Retiring at 45–55 is a different puzzle than retiring at 65–70. The overarching allocation question is how to balance growth, income, taxes, and healthcare across two very different time horizons. This guide lays out 9 rules to help you decide how a portfolio should differ for an early retiree versus a traditional retiree. In short: early retirees need a longer growth runway but tighter cash-flow risk controls; traditional retirees typically prioritize income stability, RMDs, and longevity protection. As a quick definition: portfolio allocation for an early retiree vs. a traditional retiree means choosing asset mixes, withdrawal methods, and account sequencing that match a longer pre-Social-Security/Medicare “bridge” (early) or a shorter one (traditional), while managing sequence-of-returns risk, taxes, and inflation.

Friendly reminder: The following is educational, not individualized financial, tax, or legal advice. Regulations and yields change; verify key numbers as of now before acting.

1. Anchor the Allocation to Your Two Time Horizons (Bridge Years vs. Lifetime)

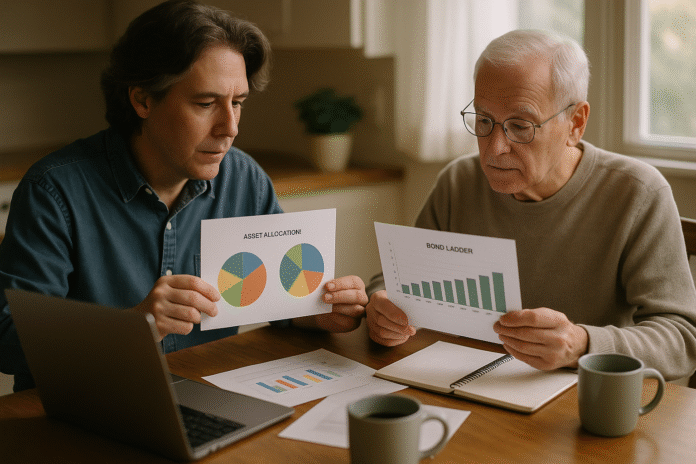

The right allocation starts by sizing two horizons: the bridge period (from retirement to the start of reliable external income like Social Security/annuities/Medicare at 65) and the lifetime horizon (30–40+ years of total retirement). For early retirees, the bridge can span 10–20 years; that’s too long for cash alone, yet too risky to fund entirely with stocks. The practical implication is a barbell: enough low-volatility assets to survive a bad first decade, plus a sizable growth sleeve to support multi-decade spending. Traditional retirees, by contrast, often have Social Security already in pay or near, Medicare at 65, and RMDs at 73 (rising to 75 in 2033), which compresses the bridge and shifts emphasis toward income stability and tax-aware withdrawals. Knowing these horizons clarifies how much to earmark for near-term spending versus long-term growth. (RMD age rules as of now: first RMD by April 1 following the year you reach 73.)

1.1 How to size the bridge

- Map fixed income sources by start date (e.g., Social Security at 67–70, annuity deferrals). SSA shows you can claim as early as 62, FRA ~67 for many born in the late 1950s–1960s, and higher monthly benefits for delaying up to 70.

- Estimate annual core expenses (premiums, housing, food, utilities) with a 10–20% buffer.

- Decide what must be liability-matched (cash/bonds/TIPS) vs. what can rely on portfolio growth. Bond ladders/time-segmented “buckets” are commonly used.

- Early retirees typically need a larger “bridge sleeve” than traditional retirees; see Rule 2 for construction.

1.2 Numbers & guardrails

- A common time-segmented allocation example: 1–2 years of cash needs (Bucket 1), ~5–8 years in high-quality bonds/TIPS (Bucket 2), rest in diversified growth (Bucket 3). Morningstar and others outline such 3-bucket frameworks.

Synthesis: Two horizons drive everything else. Early retirees fund a longer bridge and keep growth alive for decades; traditional retirees tilt more toward steady income and RMD-aware withdrawals.

2. Build a Sequence-of-Returns “Crash Bar” (Cash + Bonds + Refill Rules)

Sequence risk—the danger of poor returns early in retirement—can sink even well-funded plans. The allocation fix is time segmentation: carve out near-term spending into a low-volatility sleeve and let the growth sleeve recover. In practice, that means cash for year-1/2 spending, then Treasuries/TIPS/short-intermediate bonds to cover years 3–10; the growth sleeve refills the ladder after good years. Early retirees face more sequence risk exposure simply because they’re spending for longer before outside income arrives; traditional retirees still face it, but the exposure window is smaller and often cushioned by Social Security. Research from Vanguard and others underscores why avoiding large drawdowns in the first 5–10 years is pivotal.

