Becoming debt-free changes your monthly cash flow—and your options. This guide shows you exactly what to do with the extra money once the last payment is gone, including how to prioritize savings, invest efficiently, and rebuild credit without slipping backward. It’s written for anyone who wants a clear order of operations and practical guardrails. Quick answer: use a simple “pay yourself first” stack—build cash buffers, capture free employer match, fund tax-advantaged accounts, invest the rest in a diversified portfolio, and lock your progress with credit and insurance hygiene. This article is educational and not individualized financial advice.

Fast order of operations (at a glance):

1) Build/finish your emergency fund. 2) Grab the full employer match. 3) Max high-impact tax-advantaged accounts you qualify for. 4) Rebuild and protect your credit. 5) Create sinking funds for near-term goals. 6) Invest the rest simply and rebalance. 7) Protect with right insurance/identity safeguards. 8) Map big goals with timelines and accounts. 9) Automate and review quarterly.

1. Build a Right-Sized Emergency Fund (and Cash Buffers)

Start by committing your freed-up payment to cash reserves, because liquidity is what keeps you from falling back into debt when life happens. An emergency fund is money set aside for surprise expenses (job loss, medical bills, car repairs) and its goal is stability, not maximum yield. A practical baseline is three to six months of essential expenses; lean toward the lower end if your income is stable and the higher end if your pay is variable or you have dependents. Park this cash in a high-liquidity, FDIC-insured savings account so it’s accessible and separated from spending. If your fund is partially built, top it up first before increasing lifestyle spending or chasing investments that fluctuate. This one move turns your “extra” dollars into durable peace of mind.

1.1 Why it matters

A well-funded emergency reserve is your first defense against new debt. It prevents a blown tire, medical copay, or surprise rent increase from turning into high-interest balances. Keeping the fund in insured, liquid accounts helps ensure it’ll be there when you need it.

1.2 Numbers & guardrails

- Target size: 3–6 months of essential expenses; more if your income is variable or you’re a sole earner.

- Account type: Liquid, insured savings or money market deposit account; confirm FDIC coverage rules for your situation.

- Segregation: Keep emergency cash separate from checking to avoid casual spending “leakage.”

- Refill rule: If you draw it down, prioritize replenishing it before resuming higher-risk investing.

1.3 Mini checklist

- Calculate average monthly essential expenses (housing, food, utilities, transport, insurance).

- Multiply to set your month target; schedule automatic transfers right after payday.

- Use your bank’s nicknaming feature (“Emergency Fund”) to reinforce purpose.

A strong cash buffer is the foundation that lets all the next steps compound safely.

2. Capture the Full Employer Match and Lock in a Default Savings Rate

Your next move is to take all available “free money.” If your employer offers a retirement plan match, increase your contribution immediately to capture the full match—this is an instant, risk-free return you can’t reliably find elsewhere. Then set a default long-term savings rate (a common, workable benchmark is 15% of gross income for retirement, including the match) and automate it so your budget adapts around saving rather than the other way around. If 15% is a leap from zero, stair-step 1–2 percentage points every quarter until you get there, using the debt-free cash flow to fund each bump. This approach keeps lifestyle creep in check while compounding your future security.

2.1 How to do it

- Check plan details: Confirm match formula, vesting, and Roth vs. pre-tax options.

- Automate increases: Many plans offer “auto-escalation” (e.g., +1% each year). Turn it on.

- Coordinate with spouse/partner: Align contribution rates so household saving hits the target.

- If no plan exists: Use an IRA (Traditional or Roth) as your anchor and automate transfers.

2.2 Numbers & guardrails (as of September 2025; see References)

- 401(k)/403(b)/TSP employee limit for 2025 is $23,500; standard catch-up (50+) $7,500; special ages 60–63 catch-up $11,250 if your plan allows.

- If there’s no match, still contribute regularly—then prioritize other tax-advantaged accounts as appropriate.

Bottom line: Maximize “free” employer match first, then hard-code a savings rate your future self will thank you for.

