If you’re staring down a pile of balances and feeling overwhelmed, the Debt Snowball method can be the fresh start you need. Instead of obsessing over interest rates, you list debts from smallest to largest and attack the smallest first, rolling each freed-up payment into the next. The beauty isn’t just in the math—it’s in the momentum, clarity, and habit-building that help real people stick with a plan long enough to cross the finish line. In this guide, you’ll learn exactly why the Debt Snowball method works, how to put it to work step-by-step, and what to watch out for so you get faster wins without costly missteps.

Disclaimer: This article provides general educational information and is not financial advice. For personalized guidance, consult a qualified financial professional licensed in your region.

Key takeaways

- Motivation first, math second: Early wins keep you engaged and reduce burnout so you actually finish your payoff plan.

- Simplicity beats complexity: A clear, one-thing-at-a-time workflow cuts decision fatigue and speeds action.

- Compounding payments create lift: Each paid-off balance increases your monthly “snowball,” accelerating progress.

- Stress drops as accounts disappear: Closing accounts and streamlining bills can reduce anxiety and improve cognitive bandwidth.

- Your credit profile can benefit: Paying down revolving balances lowers utilization and can strengthen your score over time.

1) Fast Wins That Supercharge Motivation

What it is and why it matters

The Debt Snowball method organizes your debts by balance size (smallest to largest), regardless of interest rate. You make minimums on everything and pour all extra cash into the smallest debt first. That quick “paid in full” moment gives a tangible win—something behavioral research shows is unusually powerful for persistence on long tasks like debt repayment. Early victories build confidence, reduce overwhelm, and make it easier to keep going when life gets noisy.

Requirements and low-cost tools

- You need: A complete debt list (lender, balance, minimum payment, due date).

- Nice-to-have: A spreadsheet or paper tracker; envelope or zero-based budget.

- Low-cost alternatives: Free worksheets or printable debt trackers.

Step-by-step for beginners

- List your debts from smallest balance to largest.

- Make minimums on all debts to avoid fees and dings.

- Target the smallest with every extra dollar until it’s gone.

- Roll the freed-up payment to the next smallest.

- Repeat until debt-free.

Beginner modifications and progressions

- If cash is tight: Start with a micro-snowball—₨1,000–₨5,000 extra per month—and increase as you trim expenses.

- If motivation dips: Break the smallest debt into sub-goals (e.g., every ₨10,000 chunk). Celebrate each checkpoint.

- If you’re juggling many accounts: Use automatic payments for all minimums; manually attack only the target debt.

Recommended frequency, duration, and metrics

- Frequency: Update your tracker weekly; make one extra payment per pay period if possible.

- Duration: Varies—expect the first win within 2–12 weeks depending on balance size and extra payment.

- KPIs: Number of accounts closed, days to first payoff, average extra payment, and streak of on-time payments.

Safety, caveats, and common mistakes

- Mistake: Missing minimums chasing the win—avoid late fees and credit damage by automating minimums first.

- Caveat: Snowball may not minimize total interest (avalanche does); but the point here is momentum and follow-through.

Mini-plan example

- This week: List debts, set up minimum autopay.

- Next week: Move ₨3,000 of “extra” to your smallest debt and repeat each payday.

2) Simplicity That Shrinks Decision Fatigue

What it is and why it matters

Complexity kills consistency. With Snowball, you always know the next right action: pay the smallest balance. That single focus cuts down on analysis paralysis and the “I’ll figure it out later” spiral. Public-sector consumer education materials also present the snowball as a valid, easy-to-follow strategy alongside the highest-interest approach, reinforcing how accessible it is for first-time DIY payers.

Requirements and low-cost tools

- You need: A master list of balances; a calendar for due dates.

- Low-cost tools: Free debt worksheets; printable bill calendars; reminders on your phone.

Step-by-step for beginners

- Rename your target debt in your banking app with a goal tag (e.g., “Card A — Target”).

- Schedule a weekly “money hour.” During that time, log in and make the extra payment.

- Maintain a one-line rule: “All extra goes to the smallest balance.”

Beginner modifications and progressions

- Ultra-simple mode: Keep balances on a sticky note near your desk; cross out as you close accounts.

- Advanced mode: Use a tracker that auto-reorders debts as balances change and forecasts your debt-free date.

Recommended frequency, duration, and metrics

- Frequency: One weekly review; one extra payment per pay period.

- Metrics: “Hours spent deciding” (aim <15 minutes/week), number of payment actions automated, and number of skipped reviews (aim for zero).

Safety, caveats, and common mistakes

- Mistake: Constantly re-ordering debts mid-month. Pick an order and stick with it; revise only after a payoff or major change.

