If you’ve been meaning to rein in spending but everything feels noisy—apps, alerts, autopay—the simplest reboot is a one-week cash-only reset. Over seven days, you’ll set a cap, withdraw once, split cash into categories, track every purchase, and run a no-judgment audit at the end. In plain terms: cash budgeting for a week to rebuild awareness and control. Definition: A cash-only week means you cover day-to-day variable expenses (not your fixed bills) with physical cash you’ve pre-allocated; once an envelope is empty, you stop or re-prioritize. This guide gives you the exact steps, guardrails, and troubleshooting to make the experiment stick.

Friendly reminder: This article is educational, not financial advice; adapt numbers to your situation and local rules.

1. Set Your Weekly Cash Cap and Categories

Start by deciding the total amount of cash you’ll allow yourself for the next seven days and the 3–6 categories that money must cover. This first decision creates a simple constraint that makes every subsequent choice easier. A helpful way to choose the cap is to look at your recent card statements or app reports and total only the variable spending (e.g., groceries, dining, transport, small treats)—leave fixed bills like rent or insurance out of scope. If you don’t have recent numbers, pick a conservative baseline and expect to learn and adjust. The behavioral benefit here is “mental accounting”: earmarking money by category makes trade-offs visible and curbs leakage. That’s the backbone of envelope budgeting and one reason it works so well for short resets.

1.1 Why it matters

Creating a weekly cap transforms a vague intention (“spend less”) into a hard boundary you can actually follow. Classic research shows people naturally create mental “buckets” for money; when you formalize those buckets with envelopes, you reduce the blurry feeling that often leads to overspending. The physical separation also highlights what you truly value during the week: you’ll see which envelopes drain fast, and which barely move.

1.2 Numbers & guardrails

- Pick a cap equal to your average variable spending for one week (use last month’s transactions divided by four). If unknown, choose a round amount you believe is 10–20% lower than a typical week—tight enough to learn, not so tight that you’ll abandon the challenge.

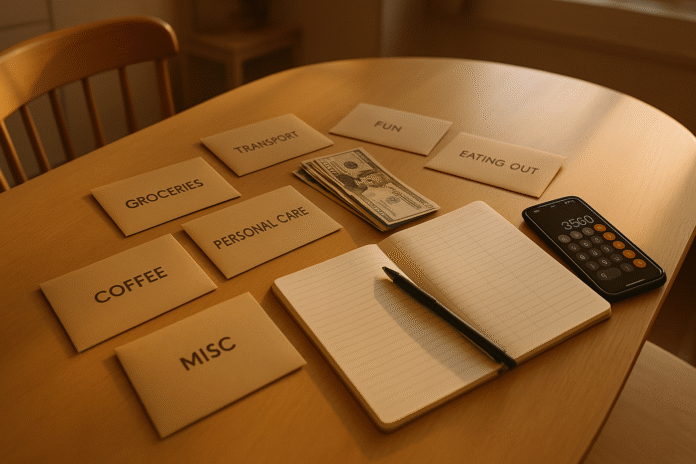

- Limit categories to 3–6: e.g., Groceries, Transport, Eating Out, Coffee/Treats, Miscellaneous.

- Leave fixed bills out (rent, utilities, loan payments).

- Plan for small change: keep a coin pouch or a clear jar so coins don’t get lost.

1.3 Mini example

Assume your past four weeks of variable card spending totaled $1,000. Your weekly average is $250. For this challenge, you choose $225 and three envelopes: Groceries $110, Transport $60, Discretionary $55. That single decision sets clear expectations.

Bottom line: a cap + a few envelopes forces honest trade-offs and positions you for wins during the week.

2. Withdraw Once (Fee-Free) and Fill Envelopes on Day 1

The cash-only week works best when you withdraw once at the start and avoid repeat ATM visits. One withdrawal reduces temptation to “top up,” and it eliminates avoidable fees that can quietly erode your budget. As of September 2025, the average total cost of an out-of-network U.S. ATM withdrawal is $4.86 (an average $3.22 surcharge from the ATM operator plus $1.64 from your own bank)—a small leak that adds up fast if you make multiple pulls. Stick to in-network machines or use grocery store debit cash-back where available to keep the challenge clean and cheap.

2.1 How to do it

- Find an in-network ATM in your bank’s app or website; many banks map fee-free partner networks.

- Withdraw your full weekly cap in denominations that match your categories (ask the teller for specific bills if needed).

- Label envelopes clearly; write category, amount, and the date.

- Seal “non-negotiables” (e.g., groceries) with a paper clip to reduce impulse raids.

- Stash emergency buffer (e.g., $20) as a separate, clearly marked mini-envelope so you don’t “accidentally” spend it.

