If you’ve ever wondered whether a few extra dollars actually move the needle, here’s the short answer: they do—dramatically. Paying beyond the minimum means sending more than the required amount due, and that extra amount attacks principal immediately, shrinking future interest and accelerating your payoff. Within minutes of reading this guide you’ll see exact, real-world numbers for credit cards, car loans, and mortgages, plus clear guardrails on when and how to add more. This article is for anyone who wants the fastest, least expensive path to debt-free—without gimmicks or guesswork. Quick takeaway: make a fixed “floor” payment higher than the minimum, automate it, and prioritize your highest interest balances first. As with all money topics, this is general education—not personal financial advice. For specifics, consider speaking with a qualified professional.

1. Credit Cards: How $25–$50 Extra Can Cut Years (and Thousands) Off Repayment

The key to credit card math is that interest accrues daily and compounds, so even small extra payments reduce tomorrow’s interest charges. In practice, many issuers compute interest with a daily periodic rate on your average daily balance, which means earlier and larger payments lower interest more than later, smaller ones. If your statement shows a box estimating how long payoff will take, that disclosure exists to highlight the effect of paying more than the minimum. Bottom line: adding even $25–$50 above the minimum can chop your timeline by many years and save thousands in interest, especially at double-digit APRs. The calculations below use standard, public formulas and typical card terms. (For background on the daily periodic rate and why earlier payments matter, see CFPB guidance. )

1.1 Numbers & guardrails (realistic example)

- Balance: $5,000

- APR: 22.99% (common for general-purpose cards as of now)

- Typical minimum (modeled): interest + 1% of principal, or $25, whichever is greater (a common formulation used in regulatory examples).

Results from month-by-month amortization:

- Minimum only: ~232 months (~19.3 years); ~$8,489 interest.

- Minimum + $25 extra: ~101 months (~8.4 years); ~$4,298 interest.

- Minimum + $50 extra: ~67 months (~5.6 years); ~$2,958 interest.

- Fixed $200/month “floor” (instead of the changing minimum): ~35 months; ~$1,871 interest.

1.2 How to act on this

- Set a fixed floor payment (e.g., $200) that’s above your initial minimum—keep it there as your minimum declines.

- Automate the floor and add ad-hoc lump-sums (tax refund, bonus) when possible.

- Avoid new purchases on that card; mixing new spending with an existing balance can trigger immediate interest on purchases.

Synthesis: On revolving debt, a small, consistent extra dollars-above-minimum strategy is the single highest-ROI move you can make—compounding interest works for you once you shrink the principal fast.

2. Auto/Student Loans: Extra Principal Shaves Months Off Fixed Loans

Installment loans (car, personal, student) have fixed payments and amortize on a schedule, but sending any amount above the required payment directly to principal shortens the schedule and lowers total interest. Because interest is calculated on the remaining balance each month, trimming principal early reduces the interest portion of every future payment. You won’t see the savings as a line item—your lender will simply adjust the payoff date earlier and reduce interest over the life of the loan. Notably, most consumer installment loans have no prepayment penalty, though mortgage rules can differ; always check your note. (Mortgage prepayment penalties are restricted under federal rules; see ATR/QM references if you’re comparing home loans.)

2.1 Numbers & guardrails (car loan example)

- Principal: $20,000

- APR: 6.5%

- Term: 60 months

- Standard payment: ≈$391.32/month

- + $50/month extra: payoff in ~53 months; interest saved ≈$468.

- + $100/month extra: payoff in ~47 months; interest saved ≈$824.

2.2 Mini-checklist

- Designate “principal only.” When you pay extra online, choose the option (or memo) that applies it to principal, not future payments.

- Confirm no penalty. Most installment loans don’t penalize prepayment; if yours does, weigh the fee against savings.

- Automate the add-on. A small auto-increase (e.g., $50–$100) compounds into major time and interest savings.

Synthesis: Fixed loans quietly reward momentum—each dollar you push to principal today deletes interest you would have owed tomorrow, accelerating every subsequent month.

3. Mortgages: Biweekly vs. Monthly and the “13th” Payment Effect

Switching from monthly to biweekly payments (half your monthly payment every two weeks) effectively results in 26 half-payments per year—the same as 13 full monthly payments. That “extra” month of principal each year shortens a 30-year mortgage by about 6 years at typical rates, slashing six figures in interest on mid-sized loans. You can accomplish the same effect by keeping monthly payments but adding one extra full payment spread across the year (or in a lump sum). Important: some third-party biweekly programs charge fees; you can usually self-implement at no cost by setting up your own extra payment. (Freddie Mac’s guidance describes mortgages with biweekly schedules and how servicers handle them—useful if you’re asking your lender about setup.)

