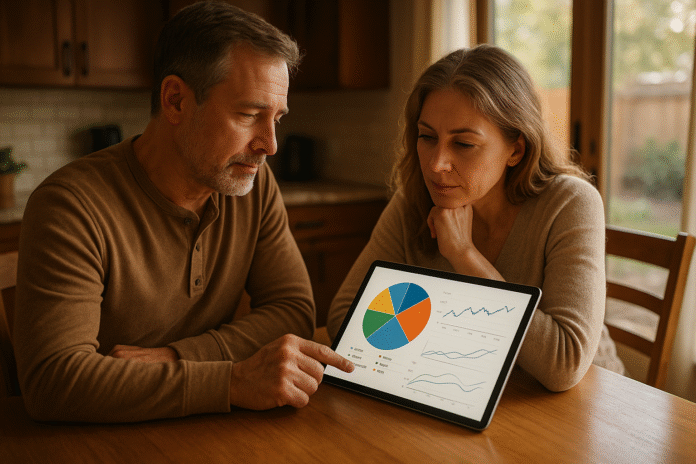

Building retirement wealth comes down to owning productive assets, keeping costs low, and sticking with a plan that matches your timeline and risk tolerance. This guide walks you through nine practical investment options—from broad stock funds and bonds to TIPS, REITs, target-date funds, cash, annuities, and tax-advantaged accounts—and shows how to use them together. It’s written for savers, pre-retirees, and retirees who want plain-English explanations plus specific guardrails. Quick answer: the core approach is a diversified mix of low-cost stock and bond funds, adjusted for age and goals, with smart use of tax-advantaged accounts and a sensible withdrawal plan. Because this topic has financial implications, treat the ideas here as general education—not personal advice—and consider consulting a fiduciary advisor for decisions about your situation.

1. Broad U.S. Stock Index Funds and ETFs

A low-cost, diversified U.S. stock index fund (e.g., tracking the S&P 500 or total market) is the engine of long-run growth for many retirement portfolios. It gives you instant exposure to hundreds or thousands of companies, spreads single-stock risk, and harnesses capitalism’s compounding. Historically, equities have delivered higher average returns than bonds over multi-decade horizons, though with sharp short-term swings; that volatility is the “price of admission” for growth. For accumulators with 10+ years to invest, owning broad U.S. equity via index funds or ETFs is often the most efficient way to capture market returns before fees and taxes. Keep costs low, automate contributions, and rebalance periodically. As of now, long-term historical data suggest U.S. stocks have earned high single-digit to low double-digit nominal returns over many decades, but the path is bumpy and future returns are uncertain.

1.1 Why it matters

- Diversification at scale: A total-market fund can hold 3,000+ stocks; your risk doesn’t hinge on one company. Investor

- Cost and tax efficiency: Index funds typically have lower expense ratios and lower turnover than active funds.

- Evidence-based: Decades of return history show equities have outpaced bonds over long horizons, though with volatility.

1.2 How to do it

- Pick a broad U.S. index (Total Market or S&P 500) and automate monthly contributions.

- Favor expense ratios under ~0.10% when possible.

- Use dollar-cost averaging for new cash; if investing a large lump sum, research shows lump-sum often wins—but choose what helps you stay invested.

Mini example: Contributing $500/month to a broad U.S. index for 30 years at a 7% average annual return (not guaranteed) grows to roughly $566,000—about $180,000 in contributions plus compounding. The exact outcome will vary; the key is consistency and time in the market.

Bottom line: Make a broad U.S. stock index fund your growth core; pair it with bonds and other diversifiers to manage the ride.

2. International Stock Funds (Developed & Emerging)

International stock funds extend diversification beyond the U.S., spreading country, currency, and sector exposures. Returns across regions can zigzag for years; owning both U.S. and non-U.S. markets helps reduce home-country concentration and potentially smooths outcomes over a full cycle. Developed markets (Europe, Japan, Canada) and emerging markets (e.g., India, Brazil) offer different growth drivers and risks. For many long-term savers, allocating 20%–40% of the equity sleeve to international index funds is a reasonable middle ground, though preferences vary. Use low-cost total international or all-world funds to keep things simple. Costs and taxes still matter, and foreign withholding taxes can reduce yields in taxable accounts—yet inside retirement accounts, those frictions are often less impactful.

2.1 Why it matters

- Diversification across economies: Different growth and inflation regimes reduce reliance on one market.