2.2 Region-specific note

ATM fee structures vary by country and bank; the strategy is the same: prioritize in-network withdrawals or cash-back at shops that don’t charge extra. Check your bank’s schedule of fees or local consumer guidance to avoid surprises. (In the U.S., Bankrate’s annual checking/ATM study is a reliable snapshot of fee trends.)

2.3 Mini checklist

- Full weekly cash withdrawn?

- Envelopes filled and labeled?

- Emergency buffer separated?

- Receipt saved for reconciliation?

Bottom line: one planned, in-network withdrawal + precise envelope stuffing prevents both fee creep and “just this once” top-ups.

3. Track Every Payment and Reconcile Daily (Takes 3–5 Minutes)

The moment cash leaves an envelope, write it down. Daily reconciliation is the power move that turns a one-off challenge into lasting clarity. Spending logs increase awareness and often shift choices in real time; in studies of expense-tracking, people tend to cut discretionary outlays and build more slack into their budgets, because recording purchases makes trade-offs tangible. Think of it as a tiny, nightly stand-up meeting with your money—no blame, just data.

3.1 Tools & options

- Paper ledger: a simple index card in each envelope or a one-page weekly sheet.

- Phone notes or calculator app: log amount + category immediately.

- Digital hybrids: even in a cash week, you can mirror entries in a budgeting app to keep longitudinal data (e.g., enter cash spends manually). Evidence suggests that routine tracking can boost awareness and discipline over time.

3.2 How to reconcile (nightly)

- Count remaining cash in each envelope.

- Subtract from the starting amount to confirm recorded spend = cash missing.

- Flag any variance (e.g., that unlogged coffee).

- Review the three biggest spends; ask “Was it worth it?” and “Would I buy it again tomorrow?”

3.3 Mini case

On Day 3, your Eating Out envelope shows $25 left, but the ledger suggests it should be $33. You realize a $8 tip wasn’t logged. That tiny catch is the point: the feedback loop helps you course-correct before the envelope hits zero.

Bottom line: tracking + nightly reconciliation is the smallest habit with the biggest payoff in a cash week.

4. Pre-Plan Meals, Routes, and Errands to Disarm Impulse Buys

Planning is the friendly cheat code of a cash-only week. By sketching meals and routes in advance, you reduce unplanned swipes (well, bills) and avoid repeat stops that usually lead to add-on purchases. Pre-committing also guards against the “I’m tired, let’s just order in” moment that drains your Eating Out envelope. You’re not trying to meal-prep for eternity—just seven days of decisions made once. Combine a simple menu with a single grocery run and cluster errands to minimize transport costs and snack temptation along the way. Your cash lasts longer when you remove situations that trigger impulsive spending; research on payment psychology shows that the context around payments shapes behavior as much as the amount.

4.1 How to do it (quick sketch)

- Meal map: choose 3 anchor dinners you can remix (e.g., roast chicken → tacos → soup).

- One grocery list: write prices next to 5–10 core items; bring only the Groceries envelope.

- Errand clustering: batch pickups/returns to a single loop; pack water/snacks to avoid convenience buys.

- Default “no-spend evenings”: block two nights for home cooking + a free activity.

4.2 Numbers & guardrails

- Aim for one grocery shop this week; if you must return, bring only the Groceries envelope and exact cash.

- Keep $5 in the Miscellaneous envelope for true last-minute needs (e.g., milk for a recipe).

- If transport prices vary (fuel vs. transit vs. rideshare), pick the cheapest viable option in advance and stick to it for the week.

4.3 Mini example

You plan three dinners for five nights: pasta bake, stir-fry, sheet-pan veggies with sausages. One $60 grocery trip covers all meals plus breakfasts. Because you pre-packed snacks, you skip the $4–$8 convenience store run on errands day.

Bottom line: a 15-minute plan slashes the number of spending “decision points,” which is exactly what you want when envelopes are finite.

5. Set Exception Rules, Sinking Funds, and an Emergency Buffer

A cash-only week works because the rules are simple—so name the exceptions upfront. Decide what doesn’t come out of envelopes (e.g., prescriptions, pre-paid bills) and what qualifies as a true emergency. An emergency fund is a dedicated cash reserve for unplanned expenses like car repairs, medical bills, or income loss—not a nicer dinner or a sale. Even in a one-week sprint, define a small emergency buffer (e.g., $20) and a sinking fund for known upcoming costs (e.g., gifts, travel) so you don’t raid category envelopes. Clear definitions prevent mid-week rationalizations that undo your progress.

5.1 How to draw the lines

- Emergency = urgent + necessary + unplanned.

