Applying for your first card without a paycheck can feel confusing—and a little intimidating. This guide breaks down exactly what to look for if you’re a student with little or no income, how to qualify legally and safely, and which features actually help you build credit at the lowest possible cost. Quick answer: if you’re under 21 and don’t have your own income, you typically need a cosigner or should start with a secured card or authorized-user route; if you’re 21+, you may be able to use household income you can reasonably access. Always choose a card that reports to all three bureaus, avoid junk fees, and turn on autopay.

This article shares general education, not personalized financial advice. Rules and examples below reflect U.S. regulations as of now.

1. Understand the Age & Income Rules Before You Apply

If you’re under 21 in the U.S. and don’t have your own income, you can’t be approved for a standalone credit card unless an adult 21+ cosigns or you can prove an independent ability to pay the minimums yourself. If you’re 21 or older, issuers may consider household income you reasonably have access to (for example, from a spouse or partner). These rules come from the Credit CARD Act and Regulation Z’s ability-to-pay requirements. Getting this wrong causes unnecessary denials and hard inquiries. Know where you stand before hitting “apply.”

1.1 Why it matters

If you’re 18–20 with no income, “spray-and-pray” applications won’t work—and can hurt your credit. For 21+, correctly listing accessible household income can change an approval decision. The CFPB amended rules in 2013 so applicants 21+ may include income they reasonably expect to access; under-21 applicants still must show their own income or use a cosigner. consumerfinancemonitor.com

1.2 How to do it right

- Under 21: Apply with a cosigner 21+ who agrees to be responsible, or start with a secured card or authorized-user path.

- 21+: List household income you can access (e.g., shared income from a spouse/partner), not just your personal wages.

- Keep evidence of income (pay stubs, assistantships, consistent allowances) and enrollment handy.

- Avoid multiple applications within a short window to limit hard inquiries.

Synthesis: Start by matching your age and income situation to what issuers are legally allowed to consider; this prevents avoidable denials and sets your application up for success.

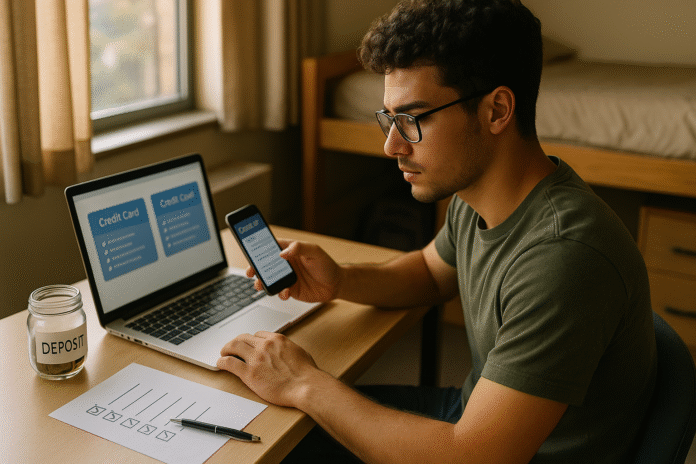

2. Choose the Right Starting Line: Secured vs. “Student” Cards

For students without income, secured cards are often the most reliable on-ramp. You pay a refundable security deposit—commonly $200–$300—and your credit limit usually equals the deposit (some issuers allow a higher limit with more deposit). Many secured products graduate to unsecured after consistent on-time payments. Some “student” cards can work if you qualify, but without income they’re tougher to get on your own.

2.1 Numbers & guardrails (as of Sep 2025)

- Typical secured-card deposit: $200–$300; some allow deposits up to $2,500 for higher limits.

- Some issuers set minimum deposits below $200 but grant at least a $200 limit (e.g., examples cited by issuers).

- Confirm graduation terms and whether your deposit earns interest while held. (Policies vary by issuer.)

2.2 Mini-checklist

- Requires refundable deposit

- Reports to all three bureaus (see item 5)

- No annual fee and reasonable APR (you’ll pay $0 interest if you always pay in full)

- Clear graduation path after 6–12 on-time payments

Synthesis: If income is your constraint, a solid secured card that reports broadly and graduates is often the cleanest, lowest-risk way to start building credit. Experian

3. Authorized User vs. Cosigner: Two Very Different Tools

When you’re not eligible for your own card, you have two “borrowed” options: become an authorized user (AU) on someone else’s account or apply with a cosigner. As an AU, you get a card, but the primary user is legally responsible; you benefit if the issuer reports AU activity to the bureaus (many do, sometimes with age limits). A cosigner, by contrast, shares full responsibility for the debt—and their credit can be affected by your usage and payments.