3.1 Numbers & guardrails (30-year fixed example)

- Principal: $300,000

- APR: 7.00%

- Standard monthly payment: ≈$1,995.91; total interest ≈$418,527 over 30 years.

- Biweekly (half-payment every two weeks): pays off in ~23.7 years; total interest ≈$315,139.

- Impact: ~6.3 years faster; ~$103,389 less interest.

3.2 How to do it safely

- Ask your servicer whether you can make principal-only extra payments and how they’re applied.

- Skip fee-based “programs.” You can send the equivalent of one extra payment per year yourself on a monthly schedule.

- Avoid escrow confusion. Extra payments should go to principal, not escrow (tax/insurance).

Synthesis: Whether you go biweekly or simply add a 13th payment, the math is identical: one extra monthly’s worth of principal per year carves years off your mortgage and leaves six-figure savings on typical balances.

4. Timing: Why Paying Early in the Cycle Saves More Than Paying Late

If your card accrues interest daily on the average daily balance, paying earlier in the billing cycle lowers the balance for more days, cutting that month’s interest and compounding the benefit. For example, on a card at 22.99% APR, sending an extra $100 30 days earlier saves roughly $1.89 in that month’s interest alone—tiny in isolation, but meaningful when repeated across months and larger amounts (and it compounds). Mortgages and many loans accrue interest daily, too; paying a $1,000 principal curtailment 15 days early on a 7% loan saves about $2.88 for that half-month and brings all future calculations down from a smaller balance. The principle is the same everywhere: sooner beats later because daily interest has fewer dollars to bite. (CFPB explains daily periodic rate mechanics and why earlier payments reduce interest.)

4.1 Quick tactics (do these consistently)

- Split your payment. Send your required payment when due and a small extra mid-cycle.

- Automate “early” dates. Set calendar rules a week or two after the statement closes.

- Target revolving balances first. Daily compounding at high APRs amplifies the benefit.

4.2 Common mistakes

- Paying late (even once) can trigger interest on purchases immediately and may add fees or lose grace periods.

- Applying extra to future payments instead of principal; verify how your servicer posts funds.

Synthesis: The same dollars, paid earlier, save more than paid later—because time is literally money when interest runs daily.

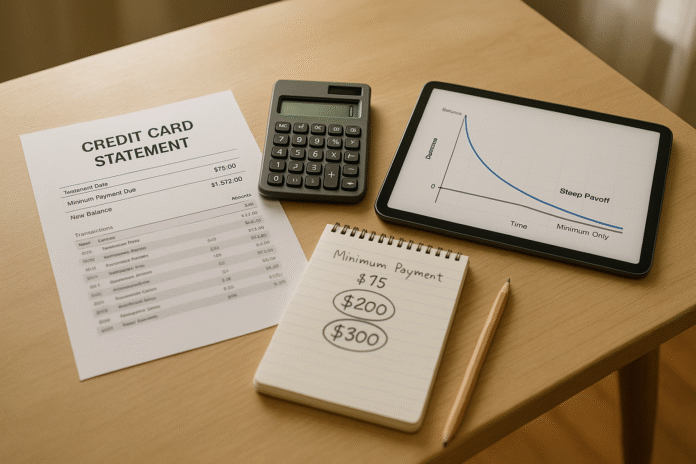

5. The Round-Up Strategy: Set a Fixed “Floor” Above the Minimum

Minimum payments shrink as your credit card balance falls, but that also slows your progress if you follow them down. Instead, establish a fixed floor payment—say $200—and keep it there until the balance is gone. This simple rule forces a larger and larger share of each payment into principal over time, hacking the slow decline that minimum-only payments produce. You can pair the floor with a “round-up” habit (e.g., round whatever the minimum is to the next $50 or $100) to add painless momentum. The result is a sharply shorter timeline and a fraction of the interest—because you’re cancelling future interest that would have existed on a bigger balance.

5.1 Numbers & guardrails (same $5,000 card)

- Minimum only: ~232 months; ~$8,489 interest.

- $200 fixed floor (instead of the changing minimum): ~35 months; ~$1,871 interest.

- Savings: ~197 months faster; ~$6,618 less interest.

5.2 Mini-checklist

- Pick a floor a bit above your current minimum (e.g., $50–$100 higher).

- Automate it so it doesn’t slip as the minimum declines.

- Add windfalls (refunds, bonuses) as extra principal; they delete future interest immediately.

- No new charges on that card; keep payoff math clean.

Synthesis: A steady, automated floor payment converts “maybe someday” into a predictable payoff track—fast, simple, and interest-efficient.