- Valuation cycles: Leadership rotates; international markets periodically trade at different valuations than the U.S.

- Currency mix: Foreign currency exposure can either cushion or amplify returns, depending on the dollar’s path.

2.2 How to do it

- Choose a total international index or all-world ex-U.S. fund for broad coverage.

- Set a target (e.g., 30% of equity) and rebalance annually within tax-advantaged accounts to minimize taxes.

- Keep fees low and avoid market-timing; consistency beats tinkering.

Mini checklist

- 3–5 fund providers you trust

- Expense ratio ≤0.20% for broad international funds

- Automatic contributions + annual rebalance

Bottom line: Non-U.S. stocks are a practical diversifier; own them through simple, low-cost index funds and rebalance.

3. Investment-Grade Bonds & Bond Ladders

High-quality bonds—Treasuries, investment-grade corporates, and high-quality municipal bonds—are your portfolio’s shock absorbers. They dampen equity volatility, fund near-term spending, and provide a known maturity value when held to maturity. Unlike stocks, bond prices move inversely to interest rates; longer-duration bonds swing more. As of now, yields remain a crucial input to future bond returns, and the duration of your bond holdings is your sensitivity to rate moves. A bond ladder—owning multiple individual bonds with staggered maturities—can help manage reinvestment and interest-rate risk for investors who want predictable cash flows. InvestorFINRA

3.1 Numbers & guardrails

- Duration rule of thumb: A 1% rate change moves a bond’s price by roughly its duration in the opposite direction.

- Ladder use case: Stagger maturities (e.g., 1–5 or 1–10 years) so some bonds roll over each year to current yields.

3.2 How to do it

- For simplicity, consider core bond index funds (U.S. aggregate) inside retirement accounts.

- If you need known cash flows, build a Treasury or high-quality muni ladder matching your spending years.

- Keep speculative (“junk”) credit small or avoid it in your safety bucket. Investor

Mini example: Suppose you need $20,000 per year for the next 5 years. You buy five Treasuries maturing in each of the next five years. Each year, one matures to fund spending; you can reinvest at the long end to keep the ladder rolling.

Bottom line: Use high-quality bonds for stability; tune duration to your horizon and consider ladders for planned withdrawals.

4. Treasury Inflation-Protected Securities (TIPS)

TIPS are U.S. government bonds whose principal adjusts with the Consumer Price Index (CPI), aiming to preserve purchasing power. They pay a fixed coupon on inflation-adjusted principal and return at least original principal at maturity, making them a direct hedge against unexpected inflation. TIPS can be held individually or via mutual funds/ETFs, and they’re often paired with nominal Treasuries to form a resilient bond sleeve. Tax note: inflation adjustments to principal are taxable in taxable accounts even before maturity, which is why many investors hold TIPS in IRAs/401(k)s.

4.1 Why it matters

- Inflation hedge: Principal rises with CPI; coupons paid on that adjusted principal.

- Government backing: Like other Treasuries, TIPS carry low credit risk.

- Real-return focus: Yields are quoted in real terms; long-term savers can target real purchasing power.

4.2 How to do it

- Use a TIPS fund or ladder to cover the first 10–20 years of retirement spending in real terms.

- Consider tax-advantaged accounts to avoid phantom income on inflation adjustments.

- Blend with nominal Treasuries; nominal often shine in deflationary shocks, TIPS in inflation surprises.

Mini example: If CPI rises 4% over a year, a $10,000 TIPS principal becomes $10,400; a 1% coupon then pays $104 rather than $100. TreasuryDirect

Bottom line: TIPS are a straightforward tool to protect purchasing power—use them deliberately within your bond mix.

5. Target-Date and Balanced Funds

Target-date funds (TDFs) package a professionally managed glide path that automatically shifts from more stocks when you’re young to more bonds as you approach retirement. They simplify investing for set-it-and-forget-it savers and are common defaults in workplace plans. Balanced funds (like 60/40) keep a fixed mix and suit investors who prefer a steady allocation. The big ideas: know your fund’s glide path (how fast it de-risks), costs, and whether it’s a to or through retirement design. For many, a single high-quality TDF is a complete core holding—just pick the date closest to your expected retirement year.

5.1 What to look for

- Glide path fit: Compare equity at target date; funds vary widely. Regulators and researchers have noted dispersion in risk near retirement. Government Accountability Office

- Fees: Lower costs leave more of the market’s return in your pocket.

