A monthly budget review is a recurring check-in where you compare plan vs. actual spending, diagnose variances, and adjust next month’s allocations before money drifts off course. In practice, it’s a 45–60 minute session to reconcile transactions, spot trends, and make decisions you’ll actually follow. Done consistently, it converts good intentions into results: lower waste, faster debt payoff, and steadier saving. This guide explains exactly why the monthly cadence matters and how to use it to improve cash flow, reduce stress, and hit long-term goals. Brief note: this article is educational and general in nature; for personal advice, consider consulting a qualified professional.

Quick definition: A monthly budget review is the process of comparing your budgeted amounts to what you actually spent in the last month, understanding the “why” behind the differences, and updating next month’s plan accordingly.

1. Variance Analysis Keeps Cash Flow Honest—and Fixable

A monthly budget review works because it forces a direct comparison between your plan and reality, so you can correct course before overspending compounds. Start by reconciling bank and card transactions to your categories, then compute the difference (variance) for each line: variance = actual − budget. The goal isn’t blame; it’s insight. If groceries were budgeted at $400 and came in at $520, you’ve learned something about prices, habits, or planning. Repeating this analysis monthly gives you enough data to see patterns—like a consistent $80–$120 overage in dining out—which you can then address with targeted rules (e.g., meal-prep twice weekly, move $100 from “miscellaneous” to “groceries”). The monthly rhythm makes the feedback loop short enough to act on while still capturing full billing cycles.

1.1 How to do it

- Reconcile every transaction since the last review (no exceptions).

- For each category, record Budget, Actual, and Variance (±).

- Circle the three largest adverse variances; write one concrete fix per variance.

- Move dollars, not just intentions: reallocate next month’s plan now.

- Log one “learning” per month (e.g., “gas prices up; raise fuel by $20”).

1.2 Numbers & guardrails

- Target ≤3 adverse variances above 10% each month.

- Cap “miscellaneous” at ≤3% of take-home pay to avoid hiding overspends.

- If net variance >0 (overspend), offset by trimming low-priority categories next month.

Synthesis: Variance analysis is budgeting’s diagnostic engine; the monthly cadence ensures you learn quickly enough to fix what’s broken before it snowballs.

2. Catch Recurring Cost Leaks Early (Subscriptions, Fees, and “Free Trials”)

Subscriptions are convenient, but they’re also where small leaks become annualized waste. A monthly review surfaces charges you forgot or couldn’t cancel, like $9.99 for a streaming add-on or $14.99 for a duplicate cloud plan—each tiny on its own but $300+ per year together. Because card issuers bill on monthly cycles, this is the ideal interval to audit: scan the last statement for anything labeled “auto-renew,” “membership,” or “trial.” If a service no longer delivers value, cancel now and set a reminder to confirm the final charge next month. The landscape is evolving too: consumer-protection rules increasingly require that canceling be as easy as signing up, which strengthens your hand when you say goodbye to a subscription.

2.1 Mini-checklist

- List all auto-renews; tag each as keep, pause, or cancel.

- If “cancel,” do it immediately and screenshot the confirmation page.

- Email yourself “Proof of cancellation — <service> — <date>.”

- Create a “trial end” calendar event 3 days before each trial rolls over.

- Ask for prorated refunds when terms allow; log any credits in your tracker.

2.2 Numeric example

Two unused services at $9.99 and $14.99 save $24.98/month. Annualized, that’s $299.76. If redirected to debt at 20% APR, those dollars can avoid ~$60 in interest over a year, accelerating payoff and compounding the win.

Region notes: In the U.S., the FTC’s Negative Option Rule targets “hard-to-cancel” designs; similar auto-renew rules exist in the U.K. and E.U., though details vary—check your country’s consumer authority site for specifics.

Synthesis: A 10-minute subscription audit during each review turns “death by a thousand cuts” into quick savings you can redirect to higher-impact goals.

