You’ve reached a saving goal when your balance can fully cover the intended purpose, in the right account and currency, with a realistic buffer and no unintended knock-ons to your budget or other priorities. In practice, that means confirming the amount, availability, timing, and downstream effects before you declare it “done” and redirect your transfers. This guide breaks that decision into 12 clear checkpoints, so you can move from “I think I’m there” to “I’m there—and I know what happens next.” It’s written for anyone tracking emergency funds, purchases, travel, tuition, sinking funds, or down payments. Because financial situations vary, treat this as educational guidance—not personal financial advice—so you can adapt thresholds to your context and local rules.

Quick answer: You’ve reached a saving goal when (1) your target amount plus a small buffer is in the correct, liquid account and currency, (2) prices/quotes and timing are confirmed, (3) your emergency fund and cash-flow resilience remain intact, and (4) you’ve redirected automation toward the next priority.

Fast steps (skim list): Set a target + buffer → verify net, settled, liquid funds → confirm quotes and dates → check you’re not raiding your emergency fund → review variance trends → ensure FX/fees won’t erode it → compare opportunity cost → lock the purchase or earmark the money → stop/redirect transfers → document and celebrate → set the next goal.

1. Target Amount + Realistic Buffer

You’ve reached your saving goal when the net, spendable balance meets the target plus a practical buffer for slippage. Start with the total you actually need to pay—invoice, tuition statement, deposit requirement, or price estimate—then add a margin for fees, taxes, shipping, price creep, and last-minute add-ons. For many consumer goals, a 3–10% buffer works; for volatile or complex goals (international travel, medical deductibles, home repairs), lean higher. The aim is to prevent “oops, we’re short” at checkout and to avoid raiding unrelated reserves to plug gaps. Confirm the number using your latest quotes (not last month’s) and today’s account balances, not just your spreadsheet projection. If the purpose involves the first payment in a series (e.g., lease deposit or school term one), make sure the buffer covers timing mismatches until the next income hits.

1.1 How to do it

- Pull the latest invoice/quote and list all line items (tax, delivery, tips, resort/cleaning fees, installation).

- Add expected fees: card surcharge, wire/transfer fee, foreign transaction, or dynamic currency conversion.

- Pick a buffer: 3–5% for stable, 8–12% for uncertain/volatile prices.

- Recalculate the goal: Goal = Base Cost + Fees + Buffer.

- Compare this to your available (not pending) balance in the designated account.

1.2 Numeric example

Laptop quoted at $1,200. Sales tax 7% ($84). Shipping $20. Payment fee 2% ($26). Base + fees = $1,330. Add 5% buffer ($66) → $1,396. You’re “done” when $1,396 is available in cash or a highly liquid account.

Synthesis: If your available funds cover the fully loaded cost plus buffer, you’ve cleared the most important threshold.

2. SMART Definition & Measurement Pass

You can’t “reach” a goal that wasn’t precisely defined. A saving goal is complete when it satisfies your original SMART spec: specific amount, purpose, account/currency, deadline, and measurable condition for “done.” If you didn’t write it all down, retro-fit the definition now and check your current status against it. The first two sentences of any goal statement should state exactly what will be purchased/held and how you’ll measure success (e.g., “₨300,000 in Bank ABC High-Yield Savings by 31 Dec, to fund a Japan trip”). Include constraints like “without dipping below 3 months’ emergency cash” so you don’t “succeed” by creating a new problem. Finally, decide how many consecutive days at-or-above target count as success; a 5–7 day streak avoids declaring victory on a fleeting balance that falls with the next bill.

2.1 Mini-checklist

- Purpose and amount are explicit and externally checkable.

- Account and currency are specified.

- Deadline and streak rule defined (e.g., 7 consecutive days ≥ target).

- Guardrail: emergency fund floor remains intact.

- Evidence source named (bank statement, app screenshot).

2.2 Tools/Examples

Use a budgeting app with goal features (e.g., category “sinking funds,” “pots,” or “vaults”), or a simple sheet with columns: Date | Balance | Target | Above Target? | Streak.

Synthesis: A SMART, streak-based definition prevents “paper victories” and gives you a clean, defensible moment to stop saving and start using.

3. Liquidity & Settlement Confirmed (Funds Are Actually Spendable)

A goal is only “reached” if the money is spendable on time. Confirm that the balance isn’t stuck in pending transfers, promotional holds, settlement windows, or volatile instruments. Cash in a high-yield savings account is generally available, but interbank transfers can take 1–3 business days; brokerage cash sweeps and money market fund redemptions may settle T+1; some banks place new-deposit holds; and international transfers can face cut-off times. As of now, many institutions offer instant or near-instant transfers domestically, but availability varies by bank, network, and limits. Double-check the payment method the vendor requires (card, wire, cashier’s check, ACH, Faster Payments, SEPA Instant, RTGS) and ensure your funds are in the account that can initiate that method today.