- Tax location: TDFs are best inside tax-advantaged accounts; they can be tax-inefficient in taxable accounts.

5.2 Common mistakes

- Owning multiple TDFs at once (you cancel out the intended glide path).

- Ignoring prospectus changes and tax implications of share-class shifts or re-mappings (a recent industry episode underscored this for investors).

Mini checklist

- Single TDF appropriate for your retirement year

- Expense ratio in the lowest tier for your plan

- “Through” vs. “to” design understood

- Annual check-in to confirm it still fits

Bottom line: If you want simplicity, a well-chosen target-date fund can be a one-and-done core—just verify the glide path and fees.

6. Real Estate & REITs

Direct real estate builds equity with leverage but comes with concentration and management risk. Public REITs (real estate investment trusts) let you own diversified property portfolios—apartments, industrial, data centers, healthcare—via liquid stocks that pay dividends. Real estate can diversify stock/bond mixes and has historically provided some inflation resilience, though public REITs behave like equities in the short run. A modest allocation (e.g., 5%–15% of the total portfolio) can add income and sector diversification; use broad, low-cost REIT index funds if you don’t want property-level headaches.

6.1 Why it matters

- Income + growth: Rent growth can support dividend growth over time.

- Inflation linkage: Property values and rents often rise with prices, though the hedge varies by cycle and vehicle. Recent research nuances when listed real estate hedges best. ScienceDirect

6.2 How to do it

- Prefer diversified REIT index funds/ETFs for simplicity.

- Keep allocations modest to avoid equity-like drawdown shocks.

- If considering direct property, stress-test vacancy, rates, and capex.

Mini example: A 60/40 stock/bond investor adds 10% REITs by trimming stocks to 50% and bonds to 40% → potential income boost and different driver set, but expect equity-like volatility.

Bottom line: REITs can diversify income sources and help with inflation resilience—size the position to your risk tolerance.

7. Cash, Money Market Funds, CDs & I Bonds

Cash and near-cash instruments are not long-term return engines, but they play a crucial role in liquidity, safety, and sequence-of-returns protection. Money market funds, high-yield savings, short CDs, and I Bonds (in the U.S.) help fund emergencies and near-term spending, so you don’t have to sell stocks in a downturn. Retirees often keep 6–24 months of living expenses in this bucket (plus a short-term bond fund) as part of a three-bucket framework: cash for years 0–2, bonds for years 2–10, and stocks for years 10+. Rates change, so shop around for yields and FDIC/NCUA coverage or Treasury backing. Use this sleeve strategically; too much cash drags long-run returns, too little can force bad-timed sales.

7.1 Why it matters

- Volatility buffer: Funds near-term needs without selling risky assets during dips.

- Psychological safety: Makes it easier to stick with the plan during volatility.

- Ladder options: CDs/T-Bills can be laddered for predictable cash flows.

7.2 How to do it

- Define your cash need (emergency + planned withdrawals).

- Build a T-Bill/CD ladder (e.g., 3, 6, 9, 12 months) and roll maturities.

- Park the rest in low-cost money market funds; check expense ratios and minimums.

Mini example: A retiree with $60,000 in annual withdrawals holds $30,000 in a rolling T-Bill ladder and $30,000 in a money market fund; a bear market year doesn’t force stock sales.

Bottom line: Cash is your shock absorber and spending runway; size it to your needs, not to headlines.

8. Annuities for Lifetime Income (Used Carefully)

Annuities convert a lump sum into a stream of guaranteed income from an insurer, which can help cover essential expenses and reduce longevity risk. SPIAs (single-premium immediate annuities) and DIAs (deferred income annuities) are the simplest forms; variable and indexed annuities add investment or market-linked features but often at higher cost and complexity. Fees, surrender charges, and riders can be substantial; understand them before buying. For many retirees, using a slice of assets to buy a plain-vanilla lifetime income stream—ideally from a highly rated insurer—can complement Social Security or other pensions.

8.1 Numbers & guardrails

- Costs matter: Variable annuities often include mortality & expense charges (~1.25%/yr typical), admin fees, fund expenses, and surrender charges.

- Use case: Cover essential expenses with guaranteed income; invest the rest for growth.

- Caveat: Indexed/variable annuities can be complex—scrutinize caps, spreads, participation rates, and liquidity. FINRA

8.2 How to do it

- Quote SPIAs/DIAs across multiple insurers; compare payout rates and insurer credit ratings.

