Choosing a budgeting method is less about buzzwords and more about fit: How do you want decisions made, who must justify spending, and how quickly should plans adapt? At a high level, zero-based budgeting (ZBB) assigns every unit of income a specific job from a “zero” starting point each period, while traditional (usually incremental/line-item) budgeting starts from last period’s figures and adjusts up or down. The sections below unpack nine practical differences to help you decide where each method excels and when to blend them. This guide is educational, not financial advice; validate numbers against your own situation and local rules.

Quick take (30 seconds):

• ZBB = rebuild from zero; forces justification and prioritization.

• Traditional = start from last year; emphasize continuity and speed.

• ZBB is powerful for cost control and alignment, but time-intensive.

• Traditional is fast and stable, but can entrench waste.

• Most teams end up with a hybrid to balance rigor and effort.

1. Starting Point: Zero vs. Historical Baseline

Zero-based budgeting begins every period as a blank slate and allocates funds strictly according to current priorities; traditional (incremental/line-item) budgeting begins with last period’s budget and tweaks it. This difference matters because your starting point controls the conversation: ZBB asks “What should we fund now?” while traditional asks “How should we modify what we funded?” If you need to surface trade-offs, eliminate legacy spend, or realign to strategy, ZBB’s zero base forces those decisions. If you need continuity and speed—especially in stable environments—traditional baselines reduce friction and cognitive load.

1.1 Why it matters

- Visibility: ZBB exposes every cost; incremental can bury small but compounding line items.

- Bias control: Starting from last year can hard-code past mistakes; ZBB reduces anchoring.

- Cycle volatility: When markets shift, ZBB reallocates faster; incremental changes lag.

- Learning curve: ZBB requires training, templates, and data; incremental is familiar.

1.2 Numbers & guardrails

- Baseline drift: A 2–3% “just because” uplift each year compounds ~6–8% over 3 years.

- ZBB cadence: Many teams run annual ZBB with quarterly light refreshes to contain effort.

- Practical cap: Limit ZBB “decision packages” to the top 60–80% of spend to stay feasible.

Synthesis: Choose your default question: ZBB favors “purpose from zero,” incremental favors “continuity with edits.” Most organizations benefit from periodic ZBB resets to detox a baseline.

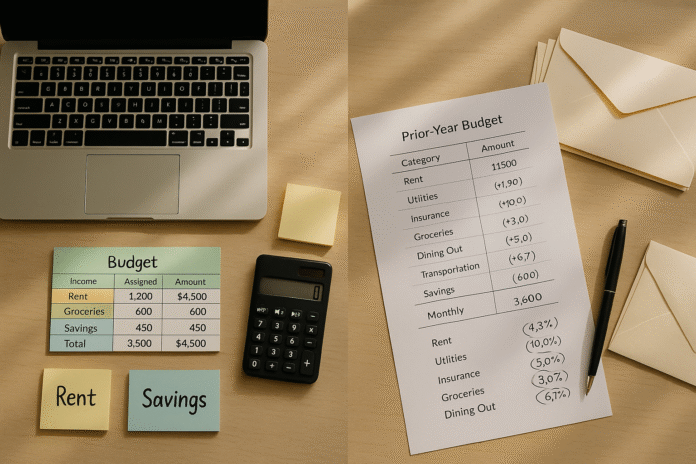

2. Allocation Logic: “Give Every Dollar a Job” vs. Category Ceilings

In ZBB, income minus outflows equals zero because every unit of income is assigned to expenses, debt, and savings; nothing is left idle. Traditional budgets set category ceilings tied to last year’s pattern, sometimes with across-the-board percentage changes. ZBB’s logic enforces explicit prioritization—if you overspend in one area, you must reassign from another. Traditional ceilings are easier to manage but can disconnect limits from real cash, especially when timing fluctuates.

2.1 How to do it (personal & team)

- Personal ZBB: Budget only money on hand; assign to categories until available funds hit 0.

- Team ZBB: Build decision packages per activity, rank by value/mandate, fund in order.

- Traditional flow: Copy last period, adjust for inflation, contracts, and policy deltas, then apply caps.

2.2 Mini example

- Income (this month): $3,000

- Must-pay: Rent $1,200, Utilities $180, Transport $220, Debt $300

- Flexible: Groceries $450, Fun $150, Sinking funds $300, Emergency $200

- Available left = $0 → if Groceries end up $480, you pull $30 from Fun and $0 remains.