3.1 Common mistakes

- Assuming every issuer reports AU data or accepts minors—policies vary; confirm before you proceed.

- Treating a cosigner like a formality; they’re fully liable, and under-21 rules are strict about who can cosign.

- Not discussing spending rules, alerts, and autopay with the primary account holder.

3.2 How to maximize benefits

- Pick an issuer that reports AU accounts and has no minimum age or one you meet.

- Keep utilization low on the shared account (ideally <10%).

- Set real-time alerts and agree on a monthly spending cap.

Synthesis: Use AU for a low-friction boost to your credit file; use a cosigner only if both parties understand the legal stakes and you can guarantee on-time payments.

4. Fees to Scrutinize: Annual, Late, Foreign, and Cash Advance

Students with limited cash flow should minimize recurring costs and penalties. Prioritize no annual fee, avoid foreign transaction fees if you’ll study abroad, and respect how expensive late fees and cash advances can be. Importantly, the CFPB’s 2024 rule to cap late fees at $8 for large issuers was vacated in April 2025—so don’t assume a universal $8 cap today. Many issuers again rely on Regulation Z’s “reasonable and proportional” standard and the prior safe harbor levels (historically $30 for a first late and $41 for subsequent, subject to adjustments), but exact fees vary by issuer.

4.1 What to check in the Schumer box (pricing table)

- Annual fee: $0 is ideal for starters.

- Late fee: Confirm current dollar amount; do not rely on the old $8 rule.

- Foreign transaction fee: 0% if you plan international use.

- Cash advance fee + APR: Often higher than purchase APR; avoid unless emergency.

- Penalty APR & returned payment fee: Know triggers and amounts.

4.2 Mini example

If your card’s late fee is $33 and you forget a $25 payment, you’d pay a fee larger than the missed payment itself. A simple auto-debit of the statement minimum prevents this. (See item 8 for automation.)

Synthesis: The cheapest student card is the one with no annual fee, no foreign transaction fees (if you’ll travel), and late fees you’ll never trigger thanks to autopay.

5. Make Sure the Card Reports to All Three Credit Bureaus

The entire point of a student card is to build credit history. That only happens if your activity is reported—preferably to Experian, Equifax, and TransUnion. Some secured and student cards report to all three; others don’t. The CFPB explicitly advises asking whether the issuer reports and reminds consumers that secured cards can help build credit if reporting occurs. You also now have permanent access to free weekly credit reports at AnnualCreditReport.com—use that to monitor your progress.

5.1 Quick checklist

- Card reports monthly to all three bureaus

- Your name and address match across applications and reports

- You review your reports monthly (free) and dispute errors promptly through each bureau

5.2 Tools/Examples

- Use the official portal AnnualCreditReport.com for weekly no-cost reports.

- If denied, request the adverse action report and check for errors or fraud flags.

Synthesis: A card that doesn’t report broadly is a dead end; verify reporting first, then build positive history you can actually prove.

6. APR, Grace Periods, and 0% Offers: Read the Fine Print

Even as a student who plans to pay in full, you should understand APR and grace periods. As of mid-2025, average APRs across all credit card accounts hover around ~21%, and accounts that actually accrue interest average ~22%—costly if you carry a balance. A true grace period means you won’t owe interest on new purchases if you pay your statement balance in full by the due date. Be wary of deferred interest promos (common on store cards) where one slip means retroactive interest on the entire purchase.

6.1 How to use this

- Always pay in full to make APR irrelevant; your effective interest rate is 0% if you never carry a balance.

- If you must finance, seek a 0% intro APR with a clear end date and a plan to pay off before it ends.

- Avoid deferred interest store cards unless you can repay 100% within the promo period.

6.2 Mini example

On a $500 laptop at 22% APR, carrying the balance for six months costs roughly $55 in interest; miss a deferred-interest deadline and you could owe all back interest from day one.

Synthesis: You’ll build faster and cheaper by using the grace period and avoiding balance-carrying; know your APR but design your habits so it rarely matters.

7. What Counts as “Income” When You Have No Job?

For under-21 applicants, issuers look at your own income (wages, reliable allowances, residual grant/scholarship funds after tuition); for 21+, issuers may consider household income you reasonably access. Student loans usually don’t count as income; work-study pay may. When in doubt, review the application’s definition of income and the CFPB’s guidance on household income rules. Never exaggerate; you can be asked to verify.

7.1 What to include (ethically)

- W-2/1099 income, assistantships, stipends you use for living expenses

- Allowances and regular support you receive (documented)

- Household income (21+ only) that you can reasonably access

7.2 What not to count

- Student loans disbursed to tuition directly (unless your issuer explicitly permits leftover amounts for expenses—rare; check terms)

- One-off gifts that aren’t ongoing

- Anything you can’t document if asked

Synthesis: Align how you answer “income” with your age and the rules; accurate reporting improves your approval odds without creating legal risk.