- Sinking fund = planned, non-monthly cost you contribute to in small amounts (envelope, jar, or app category).

- Not covered by envelopes: fixed bills already budgeted elsewhere, debt payments, and automated savings.

5.2 Mini checklist

- Create a tiny Emergency mini-envelope (start with $10–$20).

- Label one Sinking Fund (e.g., “Car Maintenance”) and drop in $5–$10 to start the habit.

- Write your exception rules on the inside flap of your Miscellaneous envelope for quick reference.

5.3 Why it matters

Emergency definitions come from consumer-finance best practice: separating true emergencies from routine costs helps you avoid tapping high-interest debt when life happens. Even a small buffer changes behavior because you know where to go when a tire goes flat—not your groceries money.

Bottom line: pre-naming exceptions + starting tiny sinking funds preserves your envelopes and your progress.

6. Use Friction and Accountability: Make Overspending Feel “Real”

Cash adds helpful friction—the “pain of paying”—that cards tend to mute. Decades of research show people are often willing to pay more when using credit compared with cash, because delayed settlement reduces psychological pain. Your cash-only week restores that healthy feedback: handing over bills makes the cost concrete. Pair that with light accountability (a buddy text, a fridge note, or a progress photo of envelopes) and you’ve built a micro-system that counters impulse buys. None of this is about shame; it’s about sensation—making the spend feel real at the moment of choice.

6.1 Practical friction boosts

- Leave cards at home for short errands; carry only the needed envelope.

- Use exact cash when possible; parting with a $20 for a $6 coffee feels wrong (that’s good).

- Commit to a 24-hour rule for non-essentials over a fixed threshold (e.g., $20).

- Share a mid-week check-in (photo of remaining cash) with a friend.

6.2 Mini example (behavioral)

Two groups bid on sports tickets: the “credit card” group bids more than the “cash” group—classic evidence that the payment method shapes willingness to pay. Bringing that insight into your week, you intentionally make cash the default. Even a single extra day of hesitation on discretionary items can save your envelope from a cascade of “small” purchases.

6.3 Advanced note

If you can’t go 100% cash (e.g., transit requires contactless), simulate friction: pre-load a fixed amount to a transit card at the start of the week and treat it like an envelope.

Bottom line: add good friction and light accountability to let cash’s natural advantages do the heavy lifting.

7. Run a Post-Week Audit and Decide What to Keep

On Day 7, count what’s left in each envelope and write down three numbers: total starting cash, total spent, and total remaining. Then add a short note for each category—what worked, what didn’t, and one tweak for next week. The goal isn’t perfection; it’s pattern-spotting. If the system helped you feel more in control (or simply more aware), consider a hybrid going forward: keep cash for problem categories (e.g., dining out) and use a digital envelope app for the rest, mirroring what behavioral research and budgeting tools have championed for years. Also note: despite growth in electronic payments, cash remains a stable fallback for many households, especially for small transactions—so keeping a cash habit for specific use cases can be both practical and resilient.

7.1 How to audit

- Tally spent vs. cap and compute the difference (savings or overage).

- Review your nightly logs: identify your top 3 high-ROI swaps (e.g., coffee at home, one grocery run).

- If you overspent, mark which envelope went first and why (timing, social plans, price surprises).

- Decide one habit to double down on next week and one to drop.

7.2 Mini case

You started with $225 and finished with $31 across envelopes. Groceries ran exactly as planned; Eating Out went over on Day 4. You realize mid-week social plans are your weak spot, so next week you’ll pre-budget one social meal and reduce Treats by $5 to fund it. That’s progress.

Bottom line: the audit turns a seven-day experiment into a personalized playbook you can reuse or scale.

FAQs

1) What is “cash budgeting” and how is it different from envelope budgeting?

Cash budgeting is a spending plan that uses physical cash to cover day-to-day variable costs for a set period; envelopes are simply the implementation—dividing that cash into labeled categories. You can do cash budgeting with one “general spend” envelope, but most people find category envelopes improve clarity and reduce leakage because of mental accounting.

2) Does paying in cash actually help me spend less?

Evidence suggests that people are often willing to pay more when using credit than when using cash, because the payment is decoupled from the purchase. Returning to cash restores helpful friction at the moment of choice. Over a week, that tends to reduce impulse buys, and your nightly tracking compounds the effect.

3) How much cash should I withdraw for a 7-day challenge?

Use your average variable spending for one week as a starting cap. If you don’t know it, estimate conservatively and expect to learn. A quick pass through last month’s statements or a government consumer worksheet is enough data to set a sensible number and start.

4) What if I run out of cash in an envelope mid-week?

