If you’re hunting for real estate markets to watch for investment opportunities over the next 12–18 months, you’ll need to filter the noise from the signal. Affordability is still tight, mortgage rates remain in the mid-6% range, and inventory has finally begun to climb. That cocktail creates a window for disciplined investors—especially in markets where job growth, demographic tailwinds, and new-construction pipelines line up. This guide spotlights five metros where conditions look attractive for investors right now, and it gives you a turnkey playbook to evaluate deals, track the right metrics, and avoid common pitfalls.

Disclaimer: This article is for educational purposes only and is not financial, tax, or legal advice. Real estate markets are local and change quickly; consult a qualified real estate professional, financial advisor, and attorney before acting on any strategy.

Key takeaways

- Inventory is rising and the market is normalizing, which can improve buyer leverage and deal flow—even if rates are still elevated.

- National outlooks call for flat-to-slightly-lower prices in 2025, making underwriting discipline and cash-flow focus more important than betting on appreciation.

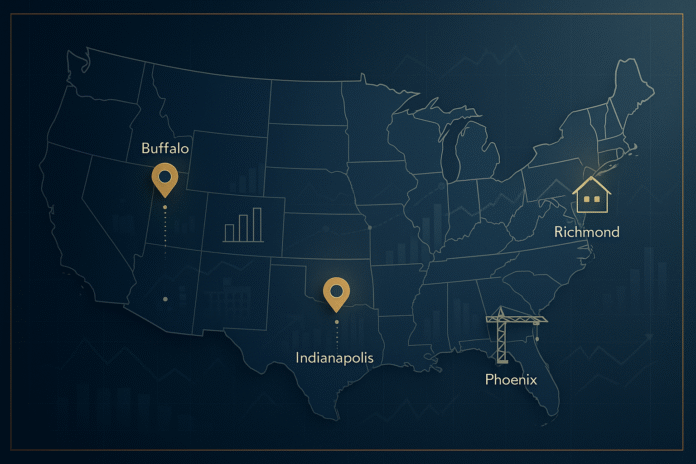

- Five standouts to watch: Buffalo (NY), Indianapolis (IN), Colorado Springs (CO), Richmond (VA), and Phoenix (AZ), each for distinct demand and affordability reasons.

- Your edge is process: consistent lead generation, fast underwriting, and data-driven offers using KPIs like cash-on-cash return, cap rate, DSCR, days on market, and inventory trend.

- Risk management wins cycles: price for today’s rents, build conservative reserves, and plan exit options (refi, sell, or hold) before you buy.

- Execution roadmap included: a quick-start checklist, troubleshooting guide, and a simple 4-week plan to move from research to offers.

How these five markets were selected

To narrow thousands of U.S. locations to an actionable short list, we blended three lenses:

- Near-term momentum: Markets that rank highly on independent outlooks for 2025 (transaction volume, price stability, days to pending).

- Affordability and job drivers: Where typical values are less stretched and employment (or steady demand anchors like the military or universities) support occupancy.

- Liquidity and inventory dynamics: Places where rising inventory or new construction increases choice without collapsing demand.

We cross-checked multiple independent sources to avoid anchoring on any single index or hype narrative, prioritizing fresh, dated analyses for 2025.

Buffalo, New York

What it is & why it’s compelling

Buffalo hits a rare combo for investors: relatively low entry prices, quick market tempo, and demand supported by stable employment anchors and regional in-migration. It topped one major 2025 “hottest markets” list for the second year in a row, with homes moving from listing to pending in roughly two weeks—a strong gauge of buyer demand—even as national conditions cool. For investors, that translates to more predictable lease-ups and ample exit liquidity if you need to sell.

Requirements / prerequisites

- Capital & financing: Conventional 20–25% down or DSCR loan options; maintain ≥6 months of PITI + repairs as reserves.

- Team: Investor-friendly agent, property manager, inspector familiar with older housing stock, local contractor.

- Tools: Deal analyzer (rent roll, pro forma), MLS feed or listing alerts, rental “comps” from trusted platforms.

- Low-cost alternative: House hack (live-in duplex), or partner JV with sweat-equity roles to reduce cash outlay.

Step-by-step implementation (beginner-friendly)

- Micro-market mapping: Identify 3–5 sub-areas based on rent-to-price ratio, school and amenity access, and renovation risk.

- Deal pipeline: Analyze 10–15 listings weekly; aim to underwrite within 15 minutes using your buy box (price, yield, condition).

- Offer discipline: Submit offers with inspection and financing contingencies; price for today’s rent, not projected growth.