3.1 Numbers & guardrails

- Domestic transfer timing: often instant to 3 business days; build a 3–5 day cushion unless you have verified instant rails.

- Brokerage sweep/MMF redemption: commonly T+1; some cutoffs apply.

- New deposit holds: can be 1–7 days depending on bank/risk checks.

- Large wires: verify cut-off (e.g., 2–4 p.m. local) to avoid a one-day slip.

3.2 Mini-checklist

- Funds in the correct account and currency.

- Transfer method tested (small test transfer cleared).

- Holds/limits checked; any “pending” has settled.

- Vendor’s payment instructions received and matched.

Synthesis: You’re done when spendable cash will reach the payee on time without last-minute hops or settlement risk.

4. Price Lock, Quote Validity & Vendor Readiness

You haven’t truly reached the goal if the price can jump before you pay. Confirm you have an active quote, fare hold, builder estimate, or invoice with validity dates; for airfare/hotels, prices can change hourly; for builders and mechanics, materials/labor can change month to month. If you need to book or lock a rate, the “done” moment is when you can complete the transaction within the quote’s validity window without dropping below your emergency fund floor. Include payment method requirements (wire only, bank transfer only) and any additional fees (resort fees, cleaning, installation, delivery). For travel, consider peak season surcharges and currency swings; for education or visas, consider government fee updates.

4.1 How to nail it

- Ask the vendor for a dated written quote and the expiry date.

- Confirm what exactly the quote covers (parts, labor, taxes, fees).

- Identify non-refundable deposits and lead times.

- Check change/cancellation policies and penalties.

- Schedule the booking/payment within the validity window.

4.2 Numeric example

Renovation quote: $8,000 valid for 30 days, excludes permits. Permits estimated $400. Possible 5% material increase next month. Build goal = $8,000 + $400 + 5% buffer = $8,820. You’re done when $8,820 is liquid and you can sign within 30 days.

Synthesis: A current, time-boxed quote plus cash in the right place converts “I have the money” into “I can lock the deal.”

5. Emergency Fund & Cash-Flow Resilience Intact

Reaching one goal shouldn’t weaken your foundation. Before you declare victory, verify that paying for the goal won’t pull your emergency fund below your minimum months-of-expenses threshold (commonly 3–6 months, adjusted for job stability, dependents, and health coverage). Also stress-test the next 60–90 days of cash flow: rent/mortgage, insurance, utilities, food, transport, and recurring subscriptions. If funding the goal forces you to take on credit card debt or miss bills, you haven’t really “reached” it. Consider seasonality (e.g., annual insurance premiums, school fees, Eid/holiday travel, taxation deadlines) that might crowd your cash in the coming quarter.

5.1 Mini-checklist

- Emergency fund ≥ your floor after this purchase.

- Next 2–3 months cash flow modeled with no shortfalls.

- Credit card balances won’t spike due to the purchase.

- Large annual/quarterly bills accounted for in the model.

5.2 Tools/Examples

Budget apps with “sinking funds” help ring-fence money; spreadsheets with month-by-month projections can flag negative balances; envelope/pots features in banks keep the emergency fund untouchable.

Synthesis: If your shock absorber remains intact and bills stay covered, the goal is reached in a sustainable way.

6. Variance-to-Plan & Trend Stability (No One-Day Flukes)

A single good-looking balance can be misleading. Check your variance to plan over the last 60–90 days and confirm a stable trend: contributions arriving on schedule, spending within budget, and no reliance on one-off windfalls. A simple approach is to track a rolling three-month average of contributions and your end-of-month balances against the target. If your average is on target and you’re above the goal for at least a week, you’re solid; if you only scrape the target on payday and immediately drop below it after bills, wait until the pattern’s stable. This checkpoint is especially helpful for freelancers or anyone with variable income.

6.1 Numbers & guardrails

- Rolling 3-month contribution average ≥ planned amount.

- End-of-month balances ≥ pro-rata target (e.g., at month 6 of 12, ≥50%).

- 7-day balance streak above the target to confirm stability.

- Variance band ±5% is acceptable unless the purchase window is tight.