Synthesis: ZBB turns your plan into a closed system that reconciles continuously; traditional ceilings are simpler to set but easier to ignore in-the-moment.

3. Justification Standard: Decision Packages vs. Line-Item Inertia

ZBB’s hallmark is full justification. Managers (or households) craft “decision packages” describing the purpose, cost, and expected outcomes of a spend and rank them for funding. Traditional budgets often inherit prior lines unless there’s a compelling reason to change. ZBB’s standard pushes clarity—what value does this subscription, project, or headcount deliver this period? Traditional budgeting relies on institutional memory and negotiated increments, which can be more pragmatic but less surgical.

3.1 Why it matters

- Cost discipline: Periodic zero-based reviews can strip out redundant vendor contracts.

- Strategic fit: Packages force a link to goals, KPIs, or mandates; low-value items defund first.

- Risk: Over-zealous ZBB can starve long-horizon work (R&D, brand, safety) that lacks near-term ROI.

3.2 Tools & examples

- Templates: Decision-package one-pagers (objective, cost, outcome, risk if unfunded).

- Scorecards: Weight impact (40%), risk (20%), compliance (20%), cost (20%).

- Example: A $120k analytics renewal scores low on impact vs. a $90k compliance upgrade; fund the latter first.

Synthesis: ZBB raises the bar from “Explain the change” to “Explain the spend.” Use it selectively where the juice (cost clarity) is worth the squeeze (time).

4. Effort & Cycle Time: High-Rigor vs. Fast & Familiar

ZBB is time-intensive; it requires granular cost mapping, ranking, and cross-functional debates. Traditional budgeting is faster, especially with mature baselines and rolling forecasts. For small teams or stable cost structures, incremental updates may deliver 80% of the value in 20% of the time. For larger organizations with legacy bloat, ZBB’s front-loaded effort can unlock multi-year savings—provided governance protects critical long-term capabilities.

4.1 Common mistakes

- ZBB fatigue: Attempting 100% ZBB annually without automation burns teams out.

- Across-the-board cuts: Blanket percentage trims in either system degrade capability randomly.

- Zombie software: Renewals that slip through because “it’s on last year’s sheet.”

4.2 Mini-checklist (contain ZBB effort)

- Prioritize top 10–15 spend buckets by magnitude.

- Time-box package drafting to 1–2 pages each.

- Automate with a budgeting platform; lock submission windows.

- Run a hybrid: ZBB for big rocks, incremental for low-risk tails.

Synthesis: ZBB trades time for precision; incremental trades precision for time. Pick the mix that your calendar—and culture—can sustain.

5. Strategic Alignment & Cost Control: Reallocation vs. Continuity

ZBB naturally reallocates resources toward current strategy because nothing is “pre-funded.” It’s potent during pivots, downturns, or post-merger cleanups. Traditional budgeting emphasizes continuity, protecting programs with proven trajectories and long-run value. The risk with ZBB is short-termism—underfunding maintenance, training, or research that pays off later. The risk with traditional budgeting is complacency—funding yesterday’s priorities because they’re embedded in the base.

5.1 Numbers & guardrails

- Reallocation target: In strategic resets, aim to redeploy 5–10% of OPEX toward top initiatives.

- Long-term carve-outs: Ring-fence minimum funding for safety, compliance, maintenance, R&D.

- Sunset triggers: Pre-define exit metrics for legacy projects to avoid ongoing drag.

5.2 Proof points & cautions

- Consulting and corporate case work show ZBB can realign G&A quickly, but outcomes vary with governance and culture; poorly run ZBB can harm brand and innovation. McKinsey & Company

Synthesis: Use ZBB to move money to strategy; use traditional baselines to protect durable value. The art is not choosing one, but orchestrating both.

6. Cash Flow & Irregular Income: Real-Time Rebalancing vs. Static Ceilings

For freelancers, seasonal earners, or teams with lumpy cash collections, ZBB works with money you actually have, not forecasts, and forces categories to flex in real time. Traditional budgets can set rational monthly ceilings but may mis-time cash; you can appear “on budget” on paper while struggling to pay a mid-month bill. Individuals often pair ZBB with cash-flow calendars, while organizations use weekly cash committees during tight liquidity.

6.1 How to do it (steps)

- Base ZBB on cleared balance or cash on hand, not expected income.

- Build a bill calendar with due dates; pre-fund any due before next payday.

- Create sinking funds (annual taxes, insurance, school fees) to smooth spikes.