Beginner modifications & progressions

- Simplify: Start with a turnkey SFR or small duplex with minimal deferred maintenance.

- Scale up: Move to BRRRR-style rehabs (buy, renovate, rent, refinance, repeat) once you have contractor capacity and cash buffers.

Recommended frequency / KPIs

- Weekly: Track new listings, price cuts, and days on market (DOM).

- Monthly: Update rent comps and cash-on-cash return assumptions; target ≥6–8% CoC (market-specific).

- Quarterly: Review portfolio DSCR (≥1.25), vacancy, and CapEx burn rate.

Safety, caveats & common mistakes

- Underestimating CapEx on older homes: Budget generously for roofs, boilers, and insulation—winters add wear.

- Property taxes & insurance: Model impacts carefully; rates vary by neighborhood and condition.

- Chasing appreciation: Cash flow should pencil even if prices flatline.

Mini-plan

- Shortlist three duplexes within your buy box.

- Walk them with your inspector and PM to finalize a conservative rent roll and CapEx plan.

- Make two offers with inspection windows and lender pre-approval ready to go.

Indianapolis, Indiana

What it is & why it’s compelling

Indianapolis is a logistics and life-sciences hub with a strong landlord-friendly reputation and accessible price points. For 2025, one leading outlook placed it near the top of the national list, with expected value growth off a comparatively affordable base and homes going under contract in roughly two weeks—an attractive blend for both buy-and-hold and small multifamily.

Requirements / prerequisites

- Financing: DSCR or conventional investor loan; consider rate buydowns if cash flow is tight at purchase.

- Team: PM with suburban coverage, lender familiar with investor products, inspector attuned to slab/foundation issues common in certain tracts.

- Tools: Automated underwriter, tax estimator, rental comp aggregator.

- Low-cost alternative: Partner with a local operator; trade capital for a share of equity and reporting rights.

Step-by-step implementation

- Define your buy box: E.g., 3-bed SFR under a set price, ≥1% monthly rent-to-price ratio (or market-appropriate equivalent), 1970s+ build.

- Lead gen: Set daily alerts for price drops and 7+ days on market; call listing agents on aging listings.

- Offer strategy: Lead with clean terms (short inspection, strong earnest money) but keep appraisal and finance protections.

Beginner modifications & progressions

- Starter path: Turnkey SFR in a B-class school cluster with below-median taxes.

- Progression: 4–20 unit small multifamily with professional PM and a capital plan targeting value-add (flooring, kitchens, systems).

Recommended frequency / KPIs

- Weekly: New listings count, DOM, and number of showings per listing.

- Monthly: CoC return and maintenance per door; benchmark against your underwriting.

- Quarterly: Rent growth vs. market (expect modest ~2–3% YoY nationally in 2025).

Safety, caveats & common mistakes

- Over-rehabbing for the tenant base: Avoid luxury finishes that won’t pay back in rent.

- Ignoring school boundary effects: Verify attendance zones; they can materially affect rent and days to lease.

Mini-plan

- Analyze 20 SFRs that match your buy box; shortlist 6.

- Drive-by (or video walk-through) and request PM rent opinions on the top 3.

- Write 2–3 offers anchored to cash-flow thresholds and inspection outcomes.

Colorado Springs, Colorado

What it is & why it’s compelling

Colorado Springs ranked as a top U.S. housing market to watch for 2025 on the strength of forecasted sales and price growth, underpinned by a large share of military households and steady population churn. Inventory is helped by new single-family construction relative to demand, while the market’s outdoor amenities and proximity to Denver add lifestyle appeal for tenants and buyers alike.

Requirements / prerequisites

- Financing: Conventional or VA-friendly strategies if you (or partners/tenants) qualify; DSCR loans for investors with rent-backed underwriting.

- Team: PM versed in military tenant cycles, inspector with wildfire and hail-risk awareness, local insurance broker.

- Tools: Hazard mapping (fire/flood), short-term rental (STR) ordinance checks, builder warranty reviews on new stock.

- Low-cost alternative: Rent-by-the-room (compliant) near employment nodes; or small townhouse acquisitions.

Step-by-step implementation

- Seasonality map: Align acquisition to PCS (Permanent Change of Station) season peaks to reduce vacancy risk.

- Inventory scan: Compare new construction vs. resale concessions; builders may offer credits that beat typical resales.

- Conservative rents: Underwrite at today’s rent; treat any military COLA-driven demand as a bonus, not a base.

Beginner modifications & progressions

- Simplify: Newer SFR in a community with robust HOA reserves and recent roofs.

- Scale up: Small multifamily near the medical corridor or key bases, with professional PM and lease-renewal systems.

