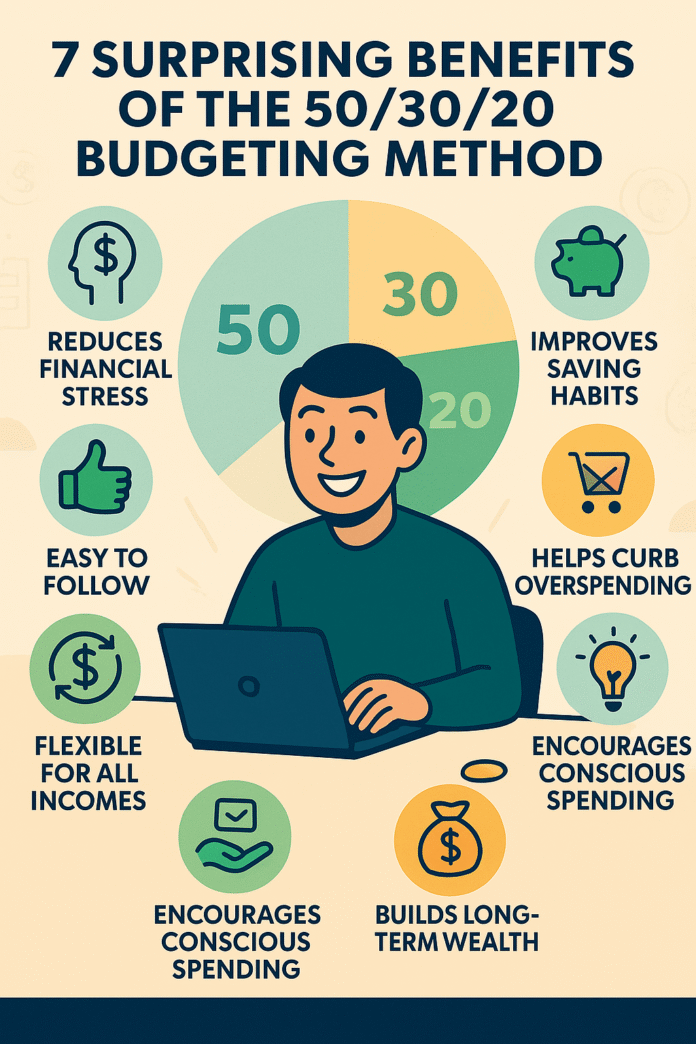

In the world of personal finance, there are a lot of scary apps and complicated strategies that are supposed to help you keep track of every penny. But sometimes the best way is the simplest way. The 50/30/20 budgeting rule is a simple way to divide your income after taxes into three big groups:

- 50% for Needs (things you need, like rent, utilities, and food)

- 30% for Wants, which are things that aren’t necessary, like going out to eat, having fun, and hobbies.

- 20% for saving money or paying off debt (for future goals, emergency funds, and getting out of debt)

A lot of people know about this rule and what it means, but not many people know all the good things it does. This method has some surprising benefits that can change how you think about and deal with money, in addition to the fact that it will help you save money. In this article, we’ll look at seven surprising benefits of the 50/30/20 budget strategy. These benefits go beyond just managing your money and include both mental and practical benefits.

The 50/30/20 rule shows beginners and even experienced budgeters who are feeling overwhelmed by their money what to do. You don’t have to make as many decisions every day because it’s so easy. This helps you avoid decision fatigue and the stress that comes with writing down every expense by hand. You can focus on your long-term financial goals without feeling limited if you set clear rules for when and how you spend money.

One reason this way of budgeting is so appealing is that it can be changed to fit your needs. The 50/30/20 rule works for everyone, no matter how much money they make. It works for students with part-time jobs, young professionals whose incomes change all the time, and older people who want to start over with their finances. You don’t have to fit into its strict structure; you can change it to fit your life. In the next sections, we’ll not only go over the basics of how to use this rule, but we’ll also talk about some of its lesser-known benefits that even the most dedicated personal finance fans didn’t know about.