- For irregular income, budget to a floor month (lowest recent earnings).

6.2 Region-specific notes

- Terminology: VAT/GST (many countries) vs. sales tax (U.S.)—budget net vs. gross accordingly.

- Pay cycles: Weekly/fortnightly regions need mid-cycle bill planning more than monthly cycles.

- Compliance: Self-employment tax set-asides differ by jurisdiction—treat as first-priority categories.

Synthesis: If timing is your pain point, ZBB plus a cash-flow view typically beats static ceilings, because it reconciles plan to bank reality and forces timely trade-offs.

7. Behavioral Effects & Accountability: Active Trade-Offs vs. Passive Drift

ZBB forces choices: going over in one category means deliberately moving money from another. That re-wires behavior—people track, adjust, and learn. Traditional budgets can encourage set-and-forget behavior, especially when overages don’t immediately require offsets. For teams, ZBB’s package ranking makes trade-offs explicit across departments; for households, envelope-style ZBB tightens day-to-day awareness.

7.1 Tools & examples

- Personal: YNAB-style ZBB assigns every dollar a job; overspends must be covered now.

- Team: Monthly “variance with offsets” meetings—every negative variance must name a funding source.

- Nudge stack: Alerts, weekly reviews, and category “cool-downs” after overspends improve adherence.

7.2 Common pitfalls

- Analysis paralysis: Over-granular categories; keep it simple (20–30 categories max).

- Shaming culture: In teams, treat variances as signal, not sin.

- Short-term bias: Protect long-horizon investments with guardrails (see §5).

Synthesis: ZBB creates a live feedback loop; traditional budgets need added rituals to avoid drift. Build accountability without punishment to sustain momentum.

8. Data, Metrics & Reviews: Granular Drivers vs. High-Level Aggregates

ZBB benefits from driver-based models (what actually makes a cost move?) and performance data tied to outcomes. Traditional budgeting often aggregates at account or department levels, which is sufficient for stability but weak for cost diagnosis. Governments increasingly blend performance information with budgets, and private teams use KPIs and activity drivers to justify packages and spot waste.

8.1 What to track

- Drivers: Volume (tickets, units served), rate (per-unit cost), and mix (product/customer).

- KPIs: Cost-to-serve, unit economics, service levels, backlog metrics.

- Cadence: Monthly variance review; quarterly driver re-estimation; annual ZBB pass on top spend.

8.2 Evidence base

- Public-sector frameworks (OECD/IMF) emphasize linking funding to results; ZBB’s package logic fits naturally with performance metrics.

Synthesis: Whatever method you use, couple money with measures. ZBB thrives on drivers; traditional baselines improve when outcomes are part of the conversation.

9. Best-Fit Use Cases & Hybrid Designs: When to Use Which (and With What Tools)

Neither method wins everywhere. ZBB excels for realignments, cost takeout, and cash-constrained seasons; traditional shines for steady operations, regulated environments, and multi-year programs. The practical answer is a hybrid: run ZBB on the biggest or most uncertain cost blocks while maintaining incremental updates elsewhere, and embed simple tools people actually use.

9.1 Where each fits

- Go ZBB when strategy shifted, margins are tight, or spend exploded without scrutiny.

- Go traditional when you need speed, mature baselines, or continuity for long-horizon work.

- Hybrid examples: ZBB for vendor spend & marketing; incremental for utilities and salaries.

9.2 Tools & resources

- Guidance & worksheets: CFPB bill/calendar and cash-flow tools; AUS Moneysmart planners.

- Apps: YNAB for personal ZBB; enterprise planning suites often support package ranking.

- Further reading: FT/HBR/McKinsey debates on ZBB’s benefits and limits.

Synthesis: Treat budgeting like a product: choose the method per problem, instrument it with the right tools, and revisit design as your context changes.

FAQs

1) What is the simplest definition of zero-based budgeting?

Zero-based budgeting starts each period at zero and assigns every unit of income to a job—expenses, debt, or savings—until nothing is unallocated. The check is that income – outflows = 0; any overspend must be covered by moving money from another category immediately. It’s the opposite of copying last period’s numbers and adding a percentage.

2) How does traditional (incremental) budgeting work in practice?

Most teams and households begin with last period’s plan, adjust for known changes (inflation, contracts, policy), tweak category caps, and call it done. It’s fast and stable, but because it anchors to history, it can perpetuate outdated spending or under-fund new priorities unless you explicitly challenge the base. Northern Ireland Assembly

3) Is ZBB only for companies, or does it work for personal finance?