2.1 Why it matters

- Withdrawals during bear markets permanently impair principal; the earlier it happens, the worse the long-run damage. Vanguard UK

2.2 How to do it

- Cash policy: Hold 12–24 months of baseline expenses in cash/T-Bills; replenish only after up years (or as required). Frameworks vary, but Benz’s 3-bucket approach is a useful template.

- Bond ladder: Build 5–8 years of Treasuries/TIPS maturing annually to meet spending; hold to maturity to mute price volatility.

- Refill rules: After strong market years, refill the ladder; after weak years, pause raises or trim discretionary spending until the ladder is rebuilt. (See guardrail approaches in Rule 3.)

2.3 Mini-example

Assume ₨ (or $) 60,000 annual spend. Keep ₨/$120k in cash (2 years), plus ₨/$300k in a 5-year Treasury/TIPS ladder. That funds 7 years without selling stocks; the growth sleeve replenishes when markets cooperate.

Synthesis: A dedicated “crash bar” buys time. Early retirees generally need a thicker bar; traditional retirees can sometimes run thinner due to Social Security and shorter bridges.

3. Match Withdrawal Method to Your Retirement Type (Fixed vs. Flexible Rules)

Allocation and withdrawals are a matched pair. For traditional retirees, a baseline safe starting rate around the 3.7%–4% neighborhood (30-year horizon) is a current research anchor as of now—but only if you can adjust spending when markets misbehave. Morningstar’s latest work pegs 3.7% as a baseline safe rate; higher is possible with flexibility. Early retirees often need a lower initial rate or stronger adjustment rules because their horizon can be 40+ years and healthcare/bridge spending is front-loaded.

3.1 Flexible frameworks that work

- Guardrails (Guyton-Klinger): Start with a rate, then raise/cut income by set percentages if the withdrawal rate breaches bands (e.g., ±20%). This can boost sustainability without obsessing over markets.

- Variable spending: Tie COLAs to portfolio returns or use “capital preservation” and “prosperity” rules to modulate in down/up years.

- Bucket-driven: Spend from cash/bonds in down years; refill after gains.

3.2 Numbers & guardrails

- Traditional retiree (30-year plan): Consider ~3.7%–4.0% start with guardrails and a 50/50± allocation. Early retiree (40-year plan): Consider a lower start (e.g., low-3%s) or commit to robust guardrails/part-time income to keep the plan resilient. (Principle sourced from current research; exact rates depend on fees, taxes, mix, and behavior.)

Synthesis: Traditional retirees can often use a higher starting rate with guardrails; early retirees should start lower or accept more spending flexibility to preserve longevity.

4. Use Taxes as a Design Constraint (Roth Conversions, Withdrawal Order, 72(t), RMDs)

Taxes sharply influence allocation and account sequencing. Early retirees often have low-income years before RMDs and full Social Security. That’s prime time for Roth conversions, capital-gains harvesting, and asset-location clean-up. Traditional retirees face RMDs at age 73, pushing income up even if spending doesn’t rise—so allocations should anticipate higher taxable distributions and potential IRMAA/means-testing effects. Designated Roth accounts in workplace plans are exempt from RMDs starting in 2024, aligning them more with Roth IRAs.

4.1 Withdrawal order (typical starting point)

- Taxable → tax-deferred → Roth often makes sense to manage brackets and preserve tax-free growth, but healthcare subsidies (Rule 5) and RMD math can invert priorities for some years.

- 72(t) SEPPs can create penalty-free income before 59½, but they’re rigid (must last 5 years or to 59½, whichever is longer) and require IRS-approved calculation methods. Consider a dedicated conservative sleeve to fund them.

4.2 Numbers & regulations

- RMDs: First distribution by April 1 following the year you turn 73 (moving to 75 in 2033).

- Roth 401(k)/403(b): No lifetime RMDs for owners starting 2024. IRS

Synthesis: Early retirees: exploit low-tax years for conversions and basis management; traditional retirees: design allocations around forced distributions and bracket control.

5. Protect Healthcare Affordability Before Medicare (MAGI, ACA Subsidies, HSA Tactics)

Healthcare is the “stealth” allocation input. Early retirees must budget premiums and out-of-pocket costs before Medicare at 65 and manage MAGI to qualify for ACA premium tax credits. MAGI for marketplace subsidies is AGI plus non-taxable Social Security and tax-exempt interest (and certain foreign income). That means Roth withdrawals and principal from taxable accounts may help you stay under thresholds, while conversions and large capital gains may push you over. Traditional retirees, already on Medicare, tend to focus more on IRMAA brackets. HSAs (if available from prior coverage) can be invested and offer triple tax benefits: deductible contributions, tax-free growth, and tax-free withdrawals for qualified expenses.