When we’re done talking about these benefits, you’ll know why the 50/30/20 rule works for so many people and how to start enjoying these benefits right away. Let’s get into the details and see how this simple way to budget can change how you feel about money in ways you might not expect.

What is the budgeting method known as 50/30/20? Here’s a quick look back.

Before you look at the surprising benefits, you need to know how the 50/30/20 budgeting method works. It’s all about keeping things simple, clear, and balanced. This is how it works:

- 50% for Needs: This group has the most important costs, which are things you have to pay. Think about the things you need, like your rent or mortgage, utilities, groceries, basic transportation, insurance, and health care. These costs are fixed and make up the base of your monthly budget.

- 30% for Things You Want: This piece lets you enjoy life a little more. It has things that aren’t necessary, like going to the coffee shop, eating out, going to the movies, traveling, and doing things you enjoy. These are fun costs that don’t have to be paid to stay alive, but they do make your life better.

- 20% for paying off debt or saving money: This part is all about improving your financial future. It goes toward paying off debts, saving for emergencies, retirement, or investing. Putting this amount aside every month will help you avoid surprise expenses and give you long-term financial stability.

An Example from Real Life

You make $4,000 a month after taxes, for example. The 50/30/20 rule says that your monthly budget should look like this:

- Needs (50%): $2,000

- Wants (30%): $1,200

- Savings and Debt (20%): $800

Even if you get money from more than one job, like a main job, a side job, or freelance work on the side, the rule still applies. Just add up your income after taxes and use these numbers.

This model is strong because it is easy to understand. You don’t need complicated charts or spreadsheets that go on forever. You just need three simple buckets to help you spend. The rule is very useful because it sets clear, immediate limits for each group. When you look at your bank statement, you’ll know exactly how much of your money is going toward necessities, how much is going toward your lifestyle, and how much is being saved for the future.

Key Points

- Flexibility: If your income goes up or you have to pay for something you didn’t expect, it’s easy to change the rule.

- Scalability: It works even if you have a job on the side or get paid at different times.

- Clarity: It shows you your finances in a clear way.

You need to know this base. Now, let’s talk about the seven benefits that aren’t obvious. This budgeting method has helped a lot of people find a new way to be financially free. Here are some of the reasons why.

1. You Don’t Know It, but It Makes You Less Worried About Money

One of the most surprising and amazing things about the 50/30/20 budgeting method is that it can help you not worry so much about money. The structure and simplicity of this method can help you relax in a world where money problems are a big source of stress.

The Science of Less Stress

You don’t have to guess where your money goes each month, and you don’t have to worry about spending too much. When people have too many choices, they often get tired of making decisions, even when it comes to budgeting. This is what behavioral economics research shows. By breaking your finances down into three main groups, the 50/30/20 rule makes it easier to make decisions about money. You don’t have to worry about making a million choices about where to cut back or how much to save anymore; you have a plan.

Example from Life

Sarah, a young professional, used to hate looking at her bank statement every month. She worried a lot because she had a lot of bills, surprise costs, and no real plan. Sarah felt like she could breathe again after switching to the 50/30/20 rule. Just knowing, “I only have this much available for non-essentials,” helped her. She didn’t have to keep asking herself, “Am I spending too much?” so she stopped worrying about money. Instead, she used the set percentages to help her make decisions.

Reasoning that supports it

- Predictability: A set structure makes things easier to predict. If you know that 20% of your income is going to savings or paying off debt, you are less likely to have money problems.

- Clarity: It’s easier to see your spending when you break it down into three neat groups. A long list of messy expenses is less scary.

- Fewer Choices: When you don’t have to make as many choices about each expense, you can focus on the things that matter most in life.

Keep this in mind

Make a basic chart: You can either make a pie chart or use a budgeting app to show how you want to spend your money. These bright, clear parts of your budget can help you remember your money plan every day and stop you from worrying about money.