6.2 Mini case

Planned save: $500/mo. Actual last 3 months: $520, $480, $505 → average $502; target met. Balance stayed above the $3,000 goal for 10 consecutive days. ✅

Synthesis: Consistency beats coincidence—trend stability makes “done” dependable.

7. Currency, FX, and Location Readiness (International Goals)

If you’re about to pay in a foreign currency or abroad, reaching the goal includes handling FX risk, fees, and payment rails. Bank markups, card foreign transaction fees, and dynamic currency conversion (DCC) can eat 1–5%+ of your balance. For bank transfers, intermediary fees and slow settlement can shave amounts or delay payments. As of now, many wallets and banks offer local-currency sub-accounts and “jars/pockets” that let you pre-fund in the target currency; for large transfers, consider rate alerts or forward-like features offered by some providers. Ensure your ID/KYC requirements are met in advance to avoid day-of blocks.

7.1 Mini-checklist

- Goal balance calculated in target currency with a rate buffer (e.g., +3–5%).

- Payment method picked (no DCC; use local-currency charge where possible).

- Transfer/withdrawal limits and compliance checks cleared.

- Proof of address/ID ready (for large wires or cash withdrawals).

7.2 Numeric example

You need €2,000 for tuition deposit. Spot rate 1.10 USD/EUR; bank adds ~3% markup → effective 1.133. Add 2% security buffer: plan for $2,314 instead of $2,200.

Synthesis: If FX frictions won’t reduce your spending power below the target, your international goal is truly reached.

8. Opportunity-Cost Crossover (When Saving More Isn’t Optimal)

A goal is “reached” the moment the next dollar would be better deployed elsewhere. Compare the after-tax return on your current savings vehicle with the after-tax APR on any high-interest debt or the expected payoff from your next priority (e.g., retirement account match, education fund). If your savings APY is 4% and your credit card APR is 24%, additional dollars beyond the buffer would destroy value; redirect them. Conversely, if you’re saving for a near-term purchase, keeping excess beyond the buffer may be fine, but consider opportunity costs like missing an employer match or not reducing refinancing risk.

8.1 How to do it

- List marginal uses for the next dollar (debt paydown, investing, next goal).

- Estimate after-tax returns/costs (APY vs APR).

- If APR > APY by a meaningful margin, stop saving past your buffer.

- If an employer match is available, prioritize capturing it.

8.2 Mini case

After hitting a $5,000 travel goal + 5% buffer, your HYSA yields 4%. You carry a $3,000 balance at 22% APR. Financially, the crossover says “goal reached—redirect new dollars to the card.”

Synthesis: You’ve reached the goal when the best use of the next dollar is no longer adding to it.

9. Automation Stop/Redirect Successfully Executed

Reaching the goal is not just about the balance; it’s about changing the system. You’re done when your automatic transfers stop funding this goal and start funding the next one (or a debt payoff). This avoids over-saving by inertia and turns momentum into compounding progress. Update any bank “pots/vaults,” standing orders, and payroll splits; rename the completed goal to avoid future contributions; and, if you use a budgeting app, close the category or set it to $0 target. Consider a “confirmation week” where transfers are paused first, then redirected after your streak rule is met.

9.1 Mini-checklist

- Standing orders to goal paused/ended.

- New automation to next goal created and scheduled.

- Budget category target set to $0 or marked Complete.

- Calendar reminder to review in 30 days.

9.2 Tools/Examples

Bank “pots/vaults,” payroll direct deposit splits, recurring transfers, and rules-based automations (“round-ups,” “sweep excess cash”).

Synthesis: When your automation points to the next priority, your current goal is not only reached—it’s retired.

10. Documentation, Evidence & Receipts (Prove It to Yourself)

A goal is real when you can prove it. Capture a dated screenshot of the account balance, the invoice/quote, and (if applicable) the booking confirmation or purchase receipt. Store them in a consistent place (note app, project folder, or budgeting app attachments). If there are warranties, serial numbers, or registrations, capture those too. For shared goals, document agreement with a spouse/partner via a short note so everyone knows the money’s purpose. Documentation helps at tax time, warranty claims, returns, and audits of your own progress later.

10.1 What to file

- Goal statement + final target math (with buffer).

- Bank statement or app screenshot (date visible).

- Invoice/quote and payment confirmation.

- Warranties/registrations (if a purchase).

- A “post-mortem” note: what worked, what didn’t.

10.2 Mini case

You hit ₹150,000 for a scooter. You save a PDF of the bank statement, the dealer invoice, and the payment confirmation; you also record the chassis number and warranty booklet. Future-you is grateful.

Synthesis: If you could show a third party everything in five minutes, the goal is objectively “done.”