- Caveat: If you’re highly interest-sensitive (large, high-APR balance), you might combine Snowball with one targeted “avalanche” exception.

Mini-plan example

- This week: Print a worksheet, list balances, circle the smallest.

- Every payday: Add your snowball transfer to the smallest until it’s gone.

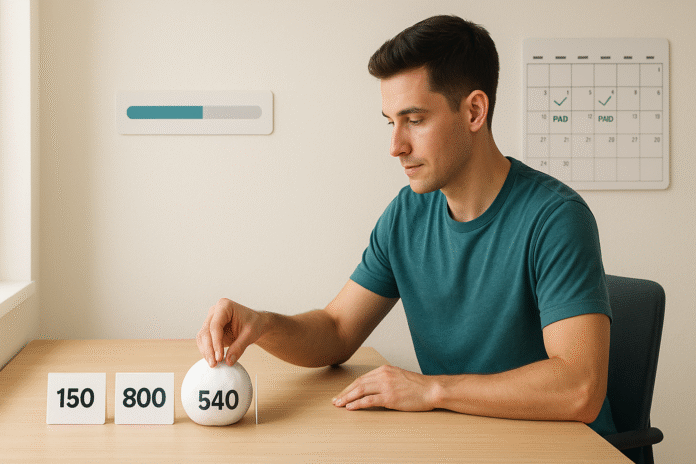

3) Compounding Payments That Accelerate Over Time

What it is and why it matters

The “snowball” name isn’t metaphorical. Each payoff frees up its minimum payment, which you then add to your extra payment—so your monthly firepower compounds. This built-in escalation can shorten your timeline significantly, even without increasing income. It’s wildly satisfying to watch the payment amounts grow larger every month.

Requirements and low-cost tools

- You need: Autopay for minimums, one designated “extra payment” on payday.

- Low-cost tools: Any spreadsheet; a simple amortization calculator.

Step-by-step for beginners

- Calculate your base snowball (sum of all minimums plus a fixed extra).

- On payoff day, redirect the paid-off minimum to the next debt immediately—don’t let it drift into lifestyle spending.

- Track the growing total (₨-per-month) to visualize momentum.

Beginner modifications and progressions

- If income varies: Commit to a minimum extra (say ₨2,000) and add “top-ups” when side-income arrives.

- If you get windfalls: Split them (e.g., 80% to snowball, 20% to starter emergency fund).

Recommended frequency, duration, and metrics

- Frequency: Redirect within 24–48 hours of a payoff; review totals monthly.

- Metrics: Snowball size over time, months shaved off your forecast, and percent of income devoted to debt.

Safety, caveats, and common mistakes

- Mistake: Letting your old payment “float” in your checking account. Automate a transfer to prevent leakage.

- Caveat: Although compounding payments speed things up, the snowball may still cost more in interest than the avalanche. Consider a “hybrid” if one account’s APR is extreme.

Mini-plan example

- This month: Snowball starts at ₨18,000.

- After first payoff: Jumps to ₨22,500, then ₨27,000—without any raise—because each closed account’s minimum is rolled in.

4) Lower Stress and More Mental Bandwidth

What it is and why it matters

Debt isn’t just a financial problem; it’s a cognitive load problem. When you have multiple accounts competing for attention, stress rises and decision quality can drop. Structured payoff plans that reduce the number of accounts (and therefore the number of decisions) are linked to better psychological functioning—including improvements in anxiety and cognitive performance—independent of the raw rupee amount of relief. Closing accounts creates real breathing room.

Requirements and low-cost tools

- You need: A consolidated bill calendar and notification controls (turn off marketing emails, keep due-date alerts).

- Low-cost tools: A shared family Google Calendar; a simple weekly checklist; a “bills” email folder.

Step-by-step for beginners

- Bundle admin into a weekly ritual: review, pay, file confirmations.

- Close or archive paid-off accounts (if appropriate in your market) only after confirming no fee, balance, or reward loss.

- Audit alert fatigue: Keep alerts for due dates, kill the rest.

Beginner modifications and progressions

- If anxiety spikes: Use a “two-account system”—one checking for fixed bills, another for daily spending—to separate noise from commitments.

- If you’re forgetful: Add a physical cue (a calendar on the fridge for payoff dates).

Recommended frequency, duration, and metrics

- Frequency: One weekly admin session; quarterly cleanup of alerts and email rules.

- Metrics: Number of open debt accounts (aim ↓ each month); number of missed alerts (aim 0); self-rated stress (1–10 scale) trended monthly.

Safety, caveats, and common mistakes

- Mistake: Closing long-standing revolving accounts without considering credit history impacts. Sometimes it’s better to keep old, no-fee cards open at a ₹0 balance to preserve age of credit.