3. Build (and Refill) Your Emergency Fund with Real Numbers

Emergency funds work only if they’re sized to your life and replenished after use. A monthly review is when you track progress, adjust the target if expenses change, and top up after any dip. Many official sources suggest aiming for 3–6 months of essential expenses; calculate your number using your actual monthly baseline—not a guess. If your essentials average $2,400, a 3-month buffer is $7,200; set a monthly transfer (say $300) and revisit after raises, moves, or family changes. If you drew down the fund for a car repair, use the review to schedule catch-up contributions over the next 3–6 months so you’re not exposed to the next surprise.

3.1 Tools & steps

- Keep the fund in a separate high-yield savings account to avoid mingling.

- Automate a monthly transfer on payday (“pay yourself first”).

- Track your months-of-expenses metric (Emergency Fund ÷ Monthly Essentials).

- After any withdrawal, create a 90-day refill plan.

3.2 Why it matters (data point)

Central-bank surveys regularly show that many households struggle with unexpected costs. Tracking progress monthly raises resilience and reduces the odds of resorting to high-interest debt when the inevitable $300–$700 surprise hits.

Synthesis: Monthly check-ins convert an abstract “rainy-day” idea into a measurable buffer that grows, gets used when needed, and gets refilled on schedule.

4. Re-Aim Debt Payoff Faster with Snowball or Avalanche

Debt strategies succeed when they’re consistent—and consistency thrives on monthly recalibration. Each review, confirm your approach: avalanche (highest APR first) to minimize interest costs, or snowball (smallest balance first) to maximize momentum. Update balances, adjust extra-payment amounts, and log the projected payoff date. If a card’s APR jumps or a balance transfer expires, switch tactics; the budget review is your built-in pivot point. Example: with $200/month extra, the avalanche saves more interest over time, but if motivation is wobbling, a snowball’s quick win could keep you engaged enough to finish the plan. Government and reputable education sources summarize both methods clearly—use their worksheets to stay on track.

4.1 Mini-workflow

- List debts with Balance, APR, Min Pay.

- Choose avalanche or snowball; highlight the current target account.

- Schedule an automatic extra payment for the target (e.g., +$150/month).

- When one debt closes, immediately roll its payment to the next (“snowballing”).

4.2 Numeric example

If you owe $1,200 at 22% APR (min $30) and add $150/month, that balance can be gone in ~7 months, saving ~$90–$120 vs. minimums. Switching that freed $180 to the next debt compounds progress.

Synthesis: The monthly review is where debt plans get recalibrated to reality so you either save the most interest (avalanche) or preserve the motivation to finish (snowball).

5. Smooth Irregular Costs with Sinking Funds (So Annual Bills Don’t Derail You)

Budgets often fail because big, infrequent expenses arrive “unexpectedly.” Sinking funds fix this by breaking large, irregular costs into predictable monthly set-asides. During your review, list the next 12 months’ known bills—insurance premiums, vehicle registration, holidays, travel, school fees—and divide by the months until due. Example: car insurance due in 6 months for $600 → save $100/month. Store each fund in separate categories (or sub-accounts if your bank supports them). When the bill hits, you pay in full with zero stress. The monthly cadence is perfect because it aligns with how you earn and pay most bills, and it gives you 12 “shots” per year to adjust as quotes change or plans evolve.

5.1 How to do it

- Create categories: Insurance, Auto Repairs, Medical, Gifts/Holidays, Travel, Home Maintenance.

- For each, write Total Cost ÷ Months Until Due = Monthly Set-Aside.

- Automate transfers on payday; label them “sinking fund — <category>.”

- Review balances monthly; re-quote large items (e.g., insurance) annually.

5.2 Mini-checklist

- Any annual bill without a matching sinking fund? Create one.

- Any fund under-target? Shift discretionary dollars until caught up.

- Upcoming trip within 90 days? Front-load that fund this month.

Synthesis: Sinking funds turn “surprises” into scheduled payments; the monthly review makes the math automatic and the execution reliable.