It works for both. Corporates use decision packages and rank by value; households use ZBB apps or spreadsheets to give every dollar a job. The behavior change is similar: you make trade-offs visible and immediate, which tends to improve adherence and reduce waste.

4) Which method is better for irregular income?

ZBB usually wins because it budgets cash on hand, pairs well with bill calendars, and allows rapid re-allocation as money arrives. Traditional ceilings can still help as targets, but you’ll need extra cash-flow planning to avoid mid-month shortfalls.

5) Does ZBB risk starving long-term investments like R&D?

Yes—if the scoring model over-weights short-term ROI, ZBB can underfund maintenance, research, or safety. Mitigate by ring-fencing minimums for critical long-horizon work and by scoring compliance, risk, and resilience alongside impact.

6) Can I combine ZBB and traditional budgeting?

Absolutely. Many organizations run ZBB on their top spend buckets each year or during pivots, then maintain incremental baselines for stable costs. Households might run full ZBB monthly but keep some fixed caps (e.g., subscriptions, utilities) on autopilot. McKinsey & Company

7) What data do I need to do ZBB well?

Driver data (what makes the cost move), outcome metrics (what value you get), and reliable vendor/contract details. Templates for decision packages and a clear scoring rubric minimize debate overhead and make trade-offs transparent. Public-sector guidance on performance budgeting maps neatly to these needs.

8) Are there recommended tools?

For individuals, YNAB supports ZBB mechanics and real-time category covering; public agencies and companies can adapt package ranking in planning suites. For simple starts, CFPB worksheets and Australia’s Moneysmart planner are free, practical options. YNABMoneysmart

9) How often should we re-baseline with ZBB?

A common pattern is annual ZBB on the biggest spend with quarterly lightweight refreshes for new information. If the context is stable, extend to 18–24 months; if volatile, shorten cycles but cap the scope to avoid fatigue. (This cadence comes from practitioner experience reflected in ZBB playbooks and case work.)

10) Where can I read balanced critiques of ZBB?

See McKinsey’s history and implementation notes, and Harvard Business Review’s reminder that ZBB is not a cure-all—governance and culture determine outcomes. For a consumer-finance angle, recent coverage in mainstream outlets explores why ZBB is trending and where it’s hard.

Conclusion

“Zero-based vs traditional budgeting” isn’t a contest so much as a design choice. ZBB shines when you need to re-prioritize quickly, uncover legacy waste, or budget to real cash; traditional shines when you need speed, stability, and continuity. The real-world solution is to blend them: run ZBB on the spend that most deserves scrutiny and keep incremental updates where predictability matters. Instrument both with outcome metrics, driver data, and practical rituals—weekly reviews for cash, monthly variance with offsets, and quarterly driver refreshes. If you’re leading a team, adopt lightweight decision-package templates and a scoring model that protects long-term investments. If you’re budgeting at home, pair ZBB with a bill calendar, sinking funds, and a category cover rule. Make the method serve the mission: a budget that tells your money where to go, aligns with what you value now, and adapts as your world changes. Start today: pick two categories, run a mini ZBB pass, and move one percent of spend to your top priority.

References

- The return of zero-base budgeting, McKinsey & Company, Aug 1, 2015. McKinsey & Company

- Zero-Based Budgeting Is Not a Wonder Diet for Companies, Harvard Business Review, Jun 30, 2016. Harvard Business Review

- Zero-Based Budgeting (ZBB), Investopedia, n.d. Investopedia

- OECD Performance Budgeting Framework, OECD, Feb 16, 2024. OECD ONE

- The Budget Preparation Process, International Budget Partnership (IBP), n.d. International Budget Partnership

- Budgeting: How to create a budget and stick with it, Consumer Financial Protection Bureau, Jun 5, 2019. Consumer Financial Protection Bureau

- Creating a cash flow budget (tool), CFPB, Aug 2021. Consumer Financial Protection Bureau

- Zero-Based Budgeting: What It Is and How It Works, NerdWallet, Jan 27, 2025. NerdWallet

- How to budget for an irregular income, MoneyHelper (UK), n.d. MaPS

- Budget planner, Moneysmart (Australian Government/ASIC), n.d. Moneysmart

- The best way to build a budget, Financial Times, Sep 16, 2025. Financial Times

- ‘Every penny has a purpose’: the rise of zero-based budgeting, The Guardian, Apr 20, 2024. The Guardian