of quitting a plan mid-stream is huge. Start by modeling both paths, then pick a method you’ll actually execute. Automate payments, track progress visibly, and consider a hybrid—snowball one or two balances, then avalanche for savings. If things feel heavy, a nonprofit credit counselor can help you create a plan you can live with.

CTA: Choose your first target balance, schedule the extra payment today, and move one card to Paid this month.

References

- Debt Snowball Method: How It Works to Pay Off Debt, Investopedia, updated July 2, 2024. https://www.investopedia.com/terms/s/snowball.asp Investopedia

- Debt Avalanche: Meaning, Pros and Cons, and Example, Investopedia, updated September 16, 2025. https://www.investopedia.com/terms/d/debt-avalanche.asp Investopedia

- How to Reduce Your Debt, Consumer Financial Protection Bureau (CFPB), published July 16, 2019; last modified March 13, 2023. https://www.consumerfinance.gov/about-us/blog/how-reduce-your-debt/ Consumer Financial Protection Bureau

- The Goal-Gradient Hypothesis Resurrected: Purchase Acceleration, Illusionary Goal Progress, and Customer Retention, Kivetz, Urminsky, & Zheng, Journal of Marketing Research, 2006. SAGE Journals

- The Endowed Progress Effect: How Artificial Advancement Increases Effort, Nunes & Drèze, Journal of Consumer Research, 2006. SSRN

- Winning the Battle but Losing the War: The Psychology of Debt Management, Amar, Ariely, et al., Journal of Marketing Research, 2011. SAGE Journals

- What Should My Credit Utilization Ratio Be?, myFICO (Fair Isaac), n.d. https://www.myfico.com/credit-education/blog/credit-utilization-be myFICO

- What is credit counseling?, CFPB, last updated August 8, 2023. Consumer Financial Protection Bureau

- Credit Card Payoff Calculator, Bankrate, n.d. Bankrate

- Golden Eggs and Hyperbolic Discounting, Laibson, Quarterly Journal of Economics, 1997. Harvard Scholar

- Doing It Now or Later, O’Donoghue & Rabin, American Economic Review, 1999. American Economic Association

- The Nature of Procrastination: A Meta-Analytic and Theoretical Review, Steel, Psychological Bulletin, 2007. https://pubmed.ncbi.nlm.nih.gov/17201571/ PubMed