6. Rebalance Categories as Prices Shift (Housing, Transport, Food Lead the Way)

Prices and priorities aren’t static, and neither should your categories be. In most household budgets, housing, transportation, and food dominate spending share; if any of these shift materially, your whole plan needs rebalancing. Use the monthly review to look at category shares, not just dollars: if food climbed from 12% to 14% of outlays, decide whether that’s acceptable or whether to trim dining out or find cheaper staples. Because these three categories reliably take the largest slices, small improvements here move the needle the most. Checking this monthly keeps you responsive to trends rather than lagging a quarter behind.

6.1 Numbers & guardrails

- Track each major category’s % of total spend; set target ranges (e.g., Food 10–15%).

- If a major category exceeds its range for 2 consecutive months, implement a rule (e.g., “one big shop + two small top-ups,” “carpool twice weekly”).

- Revisit fixed costs (rent, insurance) at renewal windows; set calendar reminders 60–90 days ahead.

6.2 Region-specific note

Local price dynamics vary—commuter costs in car-centric regions vs. transit-rich cities, or food baskets by country. Monthly tracking lets you adapt quickly to your local reality rather than chasing generic ratios.

Synthesis: Watching shares as well as dollars helps you adjust where it matters most, keeping your plan aligned with the real world’s price movements.

7. Turn Insights into Automation (So Good Choices Happen by Default)

The best time to automate a smarter decision is immediately after the review that revealed it. If your analysis shows you can raise savings by $75/month or trim groceries by $50, don’t rely on willpower—convert that into automation. Set paycheck splits so a fixed percentage goes straight to savings, retirement, or a sinking fund before it hits checking. Use card-level rules or merchant caps inside your budgeting app to slow down overspends. And if your hours or income fluctuate, use a “percentage budget”: decide fixed percentages for essentials, goals, and discretionary, and let the absolute amounts scale with the month’s pay.

7.1 Mini-automation menu

- Pay yourself first: auto-transfer to savings on payday.

- Round-ups: send card round-ups to a sinking fund or debt extra-pay.

- Merchant rules: cap monthly spend at high-risk merchants.

- Calendar holds: block 60 minutes after payday for a micro-review.

- Escalators: increase savings by +1% after each raise.

7.2 Short example

If take-home is $3,200 and you automate $300 to savings, $150 to debt extra-pay, and $100 to travel, you’ve locked in a $550/month “set-it-and-forget-it” plan the next review can verify and improve.

Synthesis: Monthly reviews identify the tweak; automation locks it in so good behavior repeats without daily effort.

8. Use Monthly Reviews to Stress-Test and Protect Your Plan

Financial resilience improves when you ask “what if?” every month—before a surprise answers for you. During your review, sketch quick scenarios: “What if income drops 10% for 3 months?” “What if rent rises 8% at renewal?” “What if the car needs $1,200 in repairs?” Convert the answers into actions: larger buffer, insurance checks, or a temporary category freeze. As consumer-expenditure patterns and household savings capacity evolve, staying adaptive reduces the need for expensive credit when something breaks. Even a one-page stress-test table—three scenarios, three planned responses—can prevent a crisis from becoming debt.

8.1 Stress-test template

- Scenario: Income -10% for 3 months → Response: pause sinking funds (except essentials), negotiate bills, pick up 1–2 overtime shifts.

- Scenario: Rent +8% at renewal → Response: get competitive quotes for renters insurance, trim dining by $80, increase roommate cost share if applicable.

- Scenario: $1,200 car repair → Response: tap sinking fund + emergency fund, refill over 4–6 months.

8.2 Guardrails

- Keep one month of basics in checking to absorb billing timing.

- Set a maximum new-debt threshold (e.g., “no new financing unless essential and <5% APR”).

Synthesis: A small monthly habit of “pre-mortems” keeps your plan robust under stress, so you react with a checklist instead of panic.