Mini Summary: The 50/30/20 method’s clear structure and organization make it easier to think about money, which lowers stress. If you make decisions easier and your money more predictable, you can feel less stressed and more at ease.

2. It makes people think about how they use their money.

The 50/30/20 rule can help you become more mindful of how you spend your money, which is one of its less well-known benefits. This method makes you think more about what you buy and helps you tell the difference between what you really need and what you just want for a little while.

How grouping things together makes people more aware

The 50/30/20 rule makes you stop and think about your spending by forcing you to put every dollar into one of three groups: “Needs,” “Wants,” or “Savings/Debt.” This break is very important for building good habits. You learn to spend wisely when you ask yourself, “Is this a need or a want?” all the time. This habit not only stops you from buying things on a whim, but it also makes you think more carefully about money.

A Situation You Can Understand

John was a big online shopper who would buy the newest gadgets and trends without thinking too much about it. After he started using the 50/30/20 plan, he started keeping track of his spending. He was surprised to find out that a lot of the things he wanted were just impulsive purchases that didn’t make him happy for long. He had to rethink his priorities after he realized this. Now, before he buys something, he asks himself if it really fits in the “wants” category or if it might be a waste of money that could be better spent on savings or paying off debt.

How to Make Habits

- More self-awareness: When you make categories on a regular basis, you have to think about things. You start to see how you spend money and change your habits to match them.

- Delayed Gratification: When you become more aware, you start to practice delayed gratification, which is a key part of building wealth over time.

- Psychological Empowerment: Being able to see where all of your money goes gives you a sense of control, which is a great reason to stick to your budget.

Remember this tip

Write down what you spend money on: For a month, write down everything you buy and put it into one of three groups: need, want, or save. This simple exercise can help you see how you act over time, which can help you make better decisions in the future.

The 50/30/20 method is more than just a way to save money; it’s also a way to be more aware of your daily financial choices. By keeping an eye on your spending on a regular basis, you become more aware of your long-term goals, which will help you spend more wisely in the long run.

3. It helps you save money for emergencies more quickly.

Giving 20% of your income to savings or paying off debt might seem like just another budgeting rule at first. But one of the surprising benefits of this method is that it can help your emergency fund grow faster, which will keep you safe in the long run.

Saving with a plan and a goal

When you know that a certain amount of your money is set aside for future needs, it helps you save money in a disciplined way. This structured approach gets rid of the common mistake of “paying yourself last,” whether you’re saving for unexpected costs or working toward big financial goals. Every month, that 20% becomes a non-negotiable commitment—a vital financial cushion that grows steadily over time.

Real-life example

Maria is a freelance graphic designer who doesn’t always make money. Before she started saving automatically, she had to scramble to pay unexpected bills because she didn’t have any money set aside for emergencies. After six months, Maria had built up a strong emergency fund, even though her income changed. This not only helped her feel less stressed, but it also gave her the confidence to negotiate better payment terms with clients because she knew she had a financial safety net.

What it does to the mind and money

- Automatic Savings: The rule’s design makes it hard for people to spend money they should be saving, which helps them save a lot of money.

- Financial Resilience: If you have a bigger emergency fund, you’re better prepared for emergencies and won’t have to use high-interest credit as often when you have unexpected expenses.

- More Confidence: Seeing your savings grow steadily can give you a big boost in confidence, which can help you stick to your financial goals and make progress on other goals.

A tip to keep in mind

Set up savings that happen automatically: Set up an automatic transfer of 20% of your pay to a special savings account. This way, the money will be saved before you even have a chance to spend it, which will help your emergency fund grow faster.

The 50/30/20 rule is a systematic way to save or pay off debt with 20% of your income. This method builds financial resilience by teaching you to be disciplined and consistent, so you’re ready for anything that comes your way.