5.1 How to keep subsidies intact

- Prefer Roth withdrawals and principal from taxable accounts (basis) to manage MAGI in ACA years.

- Time large Roth conversions/capital gains for years when subsidies won’t matter (or accept the trade-off).

- Track affordability thresholds and poverty-line updates annually. Beyond the Basics

5.2 HSA & cash guardrails

- Keep your deductible + 6–12 months of premiums in cash/cash-like assets.

- Invest the rest of the HSA for long-term healthcare inflation (if your risk tolerance allows). See IRS Pub. 969 for rules and limits.

Synthesis: Early retirees should treat healthcare as a dedicated “mini-liability.” MAGI-aware withdrawal sequencing can be worth tens of thousands over a multi-year bridge.

6. Choose the Right Glide Path (Why Rising Equity Exposure Can Reduce Risk)

Counterintuitively, opening retirement with a lower stock allocation and increasing it over time—a rising equity glide path—can reduce both the probability and magnitude of failure, especially when early returns are poor. The logic: protect the fragile early years with more bonds/cash, then gradually raise equity exposure as sequence risk diminishes. For early retirees, this can be especially attractive because the bridge years are the riskiest. Traditional retirees can also benefit, but the window is shorter. The Pfau-Kitces research showed rising glide paths outperform common declining-equity heuristics under many conditions.

6.1 Numbers & templates

- Starting equity for a 4% target often landed around 20–40%, finishing near 40–80%, depending on assumptions.

- Pair a rising glide path with Rule 2’s bond ladder so spending stays predictable while equities “re-risk” slowly.

6.2 Practical steps

- Begin with conservative equity (e.g., 30–40%) at retirement; increase 2–5 percentage points per year until hitting your strategic target.

- Use rebalancing bands (±5%) to control drift; refill the bond ladder first after gains.

- Stress-test with Monte Carlo and historical “bad decades.”

Synthesis: Rising glide paths can be a risk reducer—not a risk adder—when combined with solid cash-flow segmentation.

7. Liability-Match the Next 5–10 Years (TIPS Ladders and High-Quality Bonds)

Treat required spending like a pension liability. Rather than hoping markets cooperate, match liabilities with instruments that behave predictably: Treasury ladders, TIPS, and high-quality short/intermediate bond funds. For early retirees, a 7–10-year ladder can neutralize the long bridge to Social Security/Medicare; for traditional retirees, 5–7 years often suffices given other income sources. TIPS adjust principal with CPI; if held to maturity, they deliver real purchasing power, which is crucial when medical and living costs escalate.

7.1 Why it works

- Duration-matching hedges interest-rate risk; when rates rise, reinvestment benefits offset price declines over your horizon. Advisors often use ladders or duration-matched funds to “immunize” near-term spending.

7.2 Build the ladder

- Identify annual spending needs for years 1–10 after cash.

- Buy Treasuries/TIPS maturing each year to meet those needs (or use CDs if rates are competitive).

- Roll maturing rungs into later years during good markets; pause during bear markets.

- For inflation-sensitive essentials, favor TIPS; see TreasuryDirect for mechanics.

Synthesis: Liability-matched sleeves turn uncertainty into scheduled cash flows. That frees the growth sleeve to ride out volatility.

8. Plan for Inflation Across a 30–40-Year Horizon (TIPS, Equities, and I Bonds)

Inflation compounds quietly but relentlessly. Over 30–40 years, even moderate inflation halves purchasing power. Allocations for both early and traditional retirees should blend explicit inflation hedges with growth. TIPS directly hedge CPI; equities historically outpace inflation over long spans; and I Bonds (within purchase limits) offer CPI-linked accrual with tax deferral. I Bonds are less liquid (must hold ≥1 year; penalty before 5), whereas TIPS are marketable and can be laddered. For early retirees, inflation risk is larger due to the long horizon; traditional retirees still need hedges but can lean more on Social Security’s COLA and annuity income.

8.1 Tools & trade-offs

- TIPS ladders for essential expenses; equity index funds for long-run growth; I Bonds as safe, tax-deferred complements (not tradable; annual purchase caps apply). Kiplinger

- Revisit assumptions annually—real yields and expected returns move.

