Many people find it hard to save money on a regular basis, even when they make a good living. The old-fashioned “manual” way of saving can be scary, time-consuming, and full of mistakes, whether you’re a young professional just starting out or someone who wants to get their finances in order. Automated savings plans are helpful in this situation. You can build wealth, lower your financial stress, and reach your goals faster by setting up systems that take care of your savings on their own. You don’t have to do anything extra.

Automated savings plans are meant to help you “save without thinking.” Once you set up automatic transfers, your money is divided up according to rules you set ahead of time. This makes it less likely that you will spend too much or forget to save altogether. Imagine not having to worry about manually moving money or remembering to set aside money at the end of a busy day. The process is simple, predictable, and completely under your control. An automated savings plan can help you become financially free by letting your emergency or goal-based funds grow over time and letting compound growth work in the background.

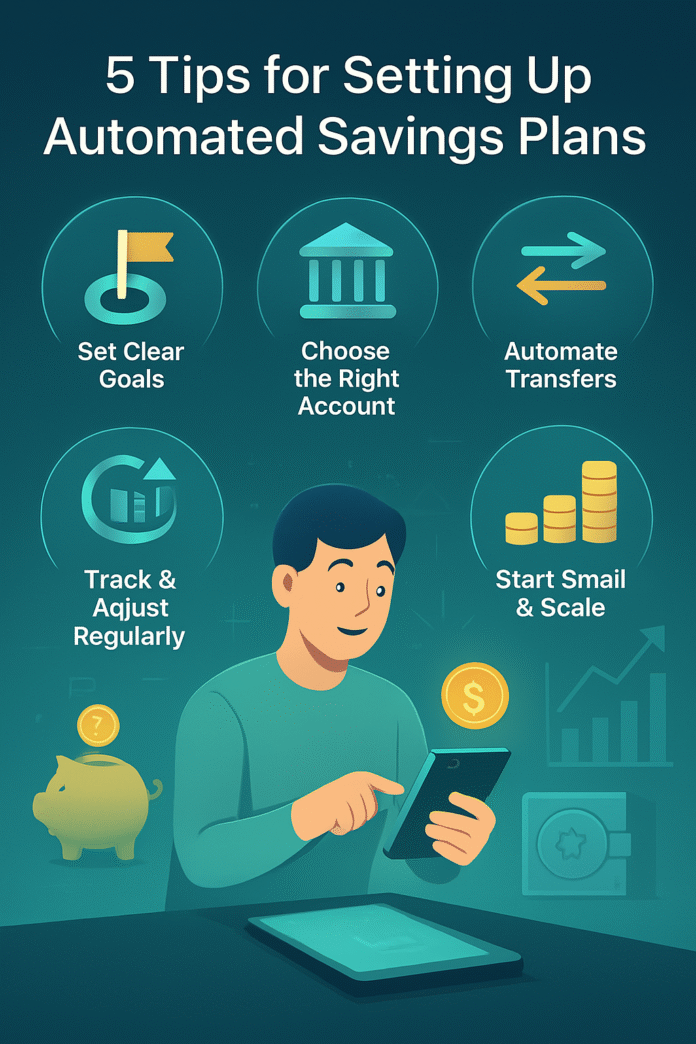

In this article, we’ll give you five useful, doable tips for setting up automated savings plans that fit your way of life. You’ll learn why automated savings are so effective, how to start with small amounts that are easy to handle, and how to make sure your savings goals match what’s most important to you. We’ll look at a number of automated ways to do things, like splitting your paycheck, using round-up apps, or setting up regular transfers. You’ll also learn why regular reviews are important, how high-yield savings can make a big difference, and what mistakes to avoid along the way.

You should feel confident and ready to use automation to your advantage by the end of this complete beginner’s guide to saving money automatically. These tips will help you develop disciplined, stress-free saving habits, whether you want to save for a vacation, an emergency fund, or retirement. Let’s get right to it and look at the best ways to automate your savings.

How Automated Savings Plans Work

When life gets busy, manual saving methods can often fall apart. A lot of people make big plans for their budgets at the start of the month, but by the middle of the month, unexpected costs or daily temptations have thrown those plans off track. Common problems that make it hard to save the old-fashioned way are forgetting things, spending money on impulse, and making deposits that aren’t always the same.

Behavioral science is what gives automated savings their real power. The “out of sight, out of mind” rule says that if you don’t see your money in your spending account, you’re less likely to spend it on things you don’t need. The money is instead put into a special account where it can grow with compound interest. Automation makes a good habit loop: the process is so smooth that you don’t think about it much, but over time, even small amounts add up to a lot.