4. It stops lifestyle creep.

People often forget that the 50/30/20 budgeting method can help you avoid “lifestyle creep.” This is when your living costs go up in proportion to your income, making it hard to save. When you make more money, it’s easy to want to spend more on things you don’t need. The best thing about this way of budgeting is that it keeps you disciplined: no matter how much money you make, your “wants” will always be limited to 30% of your income.

Control over spending with discipline

Lifestyle creep happens slowly, and you might not notice it until your extra spending takes up a lot of your income. By sticking to the 50/30/20 rule’s set percentages, you make sure that you stay balanced. You automatically set aside only 30% of any extra money you get from a raise or side project for wants, which keeps lifestyle inflation from getting in the way of your financial goals.

In the Real World

For example, David got a big raise that raised his monthly pay by 25%. Instead of moving up to a more luxurious lifestyle right away, he stuck to the 50/30/20 allocations. Because of this, he saved some of the extra money instead of spending it on a fancy car or vacation. David saw that his overall financial health got a lot better over time, even though his income went up. This was because he didn’t spend a lot more on things that weren’t necessary.

Discipline in the economy and forming habits

- Fixed Ratios: These set ratios keep people from making hasty choices and help them learn to spend money wisely by making them do it on a regular basis.

- Making smart choices: If you have a limit on how much you can spend on things you want, you’re more likely to put long-term goals ahead of short-term pleasures.

- Steady Financial Growth: By not letting your lifestyle creep up on you, you make sure that any extra money you make goes toward building long-term wealth instead of short-term comforts.

A Helpful Hint

Look at your budget once a year: When you get a raise, don’t give in to the urge to spend more. Instead, check your 50/30/20 percentages every year to make sure that any extra money is going to savings or investments instead of things you don’t need.

The 50/30/20 rule helps you stay within your budget. It limits your discretionary spending to 30% of your income, so any extra money you make goes toward savings and long-term financial stability instead of being spent all at once.

5. It lets you spend money without feeling bad about it.

The 50/30/20 method is freeing because it lets you buy things you love without feeling bad about it. When you budget the old-fashioned way, you might feel bad about every extra expense, which can make you feel like you’re missing out. But this rule makes sure that you have a clear area for spending money on fun things.

Getting Used to Financial Freedom

When you save 30% of your income for things you want, you give yourself permission to enjoy that part of your money. This way of thinking changes how you feel about spending money from guilty to powerful. You don’t feel like every dollar you spend is taking away from your future because you know you’ve already planned for it. Setting limits on your spending can help you have a better relationship with money, which makes budgeting a fun and useful activity.

Ideas that make sense

Lisa was a teacher who often felt bad about going to the spa or out with friends. She had to wonder if she was making the right choice every time she spent money like that because she was on a tight budget. But after switching to the 50/30/20 plan, she didn’t feel bad anymore because she had already planned and budgeted for her fun expenses. This freedom let her enjoy her free time more and focus on the good things in life without feeling bad about it.

Why People Spend Money Without Feeling Bad

- Pre-Allocation: Knowing that you have already paid for something makes it easier to spend money and stops you from feeling bad about it after you buy it.

- Balanced Approach: The rule’s design makes sure you have both a safety net (20% for savings) and a leisure fund (30% for wants), so you don’t have to choose between saving money and having fun.

- Structure for Empowerment: A clear, structured plan makes every purchase a celebration and a controlled choice, which helps you learn how to spend money wisely.

Key Point

Enjoy Your Money: Once a month, look over your “wants” list and think of it as a reward for sticking to your budget. You can plan a small treat or outing for yourself without feeling bad about it, since you know it’s within your budget.

Putting aside a certain percentage of your income for things you want is what the 50/30/20 rule says to do. This way of managing your money helps you have a good relationship with it so you can enjoy the good things in life without giving up your financial goals.