6. Avalanche vs. Snowball: Where to Aim Your Extra Dollars

When you have multiple debts, deciding where your extra dollars go matters as much as how much you add. Two popular methods: avalanche (aim extra at the highest APR first) and snowball (aim at the smallest balance first). Avalanche is mathematically optimal—it minimizes total interest—while snowball can be motivationally optimal because quick wins build momentum. If you can stick with either, you will get out of debt; if you’re optimizing for dollars saved, avalanche wins. Regulatory repayment-box disclosures on card statements are designed to highlight this “pay more, finish earlier” truth at a glance.

6.1 Numbers & guardrails (two-card example)

- Card A: $7,500 at 24.99% APR

- Card B: $4,000 at 17.99% APR

- Budget: Minimums + $150 extra every month

- Modeled results:

- Avalanche: ~57 months to debt-free; ~$5,371 total interest.

- Snowball: ~57 months to debt-free; ~$6,025 total interest.

- Difference: ~$654 extra interest with snowball (same timeline here due to balances and budget—your mix may differ).

6.2 How to choose

- Pick avalanche if you’re comfortable waiting a bit for the first account to vanish and want the lowest cost.

- Pick snowball if quick wins drive consistency—just switch to avalanche once motivation is solid.

- Never split the extra across many accounts; you dilute the effect.

Synthesis: Your extra dollars should generally chase the highest APR—that’s where each dollar kills the most future interest.

7. Balance Transfers & Refinance: When a Fee is Worth Paying

A 0% balance transfer can be a powerful accelerator if you can clear the balance within the promo window and avoid new purchases on that account. Typical offers charge a fee (often 3%–5%) of the amount transferred; that’s a one-time cost you compare against the interest you’d otherwise pay at your current APR. The math is straightforward: if your planned payment would generate more interest than the transfer fee during the promo period, the transfer is likely worth it. Just watch for gotchas like interest on new purchases and the end of the promo period. (CFPB’s definitions and Q&As on balance transfers and how purchases accrue interest during promos are helpful primers.)

7.1 Numbers & guardrails (concrete case)

- Current card: $8,000 at 22.99% APR

- Offer: 0% for 15 months, 3% transfer fee

- Strategy: Move the balance and pay a fixed $549.33/month (that’s $8,240 ÷ 15, where $8,240 = $8,000 + $240 fee).

- If you stay put and pay $549.33 on the old card: you’d finish in ~18 months and pay ~$1,470 in interest.

- If you transfer: you finish in 15 months and pay $240 (the fee) and $0 promo interest.

- Net savings: ≈$1,230 and 3 months faster—provided you don’t add new purchases to that card during payoff.

7.2 Quick checklist

- Calculate the breakeven: Will promo-period interest avoided exceed the fee?

- Automate payoff to finish before the promo ends.

- Don’t swipe that card until the transfer is gone; new purchases often accrue interest immediately if any balance remains.

Synthesis: A well-timed transfer turns a punishing APR into a runway for debt-free—just do the math, finish inside the window, and keep spending off that card.

FAQs

1) What does “paying beyond the minimum” actually mean?

It’s sending more than the required amount due. On credit cards, the minimum often covers accrued interest plus a small slice of principal; by paying above it, you attack principal directly. That lowers the balance used to calculate tomorrow’s interest and speeds up payoff. If your statement includes a “36-month payoff” estimate, that’s your clue to the impact of paying more each cycle.

2) How do card issuers calculate interest?

Many use a daily periodic rate (APR ÷ 365) applied to your average daily balance. Interest accrues each day you carry a balance and compounds when added to your account. This is why early and extra payments reduce interest: they lower the balance for more days in the cycle, shrinking the daily accrual.

3) Is avalanche always better than snowball?

Mathematically, yes: directing extra money to the highest APR first minimizes total interest. But the best method is the one you’ll stick with. If wiping out a small balance first keeps you consistent, start with snowball, then switch to avalanche once momentum is locked in.

4) Are biweekly mortgage programs a gimmick?

Not inherently—they essentially create one extra payment per year, which does save time and interest. The caution is paying third-party fees for something you can self-implement by making an extra principal payment annually or increasing your monthly payment to the equivalent. Ask your servicer how to apply extra payments to principal.

5) Do lenders charge prepayment penalties?

Most consumer installment loans (like auto or personal) don’t, but always check your contract. Mortgages are more regulated: many prepayment penalties are limited or banned under federal rules (with specific exceptions). Read your note and ask directly before making large curtailments.

6) Will a balance transfer hurt me if I can’t finish during the promo?

It can. If any balance remains when the promo ends, the remaining amount typically starts accruing interest at the card’s standard APR, which may be high. The fix is to divide the transferred amount (plus the fee) by the number of promo months and automate that payment so you finish in time.

7) What about using new purchases on a 0% transfer card?

Avoid it. If you carry a transfer balance month-to-month, new purchases often accrue interest immediately because you lose the purchase grace period. Use a separate card for spending you’ll pay in full each month.