8. Automation: The Easiest Way to Avoid Late Fees and Credit Dings

With busy schedules and irregular cash flow, automation is your friend. Set autopay for at least the statement minimum to avoid late fees and protect your payment history—the single most important factor in your credit. As of April 2025, the CFPB’s $8 late-fee cap for big issuers was vacated, so late fees may be higher again; automation eliminates that uncertainty. Add text/email alerts, keep your bank balance buffer, and pay early if your limit is low to keep utilization down.

8.1 Mini-checklist

- Autopay minimum + a second reminder to pay in full

- Due-date alerts 7 days and 1 day prior

- Mid-cycle manual payment if your balance creeps above 10–30% of your limit

- Calendar a monthly credit-report check (free)

8.2 Small case

A student with a $300 limit who pays weekly in $30–$50 chunks keeps utilization under 10–20%, avoids interest, and never triggers a late fee.

Synthesis: A few minutes of automation prevents the two most expensive mistakes: late payments and high utilization.

9. Extra Features That Actually Help Students (and Which to Skip)

Shiny features are nice; practical ones build credit and save money. Prioritize $0 annual fee, card lock, real-time alerts, virtual card numbers, and mobile wallet support for safer online and on-campus purchases. A no foreign transaction fee card helps if you’re studying abroad. Skip flashy rewards if they come with higher costs or nudge you to overspend. And remember: any card can be a bad card if it doesn’t report to the bureaus or tempts you into carrying a balance you can’t pay off. Consumer Financial Protection Bureau

9.1 What to look for

- $0 annual fee and clear path to graduation (secured → unsecured) Consumer Financial Protection Bureau

- Security: instant card lock, virtual card numbers, zero-liability protections (network/issuer policies vary)

- Travel: no foreign transaction fees if relevant

- Budgeting: spending categories, autopay, alerts

9.2 What to skip (for now)

- Rewards that encourage overspending

- Store cards with deferred interest traps and high APRs (often 30%+).

Synthesis: Choose features that strengthen habits and lower risk; ignore bells and whistles until you’ve built six–twelve months of spotless history.

FAQs

1) Can I get a student credit card with absolutely no income?

If you’re under 21, you generally need either your own verifiable income or a cosigner who’s at least 21 and willing to be legally responsible. If you’re 21+, you can often list household income you reasonably access (e.g., shared income with a spouse/partner). If neither applies, consider a secured card or authorized-user route first to establish credit safely.

2) Do scholarships or financial aid count as income?

Most issuers don’t treat student loans as income, and grants applied directly to tuition typically don’t count. Some applications may allow residual scholarships or stipends that you control for living expenses, but this is issuer-specific—check the definition on the application and be prepared to document it. Never misstate income. Bankrate

3) What credit limit should I expect on a secured card?

Many secured cards set your limit equal to your deposit—often $200–$300 to start, with options to increase by depositing more. Some issuers allow higher deposits (e.g., up to $2,500) for bigger limits. Your deposit is refundable when you close in good standing or graduate to unsecured.

4) Do authorized users always build credit?

Usually, yes—but only if the issuer reports authorized-user activity to the bureaus and the main account stays in good standing. Some issuers have minimum-age policies or limited reporting for minors, so verify before you rely on this path. Keep utilization low and payments on time to see the benefit.

5) What’s a “good” APR for a starter card in 2025?

APR varies by credit profile and product. As of 2025, average APRs are around ~21% for all accounts and ~22% for accounts assessed interest—which is expensive if you carry a balance. The best move is to pay in full and use the grace period, making APR largely irrelevant to you.

6) Are late fees capped at $8 now?

No. The CFPB finalized an $8 cap for large issuers in 2024, but a federal court vacated that rule in April 2025. Issuers may again set higher late fees consistent with Regulation Z (historically $30/$41 safe harbors, subject to adjustments). Always check your card’s current terms and avoid late payments via autopay. Consumer Financial Protection Bureau

7) How do I monitor my credit for free?

Go to AnnualCreditReport.com for free weekly reports from Equifax, Experian, and TransUnion (a permanent change). Review them monthly to confirm your account is reporting and to dispute any errors promptly.

8) What utilization should I aim for?

Try to keep utilization below 30%, and ideally under 10% on your student/secured card. Paying early (even mid-cycle) helps if your limit is small. Low utilization plus on-time payments are the two most powerful drivers of early score gains. Consumer Financial Protection Bureau

9) Is a store card a good first card?