- Keep any complex annuity to a modest slice; verify surrender periods and total all-in costs. Investor

- Consider buying inside tax-advantaged accounts to defer taxes on growth.

Mini example: A retiree allocates 20% of a $1,000,000 portfolio to a SPIA to cover a $15,000/yr gap in essential expenses, leaving 80% invested for growth and inflation.

Bottom line: Simple income annuities can reduce longevity anxiety—just watch costs and complexity with other annuity types.

9. Tax-Advantaged Accounts: 401(k), IRA, Roth IRA & HSA

The wrapper you use—401(k), 403(b), IRA, Roth IRA, and HSA—can be as important as the investments inside. Tax-deferred accounts let gains compound before taxes; Roth accounts can deliver tax-free withdrawals; HSAs in the U.S. offer triple tax advantages when used for qualified healthcare (deductible contributions, tax-free growth, tax-free qualified withdrawals). Rules evolve (contribution limits, RMD ages), so rely on current official guidance. As of now, RMDs generally begin at age 73, with the first RMD allowed to be delayed until April 1 of the year after you reach that age (but then you take two that year). Publication 969 explains HSA rules and annual limits and is updated regularly.

9.1 How to use them together

- Prioritize matches: Contribute enough to capture your employer match first.

- Max tax-advantaged space: Fill 401(k)/403(b)/IRA, then consider Roth strategies; fund HSAs if eligible.

- Asset location: Place tax-inefficient assets (bonds, REITs) in tax-deferred accounts; keep broader equity indexes in taxable accounts if needed.

9.2 Region-specific notes

- Account names and tax rules vary by country (e.g., ISAs/SIPPs in the UK, RRSP/TFSA in Canada). If you’re outside the U.S., look for local equivalents that shelter investment growth and watch cross-border tax issues.

Mini checklist

- Employer match captured

- Annual limits reviewed as of the current tax year

- RMD age and timing on your calendar (e.g., age 73, with April 1 first-year option)

Bottom line: Maxing tax-advantaged accounts accelerates compounding; keep up with current limits and RMD rules.

FAQs

1) What’s the simplest portfolio that still works?

A two-fund combo—one total stock market index fund and one total bond market index fund—can be enough for many investors. Pick an allocation (e.g., 70/30 while accumulating, shifting toward 40/60 by retirement), automate contributions, and rebalance annually. If you want even less maintenance, consider a target-date fund that bundles both and adjusts over time.

2) How much international stock exposure should I have?

There’s no single right answer, but many investors use 20%–40% of their equity in non-U.S. funds to balance home-country bias and global diversification. A total international index fund keeps costs and tracking tight. Rebalance once or twice a year rather than reacting to headlines.

3) Is dollar-cost averaging better than investing a lump sum?

Historically, lump-sum investing has outperformed DCA roughly two-thirds of the time because markets rise more often than they fall. But DCA can be behaviorally easier; the “best” choice is the one that keeps you fully invested. If a lump sum makes you anxious, phase it in over 6–12 months.

4) How do I protect against inflation in retirement?

Use a mix: TIPS for direct CPI linkage, REITs/real estate for potential rent and asset value growth, and equities for long-run real return potential. Keep cash for near-term needs so you aren’t forced to sell in a downturn; rebalance to maintain targets.

5) Are annuities worth it?

They can be—simple SPIAs/DIAs bought from strong insurers often offer the cleanest trade: lifetime income for a lump sum. Be cautious with variable/indexed annuities given fees, surrender periods, and complex riders. Get multiple quotes and read every page. FINRA

6) How big should my cash bucket be in retirement?

Aim to cover 6–24 months of essential expenses with cash, T-Bills, and short CDs, sized to your risk tolerance, pension/Social Security reliability, and portfolio volatility. Combine this with a low-duration bond sleeve for years 2–10 to mitigate sequence-of-returns risk. Morningstar

7) What’s “sequence of returns” risk—and why should I care?

It’s the danger of poor early-retirement returns combined with withdrawals, which can permanently dent portfolio sustainability even if average returns later are fine. Strategies include flexible withdrawals, a cash/bond buffer, and opportunistic Roth conversions.

8) Should I use a bond fund or build a bond ladder?

Bond funds are easy and diversified; yields and durations adjust continually. Ladders give you date-certain cash flows and control over credit quality, useful for funding known liabilities. Many retirees blend both—funds for general ballast and a ladder for the first years of withdrawals. Schwab Brokerage

9) How do RMDs work?