6. It helps you not buy things just because you want them.

Buying things on a whim is one of the hardest things to do when you’re trying to stick to a budget. Even the best-laid plans can be ruined by the temptation of a “must-have” item. But the 50/30/20 rule makes it easy to say no to impulse buying because it sets clear limits.

What Makes Buying on a Whim So Tempting

People buy things on impulse for a lot of different reasons, like emotions, ads, friends, or just the excitement of the moment. If you don’t think about your long-term financial goals, these choices can add up quickly and throw your budget off balance. The 50/30/20 method tells you exactly how much money to spend in each category, which makes it easier to avoid making snap decisions.

An Example from Real Life

Alex used to stop at every sale and often ended up with more than he needed. After he started using the 50/30/20 rule, he became very aware of how much extra money he had. He stopped and thought about each purchase because he was aware of this. Alex learned to wait, think, and finally say “no” to things that didn’t really add value to his life after realizing that he could only spend 30% of his income on wants.

How the Rule Helps You Keep Control

- Set Limits: You know exactly how much you can spend on things that aren’t necessary because there are clear limits in place.

- Mental Checkpoints: Just ask yourself, “Is this part of my 30%?” makes people stop and think, which can help them not act on impulse.

- Reinforcing Priorities: When you buy something, you think about how it fits into your long-term goals. This makes you more likely to wait before you buy.

A tip to keep in mind

Make a rule that says: If you didn’t plan to buy something, wait 24 hours before you do. A lot of the time, the first impulse will go away. This will help you figure out if you really need the item in your “wants” budget.

Mini Summary: The 50/30/20 rule makes it hard to buy things on a whim because it sets clear spending limits. This self-control keeps you from giving in to short-term temptations and makes sure that your spending fits with your long-term financial goals.

7. It helps you get ready for bigger financial goals, like buying a house or investing.

The 50/30/20 method is a great way to plan for bigger financial goals and also helps you budget for everyday costs. This rule will help you develop good habits that will help you reach your financial goals, like buying a house, starting a business, or investing in the stock market.

Getting Better With Money Over Time

One of the most important things about being financially independent is being able to consistently save money for future investments. Putting 20% of your income into savings or paying off debt not only protects you from emergencies, but it also helps you get into the habit of saving money on a regular basis. This habit will help you a lot when you need to make bigger financial commitments in the future.

What it means in real life

For instance, Marcus had always wanted to buy his first house. Marcus was scared at first because the down payment had to be so big. That’s when he started using the 50/30/20 rule. What started out as a small habit of saving 20% of his income grew into a lot of money over time. This steady method not only made investing less scary, but it also taught Marcus to put long-term goals ahead of short-term pleasure. His new habit quickly became a powerful tool that helped him get closer to buying a house and gave him more chances to invest.

Long-term training has more benefits than just the ones you can see right away.

- Consistency Over Time: The key to successful investing is to save regularly and with discipline.

- Building Creditworthiness: You can get loans or mortgages more easily if you always pay off your debts and save money.

- Change Your Mindset: Instead of looking for quick fixes, think about how to build wealth over time.

Tip to Take Away

Make Detailed Plans: Write down your financial goals, like how much money you want to save for a down payment or how much you want to invest. The 50/30/20 rule can help you slowly save more money for these bigger goals.

The 50/30/20 rule helps you keep track of your money each month and teaches you good habits that will help you reach big financial goals like buying a house or investing. It turns daily discipline into the money power you need to reach bigger goals.

Extra: Why It’s Best to Keep Things Simple When Budgeting

Less is often more when it comes to personal finance, which can be hard to understand. If you have too many complicated budgeting systems, you might get tired of keeping track of your money and fail in the end. The 50/30/20 budgeting method is very effective because it is easy to understand and follow, so anyone can use it, even if they don’t know much about money.

The Advantages of a Straightforward Approach

- Easy to Use: You won’t feel as overwhelmed if you only have to keep track of three main groups. This simple design makes it easier to stick to your budget over time.