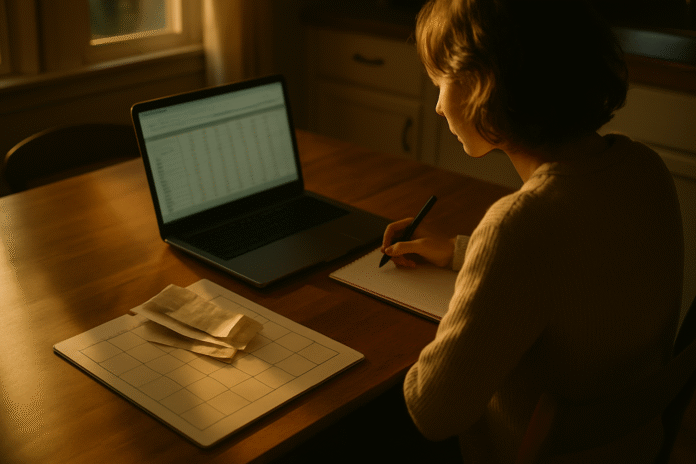

9. Create Accountability and Momentum with the Right Tools

Consistency beats brilliance. A monthly review becomes a habit when it’s simple, scheduled, and supported by tools you’ll actually open. Choose one system—spreadsheet, envelope-style app, or your bank’s built-in budget—and stick with it for 90 days. Use a budget planner to structure categories, then layer on transaction import and basic reports (category trends, monthly summaries). If you share money with a partner, add a 20-minute “money huddle” to align on any changes before the new month starts. Public services and nonprofit tools offer solid planners if you want a neutral starting point.

9.1 Mini-checklist (monthly)

- Reconcile all accounts; clear pending transactions.

- Review top three variances; write one fix each.

- Update debt targets and savings transfers.

- Add or adjust sinking funds for upcoming bills.

- Book next month’s review on the calendar now.

9.2 Partner protocol (if applicable)

- Share the numbers without blame; stick to facts.

- Agree on one “cut” and one “protect” category per month.

- Celebrate a win (debt closed, fund milestone) to reinforce the habit.

Synthesis: The right cadence and tools turn monthly reviews into a sustainable rhythm that builds confidence and measurable progress over time.

FAQs

1) What exactly should my monthly budget review include?

At minimum: reconcile every transaction, calculate category variances, choose three fixes, update next month’s plan, and schedule any automation (transfers, payment rules). If you use sinking funds, check their balances against upcoming bills. If you’re paying off debt, confirm your target account and extra-payment amount. Finish by logging one written lesson—this helps you remember and compound improvements.

2) Is monthly the best frequency, or should I review weekly?

Both can work. Weekly check-ins are great for keeping receipts and small habits in line, but monthly is the most natural full cycle because income, bills, and statements tend to run monthly. Many people do a quick 10-minute weekly “touch” and a deeper 45–60 minute monthly review. If you choose only one, make it monthly so you capture the complete picture.

3) How do I size my emergency fund during reviews?

Use your actual essentials (housing, utilities, groceries, transport, minimum debt payments) and multiply by 3–6 months. Track progress as “months-of-expenses.” Recalculate after any life change—new rent, a baby, or a job shift—and increase your automatic transfer when possible. If you withdraw for a true emergency, create a 90-day plan to refill so the buffer remains intact.

4) Which debt payoff method should I pick?

Choose avalanche if you prioritize minimizing interest; choose snowball if early wins keep you motivated. The “best” strategy is the one you’ll follow for the months it takes to finish. You can also start snowball to build momentum and switch to avalanche later. Reconfirm your choice during each monthly review as balances and rates change.

5) How do I handle irregular expenses like holidays or annual insurance?

Create sinking funds. Divide the expected total by the months until due and save that amount automatically each month. Keep separate categories (or sub-accounts) so you don’t mingle these dollars with daily spending. During reviews, compare each fund’s balance to the timeline and front-load any that are behind schedule.

6) What categories should I watch most closely?

Because housing, transportation, and food typically take the largest shares, even small percentage improvements in these areas move the needle. Track each as a percent of total spending and set target ranges; adjust if a category exceeds its range two months in a row.

7) How can I make canceling subscriptions less painful?

Keep a single spreadsheet or note with service name, amount, renewal date, and cancellation steps. Schedule calendar nudges 3–5 days before trial end dates. If a service resists cancellation, know that consumer rules increasingly require that cancellation be as easy as sign-up; keep screenshots and escalate as needed with your card issuer if charges continue.