Recommended frequency / KPIs

- Weekly: Track active listings and price-cut frequency; watch builder incentives.

- Monthly: Vacancy days between tenancies; aim ≤14 days at stabilized operations.

- Quarterly: Expense ratio (<40–45% for SFRs), DSCR (≥1.25–1.3).

Safety, caveats & common mistakes

- Underinsuring for hazards: Price wildfire and hail risks into insurance and reserves.

- Missing municipal rules: STR and occupancy rules vary—verify before modeling.

- Thin reserves: Aim for ≥6 months PITI + $3–5k per door in liquidity.

Mini-plan

- Shortlist five new-build communities and five resale neighborhoods within your budget.

- Price two offers (one builder, one resale) with the same rent and expense model.

- Pick the better risk-adjusted yield after factoring incentives and HOA dues.

Richmond, Virginia

What it is & why it’s compelling

Richmond enjoys state-capital stability, a growing services economy, and a vibrant arts/food scene that retains young talent—yet entry prices remain approachable compared with many East Coast peers. It ranked in multiple 2025 outlooks, with a quick sale cadence (single-digit days to pending) and steady, modestly positive value expectations. That pace signals resilient demand even as the national market cools.

Requirements / prerequisites

- Financing: Conventional investor loans; consider portfolio lenders for small multis.

- Team: Local PM with experience across city + suburban jurisdictions; inspector attuned to older-home systems.

- Tools: Historic-district and permit lookups, floodplain checks along the James River.

- Low-cost alternative: Duplex/ADU strategies to boost gross rent with lower land costs.

Step-by-step implementation

- Regulatory scan: Identify any historic or flood-related restrictions that add costs/time.

- Yield targeting: Focus on B-class rentals in school zones with diverse employment access; price for cash flow at current rates.

- Offer playbook: Short inspection period and strong earnest money deposit (EMD) to win competitive deals—without waiving key protections.

Beginner modifications & progressions

- Starter: Newer townhome/duplex outside historic overlays to reduce surprise CapEx.

- Next level: 4–12 unit buildings with light value-add (flooring, fixtures, energy upgrades) to lift NOI.

Recommended frequency / KPIs

- Weekly: DOM by submarket and number of scheduled showings.

- Monthly: Rent-to-income screening outcomes; stay conservative on ratios to reduce delinquency risk.

- Quarterly: Re-underwrite taxes/insurance and compare to actuals.

Safety, caveats & common mistakes

- Ignoring flood risk: Verify flood maps and insurance needs early.

- Overpaying in historic overlays: Rehab timelines and compliance costs add up—adjust offers accordingly.

- Assuming endless appreciation: Underwrite steady rents and modest growth.

Mini-plan

- Pull 12 months of sales and rent comps for two target ZIPs.

- Walk three properties with your PM to price realistic turns and rent.

- Make one conservative, finance-contingent offer that still closes quickly if accepted.

Phoenix, Arizona

What it is & why it’s compelling

Phoenix remains a Sun Belt heavyweight with scale, business formation, and in-migration—yet after the post-pandemic surge, inventory has rebounded closer to (or above) 2019 levels across parts of Arizona. That creates more selection and negotiating room while long-term demand drivers persist. One major 2025 ranking placed Phoenix among the top 10 metros expected to lead in combined sales and price growth. For buy-and-hold investors, that mix of liquidity and relative affordability in outlying submarkets is a powerful combination.

Requirements / prerequisites

- Financing: Conventional or DSCR loans; rate buydowns may pencil in certain submarkets; confirm HOA rules if purchasing in planned communities.

- Team: PM who understands HOA dynamics and heat-season maintenance; inspector trained for slab and HVAC lifespan issues.

- Tools: Water-use and heat-risk mapping, HOA CC&Rs review, STR ordinance check (if relevant).

- Low-cost alternative: Townhome/condo in strong HOAs with predictable capital plans.

Step-by-step implementation

- Submarket selection: Compare inner-ring vs. exurban rent-to-price ratios; model commute times and employer nodes.

- Builder vs. resale: Evaluate builder incentives (rate buydowns, credits) versus resale price cuts and repairs.

- Offer mechanics: Use inspection results to negotiate HVAC/roof credits—high-heat climates magnify those costs.

Beginner modifications & progressions

- Starter: 3-bed SFR or townhome with newer HVAC and roof to reduce surprise CapEx.

- Progression: Build a small SFR portfolio in the same HOA for management efficiency, or a 5–20 unit garden-style property if available.

Recommended frequency / KPIs

- Weekly: Inventory trend and price-reduction counts.

- Monthly: Utility and maintenance per door (track summer spikes).

