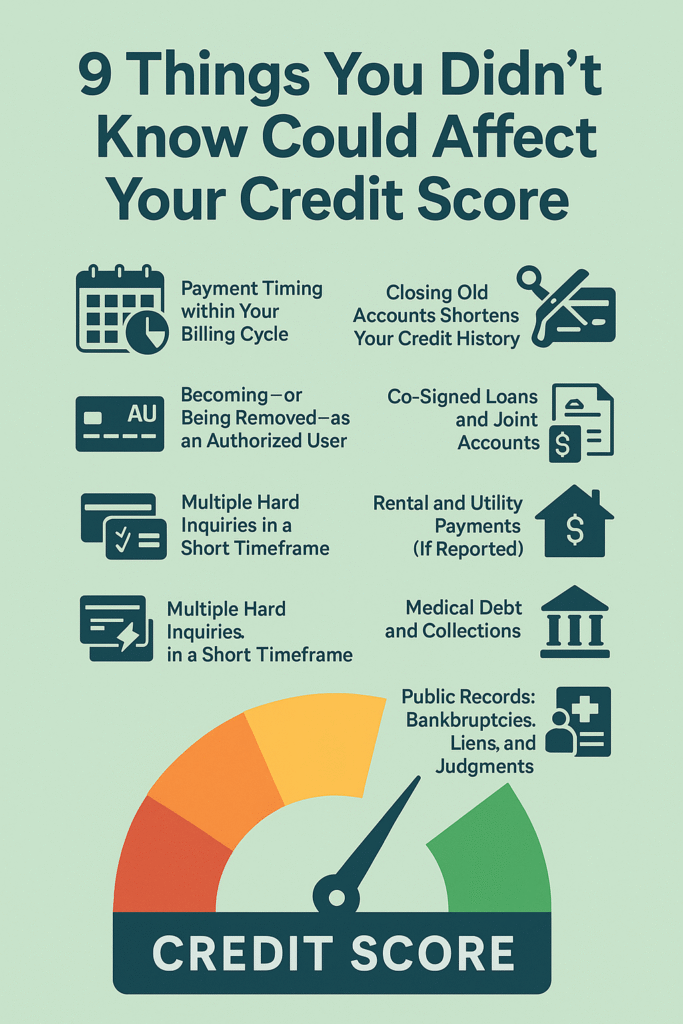

It can be hard to know what to do to raise your credit score. Your score doesn’t seem to change or even go down, even though you pay your bills on time and keep your balances low. Your payment history, how much you owe, how long you’ve had credit, new credit, and your credit mix are all things that can have a big effect on your credit score. But there are also a lot of less well-known things that can change your score, and they might do so in ways you don’t expect. You need to know about these hidden things that can hurt your credit profile if you want to get better rates on loans, credit cards, and insurance.

We talk about nine things in depth that you may not have known could lower your credit score. We explain why and how each one affects your score, and we also give you helpful advice on how to deal with them. We also answer frequently asked questions and give you steps you can take right away.

Beginning

Your credit score is more than just a number; it’s a way for lenders, landlords, insurers, and even some employers to see how good you are at managing your money. In the U.S., FICO® and VantageScore® are the two most common ways to score. They both look at similar data, like payment history, credit utilization, length of credit history, new credit, and credit mix, but their algorithms are different.

But there are other things that can change your score without you knowing it right away. For example, did you know that if you were taken off as an authorized user on a friend’s old account, your average account age could go down and your score could go down? Or that if you report your rent payments, they might help your credit, but only if you do it the right way? These things matter.

This long article goes into detail about nine little-known things that can affect your credit score. Learning these little things can help your credit health and help you do well in today’s competitive lending market.

1. When you pay your bill: Why it matters

People believe that as long as you pay your credit card bill on time, you’re fine. But when you pay during the billing cycle can change the balance that credit bureaus see, which affects your credit utilization ratio.

Due Date vs. Statement Closing Date

Credit card companies only show you your balance on the day your statement closes, not the day your payment is due. The bureaus only see the $900 balance at the end of the cycle, even if you pay it off on time.

How it changes things in the real world

A high reported balance can raise your utilization ratio (balance ÷ credit limit), which is about 30% of your FICO® Score1. For example, if you have a $1,000 limit and a $900 balance, you are using 90% of your credit. Your score could drop by 20 to 30 points, even if you pay it off the next day.

How to Get the Most Out of Paying More Than Once

You might want to pay your bill before the statement closing date if it’s usually high. This will lower the reported balance.

Request a new date for your statement.

A lot of issuers let you change the date on your statement so that it fits better with your paychecks.

Set up alerts

Use issuer apps to get alerts when your balance gets close to a limit, like 30% of your limit. Then, pay it off early.

2. Why credit utilization per account is important

The overall credit utilization ratio is very important, but some scoring models also look at how much you use each account. Even if you don’t use a card very often, having a high balance on it can still hurt.