First, don’t panic—this is information. Check your log, identify what pushed the envelope to zero, and decide whether to reallocate from Miscellaneous or pause that category for the week. Avoid topping up from an ATM, which adds fees and dilutes the experiment’s lesson. Reflect in your Sunday audit and adjust next week’s split.

5) Are ATM fees really that bad?

They add up, especially with multiple withdrawals. As of September 2025, the average out-of-network U.S. withdrawal costs $4.86 (surcharge plus your bank’s fee). One in-network withdrawal at the start of the week avoids this leak.

6) Can I still use cards for fixed bills during the week?

Yes. The cash-only challenge covers variable daily spending; fixed bills can remain on autopay. Keeping scope tight makes the week doable and isolates the habits you’re trying to test—impulse control and awareness—without disrupting essential payments.

7) What if my city is mostly cashless?

Use a hybrid approach: pre-load specific amounts to transit or payment apps (treat them like envelopes), and still withdraw cash for categories where merchants accept it. The point isn’t dogma; it’s restoring immediacy to your spending decisions and capping weekly outflow. Where cash acceptance is low, mirror envelopes digitally.

8) How do I handle emergencies?

Define an emergency as urgent, necessary, and unplanned. Keep a small, separate cash buffer for the week, and maintain a longer-term emergency fund outside this challenge for bigger surprises (e.g., car repair). Clear definitions prevent “emergency drift” into treats or upgrades.

9) Is there evidence that expense tracking works?

Yes. Studies of spending diaries and expense-tracking show associations with lower discretionary spending and better budget slack, partly by increasing financial self-awareness. Your nightly check-ins create that same feedback loop in miniature.

10) What should I do after the week ends?

Run a simple audit: total spent, total left, and one tweak per envelope. If cash felt helpful, keep it for your “trouble” categories and move the rest to a digital envelope app—many modern tools implement the classic method while tracking fixed bills, too.

Conclusion

A cash-only week is a short sprint with long echoes. By setting a firm cap, making one planned withdrawal, and dividing bills into a few envelopes, you convert fuzzy intentions into concrete boundaries. Daily logging and a simple audit replace guesswork with facts, and the physicality of cash restores healthy friction at the point of purchase—“Do I really want this enough to hand over these bills right now?” Define exceptions before you start, seed tiny sinking funds, and use accountability nudges so your environment supports your goals.

Most importantly, treat the seven days as a curiosity project, not a pass/fail test. Notice which categories drain fastest, what triggers impulse buys, and which small changes produced outsized calm. Then decide what to keep: maybe cash for dining out and a digital envelope for groceries; maybe one weekly withdrawal as a new ritual; maybe nightly 3-minute reconciliations for good. You’re not aiming for austerity—you’re building a budget that feels honest and livable.

Ready to try it? Pick your cap, fill three envelopes, and start today. Your 7-day cash budgeting reset begins with one in-network withdrawal and a pen.

References

- 2024 Survey & Diary of Consumer Payment Choice (Report). Federal Reserve Bank of Atlanta, 2024. Federal Reserve Bank of Atlanta

- 2024 Findings from the Diary of Consumer Payment Choice (Summary). Federal Reserve Financial Services, 2024. FRB Services

- Survey: ATM Fees Hit Record High (2025 Checking & ATM Fee Study). Bankrate, Sept 10, 2025. Bankrate

- ATM Fees Hit Record High (Press Release PDF). Bankrate, Sept 10, 2025. Bankrate

- An Essential Guide to Building an Emergency Fund. Consumer Financial Protection Bureau (CFPB), Dec 12, 2024. Consumer Financial Protection Bureau

- Assess Your Spending (Step-by-Step). Consumer Financial Protection Bureau (CFPB), Dec 12, 2024. Consumer Financial Protection Bureau

- Mental Accounting Matters. Richard H. Thaler, Journal of Behavioral Decision Making, 1999. University of Bath Personal Homepages

- A Further Investigation of the Credit-Card Effect on Willingness to Pay. Drazen Prelec & Duncan Simester, 2001 (MIT). Massachusetts Institute of Technology

- Effects of Payment Mechanism on Spending Behavior. Dilip Soman, Journal of Consumer Research (working/archival PDF). Rotman School of Management

- Envelope Budgeting | Actual Budget Documentation. Actual Budget, accessed Oct 2025. Actual Budget

- How Does Expense-Tracking Inform Financial Behaviors? Yiling Zhang, Consumer Interests Annual (2023). consumerinterests.org

- Budget Recording Tools Improve Financial Skills (Field Evidence). GFLEC Working Paper (Herrera/Frisancho/Prina), 2021. GFLEC