If the past few years have taught us anything, it’s that life doesn’t schedule its surprises. A car repair, a medical bill, a sudden job change—these moments show up uninvited and usually with a price tag. That’s where your emergency fund comes in. In this guide, you’ll learn practical, step-by-step strategies to save and grow that fund—without getting lost in jargon or risky moves. We’ll cover setup tactics, safe places to keep the cash, and simple systems that make saving automatic and sustainable.

This article is written for everyday earners—salaried workers, freelancers, and small-business owners—who want a dependable cushion when life happens. We’ll keep things tactical and beginner-friendly, with clear instructions, sample mini-plans, and a four-week starter roadmap you can use right away.

Important: This content is educational and not individualized financial advice. Everyone’s situation is different. Before making significant decisions, consider consulting a qualified financial professional.

Why it matters now: Many adults report difficulty covering even a modest unexpected expense in cash, and common guidance suggests building three to six months of essential expenses as a target for an emergency fund. In other words, the need is real—and so is the payoff for getting started today.

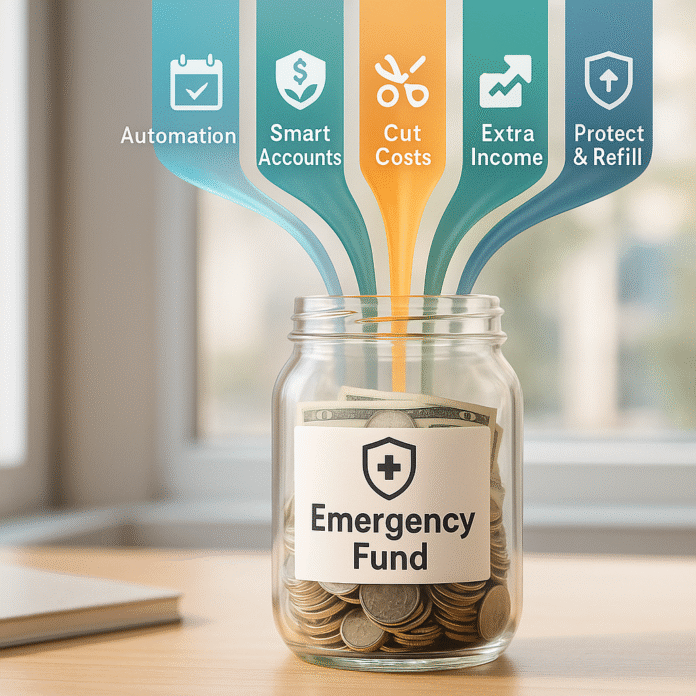

Key takeaways

- Automate first. Paying yourself first—automatically—turns saving from a decision into a default.

- Store cash smartly. Keep the fund safe, liquid, and insured where applicable; use simple “tiers” for access and yield.

- Cut friction, not joy. Reduce recurring costs and fees that quietly drain your fund without extreme deprivation.

- Boost the inflow. Side income, windfalls, and cash-back tactics can speed up your savings runway.

- Protect the buffer. Set guardrails (what counts as an emergency, how to refill after use) so the fund lasts and grows.

1) Pay Yourself First with Automation

What it is & why it works

“Pay yourself first” means moving money to savings before it blends into everyday spending. Automation makes that move happen on schedule, without willpower. Over time, those consistent deposits build the habit and the balance.

Requirements & low-cost alternatives

- Requirements: A checking account for income; a separate savings account for the emergency fund; online banking access to set recurring transfers.

- Low-cost alternatives: If your bank lacks automation, use a budgeting app or calendar reminders and transfer manually on payday.

Step-by-step implementation (beginner-friendly)

- Pick your target (e.g., one month of essential expenses to start; long-term goal: 3–6 months).

- Open a separate savings account titled “Emergency Fund” to avoid accidental spending.

- Set an automatic transfer from checking to savings for the day after payday (weekly, biweekly, or monthly).

- Start small (e.g., 2–5% of take-home pay) and increase by 1–2 percentage points each quarter or whenever you get a raise.

- Treat windfalls specially: pre-commit a percentage (e.g., 50–80%) to the emergency fund on arrival.

Beginner modifications & progressions

- If cash is tight: Automate a token amount (even $5–$20 per payday). The momentum matters.

- Progression: Add a second, smaller mid-month transfer to reduce the temptation to spend mid-cycle.

- Stretch goal: “Round up” transactions or salary to the nearest $10/$50 and sweep the difference to savings.

Recommended frequency & metrics

- Frequency: Transfer each payday.