- Visual Impact: A simple pie chart with 50%, 30%, and 20% is not only easy to read, but it also serves as a constant, visual reminder of your financial discipline.

- Less work to keep track of: People can get tired of looking at data when they have to keep track of dozens of expenses on a complicated budget. The 50/30/20 method lowers this risk by focusing on large groups.

- Natural Evolution: This method changes as your money situation or goals change. It lets you change percentages without ruining your whole budget.

Uses in the Real World

Think about Lisa, a busy professional who used complicated budgeting software for a year before switching to the easier 50/30/20 method. Lisa found out that the minimalist way of doing things was not only easier to keep up with, but it also helped her stay on top of her money better. Lisa was less stressed during her monthly reviews because she didn’t have to keep track of as many numbers. This gave her more time to make plans for her money and reach her long-term goals.

Why It’s Important to Keep Things Simple

It’s not about keeping track of every single expense when you plan your finances; it’s about making habits that help you save and grow. Simple is the best way to be consistent. Even if you don’t have a degree in finance, the 50/30/20 rule makes it easier to start budgeting right away. This method can help you develop habits that will help you plan your finances and make more complex investments in the future.

The 50/30/20 method is a great example of how simple things can be in a world where money is so complicated. Its clear structure not only helps with consistency, but it also keeps people from getting burned out. This makes it the best place to start for anyone who wants to take charge of their financial future.

Common Misunderstandings or Criticisms (and How to Respond)

A lot of people like the 50/30/20 budgeting method, but not everyone does. Let’s talk about some common complaints and give some helpful answers:

Criticism 1: “It won’t work for families with low incomes.”

- Answer: The 50/30/20 rule is great because you can change it to fit your needs. You can change the percentages to better fit your situation if you don’t make a lot of money. Starting with a plan is the most important thing. You might have to spend more on things you need at first, but it’s still very helpful to keep track of and categorize your spending.

Criticism 2: “It’s too easy for complicated financial goals”

- Answer: Things being simple is a good thing, not a bad thing. A lot of people can’t stick to a complicated budget. The 50/30/20 method is a good way to start taking care of your money, and you can change it as your goals change. It helps you learn how to manage your money and get the habits you need for more complicated planning in the future.

Criticism 3: “I can’t write everything down by hand.”

- Answer: If you don’t want to keep track of your spending by hand, there are a lot of budgeting apps and templates that work with the 50/30/20 framework. These tools do a lot of the work for you, which makes it easier and helps you stay on track without having to write everything down.

Criticism 4: “What if my income isn’t steady?”

- A counterargument: The method works well with incomes that change. The percentages are based on your total income after taxes each month. You follow the same rules even when times are tough. This consistency will help your finances become more stable over time, even if your income is not steady.

Things to Remember

- Being open to change is important: You can change the 50/30/20 percentages if you need to.

- Foundation Over Perfection: Starting with a simple structure makes it easier to plan for more complicated financial matters later on.

- You have tools: Use budgeting apps to make the process easier and save you time on tracking things by hand.

The 50/30/20 method is easy to use and adaptable, so it can work for a lot of different financial situations, like families with low incomes or people who don’t always have money coming in. The best way to fight these false ideas is to show people how to budget well.

In conclusion

The 50/30/20 budgeting method is more than just a way to save money; it’s a complete system that can change how you think about your money. You get not only financial control but also mental peace, mindful spending habits, protection against lifestyle creep, and even training for future financial goals like buying a home or investing through its simple but powerful structure.

In this post, we’ve talked about seven surprising benefits of the 50/30/20 rule. These include lowering money stress, encouraging mindful spending, building an emergency fund faster, stopping lifestyle creep, letting you indulge without feeling guilty, stopping impulse purchases, and preparing you for bigger goals. The method is so simple that anyone can use it and change it to fit their needs. These are the things that will make it work, even when other budgeting methods don’t.