8) What if my income is irregular?

Use percentage-based budgeting so allocations scale up and down with income. Build a slightly larger buffer (e.g., 2–4 weeks of expenses) in checking to smooth timing gaps. In your monthly review, plan for the lowest expected month, then treat any excess as a separate decision: debt extra-pay, emergency fund, or one-off purchases.

9) Which tools do you recommend to get started free?

Publicly supported planners are a solid baseline and avoid upselling. Try MoneyHelper’s Budget Planner (U.K.) or ASIC’s Moneysmart budgeting guides (Australia). Combine these with your bank’s categorized transaction feed or a simple spreadsheet to keep control and visibility high.

10) How soon will I see results from monthly reviews?

Usually within the first 1–2 cycles: subscription cuts show up immediately, and debt acceleration or savings automation compounds over subsequent months. Expect a learning period where variances are messy; the goal is directional improvement. By month three, most people can point to at least one closed debt, a clearer emergency-fund path, and fewer surprise bills.

Conclusion

Monthly budget reviews are the engine that turns your money plan into results. Because they align with billing cycles and paychecks, they’re frequent enough to catch mistakes early but spacious enough to reflect a complete picture. Each session is a simple pattern: reconcile, analyze variances, pick three fixes, adjust next month’s plan, and automate the best decisions so they stick. Layer in sinking funds for irregular costs, a considered debt strategy, and a measurable emergency-fund target, and your finances become calmer and more resilient. Over time, you’ll spend less energy firefighting and more time choosing trade-offs deliberately—funding what matters, cutting what doesn’t, and adapting as life changes. Start this month; put a 60-minute calendar block on the last weekend of every month and follow the checklists above. Your copy-ready next step: book your first review now and move one dollar to your highest-priority goal today.

References

- Budgeting: How to create a budget and stick with it — Consumer Financial Protection Bureau (June 5, 2019). https://www.consumerfinance.gov/about-us/blog/budgeting-how-to-create-a-budget-and-stick-with-it/

- Creating a monthly household budget (Guide PDF) — Consumer Financial Protection Bureau (2022). https://files.consumerfinance.gov/f/documents/cfpb_building_block_activities_creating-monthly-household-budget_guide.pdf

- How to reduce your debt — Consumer Financial Protection Bureau (July 16, 2019). https://www.consumerfinance.gov/about-us/blog/how-reduce-your-debt/

- Consumer Expenditures — 2023 Results (news release) — U.S. Bureau of Labor Statistics (September 25, 2024). https://www.bls.gov/news.release/cesan.htm

- Setting up an emergency fund — Financial Consumer Agency of Canada (March 28, 2025). https://www.canada.ca/en/financial-consumer-agency/services/savings-investments/setting-up-emergency-funds.html

- Making a budget — Financial Consumer Agency of Canada (August 21, 2025). https://www.canada.ca/en/financial-consumer-agency/services/make-budget.html

- Survey of Household Economics and Decisionmaking: Unexpected expenses ($400) — Board of Governors of the Federal Reserve System (May 28, 2025). https://www.federalreserve.gov/consumerscommunities/sheddataviz/unexpectedexpenses.html

- Negative Option Rule (final rule) — Federal Register / Federal Trade Commission (November 15, 2024). https://www.federalregister.gov/documents/2024/11/15/2024-25534/negative-option-rule

- Federal Trade Commission Announces Final “Click-to-Cancel” Rule — Federal Trade Commission (October 16, 2024). https://www.ftc.gov/news-events/news/press-releases/2024/10/federal-trade-commission-announces-final-click-cancel-rule-making-it-easier-consumers-end-recurring

- Budget planner (tool) — MoneyHelper, U.K. https://www.moneyhelper.org.uk/en/everyday-money/budgeting/budget-planner

- How to do a budget — ASIC Moneysmart, Australia. https://moneysmart.gov.au/budgeting/how-to-do-a-budget