- Metrics: Savings rate (% of take-home pay), total emergency balance, and “months of expenses covered.”

- Milestones: 1 month saved, 3 months, 6 months.

Safety, caveats & common mistakes

- Mistake: Automating too aggressively and triggering overdrafts.

- Fix: Schedule transfers the day after money arrives, and maintain a small checking cushion.

- Caveat: If income varies, use a percentage of last month’s income or a rolling average.

Mini-plan (example)

- Automate 5% of take-home pay to “Emergency Fund” the day after payday.

- Increase to 7% in two months after eliminating a subscription and negotiating a bill.

2) Optimize Where Your Cash Lives (Safety, Liquidity, and Smart Tiers)

What it is & why it works

Your emergency fund must be safe, liquid, and easy to access during a real emergency. You can balance those needs by using a simple “tiering” system—keeping a chunk instantly accessible and placing the overflow in slightly higher-yield, low-risk options with quick access.

Requirements & low-cost alternatives

- Requirements: Savings account; optional money market or short-term time deposit account; knowledge of your country’s deposit insurance program.

- Low-cost alternatives: A single high-yield savings account is perfectly fine if simplicity helps you stick with it.

Step-by-step tiering approach

- Tier 1 (immediate cash): Keep 1–2 months of essential expenses in a standard or high-yield savings account—fast access, no penalties, typically insured if applicable in your jurisdiction.

- Tier 2 (near-cash): Consider a no-penalty time deposit or short-term time deposit ladder for a portion of the fund you’re less likely to touch. This can improve yield while remaining relatively accessible.

- Tier 3 (overflow reserves): For balances beyond 3–6 months (or for those with unusually stable income), consider very conservative cash-equivalent vehicles. Understand that certain vehicles—like money market funds—are investments, not bank deposits, and may not carry deposit insurance; learn the differences and risks before opting in.

Beginner modifications & progressions

- Beginner: Keep everything in one insured savings account while you’re building your first 1–3 months.

- Progression: After hitting 3 months, ladder small time deposits (e.g., three-month spacing) with modest amounts you can afford to leave untouched.

Recommended frequency & metrics

- Frequency: Review accounts each quarter to ensure rates are competitive and your tier balances still fit your needs.

- Metrics: Days to access cash, % insured coverage (where applicable), average yield across tiers.

Safety, caveats & common mistakes

- Insurance awareness: Know your local deposit insurance rules and coverage limits. In some jurisdictions, eligible deposits at insured institutions are protected up to a specific limit per depositor and per ownership category.

- Liquidity reality: Standard time deposits usually charge early withdrawal penalties; no-penalty versions trade some yield for flexibility.

- Don’t chase yield: Your emergency fund is not an investment account. Liquidity and safety come first.

Mini-plan (example)

- Hold ₹/$ equivalent of one month’s expenses in a high-yield savings account.

- Move the next one month’s expenses into a no-penalty time deposit once your savings exceed two months.

3) Cut Friction, Not Joy: Systematically Reduce Recurring Costs and Fees

What it is & why it works

You don’t need a spartan lifestyle to grow an emergency fund—you need to remove waste. Think hidden fees, forgotten subscriptions, and overpriced recurring services. Systematic pruning frees cash each month without making life miserable.

Requirements & low-cost alternatives

- Requirements: Recent bank/credit card statements (90 days), a notes app or spreadsheet, and a willingness to make a few phone calls.

- Low-cost alternatives: Use a free budgeting worksheet or a basic expense tracker if spreadsheets feel heavy.

Step-by-step implementation

- Audit 90 days of statements. Highlight recurring charges and one-off fees.

- Categorize by “must-have,” “nice-to-have,” and “didn’t notice.”

- Cancel or downgrade the “didn’t notice” and some “nice-to-have” items.

- Negotiate: Call your internet/mobile/insurance provider and ask for loyalty pricing or a competing offer match.

- Fix fee leaks: Enable account alerts; move to fee-free checking; avoid overdrafts by timing transfers the day after payday.

- Create a savings capture rule: Every time you lower a bill or cut a subscription, increase your automatic transfer by the same amount.

Beginner modifications & progressions

- Beginner: Start with subscriptions; they’re easy wins.

- Progression: Tackle “big rocks” like housing or car costs during renewal/lease windows.

Recommended frequency & metrics

- Frequency: A 90-day audit now, then a 30-minute review each quarter.

- Metrics: Monthly savings captured, number of subscriptions canceled, fees avoided, and the “bill cut → transfer increased” tally.