11. Timing Window & Calendar Fit (No Collisions)

Even if the money is ready, the timing can undermine success. Check that completing the goal now doesn’t collide with other commitments: moving dates, quarterly taxes, travel overlaps, or blackout periods for bookings. Add lead time for administrative steps—visa processing, proof of funds letters, inspection appointments, delivery windows, or installation bookings. For seasonal purchases or sales, ensure you’re inside the optimal window (e.g., booking flights 1–3 months out regionally, earlier for holidays; purchasing appliances during common promo periods). Build a calendar buffer so one small delay doesn’t domino your plans.

11.1 Mini-checklist

- Payment/booking dates placed on calendar with reminders.

- Admin lead times included (visas, inspections, permits, shipping).

- No cash-flow collisions with known big bills in the same week.

- Backup dates if Plan A slips by a few days.

11.2 Numeric example

Tuition due Aug 15; transfer takes up to 3 business days; bank wire cut-off 2 p.m.; visa appointment Aug 10. Your “done” date must be Aug 7–9 at the latest, with funds already settled.

Synthesis: Money + calendar alignment makes execution smooth instead of stressful.

12. Post-Goal Glidepath (Protect, Use, or Rebalance)

Reaching a goal creates a new state: you either spend, ring-fence, or redeploy the cash. For spending goals, execute the payment and archive the documentation. For “held” goals (emergency fund tiers, upcoming tax bill), park funds in the right vehicle (e.g., insured high-yield savings, treasury bill ladder, or a cash-like option if appropriate for your region and risk). For investment-denominated goals, rebalance so your portfolio’s risk matches the new horizon—short-term goals should not drift into volatile assets. Finally, write a short “glidepath” note: what changes now, what automation points where, and what success looks like for the next goal.

12.1 Options & guardrails

- Spend now: pay and confirm delivery/booking.

- Ring-fence: keep in a safe, liquid account; label it clearly.

- Redeploy: move surplus to debt, retirement, or the next goal.

- Rebalance: adjust investments to your new risk/return mix.

12.2 Mini case

You saved $10,000 for a home down payment buffer but the appraisal came in lower, reducing cash needed by $2,000. You close, then immediately redirect $2,000 to a high-interest debt and increase retirement contributions by 1%.

Synthesis: A clear glidepath prevents “goal drift” and compounds the gains from your success.

FAQs

1) What’s the simplest way to confirm I’ve reached a saving goal?

Use a three-part check: (a) your available balance covers the fully loaded cost plus a buffer, (b) funds are in the right account/currency and spendable within the booking/payment window, and (c) your emergency fund and near-term cash flow remain intact. If all three are true for at least 5–7 consecutive days, you can safely mark the goal complete and redirect automation.

2) How big should my buffer be?

For stable prices and domestic payments, 3–5% is often enough. For international, volatile, or multi-party goals (weddings, renovations, medical procedures), set 8–12%. If you face FX fees or transfer markups, add another 2–3% to cover rate slippage. The right buffer is the smallest amount that keeps you from raiding other funds if something changes last minute.

3) Does a pending transfer count toward my goal?

Not until it settles. Pending ACH, interbank transfers, or brokerage redemptions can fail or be delayed. Treat goal money as real only when it’s in the correct account and cleared. If you’re on a tight deadline, move cash earlier and verify cut-offs to avoid missing payment windows.

4) Should I ever exceed the target by more than the buffer?

Yes, if your next most valuable dollar is still to this goal (e.g., imminent price surge, locking a scarce booking, or a penalty for falling slightly short). Otherwise, once you’ve hit the target + buffer, the opportunity cost test usually says to redirect to higher-impact uses like debt payoff or a matched retirement contribution.

5) How do I prevent over-saving once I hit the goal?

Build a “goal closure protocol”: pause transfers immediately, confirm your 7-day streak above target, then redirect transfers to the next priority. Rename or archive the goal, export a final snapshot, and set a 30-day reminder to review. Systems prevent inertia from quietly over-allocating cash.

6) What if prices jump after I’ve reached the goal?

Use your buffer first. If the jump exceeds your buffer, reassess: can you delay, switch vendors, or trim scope? For travel and electronics, price protection policies or alternative dates can help. If a large, permanent increase occurs (e.g., tuition, regulated fees), update the target; don’t gut your emergency fund to force a purchase.

7) I have variable income—when can I confidently say I’m done?

Lean on trend stability: require a 7-day balance streak above target, a rolling 3-month contribution average at/above plan, and a cash-flow projection with no shortfalls over the next 60–90 days. These smooth out the noise of uneven paychecks and prevent a payday illusion of success.