Details about FICO®

FICO® 8 mostly looks at overall utilization, but earlier and some specialized FICO® versions, like FICO® Bankcard Score, also look at per-account utilization$^2$.

How VantageScore Works

VantageScore® 3.0 looks at how much you use all of your accounts, as well as how much you use the three accounts with the highest balances.

How to Get the Most Out of Your Balances

Don’t just put all your charges on one card; spread them out more evenly across all of them.

Pay Off Some Cards

Pay close attention to cards that are close to their limits; it’s best if each one is used less than 30% of the time.

Request higher credit limits

If your income and credit history allow it, raising your limit while keeping your balances the same lowers your utilization ratios.

3. Closing old accounts makes your credit history shorter. Why this matters:

About 15% of your FICO® Score4 comes from how long you’ve had credit. There are two main measures:

- The Oldest Account’s Age

- The Average Age of All Accounts

If you close an old card with a zero balance, it will no longer be counted in the average age and score over time.

How to Get the Most Out of Low-Use Cards

If a card doesn’t have an annual fee, keep it open and use it to buy small things every year to keep it active.

Don’t close; instead, downgrade.

Instead of closing the account, ask your issuer to switch you to a version that doesn’t charge you anything.

Set a limit on how many new accounts can be opened.

Don’t get new credit unless you really need it. Every new account can make your average age go down.

4. Why it matters to become or be removed as an authorized user

Adding yourself as an authorized user to a credit card that has a long history and low use can help your score.5 On the other hand, losing an old authorized-user account or getting kicked off will lower the average age of your credit and may raise your utilization profile.

How to Make the Most of It: Pick Wisely

Only accept authorized-user adds on cards that have a good payment history and a high credit limit.

Stay in Good Shape

Encourage the main cardholder to pay their bills on time and keep their balances low.

Be Careful of Removal

If your score suddenly drops, check to see if an issuer has taken you off. If so, ask the main user to add you back.

5. A lot of hard questions in a short amount of time

Why It Matters

When you apply for a new account, the lender will check your credit. Each hard inquiry can lower your score by 5 to 10 points and stay on your report for two years.6 If you look for mortgage or auto loan rates over a period of 14 to 45 days, that counts as one inquiry. But if you apply for more than one credit card or personal loan at the same time, that counts as more than one inquiry.

How to Improve Your Plan Applications

Wait at least six months between applications when you want to get a new credit card or loan.

Use Tools to Get Prequalified

A lot of issuers offer “soft” prequalification, which doesn’t change your score.

Put Questions Together

FICO® sees all auto loan applications as one request, so only apply for them over a two-week period.

6. Loans with a co-signer and shared accounts

Why It Matters

You both have to pay back a loan or share a bank account if you co-sign it. If the other person is late or doesn’t pay, it will show up on both of your credit reports.

You might co-sign for a friend’s car loan in real life because you think it’s low risk until they get into trouble with money. If you don’t pay your bill on time, your FICO® Score could drop by as much as 100 points.8

Before Co-Signing, Think Again:

Only Co-Sign for People with Good Credit Histories and Strong Financial Habits.

Keep an eye on the account and ask for reminders about due dates and balances.

Leave When You Can

You could refinance the loan in the borrower’s name only or pay it off so you can stop being a co-signer if you don’t trust them anymore.

7. Rent and utility bills (if they were paid)

Why It’s Important

Credit reports don’t usually show rent and most utility payments. But services like Experian RentBoost® or Equifax Rental Exchange can add good rental history to your file, which could raise your score, especially if you don’t have much or any credit history.

Reports on Utilities and Telecommunications

Some fintech apps let you report payments that are on time for things like streaming services, phone bills, and electricity bills. This can help with other ways to score.

How to Get the Most Out of Rent Reporting

You can ask your landlord or property manager to report your rent, or you can hire a company to do it for you.

Fintech apps

like UltraFICO (which needs access to your banking data) and Experian Boost® (which reports payments for utilities and telecom) can help you get more accurate information.

Keep Paying on Time

Your score will only go up if you pay off your debts on time. If you pay late or only part of what you owe, they might not be reported or could hurt your score.

8. Medical bills and collections

Why It Matters

Medical bills often go unpaid for longer than other debts, so they end up in collections. FICO® 9 and VantageScore® 4.0 don’t count medical collections that have been paid off and give unpaid ones less weight. But older scoring models and some lenders still punish them a lot.1

Holds in the Grace Period

Healthcare providers can send unpaid bills to collections after 90 to 180 days. The time starts when the service is finished, not when you get the bill.

Changes in Reporting

Some collection agencies don’t report to all three bureaus (Experian, Equifax, and TransUnion), which can have different effects.

How to Make the Most of Looking Over Medical Bills

Look over your bills for mistakes and talk about charges within the first 60 days.

Settle the Deal

Ask your provider to pay in full for less or set up payment plans.

Make sure the deletion happens after payment.