8) Should I build an emergency fund before adding extra payments?

Often, yes—at least a starter fund (e.g., one month of expenses). Without a cushion, you risk putting emergencies on high-APR credit, which can undo progress. A balanced approach is to build a small buffer while still paying a fixed amount above the minimum on your highest-APR debt.

9) How do I know which extra-payment strategy is best for me?

If you value lowest cost, choose avalanche (target the highest APR). If you need quick wins, choose snowball (smallest balance first). Whichever you choose, set a fixed floor above the minimum and automate it. Revisit the plan after 60–90 days to make sure it still fits your cash flow.

10) Are the APRs in this article realistic?

Yes—double-digit APRs on credit cards are common, and public Federal Reserve releases track average APRs across accounts. Your own APR depends on your issuer and credit profile; check your statement’s Schumer box and disclosures for exact rates.

11) What’s the single easiest step to start today?

Pick one high-APR account, set a fixed floor payment $25–$100 above the current minimum, and automate it for the day after your statement closes. Then, whenever cash allows, toss a small lump sum at principal. These two habits, repeated, deliver outsized results.

12) Can I replicate biweekly savings without changing due dates?

Yes. Divide one full monthly payment by 12 and add that fraction to every monthly payment (or make one extra full payment annually). The math mirrors biweekly’s “13th payment” benefit—no special program needed.

Conclusion

Debt payoff is a math problem you can win with small, repeatable moves. The seven calculations above show that even modest extras—$25 on a credit card, $50 on a car loan, one extra mortgage payment per year—can erase years and thousands in interest. The mechanism is simple: every dollar beyond the minimum deletes future interest by shrinking principal earlier, and the benefit compounds across time. If you’re starting today, pick your highest-APR balance, set a fixed floor above the minimum, automate it, and avoid new charges on that account. Once the first balance falls, roll that payment to the next (avalanche for pure savings, snowball for motivation). If you can safely exploit a 0% transfer, do the fee-versus-interest math and finish within the promo. Small choices, repeated consistently, are how debt-free happens—quietly, predictably, and sooner than you think.

Ready to move? Set your first automated floor payment $50 above your next minimum—right now.

References

- What is a “daily periodic rate” on a credit card? — Consumer Financial Protection Bureau (CFPB), Sept 25, 2024. https://www.consumerfinance.gov/ask-cfpb/what-is-a-daily-periodic-rate-on-a-credit-card-en-46/

- How does my credit card company calculate the amount of interest I owe? — CFPB, Jan 22, 2024. https://www.consumerfinance.gov/ask-cfpb/how-does-my-credit-card-company-calculate-the-amount-of-interest-i-owe-en-51/

- Consumer Credit — G.19 (current release and methodology notes) — Board of Governors of the Federal Reserve System, accessed Sept 2025. https://www.federalreserve.gov/releases/g19/current/

- Appendix M2 to Part 1026 — Sample Calculations of Repayment Disclosures — CFPB (Regulation Z), accessed Sept 2025. https://www.consumerfinance.gov/rules-policy/regulations/1026/M2

- A box on my credit card bill says I’ll pay off the balance in three years if I pay a certain amount. What does that mean? — CFPB, Feb 2, 2024. https://www.consumerfinance.gov/ask-cfpb/a-box-on-my-credit-card-bill-says-that-i-will-pay-off-the-balance-in-three-years-if-i-pay-a-certain-amount-what-does-that-mean-do-i-have-to-pay-that-much-if-i-pay-that-much-and-make-new-purchases-will-i-still-owe-nothing-after-three-years-en-36/

- Guide Section 8303.1 — Biweekly payment schedules — Freddie Mac Single-Family Seller/Servicer Guide, accessed Sept 2025. https://guide.freddiemac.com/app/guide/section/8303.1

- Guide Exhibit 60 — Servicer remittance requirements (biweekly context) — Freddie Mac, July 9, 2025. https://guide.freddiemac.com/app/guide/exhibit/60

- Credit cards: key terms (Balance transfer definition) — CFPB, Dec 28, 2022. https://www.consumerfinance.gov/consumer-tools/credit-cards/answers/key-terms/

- Do I pay interest on new purchases after I get a 0% balance transfer? — CFPB, Feb 2, 2024. https://www.consumerfinance.gov/ask-cfpb/do-i-pay-interest-on-new-purchases-after-i-get-a-zero-or-low-rate-balance-transfer-en-49/

- Ability-to-Repay/Qualified Mortgage Rule (prepayment penalty limits, overview) — CFPB Small Entity Compliance Guide, Apr 1, 2021. https://files.consumerfinance.gov/f/documents/cpfb_atr-qm_small-entity_compliance-guide.pdf