8.2 Mini-example

An early retiree with $60k real annual need might cover $35k with a 15-year TIPS ladder (essentials) and fund the rest from a global equity sleeve. A traditional retiree could cover $25k with TIPS plus Social Security COLA, keeping a smaller equity slice.

Synthesis: Combine explicit inflation hedges (TIPS/I Bonds) with implicit hedges (equities) and update as real yields change.

9. Add Longevity Insurance When It Helps (SPIA, DIA, QLACs)

Longevity is the ultimate risk: living long enough to exhaust assets. The toolkit includes single-premium immediate annuities (SPIA), deferred income annuities (DIA), and QLACs inside IRAs/401(k)s. Early retirees might defer annuitization until later (e.g., 70s) to lock in higher age-based income and preserve flexibility in the bridge years. Traditional retirees can annuitize sooner, particularly if they value guaranteed income over bequest motives. SECURE 2.0 raised the QLAC purchase cap to $200,000 (indexed thereafter); providers report the indexed limit is $210,000—confirm the current year’s cap before purchasing. Recent IRS/Treasury regs under §401(a)(9) formalized post-SECURE 2.0 changes to RMDs/QLACs. IRS

9.1 When it fits

- You want mortality credits and a higher floor of guaranteed income.

- You want to reduce sequence risk by offloading part of spending to an insurer.

- You have large tax-deferred balances and want to lower future RMDs via a QLAC.

9.2 Allocation ideas

- Cap annuity purchases at the IRS limit for QLACs in qualified accounts; in taxable accounts, shop SPIA quotes and consider inflation-adjusted options.

- Pair annuity income with a smaller bond ladder and a growth sleeve for discretionary goals.

- Model with and without annuitization to test spending flexibility and legacy goals.

Synthesis: Longevity pooling can let you spend more, sooner with less fear of ruin. Early retirees often wait to annuitize; traditional retirees may annuitize earlier to stabilize income.

FAQs

1) What’s the single biggest allocation difference for an early retiree vs. a traditional retiree?

Time horizon. Early retirees must fund a long bridge period before Social Security/Medicare, so they typically carry a thicker near-term bond/TIPS sleeve and a growth sleeve sized for 40 years. Traditional retirees often have Social Security active and a shorter bridge, so they can tilt more toward income stability and RMD-aware withdrawals. SSA and IRS timelines (FRA near 67; RMDs at 73) drive these differences.

2) How much cash should a retiree keep?

Enough to avoid selling stocks into a slump. A practical band is 12–24 months of core expenses in cash/T-Bills, plus a 5–8-year bond/TIPS ladder for years 3–10. That structure has become common in bucket frameworks and helps neutralize sequence risk in the fragile first decade.

3) Are rising equity glide paths really safer?

They can be. Research by Pfau and Kitces found that starting conservatively and raising equity over time may reduce failure risk compared with the classic declining-equity path, especially when early returns are poor. It’s not magic—pair it with a bond ladder and spending flexibility.

4) What’s a realistic safe starting withdrawal rate now?

For a 30-year plan, studies in 2023–2025 suggest a baseline near 3.7%–4%—if you’re flexible with spending. Longer horizons (early retirement) often warrant lower starts or stronger guardrails. Your fees, taxes, and allocation matter.

5) Should I delay Social Security and “bridge” with my portfolio?

Often yes. Bridging to a later claim (up to age 70) can raise inflation-adjusted lifetime benefits, but recent research notes it’s not always optimal if portfolio or health circumstances point the other way. Model both paths, including tax and survivor benefits. Morningstar

6) How do ACA subsidies affect early retirement withdrawals?

ACA premium credits depend on MAGI, not just cash flow. Favor Roth withdrawals and principal (basis) to keep MAGI manageable, and be cautious with conversions and gains in subsidy years. Verify thresholds and definitions annually.

7) Are HSAs worth investing for retirement healthcare?

Yes, if you can. HSAs offer triple tax advantages and can be invested for long-term healthcare inflation; just keep a cash buffer for deductibles and near-term premiums. See IRS Pub. 969 for current rules.

8) What if I need money before 59½?

The 72(t) SEPP exception allows penalty-free withdrawals if you commit to a schedule for at least 5 years or until 59½ (whichever is longer) and use IRS-approved calculation methods. These are rigid—build a dedicated safe sleeve to support them.

9) Where do TIPS and I Bonds fit?

Use TIPS to build inflation-protected ladders for essential spending and I Bonds as a safe, CPI-linked complement (mind purchase limits and holding requirements). Both help address multi-decade inflation risk.