- Caveat: Always confirm country-specific rules and consequences with your bank or a licensed professional.

Mini-plan example

- This weekend: Move all bill emails to one folder; set a Sunday reminder.

- Next month: After a payoff, call the lender to confirm ₹0 balance and account status, then file a closure or retention decision.

5) A Cleaner Credit Profile as Balances Fall

What it is and why it matters

As you eliminate smaller revolving balances, your credit utilization—the portion of available credit you’re using—falls. Utilization is a major component of widely used credit scoring models, and lower utilization is generally better for your score. Snowballing through smaller cards can reduce both overall utilization and the number of accounts with balances, which many scoring models consider.

Important: Credit scoring models vary, and nothing guarantees a score increase. But systematically lowering revolving balances is typically positive for your profile.

Requirements and low-cost tools

- You need: Access to your credit reports and utilization percentages.

- Low-cost tools: Annual free reports; bank dashboards that show “% used.”

Step-by-step for beginners

- Target revolving accounts first when balances are similar—small card balances often produce the biggest utilization improvements per rupee paid.

- Avoid new hard inquiries while paying down—protect your trajectory.

- Verify reporting—check that lower balances are reflected after statement cuts.

Beginner modifications and progressions

- Fast-track option: Time extra payments right before the statement date to lower reported balances sooner.

- Progression: After your third payoff, call issuers to request higher limits on well-managed accounts (don’t spend them), which may further reduce utilization.

Recommended frequency, duration, and metrics

- Frequency: Review utilization monthly after statement dates.

- Metrics: Overall utilization (<30% goal; lower is better); number of accounts with a balance; score trend.

Safety, caveats, and common mistakes

- Mistake: Closing a card you’ve just paid off and inadvertently spiking utilization (reduces available credit).

- Caveat: Don’t carry a balance for “credit building.” You can pay in full and still have utilization reported from mid-cycle spending. myFICO

Mini-plan example

- This month: Pay the smallest two card balances to ₹0.

- Next month: Let one small recurring charge hit a retained, no-fee card and pay in full before the due date to keep the account active.

Quick-Start Checklist

- List every debt with balance, minimum, APR, and due date.

- Choose Snowball order: smallest to largest.

- Automate minimums for all accounts.

- Set a fixed extra payment per payday.

- Schedule a weekly money hour to send the extra to your target debt.

- Track KPIs: accounts closed, snowball size, days since last missed payment.

- Keep a starter emergency fund (even ₹20,000–₹50,000) to prevent backsliding.

- Review monthly; celebrate each payoff with a low-cost ritual.

If you prefer to save the most interest, the debt avalanche (highest rate first) wins on pure math—but many people stick with snowball longer because the early emotional wins matter. A hybrid is fine, too.

Troubleshooting & Common Pitfalls

“I keep missing minimums while chasing the small debt.”

Automate every minimum first. Your extra payment is the only manual step.

“An emergency wiped out my progress.”

Rebuild a small buffer first, then resume. Consider a temporary “avalanche exception” if one balance ballooned.

“I’m losing motivation.”

Shrink the horizon. Create micro-wins (every ₹10,000 paid), track streaks (days without new debt), and pair payments with a reward ritual (e.g., a favorite home-cooked meal).

“My spouse isn’t on board.”

Use the weekly money hour together; agree on a small celebration for each payoff; keep discretionary “fun money” to avoid rebellion.

“A high-APR balance is growing faster than I can pay it.”

Consider a hybrid: move that one to the front, then resume Snowball order, or explore consolidation/0% balance transfers if appropriate in your market.

“I’m not seeing any credit score change.”

Check statement dates and utilization reporting; ensure balances are actually posting lower each month and avoid closing old, no-fee cards.

How to Measure Progress (Without Guesswork)

- Time to first win: Target ≤ 60 days; this is your morale anchor.

- Closed accounts: Aim for at least one closure per quarter.

- Snowball growth rate: Track the jump in your monthly payoff amount after each closure.

- Credit utilization: Overall and per-card; trend down month-over-month.

- Stress score: A simple 1–10; log it monthly—you should see a downward trend as accounts disappear.

A Simple 4-Week Starter Plan (You Can Begin Tonight)

Week 1 — Setup & First Push

- Gather statements; list balances smallest to largest.

- Automate minimums; pick your target debt.

- Make your first extra payment (any amount counts).

- Create your weekly money hour event.

Week 2 — Momentum & Leak-Plugging

- Cut one recurring expense (subscriptions, unused apps) and redirect the savings to your snowball.

- Set alerts only for due dates and payment confirmations; mute noise.