3. Prioritize High-Impact Tax-Advantaged Accounts (HSA, IRA, 401(k)) in a Smart Order

Once the match is secured and your emergency fund is on track, direct extra dollars to tax-efficient accounts you’re eligible for. Many households get the best long-run benefit by following a simple order: (1) employer match, (2) HSA if eligible, (3) IRA (Roth or Traditional based on your tax outlook and eligibility), then (4) additional 401(k) contributions up to the annual limit. HSAs (paired with qualifying high-deductible health plans) can offer a “triple tax advantage”: potential tax-deductible contributions, tax-deferred growth, and tax-free withdrawals for qualified medical expenses—even in retirement. IRAs expand your investment choices and, depending on income, offer tax-free growth (Roth) or deductible contributions (Traditional). Extra 401(k) contributions help you take advantage of higher annual limits and automated payroll saving.

3.1 Numbers & guardrails (as of September 2025; see References)

- HSA 2025 limits: $4,300 self-only / $8,550 family; +$1,000 catch-up at 55+.

- IRA 2025 limit: $7,000; +$1,000 catch-up at 50+. Roth IRA income phase-outs apply.

- 401(k) 2025 limit: $23,500; +$7,500 catch-up at 50+; ages 60–63 may contribute $11,250 catch-up if plan allows.

- Roth vs. Traditional: Favor Roth if you expect a higher tax rate later; favor Traditional if you expect a lower rate later (you can split contributions if unsure).

3.2 Tools/Examples

- Practical example: After the match, a family on an HSA-eligible plan contributes $8,550 to the HSA, funds Roth IRAs ($7,000 each if eligible), then returns to the 401(k) up to $23,500.

- Dollar-cost averaging: Automate monthly contributions across all accounts—consistency beats timing.

Synthesis: The right account order stretches each excess dollar by reducing taxes now and/or later, while keeping your investing rhythm automatic.

4. Rebuild and Strengthen Credit Deliberately

Debt-freedom is the perfect moment to harden your credit profile. The two most influential FICO factors are on-time payments (35%) and amounts owed/credit utilization (30%), so focus there. Keep utilization under 30% on each card and across all cards (single-digit use is even better). If you have thin or damaged credit, use a secured card or credit-builder loan and pay on time, every time. Pull your credit reports regularly—errors are common—and dispute any inaccuracies. For identity protection and to control new accounts, consider a credit freeze, which is free to place and lift in the U.S., and doesn’t affect your score. Healthy credit reduces your cost of borrowing for big goals and can lower insurance premiums in some regions.

4.1 Mini-checklist

- Autopay: Set every open credit line to at least statement-balance autopay.

- Utilization rule: Aim for <30% per card and overall; lower is better.

- Reports: Check all three bureaus weekly (free) and dispute errors.

- Freeze: Freeze your credit to block unauthorized new accounts; thaw when you intentionally apply.

4.2 Tools/Notes

- Where to get reports: Use the official AnnualCreditReport site for Equifax, Experian, and TransUnion.

- If you’re outside the U.S.: Your country’s bureaus and rights differ; look for your national consumer protection agency’s guidance.

Strong credit is a money-saver; it turns your clean slate into lower rates and wider options.

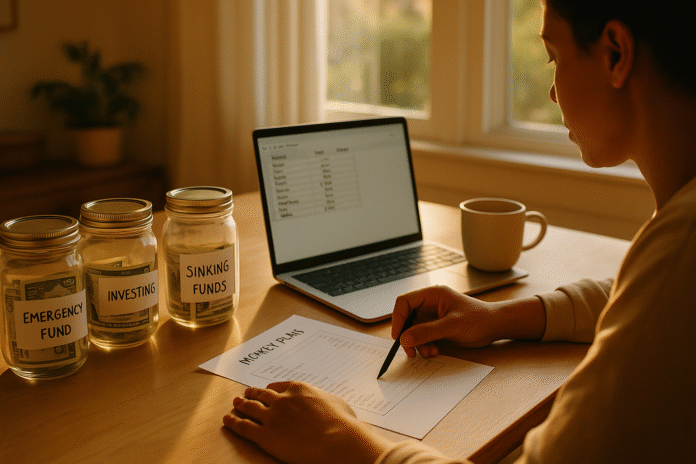

5. Create Sinking Funds to Keep Near-Term Goals From Becoming New Debt

Sinking funds are purpose-labeled savings buckets for expenses you know are coming (car repairs, travel, insurance premiums, property taxes, holidays). They convert “future surprises” into planned purchases and are especially powerful right after becoming debt-free, when you’re tempted to spend more freely. Allocate a slice of your former payment to these buckets via automatic transfers. Use separate sub-accounts if your bank allows, or a budgeting app with rules-based envelopes. This not only prevents new debt but also reduces stress—planning turns wishful spending into intentional choices.