- Quarterly: Lease renewal rate and concession use (free month, small upgrades).

Safety, caveats & common mistakes

- Water/heat risk: Price in drought and extreme-heat wear on systems; budget extra for HVAC.

- HOA reliance: Confirm reserve studies and upcoming special assessments.

- Short-term rental assumptions: Local rules shift—do not base underwriting on STR premiums unless fully compliant and proven.

Mini-plan

- Shortlist five HOAs across two Phoenix submarkets.

- Underwrite 8–10 listings (mix of new-build and resale) using conservative rent comps.

- Submit two offers with repair/credit priorities around HVAC and roof life.

Quick-start investor checklist

Set your foundation (week 0)

- Nail your buy box (asset type, beds/baths, price cap, yield thresholds).

- Get pre-approved (or line up DSCR financing); collect proof of funds.

- Build your local team (agent, lender, PM, inspector, insurance broker, closing attorney or escrow officer).

- Create a simple deal dashboard (sheet or software) with fields for rent, expenses, exit options, and risk notes.

- Subscribe to weekly market updates for your target metros.

Daily/weekly habits

- Analyze 10–15 listings per market each week; write 1–3 offers.

- Re-check DOM, price cuts, and inventory trend—these are cycle tells.

- Update your rent comps monthly; national rent growth in 2025 looks modest (~2–3% YoY), so avoid aggressive rent bumps in underwriting.

Troubleshooting & common pitfalls (and what to do instead)

- “My deals don’t pencil at today’s rates.”

Fix: Increase down payment or add rate buydown into negotiations; pursue properties needing cosmetic updates that justify NOI lift post-turn. Expect mid-6% mortgage rates near-term based on recent surveys and forecasts. - “Every property I like gets snapped up.”

Fix: Tighten your buy box and speed. Pre-write offer templates with your agent. Prioritize aging listings and price-reduced properties; sellers there are signaling flexibility. - “I underestimated repairs.”

Fix: Build a CapEx reserve line item; require contractor line-item bids during inspection; renegotiate or walk if the numbers break. - “Rents aren’t growing as fast as I expected.”

Fix: Underwrite flat rent the first year; focus on operational wins (vacancy days, renewal rates, utility passthroughs). Nationally, rent growth looks moderate—budget accordingly. - “I’m worried prices could slip later this year.”

Fix: Buy for durable cash flow; model a small price decline. Several national outlooks show flat-to-slightly-down prices in 2025; your underwriting should still work in that scenario.

How to measure progress & results (practical KPIs)

- Cash-on-cash return (CoC): Annual pre-tax cash flow ÷ total cash invested; compare to your hurdle (e.g., 6–8%+ for stabilized SFRs depending on market).

- Cap rate (unlevered): NOI ÷ purchase price; helpful for apples-to-apples comparisons across submarkets.

- DSCR: NOI ÷ annual debt service; aim ≥1.25–1.30 at purchase.

- Vacancy days: Days to lease between tenants; track trend and causes (pricing vs. condition).

- Delinquency rate: % of tenants late by >30 days.

- Inventory and DOM trend: Early warning indicators of negotiation leverage and pricing power.

- Price cuts: Share of active listings with reductions; a real-time proxy for seller motivation.

- Rent growth vs. market: Bench your rent changes vs. current local trend; nationally 2025 rent growth is modest ~2–3% YoY.

A simple 4-week starter plan (from research to offers)

Week 1 — Define & prepare

- Set your buy box and target the five metros (or pick two to start).

- Get pre-approved and assemble your team.

- Build your deal dashboard and import live listing feeds.

- Read the latest national and local market updates to calibrate expectations (inventory gains, mortgage rate trend, rent growth).

Week 2 — Source & underwrite

- Underwrite 30–40 deals across your markets; shortlist 8–10.

- Call on price-reduced or >14 DOM listings; ask about seller priorities (timing vs. price).

- Order pre-inspections or contractor walk-throughs on top candidates (if permitted).

Week 3 — Walk & negotiate

- Physically or virtually tour the top 4–6 properties with your PM and inspector.

- Draft 2–3 offers with inspection and financing contingencies; consider rate buydown or closing credit asks instead of price cuts if sellers resist.

Week 4 — Diligence & decision

- Complete inspections; update CapEx, insurance, and taxes in your model.

- Renegotiate based on findings or walk.

- If accepted, order appraisal, finalize insurance, and plan your Day 1 make-ready tasks.

Frequently asked questions

1) Are these five markets “the best” for everyone?

No. They’re markets to watch based on recent 2025 outlooks, inventory dynamics, and affordability. Your goals, capital, and risk tolerance may point to different choices. Always validate with local data.