10) Do annuities belong in my allocation?

Sometimes. SPIAs/DIAs/QLACs can raise guaranteed income and reduce sequence risk. SECURE 2.0 increased QLAC caps and recent regs clarified rules; some providers list $210,000 as current indexed limit—verify your current cap.

11) Is a bucket strategy better than a single balanced fund?

Buckets add behavioral and cash-flow clarity by time-segmenting spending, which can help you stay invested. A single balanced fund is simpler but doesn’t explicitly schedule cash. Many retirees blend both—bucket the near-term; use low-cost index funds for the growth sleeve.

12) How should international stocks and real assets fit?

They can diversify inflation and policy risks. Keep them in the growth sleeve (Rule 8) and avoid concentration. The exact slice depends on your tolerance for currency swings and tracking error—stress-test before making big tilts.

Conclusion

The biggest misunderstanding about retirement allocation is thinking there’s one “retiree portfolio.” There are at least two: an early-retiree allocation that must carry a long bridge and a traditional-retiree allocation that leans on Social Security/Medicare sooner and navigates RMDs. The rules in this guide all flow from that insight. Start by sizing your two time horizons, then build a sequence-risk crash bar (cash + bonds + refill rules), pick a flexible withdrawal method, and coordinate taxes, healthcare, and inflation. Consider a rising equity glide path to protect the fragile early years and liability-match essential expenses with Treasuries/TIPS. Finally, evaluate annuitization to raise guaranteed income if it fits your goals.

From here, sketch your bridge-year cash flows, decide how many years to liability-match, and test a rising-glide allocation with guardrails at a conservative starting rate. Revisit annually, especially as regulations, yields, and healthcare costs evolve. Ready to tailor this to your plan? Draft your two-horizon map and model three scenarios—conservative, base, upside—then pick the allocation that keeps your sleep score high.

Call to action: Map your bridge years, build a 7-year ladder, and set your initial guardrails—then let your growth sleeve do its job.

References

- Retirement Topics — Required Minimum Distributions (RMDs), Internal Revenue Service. IRS

- Retirement Plan and IRA Required Minimum Distributions (FAQs), Internal Revenue Service. IRS

- How Retirees Can Determine a Safe Withdrawal Rate, Morningstar. Morningstar

- Morningstar’s Retirement Income Research: Reevaluating the ‘4%’ Withdrawal Rule, Morningstar. Morningstar

- Reducing Retirement Risk with a Rising Equity Glide Path, Journal of Financial Planning — Wade Pfau & Michael Kitces. Financial Planning Association

- Retirement Risk, Rising Equity Glide Paths, and Valuation-Based Asset Allocation, Journal of Financial Planning — Michael Kitces. Financial Planning Association

- Decision Rules and Maximum Initial Withdrawal Rates, Journal of Financial Planning — Jonathan Guyton. Financial Planning Association

- Why Guyton-Klinger Guardrails Are Too Risky For Retirees (and how to fix them), Kitces.com. Nerd's Eye View | Kitces.com

- Treasury Inflation-Protected Securities (TIPS), TreasuryDirect. treasurydirect.gov

- What’s a Modified Adjusted Gross Income (MAGI)? Healthcare.gov. HealthCare.gov

- Publication 969 (2024): Health Savings Accounts and Other Tax-Favored Health Plans, Internal Revenue Service. IRS

- Notice 2022-6: Determination of Substantially Equal Periodic Payments (SEPP/72(t)), Internal Revenue Service. IRS

- Full Retirement Age (FRA), Social Security Administration. and https://www.ssa.gov/benefits/retirement/planner/agereduction.html Social Security

- The Bucket Approach to Building a Retirement Portfolio, Morningstar. Morningstar

- Show Clients They Can Spend More in Retirement, Vanguard — sequence risk explainer. Vanguard Advisors

- Internal Revenue Bulletin 2024-33 — Final Regulations on RMDs, IRS. IRS

- Treasury/IRS: Final Regulations on Roth Catch-Up and SECURE 2.0 Provisions, IRS Newsroom. IRS

- When Does a QLAC Make Sense? Lord Abbett — notes indexed QLAC cap figure. Lord Abbett

- Using Bonds to Meet Retirement Expenses, Journal of Financial Planning. Financial Planning Association

- Do You Need More Than 3 Buckets? Morningstar. https://research.morningstar.com/articles/B6FHR5OBAJDXZKXBWSUW5DXCEE/do-you-need-more-than-3-buckets Phillips Financial Strategies