In the U.S., most tax-deferred retirement accounts require Required Minimum Distributions starting at age 73 (as of tax year). You can delay the first RMD until April 1 of the following year—but then you’ll owe two RMDs that year. The IRS provides worksheets and FAQs to calculate amounts.

10) Are index funds safe from big tax surprises?

Inside tax-advantaged accounts, you’re shielded from annual taxation of capital gains and income. In taxable accounts, index funds are often tax-efficient due to low turnover, but distributions can still happen—especially if funds face large redemptions or share-class changes. Stay mindful of distributions near year-end.

Conclusion

Retirement wealth builds fastest when you combine productive assets (stocks, real estate), stability (bonds, cash), inflation protection (TIPS, property income), and tax-smart wrappers (401(k)/IRA/Roth/HSA). Keep fees low, automate contributions, and choose an allocation you can live with through bear markets. For most savers, a diversified core of broad stock and bond index funds—perhaps inside a target-date fund—does the heavy lifting; you then layer in TIPS for purchasing-power defense, a measured slice of REITs for income and diversification, and the right cash buffer to weather storms. If longevity risk looms large, consider converting a slice of assets to a simple lifetime annuity to cover essentials. Finally, respect the calendar: contribution limits, RMD ages, and tax rules change, so update your plan yearly. Put it all together, and you’ll have a durable, boring-in-the-best-way strategy built to compound across decades.

Next step: Pick your core funds, set your contribution and rebalancing schedule, and calendar a 30-minute annual check-in to keep the plan on track.

References

- Asset Allocation, Diversification, and Rebalancing 101, U.S. SEC—Investor.gov, https://www.investor.gov/introduction-investing/getting-started/asset-allocation

- Index Funds (Investor Bulletin), U.S. SEC—Investor.gov, https://www.investor.gov/introduction-investing/investing-basics/investment-products/mutual-funds-and-exchange-traded-4

- Historical Returns on Stocks, Bonds and Bills: 1928–2024, Aswath Damodaran (NYU Stern), https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

- Treasury Inflation-Protected Securities (TIPS), U.S. Treasury—TreasuryDirect, https://treasurydirect.gov/marketable-securities/tips/

- TIPS Tax Treatment (SEC0042), U.S. Treasury—TreasuryDirect, https://treasurydirect.gov/forms/sec0042.pdf

- Sequence Risk During Retirement, Morningstar (Rekenthaler Report), https://www.morningstar.com/columns/rekenthaler-report/sequence-risk-during-retirement

- How to Avoid Outliving Your Retirement Savings? It’s All in the Sequence, Morningstar, https://www.morningstar.com/retirement/how-avoid-outliving-your-retirement-savings-its-all-sequence

- Cost averaging: Invest now or temporarily hold your cash?, Vanguard Research (PDF), 2023, https://corporate.vanguard.com/content/dam/corp/research/pdf/cost_averaging_invest_now_or_temporarily_hold_your_cash.pdf

- Target Date Retirement Funds—Tips for ERISA Plan Fiduciaries, U.S. Department of Labor (EBSA), 2013, https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/fact-sheets/target-date-retirement-funds-erisa-plan-fiduciaries-tips.pdf

- Nareit: REITs and Inflation Protection, Nareit, https://www.reit.com/investing/investment-benefits-reits/reits-and-inflation-protection

- Retirement Plan and IRA Required Minimum Distributions (RMDs) – FAQs, IRS, https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs

- IRS Publication 969—Health Savings Accounts and Other Tax-Favored Health Plans, IRS, https://www.irs.gov/publications/p969

- Bonds—Interest Rate Risk and Duration, FINRA Investor Insights, https://www.finra.org/investors/insights/bonds-interest-rate-changes-duration

- Variable Annuities—What You Should Know, U.S. SEC (Investor Bulletin), https://www.sec.gov/investor/pubs/varannty.htm

- Investor Bulletin: Target Date Funds, Investor.gov (SEC/FINRA), https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-bulletins/target-date-funds-investor-bulletin

- Consumer Price Index (Latest Releases), U.S. Bureau of Labor Statistics, https://www.bls.gov/news.release/cpi.nr0.htm

- Vanguard to Pay More Than $100 Million Over Target-Date Fund Mess, Barron’s Advisor, https://www.barrons.com/advisor/articles/vanguard-target-date-fund-sec-penalty-3a2a33d5