5.1 How to set them up

- List the categories: Auto maintenance, medical deductibles, home repairs, gifts, travel, tech upgrades, insurance premiums, big annual subscriptions.

- Annualize the cost: Estimate yearly total, divide by 12 for the monthly transfer.

- Automate: Schedule transfers the day after payday to each bucket.

- Name the accounts: Clear labels (“Next Car,” “Roof Fund”) curb impulse raids.

5.2 Mini example

If you expect $1,200 in car costs this year and a $600 insurance premium, send $150/month into “Auto” and $50/month into “Insurance Premium.” When the bill arrives, you pay cash—no credit card backslide.

With sinking funds humming, you won’t undo your progress when predictable expenses inevitably show up.

6. Invest the Rest With a Simple, Diversified Portfolio—and Rebalance

Once cash buffers and near-term buckets are set, direct remaining surplus to a low-cost, diversified portfolio you can stick with through market swings. A practical default is a broad stock index fund + high-quality bond index fund (or a single target-date fund). Keep costs low, automate contributions, and rebalance periodically to maintain your risk level. Staying simple helps you avoid chasing “hot hands” that rarely beat the market over time. Use dollar-cost averaging by contributing the same amount each month; this smooths your entry points and keeps you participating through volatility.

6.1 Numbers & guardrails

- Simplicity: A two-fund core (total U.S./global stock + total bond) or a target-date fund is plenty for most.

- Rebalancing: Review annually or when allocations drift beyond set thresholds (e.g., ±5–10 percentage points).

- Costs: Favor low-expense ratio index funds; long-term, many active funds underperform their benchmarks.

6.2 Tools/Examples

- Example allocation: A 30-something might choose 80% global stock / 20% bonds; a 50-something might prefer 60/40—adjust to your risk tolerance and timeline.

- Account protection: Brokerage accounts aren’t bank-insured, but many U.S. brokers are SIPC members, which offers limited protection if a firm fails (not market-loss insurance).

- Stay the course: Set investment rules (when to rebalance, when not to trade) to avoid emotional decisions.

When you invest steadily and rebalance, you convert your new cash flow into long-run wealth with less drama.

7. Protect Your Progress With Insurance and Identity Safeguards

You’ve built cash and started investing—now shield those gains. Ensure you have appropriate insurance across key risks: health, disability income (often overlooked), renters/homeowners, and adequate auto liability. Consider a personal umbrella policy if you have meaningful assets or liability exposure; it adds liability coverage above your home/auto limits and can cover risks like libel or slander. Review beneficiaries on retirement accounts and life insurance—beneficiary designations typically control where those assets go, often outside probate. On the identity front, use strong unique passwords, multifactor authentication, and consider maintaining a credit freeze to block unauthorized new accounts.

7.1 Mini-checklist

- Audit coverage yearly: Health, disability, life (term often fits pure income protection), homeowner/renter, auto.

- Umbrella: Get quotes for $1–$2 million if your assets or risks warrant it.

- Beneficiaries: Verify primary and contingent names across retirement and insurance.

- Identity: Keep credit frozen; thaw only when applying.

7.2 Region-specific notes

Insurance standards and public benefits vary by country. If you’re outside the U.S., confirm your local equivalents (e.g., national healthcare gaps, employer-provided disability, legal liability norms) and adjust coverage accordingly.

Protecting your downside is what keeps compounding intact when life throws a curveball.