Safety, caveats & common mistakes

- Mistake: Cutting essentials that degrade quality of life and cause you to backslide.

- Fix: Reallocate savings from invisible waste, not from core well-being.

- Caveat: Some contracts have early termination fees; time your changes at renewal.

Mini-plan (example)

- Cancel two unused subscriptions and negotiate a lower internet bill.

- Increase your automatic transfer by the combined monthly savings starting next payday.

4) Boost the Inflow: Earmark Extra Income and Windfalls

What it is & why it works

Faster inflows accelerate compounding—especially early on. Small, temporary boosts (a weekend project, a seasonal gig, selling unused items) can fund big chunks of your target and shorten the time to security.

Requirements & low-cost alternatives

- Requirements: A short list of low-barrier income ideas (freelance skill, seasonal retail shift, tutoring, delivery, selling items you no longer use).

- Low-cost alternatives: Cash-back or reward strategies you already use—only if they don’t increase spending.

Step-by-step implementation

- Choose one micro-hustle you can start within a week (2–5 hours/week).

- Pre-commit a percentage of all extra income (e.g., 80%) to your emergency fund.

- List and sell idle items with a simple rule: if you haven’t used it in a year and it’s not sentimental or essential, consider selling.

- Capture windfalls (tax refunds, bonuses, gifts) by automatically transferring a fixed percentage upon receipt.

Beginner modifications & progressions

- Beginner: Pick the lowest-effort option (sell items at home) and set a one-week deadline.

- Progression: Add a recurring gig for one month and revisit; avoid burnout by setting clear hours and a stop date.

Recommended frequency & metrics

- Frequency: One burst project per month or a four-week sprint.

- Metrics: Extra income generated, % sent to the emergency fund, and months shaved off your goal date.

Safety, caveats & common mistakes

- Tax awareness: Track extra income for your tax records.

- Burnout risk: Set boundaries. A short sprint is better than an unsustainable marathon.

- Spending creep: Avoid offsetting your gains with celebration spending; celebrate with a free reward (day trip, movie night at home).

Mini-plan (example)

- List five items for sale this weekend; transfer proceeds to the emergency fund.

- Do a two-Saturday gig next month; earmark 80% of earnings to your fund.

5) Protect the Buffer and Make It Last (Rules, Refill, and Rate Shopping)

What it is & why it works

Growing the fund is half the battle; protecting it is the rest. You need a clear definition of “emergency,” automatic refill rules after withdrawals, and a habit of rate shopping so your cash earns a fair return without sacrificing safety or liquidity.

Requirements & low-cost alternatives

- Requirements: Written rules, a separate account name (“Emergency Fund”), quarterly calendar reminders.

- Low-cost alternatives: A sticky note with your rules on your debit card or phone lock screen.

Step-by-step implementation

- Define “emergency.” Examples: necessary car repair, medical bill, urgent housing repair, temporary loss of income. Not an emergency: vacations, gifts, routine shopping.

- Create a refill policy. If you withdraw ₹/$X, automatically increase transfers or apply the next windfall until the fund returns to target.

- Set a rate-shopping reminder. Quarterly, compare your savings account rate and fees; consider moving to a better account if friction is low.

- Build “sinking funds.” For predictable non-monthly expenses (insurance premiums, car maintenance), create separate mini-buckets so they don’t raid your emergency stash.

Beginner modifications & progressions

- Beginner: Write a one-sentence emergency definition and share it with a trusted accountability partner.

- Progression: Add a simple “emergency verification” checklist (“Is it necessary? Is it urgent? Is there a cheaper stopgap?”).

Recommended frequency & metrics

- Frequency: Quarterly check-in; after any withdrawal; when a life event occurs (new child, move, job change).

- Metrics: Days to refill after withdrawal, % of non-emergency withdrawals (aim for zero), current account APY vs. alternatives.

Safety, caveats & common mistakes

- Mistake: Parking all funds in illiquid vehicles.

- Fix: Keep at least 1–2 months immediately accessible; use no-penalty time deposits or only modest ladders for the rest.

- Caveat: Investments designed for yield may not be insured and can fluctuate in value. Always confirm the product type and coverage.

Mini-plan (example)

- Write and save your emergency definition in your banking app notes.

- After any withdrawal, route 75% of your next windfall or bonus to refill the fund until it’s back to target.

Quick-Start Checklist (Print or Save)

- Name a separate “Emergency Fund” savings account.

- Automate a payday transfer (start with 2–5% of take-home).

- Set your first milestone: one month of essential expenses.

- Run a 90-day expense audit; cancel two subscriptions; increase your transfer by that amount.