If you’re looking for a budgeting method that will help you stay on track and be useful, the 50/30/20 rule might be just what you need. Try it for a month and see how it changes the way you spend money. You might be surprised at how helpful it is. Remember that you don’t have to be perfect; the key to long-term financial success is to be consistent and make small changes over time.

Last thought: Make your own 50/30/20 budget today. Don’t worry about how easy it is; trust the process and watch your financial stress turn into power and smart savings.

Questions that come up a lot

Here are some common questions about the 50/30/20 budgeting method, along with clear, short answers to help you on your way to understanding your finances:

- Is it possible to change the 50/30/20 rule to fit my life? For sure! The 50/30/20 method is great because it can be used in many ways. You can change the ratios if your basic needs take up a larger part of your income. For example, you could start with a 55/25/20 split. The most important thing is to create a system that works for you and then improve it over time as you learn more about how you spend and make money.

- Is it okay if my income isn’t steady? Yes, the rule works well for people whose incomes change, like freelancers or contractors. Just figure out how much money you make after taxes for each period and give each one a percentage. Many budgeting apps have features that make it easier and more accurate to keep track of changing income.

- Should I still save money if I owe money? The 20% in the 50/30/20 rule is for paying off debt and saving money. If your debt has high interest rates, you might want to put more of that 20% toward paying it off and then change it as you pay it off. The most important thing is to keep saving money for your future safety while also being responsible with your debt.

- How do I calculate 50/30/20 after taxes? The rule is based on your net income, which is the money you actually take home after taxes and other deductions. To start, subtract all of your required withholdings from your gross income. Then, use the 50/30/20 percentages on the amount that is left. This makes sure that every dollar is planned and purposeful.

- Can you use this method with a partner or family? Of course. The 50/30/20 rule is a great way for couples and families to work together on a budget. You can pool your money and set aside percentages based on your common financial goals. Regular communication and clear tracking help make sure that everyone is on the same page, which makes it a tool that everyone can use to manage their home.

- What if I buy something without thinking? Don’t worry; the 50/30/20 method’s structure will help you get back on track. Look at what you bought, figure out why you bought it, and change your budget if you need to. Keeping track of your purchases over time will help you avoid these surprise costs more often, and you’ll learn to tell the difference between real wants and fleeting desires.

- How long will it be before I see the benefits? A lot of people start to see changes in the first few months, like less anxiety and better spending habits. The real test of success, though, is how consistent you are. Follow the rule for at least a month, and then check your finances to see how your spending habits have changed.

A Short List of the Most Common Questions:

- You can change the 50/30/20 rule to fit your own life.

- Every cycle, the allocations are recalculated to take into account income that isn’t steady.

- The rule helps you save money and pay off debt, even if your finances are hard to understand.

- By making a budget together, couples and families can stay on the same page about their money goals.

Last Thoughts

The 50/30/20 budgeting method has a lot of benefits that go beyond just adding up numbers. For example, it can help you worry less about money, develop good spending habits, build strong emergency funds, and get ready for future investments. It’s easy to use, flexible, and has a proven structure, so you can take charge of your financial future without having to worry about complicated tracking systems.

Try the 50/30/20 rule for a month and see how it changes the way you save and spend money. Then make any changes that are needed. This method gives you a clear path to a better, safer, and more fulfilling future, whether you’re just starting out with your money or want to start over.

Accept the simplicity, trust the process, and enjoy the new clarity that comes with every well-planned budget. You can reach your financial goals, whether they are investing, buying a home, or just living a stress-free life, if you stick to a system that is both helpful and motivating.

Good luck with your budget, and here’s to a future full of peace and financial freedom!

By learning about these benefits and making a budget that is both structured and simple, you are preparing yourself for both short-term relief and long-term success. Remember that every little bit counts, and that good money management is the key to making big dreams come true. Enjoy the ride, and remember that every penny you save is a step toward a better future.