8) How do international fees affect “done”?

Foreign transaction fees, DCC, wire fees, and FX markups reduce your real purchasing power. Calculate your goal in the target currency and add a 3–5% markup and 2% slippage buffer unless you have a verified local-currency payment path. Pre-funding a local-currency “jar/pocket” can control this risk.

9) Does it matter which account holds the goal money?

Yes. The right account balances yield, safety, and availability. For near-term goals, insured high-yield savings or cash-equivalents with predictable settlement are typical. For same-day or weekend needs, a checking account or wallet with instant rails may be better. Match the vehicle to your timeline and payment method.

10) What should I do the day I reach the goal?

Execute your closure protocol: confirm target + buffer, ensure liquidity, lock the price/booking, make the payment, archive evidence, pause the old automation, and set the new one. Then write a 3-line post-mortem: what worked, what didn’t, what to do differently next time.

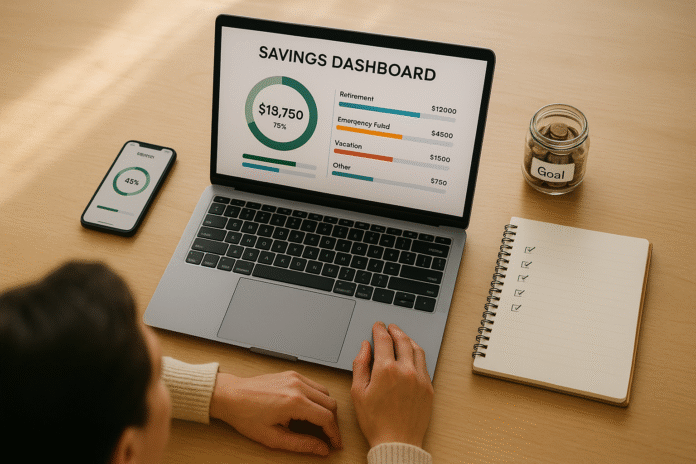

11) How do I track multiple goals at once without getting confused?

Use a dashboard: one row per goal with columns for Target | Buffer | Account | Currency | Deadline | Current Balance | Variance | Streak Days | Status. Color-code: green for above target, amber for within 5%, red for at risk. Most banking apps with “pots” or spreadsheets with conditional formatting make this simple.

12) What if reaching one goal endangers another (like my emergency fund)?

Then you haven’t truly reached the first goal yet. Your definition should include guardrails like “without dropping the emergency fund below X months.” If funding Goal A jeopardizes Goal B, either adjust the timing, trim the purchase, or increase the buffer until both conditions can be satisfied.

Conclusion

Knowing how to know when you have reached a saving goal is less about a single magic number and more about a disciplined completion test. You verify the amount (with a buffer), ensure the money is liquid and in the right place, confirm prices and timing, protect your emergency fund, and pass stability and opportunity-cost checks. Then you change the system—stop the old automation, document the win, and send momentum to the next priority. This approach prevents last-minute shortfalls, avoids hidden fees and settlement surprises, and keeps your broader financial plan intact. Most importantly, it turns a vague feeling of “maybe I’m there” into a repeatable closure protocol that’s calm, confident, and fast.

CTA: Mark one goal “complete” today, redirect your auto-transfer to the next one, and enjoy the compounding effect of a clean finish.

References

- Emergency savings: how much is enough? — Consumer Financial Protection Bureau (2023). https://www.consumerfinance.gov/ask-cfpb/how-much-should-i-save-for-emergencies-en-1101/

- Deposit Insurance at a Glance — Federal Deposit Insurance Corporation (FDIC) (2024). https://www.fdic.gov/resources/deposit-insurance/

- The ACH Network: How It Works — Nacha (2024). https://www.nacha.org/ach-network

- SEPA Instant Credit Transfer (SCT Inst) — European Payments Council (2024). https://www.europeanpaymentscouncil.eu/what-we-do/sepa-instant-credit-transfer

- Money Market Funds—What You Should Know — FINRA (2023). https://www.finra.org/investors/learn-to-invest/types-investments/mutual-funds/money-market-funds

- Building an emergency fund — MoneyHelper (UK) (2024). https://www.moneyhelper.org.uk/en/savings/types-of-savings/emergency-savings

- Publication 590-B: Distributions from Individual Retirement Arrangements (IRAs) — Internal Revenue Service (2024). https://www.irs.gov/publications/p590b

- Faster Payments: About the Service — Pay.UK / Faster Payments (2024). https://www.fasterpayments.org.uk/