- Choose one extra-income action for the next 2–4 weeks; pre-commit 80% to your fund.

- Write your emergency definition and refill rule.

- Calendar a quarterly review to check rates, insurance coverage (where applicable), and progress.

Troubleshooting & Common Pitfalls

“I keep overdrafting after I automate.”

- Move the transfer to the day after payday.

- Keep a small checking cushion (e.g., ₹/$100–₹/$300) to absorb timing quirks.

- Use low-balance alerts and a second weekly check.

“I start strong and then stop.”

- Shrink the transfer to a token amount rather than pausing entirely.

- Add a transfer escalation: +1–2% every quarter or when a bill drops.

“I keep dipping into the fund for non-emergencies.”

- Rename the account to “Emergency Fund—Do Not Touch.”

- Create sinking funds for predictable costs (insurance, car maintenance, holidays).

- Use a simple three-question test: Is it necessary? Is it urgent? Is it unexpected?

“Rates changed—now what?”

- During your quarterly review, compare your current rate and fees.

- If switching is easy and safe, move only the Tier 2/overflow portion first.

“Variable income makes automation hard.”

- Use a percentage of last month’s income rather than a fixed amount.

- Add a small, automatic “top-off” at month-end if cash flow allowed.

How to Measure Progress (Simple KPIs)

- Savings rate: % of take-home income going to the emergency fund.

- Months of essential expenses covered: Your emergency fund ÷ average monthly essentials.

- Time to goal: Based on your current savings rate and target.

- Refill speed: Days to restore the fund after a withdrawal.

- Leak rate: Number of non-emergency taps (aim for zero).

- Account efficiency: Current yield vs. available safe alternatives; % of balance covered by applicable deposit insurance.

A Simple 4-Week Starter Plan

Week 1: Set the foundation

- Open and label a separate savings account as “Emergency Fund.”

- Calculate essential monthly expenses (housing, utilities, groceries, transport, minimum debt payments).

- Automate a transfer for the day after payday (start small).

- Write your emergency definition and refill rule.

Week 2: Capture easy wins

- Audit the past 90 days of statements.

- Cancel/downgrade two subscriptions and negotiate one bill.

- Increase your automated transfer by the total saved.

Week 3: Add a cash sprint

- Select one extra-income action (a quick gig or sell items at home).

- Pre-commit 80% of proceeds to the emergency fund.

Week 4: Tune where cash lives

- Verify your account’s fees, rate, and insurance coverage where applicable.

- If your balance exceeds one month’s expenses, consider a no-penalty time deposit or keep it simple in one high-yield savings account.

- Book a quarterly review reminder.

FAQs

1) How big should my emergency fund be—really?

A common rule of thumb is three to six months of essential living expenses. If your income is very stable and you have strong insurance coverage, aim toward the lower end; if your income is variable or you have dependents, lean higher. Start with one month as your first milestone and build from there.

2) Where should I keep my emergency fund?

Prefer safe, liquid accounts. Many people use a high-yield savings account for instant access and, where applicable, deposit insurance. If you build beyond a few months, you can consider a small no-penalty time deposit or a simple ladder for a portion you’re unlikely to touch. Keep at least 1–2 months immediately accessible.

3) Are money market funds the same as money market accounts?

No. A money market fund is a type of investment fund and is not a bank deposit; it may not carry deposit insurance. A money market deposit account is a bank account and, when held at an insured institution, is generally covered up to applicable limits. Know which one you’re using.

4) What counts as a real emergency?

Necessary, urgent, unexpected expenses: medical bills, critical home or car repairs, or temporary income loss. Planned expenses (vacations, gifts, routine upgrades) belong in sinking funds, not your emergency fund.

5) I have high-interest debt. Should I build the fund first or pay the debt?

At minimum, build a starter fund (e.g., one month of expenses or a smaller buffer suited to your risk) so a surprise doesn’t push you deeper into debt. Then run a dual track: keep a small automated transfer to savings and aggressively pay down high-interest balances.

6) Should I invest my emergency fund to earn more?

Generally, no. The primary goals are safety and liquidity. If an emergency hits during a market downturn, you don’t want your safety net to fall in value or be locked. Keep investments and emergency savings separate.

7) How do I keep from raiding the fund for non-emergencies?

Write a one-sentence rule, rename the account, and build separate sinking funds. If you slip, refill immediately by diverting windfalls and raising your auto-transfer temporarily.

8) What if my income is irregular?