Store cards can be tempting, but many carry deferred interest traps and very high APRs (often around 30%+), which can be punishing if you carry a balance or miss a promo deadline. A no-annual-fee secured or student card that reports to all three bureaus is usually a safer first step.

10) Can alternative underwriting help if I have no credit?

Some card programs consider cash-flow data (bank transactions) in addition to or instead of traditional scores. U.S. regulators have recognized that responsibly using cash-flow/alternative data can expand access, though practices vary by issuer. If invited, connecting bank data can help demonstrate ability to repay.

11) What happens if I’m denied?

Expect an adverse action notice explaining why. Use it to fix issues (e.g., thin file, unverifiable income). Pull your free credit reports, correct errors, and consider a secured card or authorized-user path for 6–12 months before reapplying. Spacing out applications helps protect your score. Consumer Advice

12) Do these rules apply outside the U.S.?

No. This guide reflects U.S. law and practices (CFPB/Regulation Z). Other countries use different rules and credit systems. If you study abroad, focus on card acceptance, foreign fees, and EMV compatibility—and always pay in full.

Conclusion

Starting credit with no paycheck is absolutely possible—if you align your application with the rules and pick the right tool for your situation. Under 21 without income? Use a cosigner, go authorized-user, or choose a secured card that reports to all three bureaus and offers a clear path to graduation. Over 21 with access to shared household funds? Follow the CFPB’s guidance on income you can reasonably access and select a no-annual-fee student or secured product that won’t nickel-and-dime you with penalties. In every case, automation and habits win: turn on autopay, monitor your weekly free reports, keep utilization under 10–30%, and leverage the grace period so interest never applies. After six to twelve months of clean history, you’ll typically qualify for better terms and higher limits—without ever overspending to get there.

CTA: Pick one path (secured, AU, or cosigner), set autopay today, and check your free credit reports this week—your future self will thank you.

References

- 12 CFR §1026.51 — Ability to Pay (Regulation Z), Consumer Financial Protection Bureau, continuously updated. Consumer Financial Protection Bureau

- 2013 Final Rule Amending Ability-to-Pay (Adults 21+), CFPB, Apr 2013. Consumer Financial Protection Bureau

- Ask CFPB: Stay-at-home Spouse/Partner & Household Income, CFPB, Sept 6, 2024. Consumer Financial Protection Bureau

- 12 CFR §1026.52 — Limitations on Fees (including late fees), CFPB, continuously updated. Consumer Financial Protection Bureau

- Judge Scraps CFPB $8 Late-Fee Rule, Reuters, Apr 15, 2025. Reuters

- CFPB Late-Fee Rule Vacated / Abandoned (Case updates), Consumer Finance Monitor & Goodwin Insights, Apr–May 2025. ; https://www.goodwinlaw.com/en/insights/blogs/2025/05/cfpb-agrees-to-eliminate-%248-cap-on-credit-card-late-fees consumerfinancemonitor.com

- Free Weekly Credit Reports — Permanent Access, Federal Trade Commission, Jan 4, 2024. Consumer Advice

- AnnualCreditReport.com — Official Portal, AnnualCreditReport.com, accessed Sep 2025. annualcreditreport.com

- Average Credit Card APRs (All Accounts / Assessed Interest), FRED (Federal Reserve), updated Jul–Sep 2025. ; NerdWallet, Apr 7, 2025. https://www.nerdwallet.com/article/credit-cards/what-is-the-average-credit-card-interest-rate FRED

- Authorized Users & Credit Building, Experian, Apr 30, 2024 & Sep 5, 2025. ; https://www.experian.com/blogs/ask-experian/checking-to-see-if-your-children-have-credit-reports/ Experian

- Secured Card Deposits Explained, Discover (Jan 17, 2025), Capital One (Jun 3 & Jun 10, 2025), Bankrate (Apr 15, 2025). ; https://www.capitalone.com/learn-grow/money-management/how-secured-credit-cards-work/ ; https://www.capitalone.com/learn-grow/money-management/secured-card-deposits/ ; https://www.bankrate.com/credit-cards/building-credit/secured-card-deposit-amount/ BankrateDiscoverCapital One

- Alternative Data / Cash-Flow Underwriting (Regulatory view), Interagency Statement via CFPB & OCC/FDIC, Dec 3, 2019; CFPB blog July 26, 2023. ; https://www.occ.gov/news-issuances/bulletins/2019/bulletin-2019-62.html ; https://www.consumerfinance.gov/about-us/blog/credit-scores-only-tells-part-of-the-story-cashflow-data/ Consumer Financial Protection BureauOCC.gov

- Deferred Interest & High Retail APRs, Times Union citing Bankrate Retail Cards Study, Sep 2025. Times Union