2) How do current mortgage rates impact what I can afford?

Rates near the mid-6% range compress cash flow and lower maximum loan amounts; that’s why buy-box discipline and conservative underwriting matter. Consider buydowns and seller credits.

3) Should I wait for rates to drop before buying?

Timing the rate cycle is hard. Some forecasts see rates drifting slightly lower into late-2025, but not collapsing. If a property cash flows at today’s rate with contingency buffers, you can refinance later if rates fall.

4) What if national home prices slide this year?

Several outlooks point to flat-to-slightly-negative national prices in 2025. Focus on cash flow first; price declines matter less if your property pays you to hold.

5) How much cash reserve should I keep?

A common rule is ≥6 months of PITI plus a CapEx cushion per door. Older housing stock or hazard risks (hail/wildfire/heat) warrant more.

6) Are short-term rentals a smart entry point now?

Maybe—but regulation risk is meaningful. If you pursue STRs, buy assets that also pencil as long-term rentals in case rules change.

7) What’s a reasonable 2025 rent growth assumption?

Modest. National single-family rent growth has hovered around ~2–3% YoY this year. Underwrite conservatively and let upside surprise you.

8) Which property type is best for first-time investors?

Often a small SFR or duplex with light value-add potential and stable school zoning. Simpler operations, easier financing, and liquid resale.

9) How many deals should I analyze before buying?

Expect to analyze dozens and offer on several before one sticks, especially in faster submarkets. The skill is speed plus discipline.

10) What KPIs matter most in year one?

Cash-on-cash return, DSCR, vacancy days, expense ratio, and actual vs. pro forma rents. Update quarterly and course-correct quickly.

11) What’s the biggest rookie mistake?

Underestimating expenses—especially taxes, insurance, and CapEx. Always reconcile pro forma with PM and inspector input.

12) Should I assume appreciation in these markets?

Treat appreciation as a bonus, not a base case. Buy assets that cash flow at today’s rents and rates.

Conclusion

The next phase of the housing cycle rewards operators, not speculators. With inventory rising, mortgage rates hovering in the mid-6% range, and national price growth expected to be flat-to-slightly-down, your edge comes from choosing the right markets, underwriting conservatively, and executing a repeatable process. Start with one of the five metros above—Buffalo, Indianapolis, Colorado Springs, Richmond, Phoenix—run the playbook, and let disciplined offers do the heavy lifting.

Call to action: Pick one market from this list, define your buy box tonight, and underwrite your first 10 deals by this weekend.

References

- The 10 Hottest Housing Markets for 2025, Zillow, January 14, 2025. https://www.zillow.com/learn/hottest-housing-markets/

- Zillow Home Value and Home Sales Forecast (July 2025), Zillow Research, July 21, 2025. https://www.zillow.com/research/home-value-sales-forecast-33822/

- Redfin Forecast: U.S. Home Prices Will Dip 1% By the End of 2025, Redfin News, May 22, 2025. https://www.redfin.com/news/home-price-forecast-decline-2025/

- Top Housing Markets for 2025, Realtor.com Research, December 10, 2024. https://www.realtor.com/research/top-housing-markets-2025/

- July 2025 Monthly Housing Market Trends Report, Realtor.com Research, July 31, 2025. https://www.realtor.com/research/july-2025-data/

- Mortgage Market Survey Archive (Weekly Rates), Freddie Mac PMMS, accessed August 14, 2025. https://www.freddiemac.com/pmms/archive

- Mortgage Rate and Home Price Growth Forecasts Revised Lower, Fannie Mae ESR Group, July 24, 2025. https://www.fanniemae.com/newsroom/fannie-mae-news/mortgage-rate-and-home-price-growth-forecasts-revised-lower

- Single-Family Rent Index: April 2025, Multi-Housing News summary, July 30, 2025. https://www.multihousingnews.com/us-single-family-rent-index-2025/

- Single-Family Rent Growth in U.S. Trends Upward in 2025, World Property Journal (CoreLogic SFRI), April 7, 2025. https://www.worldpropertyjournal.com/real-estate-news/united-states/irvine/real-estate-news-corelogic-2025-single-family-rent-index-sfri-us-single-family-rent-data-for-2025-molly-boesel-14410.php

- 12 states are back above pre-pandemic housing inventory levels, ResiClub Analytics, August 2025. https://www.resiclubanalytics.com/p/state-inventory-update-housing-market-august-2025

- United States Housing Market & Prices (Live Overview), Redfin Data Center, accessed August 2025. https://www.redfin.com/us-housing-market