8. Plan Your Next Big Goals (Home, Education, Business) With Timelines and the Right Accounts

Your surplus can now do more than protect—you can aim it at big goals. Define the goal, timeline, and “investment policy” for each. Shorter timelines (under ~5 years) usually favor safer, more liquid vehicles (high-yield savings, CDs, short-term bond funds), while longer timelines can handle market risk for higher expected return. For education, explore your country’s tax-advantaged options (e.g., in the U.S., 529 plans); for a home, build a down-payment fund with a conservative allocation that won’t collapse right before closing. For a business, separate capital from personal funds and maintain extra runway. The key is matching risk to horizon so you’re not forced to sell volatile assets at the wrong time.

8.1 How to do it

- Define the “when” and “how much.” Work backward to a monthly savings target.

- Pick the container: Savings/CDs for short horizons; diversified portfolios for long horizons.

- Automate contributions: Treat each big goal like a bill you pay your future self.

- Review annually: If the target moves, update the monthly transfer rather than skipping it.

8.2 Numeric example

Buying a home in three years? Need $45,000? Save $1,250/month (before assumed growth). If you expect modest interest at 3% in cash-like instruments, the monthly target drops slightly—but keep assumptions conservative so market swings can’t derail you at the finish line.

Clarity about timelines and account choice turns dreams into concrete plans you can actually fund.

9. Automate Your Money System and Review Quarterly

Finally, lock in the system so it runs on autopilot. Route paycheck inflows to checking, then schedule automatic “first” transfers: emergency top-ups, retirement plan contributions, HSA/IRA contributions, sinking funds, and investing. Use calendar reminders each quarter for a 30-minute “money check-in”: confirm contributions, scan accounts, top up any buckets, and note any upcoming lump-sum expenses. Annually, rebalance investments and revisit insurance and beneficiaries. Automation reduces decision fatigue, and regular reviews catch small drift before it becomes a problem.

9.1 Mini-checklist

- Direct deposit map: Checking → emergency fund → retirement/HSA/IRA → sinking funds → taxable investing.

- Quarterly review: Contribution % still on target? Any new goals? Any bills to annualize?

- Annual tasks: Rebalance, open-enrollment benefits review, insurance audit, beneficiary check.

- Lifestyle guardrail: If income rises, auto-increase savings first (then consider lifestyle upgrades).

A system that runs by default ensures today’s great intentions become tomorrow’s consistent results.

FAQs

1) I’m debt-free but don’t have much cash—should I invest or save first?

Save first. Build your emergency fund (3–6 months of essential expenses) in insured, liquid accounts so you’re resilient to surprises. Investing is important, but without a buffer, you risk selling at the wrong time or re-using credit. Once your cash floor is solid, invest systematically.

2) What’s the best “order of operations” after the last debt?

A common, effective stack is: emergency fund → capture full employer match → HSA (if eligible) → IRA (Roth or Traditional based on taxes) → max remaining 401(k) → taxable investing. This balances near-term stability with long-term growth and tax efficiency.

3) Roth or Traditional—how do I choose?

It hinges on taxes. If you expect your future tax rate to be higher, Roth contributions (tax now, tax-free later) can make sense. If you expect a lower retirement tax rate, Traditional contributions (deduct now, taxed later) may fit. When uncertain, split contributions and revisit annually.

4) How much should I invest each year for retirement now that I’m debt-free?

A widely used benchmark is ~15% of gross income for retirement savings (including employer match). If you’re starting later or want earlier retirement, aim higher. Use auto-escalation and raises to ratchet up your savings rate with minimal friction.

5) Should I pay off my mortgage early or invest extra?

It depends on your mortgage rate, risk tolerance, and goals. If your rate is low and you’re comfortable with market risk, long-term investing may produce higher expected returns. If guaranteed debt-free housing brings you peace or your rate is high, extra principal payments can be the right call. You can blend the two.

6) How do I rebuild credit without going back into debt?

Keep utilization low, pay in full and on time, and consider a secured card or credit-builder loan if your file is thin. Check reports weekly and dispute errors. A credit freeze adds another layer of protection and doesn’t affect your score.

7) Is an HSA really “triple tax-advantaged”?

Yes—if you’re eligible and use funds for qualified medical expenses: contributions can be pre-tax or deductible, growth is tax-deferred, and qualified withdrawals are tax-free. If you invest HSA funds for the long run, keep receipts for future reimbursements and be mindful of plan fees and the HDHP’s higher deductibles.