When you pay off a collection, ask the agency for a written confirmation that they will take the entry off your report.

9. Public Records: Bankruptcies, Liens, and Judgments

Why It Matters

Bankruptcies, tax liens, and civil judgments are all public records that can hurt your score by hundreds of points and stay on your report for years (bankruptcy up to 10 years$^1$$^2$).

If you file for Chapter 7 bankruptcy, it will stay on your record for 10 years. If you file for Chapter 13 bankruptcy, it will stay for 7 years.

Removing liens and judgments

If you don’t keep your tax liens and judgments up to date, they can stay on your record even after you’ve paid them.

How to Get the Most Out of Your Reports

You can get free yearly credit reports from AnnualCreditReport.com to find wrong public records.

Get rid of paid liens and judgments

Get the court papers from the credit bureaus that show you are happy.

Find a lawyer

Professionals can help you seal or erase records when they can and work out lien releases.

Questions and Answers (FAQs)

Q1: How often does my credit score change? Credit bureaus only update scores when they get new information from lenders, which happens every 30 to 45 days for most people.

Q2: Do soft inquiries hurt my credit score? No, soft pulls, like checking your own score or doing prequalification checks, don’t change your score.13

Q3. Can I get a hard inquiry removed from my credit report? Only if it wasn’t right or wasn’t approved. You can file a complaint with the bureau, and if the lender can’t prove the inquiry, it has to be taken down.14

Q4. Will paying off a collection account raise my score again? Yes, under FICO® 9 and VantageScore® 4.0, paid medical collections no longer hurt your score. But older models may still hurt your score until the entry ages off, which can take up to seven years.15

Q5: What do I do if my credit report has errors? You can file a dispute with the bureau that reported the mistake online, by phone, or by mail. Allow the bureau 30 days to look into the issue and get back to you.

To sum up

There are many things that can affect your credit score, and paying your bills on time is just one of them. There are a lot of things that can affect your credit score. For example, when you pay your bills and how much you use your accounts can have an effect, as can things that don’t seem related, like your rental history and co-signed loans. By being aware of and taking care of these nine hidden factors, you can not only protect your score, but also save money on insurance, car loans, mortgages, and more.

Next Steps:

- Check out your free reports from Experian, Equifax, and TransUnion at AnnualCreditReport.com.

- Set Up Alerts: Use your creditor’s app or a credit-monitoring service to keep track of when your bills are due, how much you owe, and any questions you have.

- Sign up for Reporting Services: Add good information with Experian Boost®, rent reporting, or other financial technology tools.

- If you have a complicated problem, like a disagreement over public records or a co-signed loan, you should talk to a certified credit counselor or lawyer.

You can turn these hidden things into chances if you stay alert and informed. This will improve your credit score and give you more freedom with your money.

References

- FICO®. “What Factors Affect FICO® Scores?” FICO. https://www.myfico.com/credit-education/whats-in-your-credit-score

- FICO®. “FICO® Scores: How They’re Calculated.” FICO. https://www.fico.com/blogs/risk-compliance/factors-affect-credit-scores

- VantageScore®. “How VantageScore® Calculates Your Credit Score.” VantageScore. https://vantagescore.com/how-credit-scoring-works

- Consumer Financial Protection Bureau. “Your Credit Scores.” https://www.consumerfinance.gov/ask-cfpb/what-is-a-credit-score-en-159/

- Experian. “Authorized User.” https://www.experian.com/blogs/ask-experian/what-is-an-authorized-user/

- FICO®. “Inquiry Types & Your FICO® Score.” https://www.fico.com/blogs/risk-compliance/hard-inquiry-soft-inquiry-dispute-faq

- Federal Trade Commission. “Credit-Based Insurance Scores.” https://www.consumer.ftc.gov/articles/0153-credit-based-insurance-scores

- FICO®. “Understanding Co-Signers and Credit Scores.” https://www.myfico.com/credit-education/credit-scores-co-signers

- Experian. “RentBoost®.” https://www.experian.com/consumer-products/rentboost

- Experian. “Boost Your Credit by Reporting Bills.” https://www.experian.com/boost

- FICO®. “FICO® Score 9 vs Previous Versions.” https://www.fico.com/blogs/risk-compliance/fico-score-9

- U.S. Courts. “Bankruptcy Basics.” https://www.uscourts.gov/services-forms/bankruptcy

- Consumer Financial Protection Bureau. “Do inquiries affect my credit score?” https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-a-soft-credit-inquiry-and-a-hard-credit-inquiry-en-116/

- Equifax. “Removing Unauthorized Hard Inquiries.” https://www.equifax.com/personal/education/credit/score-basics/hard-inquiries/

- VantageScore®. “Medical Collections and Credit Scores.” https://vantagescore.com/blog/medical-debt-credit-scores

- Federal Trade Commission. “Credit Report Errors.” https://www.consumer.ftc.gov/articles/0151-disputing-errors-credit-reports

2/2

Ask ChatGPT