Week 3 — Systems & Mini-Milestones

- Add micro-goals (every ₹10,000 paid).

- Prepare a low-cost celebration for your first payoff.

- Revisit your budget; try to add ₹1,000–₹5,000 more to the snowball.

Week 4 — Review & Re-aim

- If you closed an account, immediately roll its minimum into the next debt.

- Re-forecast your debt-free date; check utilization after statement cuts.

- Plan next month’s “money hour” cadence and a new micro-reward.

FAQs

1) What’s the main difference between Snowball and Avalanche?

Snowball prioritizes smallest balances to generate quick wins; Avalanche prioritizes highest interest rates to minimize total interest. Many people stick with Snowball longer because early wins are motivating, though Avalanche wins on pure cost savings.

2) Will the Debt Snowball method hurt me because I’m not tackling high interest first?

Possibly in total interest paid, yes. But if Snowball keeps you consistent when other methods don’t, the behavioral payoff can outweigh the extra interest for many people. Consider a hybrid if one APR is extreme.

3) I have both loans and credit cards. Which should I hit first?

If balances are similar, starting with small revolving balances can quickly lower utilization and simplify your profile—useful for motivation and credit health.

4) How much extra should I add to my snowball?

Any consistent amount works. Start with what you can (even ₹1,000–₹5,000 per month) and increase as you cut expenses or boost income.

5) Won’t closing credit cards after payoff hurt my credit?

It might if closing reduces your overall credit limit (raising utilization) or shortens average account age. Consider keeping old, no-fee cards open at ₹0 with occasional small charges paid in full.

6) How often should I make extra payments—weekly or monthly?

Match them to your pay schedule. Weekly or biweekly can boost motivation and reduce temptation to spend the extra.

7) What if an emergency hits mid-plan?

Pause extra payments, fund a small buffer, then resume. A small emergency fund prevents you from sliding backward.

8) Can Snowball help my credit score?

It can. As revolving balances fall, utilization declines—a key scoring factor—though results vary by profile.

9) Is Snowball still worth it if I’m very disciplined?

If you’re truly indifferent to motivation and only care about cost, Avalanche is usually cheaper. Many disciplined payers still prefer Snowball for traction and clarity.

10) Do I need apps or fancy software?

No. A paper worksheet or simple spreadsheet is enough to list, order, and track debts and payments.

11) How soon will I feel less stressed?

Often after your first closure. Fewer accounts to track can reduce anxiety and free mental bandwidth, which in turn helps you stick with the plan.

12) Is it okay to switch to Avalanche later?

Absolutely. Your plan is a tool, not a rule. Some people start with Snowball for the quick wins, then switch once motivation is cemented.

Conclusion

The Debt Snowball method shines because it’s built for real life. It trades theoretical perfection for boots-on-the-ground progress—fast wins, fewer decisions, growing payment power, lower stress, and a cleaner credit profile over time. Used thoughtfully (and paired with an emergency buffer and automated minimums), it’s a pragmatic path from overwhelmed to in-control.

Ready to roll? List your balances now, circle the smallest, and make your first extra payment today—the snowball starts with one push.

References

- How to reduce your debt, Consumer Financial Protection Bureau, July 16, 2019 (last modified Mar. 13, 2023). Consumer Financial Protection Bureau

- Tool 3: Reducing debt worksheet (Your Money, Your Goals toolkit), Consumer Financial Protection Bureau, n.d. Consumer Finance Files

- Debt Snowball Method: How It Works to Pay Off Debt, Investopedia, updated July 2, 2024. Investopedia

- Debt Avalanche vs. Debt Snowball: What’s the Difference?, Investopedia, updated May 16, 2024. Investopedia

- Winning the battle but losing the war: The psychology of debt management, Journal of Marketing Research, 2011. SAGE Journals

- Winning the battle but losing the war: The psychology of debt management (JSTOR PDF), Journal of Marketing Research, 2011. JSTOR

- Repayment Concentration and Consumer Motivation to Get Out of Debt, Journal of Consumer Research, August 9, 2016. Oxford Academic

- Small Victories: Creating Intrinsic Motivation in Task Completion and Debt Repayment, Journal of Marketing Research, first published online Dec. 1, 2015. SAGE Journals

- Reducing debt improves psychological functioning and changes decision-making in the poor, Proceedings of the National Academy of Sciences (open access on PMC), 2019. PMC

- What’s in my FICO® Scores?, myFICO, n.d. myFICO

- What Is a Credit Utilization Rate?, Experian, Nov. 5, 2023. Experian

- How FICO scores look at credit card limits (utilization overview), myFICO, n.d. myFICO