8) What investment mix should I use now that I’m investing more?

Start with a simple diversified core (global stock index + high-quality bond index) or a single target-date fund. Choose an equity/bond split that matches your risk tolerance and time horizon (e.g., 80/20 for long horizons, 60/40 as you approach retirement). Rebalance annually or when your mix drifts.

9) How often should I rebalance?

Once a year is plenty for most investors, or when your allocations drift beyond set bands (e.g., ±5–10 percentage points). Rebalancing controls risk by realigning to your target mix; doing it too often can raise costs without improving outcomes.

10) Where should I keep my emergency fund?

In insured, liquid accounts (e.g., savings or money market deposit accounts) where funds are accessible and stable. Confirm deposit insurance rules for your situation and avoid chasing yield with instruments that can lose value when you need the cash.

11) Do I need umbrella insurance?

If you have assets or potential liability exposure (e.g., teenage drivers, rental property, public-facing work), a personal umbrella policy can add $1–2 million of liability protection above home/auto limits for relatively modest premiums. It’s a backstop for low-probability, high-severity events.

12) How do I stop lifestyle creep after becoming debt-free?

Automate savings first, pre-decide a modest “celebration” budget, and direct raises/bonuses into contributions before they hit checking. Review quarterly. The habit of paying your future self first is the most reliable guardrail.

Conclusion

Paying off the last debt is the moment you take back control of your cash flow. The smartest next steps are simple, repeatable, and defensible: secure your cash floor, capture “free” employer match, route dollars through tax-efficient accounts, and invest the rest in a diversified, low-cost portfolio you can hold through ups and downs. Fortify your credit and insurance, set up sinking funds for known expenses, and map longer-term goals with timelines and the right account types. Most importantly, automate your system and review on a set cadence so good choices happen by default. Small, boring moves—done consistently—compound into freedom. Ready to lock it in? Set an automatic transfer today that future-you can’t miss.

References

- “An Essential Guide to Building an Emergency Fund,” Consumer Financial Protection Bureau (Dec 12, 2024). Consumer Financial Protection Bureau

- “Understanding Deposit Insurance,” Federal Deposit Insurance Corporation (Apr 1, 2024). FDIC

- “What SIPC Protects,” Securities Investor Protection Corporation (accessed Sep 2025). sipc.org

- “What’s in My FICO® Scores?” FICO (accessed Sep 2025). myFICO

- “Free Credit Reports,” Federal Trade Commission (Jan 4, 2024). Consumer Advice

- “How to Place or Lift a Security Freeze on Your Credit Report,” USA.gov (Aug 13, 2025). USAGov

- “401(k) Limit Increases to $23,500 for 2025; IRA Limit Remains $7,000,” Internal Revenue Service (News Release IR-2024-285; Nov 1, 2024). IRS

- Notice 2024-80: “2025 Amounts Relating to Retirement Plans and IRAs,” Internal Revenue Service (Nov 1, 2024). IRS

- Rev. Proc. 2024-25: HSA/HDHP 2025 Parameters, Internal Revenue Service (May 2024). IRS

- “Publication 969: Health Savings Accounts,” Internal Revenue Service (Jan 23, 2025). IRS

- “How Much Do I Need to Retire?” Fidelity (accessed Sep 2025). Fidelity

- “SPIVA U.S. Scorecard, Year-End 2024,” S&P Dow Jones Indices (2025). S&P Global

- Zhang, Y. et al., “Rational Rebalancing: An Analytical Approach to Multi-asset Portfolio Rebalancing,” Vanguard (2025). Vanguard

- “Dollar-Cost Averaging,” Investor.gov (accessed Sep 2025). Investor

- “What Is an Umbrella Liability Policy?” Insurance Information Institute (accessed Sep 2025). III

- “Retirement Topics – Traditional and Roth IRAs,” Internal Revenue Service (accessed Sep 2025). IRS

- “Your Money, Your Goals Toolkit,” Consumer Financial Protection Bureau (2025). Consumer Financial Protection Bureau