Use percent-based automation (e.g., 10% of last month’s income), plus a small month-end top-off if cash flow allows. Build a higher target (closer to six months) to cushion dry spells.

9) How do early withdrawal penalties on time deposits work?

Traditional time deposits generally penalize early withdrawals, often costing some interest. No-penalty versions reduce or remove this risk but may offer lower yields. If liquidity is critical, keep more in regular savings.

10) How often should I revisit my emergency fund plan?

Quarterly is a good rhythm. Also revisit after life events (new job, move, child, major purchase) and after any emergency withdrawal. Check that your cash is still safe, liquid, and appropriately covered under any relevant insurance scheme.

11) I’m starting from zero. What’s the absolute first step?

Open a separate account, automate a small payday transfer (even ₹/$10–₹/$25), and celebrate your first ₹/$100 saved. Then follow the 4-week plan above.

12) Can I keep some emergency cash at home?

A small amount for true immediate necessities is fine, but it’s risky to hold large sums physically. Prioritize secure, liquid accounts for the bulk of your buffer.

Conclusion

An emergency fund is not just a pile of cash—it’s a promise to your future self. By automating savings, choosing safe homes for your money, cutting financial friction, boosting inflows, and protecting the buffer with clear rules, you build something more valuable than interest: confidence. Start small, keep going, and let your system do the heavy lifting.

CTA: Take 10 minutes now to open or label your “Emergency Fund” account and schedule your first automatic transfer—future you will be grateful.

References

- An essential guide to building an emergency fund, Consumer Financial Protection Bureau, December 12, 2024. https://www.consumerfinance.gov/an-essential-guide-to-building-an-emergency-fund/

- How to save for emergencies and the future, Consumer Financial Protection Bureau, February 26, 2018. https://www.consumerfinance.gov/about-us/blog/how-save-emergencies-and-future/

- Start an Emergency Fund, Financial Industry Regulatory Authority, (page currently maintained; accessed August 14, 2025). https://www.finra.org/investors/personal-finance/start-emergency-fund

- Five Financial Tips for New Parents (section: Set Up an Emergency Fund), Financial Industry Regulatory Authority, May 14, 2025. https://www.finra.org/investors/insights/five-financial-tips-new-parents

- How to Prepare for and Survive Financial Hardship, Financial Industry Regulatory Authority, April 30, 2024. https://www.finra.org/investors/insights/prepare-survive-financial-hardship

- Expenses – Unexpected Expenses and Emergency Savings (Survey of Household Economics and Decisionmaking), Board of Governors of the Federal Reserve System, May 28, 2024 (with 2025 data visuals updated May 28, 2025). https://www.federalreserve.gov/publications/2024-economic-well-being-of-us-households-in-2023-expenses.htm

- Adults who would cover a $400 emergency expense using cash or its equivalent (data visualization), Board of Governors of the Federal Reserve System, May 28, 2025. https://www.federalreserve.gov/consumerscommunities/sheddataviz/unexpectedexpenses.html

- Understanding Deposit Insurance, Federal Deposit Insurance Corporation, April 1, 2024. https://www.fdic.gov/resources/deposit-insurance/understanding-deposit-insurance

- Deposit Insurance (overview), Federal Deposit Insurance Corporation, (page currently maintained; accessed August 14, 2025). https://www.fdic.gov/resources/deposit-insurance

- Cash Sweep Programs for Uninvested Cash in Your Investment Accounts — Investor Bulletin, U.S. Securities and Exchange Commission (Office of Investor Education and Advocacy), May 14, 2025. https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-bulletins/cash-sweep-programs-uninvested-cash-your-investment-accounts-investor-bulletin

- Money Market Funds: Investor Bulletin, U.S. Securities and Exchange Commission (Office of Investor Education and Advocacy), November 4, 2024. https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-bulletins/updated-12

- What are the penalties for withdrawing money early from a certificate of deposit (CD)?, HelpWithMyBank.gov (Office of the Comptroller of the Currency), (page currently maintained; accessed August 14, 2025). https://www.helpwithmybank.gov/help-topics/bank-accounts/certificates-of-deposit/cd-penalties.html

- High-Yield CDs: Protect Your Money by Checking the Fine Print, U.S. Securities and Exchange Commission (Investor Education), December 2, 2008. https://www.sec.gov/about/reports-publications/investorpubscertifichtm

- Monthly payment worksheet (includes emergency savings rule of thumb), Consumer Financial Protection Bureau, (publication PDF; accessed August 14, 2025). https://files.consumerfinance.gov/f/documents/cfpb_buying-a-house_monthly-payment_worksheet.pdf