Automated savings plans make sure that money is always going toward your financial goals, freeing up your mind for other important choices. Research shows that people who set up automatic savings are more likely to be financially secure in the long run. Scheduled, regular transfers also help you build a safety net for emergencies and give you a plan for how to reach your goals, like buying a house or retiring without stress.

In short, automation changes saving from a scary, error-prone task to a system that works while you sleep. This “set it and forget it” method not only makes managing money easier, but it also lowers the stress of having to check your bank balance all the time. When you automate, you’re basically setting up your future self to succeed, which is an important part of any good personal finance plan.

Tip #1: Start with Small Amounts and Work Your Way Up

One of the biggest problems with saving money is being afraid of committing too much too soon. A lot of people are afraid to set up an automated savings plan because they don’t want to move a lot of money at once, especially if their income changes or they’re still getting their finances in order.

Keep it Under Control

The most important thing is to start small. You don’t have to spend a lot of money to get your finances in order. Even a small amount, like $25 a week, can help you get there without putting too much strain on your monthly budget. It’s like making a workout plan: if you’ve never worked out before, you wouldn’t start with a hard workout every day. Instead, you’d start out slowly and work your way up to more difficult tasks as you get stronger and more fit.

For instance, Emily, a young professional, started her automated savings plan with only $25 a week. At first, it didn’t seem like it had much of an effect on her checking account. But after a while, the small donations added up. Emily raised her contributions a little bit each year when she got a raise. Eventually, her savings were strong enough to pay for a family vacation, and she never felt “broke” during the month.

How to Slowly Raise Your Contributions

Here are some tips to help you slowly build up your savings:

- Use Pay Raises and Bonuses: When you get a raise, think about putting some of that money into your savings plan. Over time, even a 1% or 2% rise can make a big difference.

- Set up Regular Reviews: Set a reminder every three months to look over your savings plan. If you see that you can comfortably stay within your budget, try gently increasing the amount of your automated transfer.

- Use Savings Tools That Let You Change Your Mind: You can set up flexible automated transfers with a lot of apps and online banking sites. You can easily change the amounts with tools like Ally Bank, Chime, or even budgeting apps that have built-in savings features.

Benefits for the Mind

Starting small is good for your mental health as well as your finances. It stops you from feeling “locked in” to an overwhelming amount of money leaving your checking account, which helps you save money and avoid burnout. As you see your savings grow steadily, you build confidence by slowly increasing your contributions. This helps you develop good money management habits.

Things to Think About Using Tools and Apps

- Acorns: This service automatically rounds up your purchases and sends the extra money to your savings account. This is a good way to start small.

- Digit: An app that looks at how you spend your money and sets aside small amounts based on your habits.

- Banking Apps: Many banks have simple automated transfer features that let you set up regular payments from your checking account to your savings account.

A List of Things to Do

- Decide how much to start with: Even $25 a week is a good amount.

- Set up a transfer that happens on a regular basis. You can do this with your bank or a savings app.

- Set up quarterly reviews: As your finances get better, change how much you give.

- Celebrate small wins: Look at how much you’ve saved and let that motivate you to save more over time.

You can make a long-lasting automated savings plan that changes with your income and life changes by starting small and building up over time. This step-by-step method makes sure that your savings habit is based on confidence instead of sacrifice, which will make it easier to stick with in the long run.

Tip #2: Make Sure Your Savings Goals Fit with Your Lifestyle and What You Care About

When automation is meaningful to you, it works best. That means making sure that your savings goals fit with your own way of life and financial needs. Setting aside money for an emergency fund, saving up for a dream vacation, or making a down payment on a house are all good examples of clear, personal goals that can help you stay motivated and accountable.

Making Goals Clear

Before you set up your automatic savings, take some time to think about what you want to save for. Think about:

- What are the most important financial goals for me right now?

- Should I save money for emergencies, or should I be working toward longer-term goals like retirement?

- How much do I want to put away in each group?

The first step is to clearly state and measure your goals. For example, you might choose:

- $1,000 in the next six months for an emergency fund.

- $2,500 for a vacation over the next year.

- Down payment: $10,000 in the next two years.

Grouping Your Savings

One way to make sure your goals match your lifestyle is to set up several sub-accounts or “buckets” for different savings goals. It is now easier to keep track of your savings and stay focused because many banks and financial apps let you label different parts of your savings. You could, for instance, have different sub-accounts for vacations, emergencies, home improvements, and even hobbies. This makes it easier to see how far you’ve come, and each automated transfer feels like a step closer to reaching a certain goal.

Using Tools That Help You Keep Track of Your Goals

You might want to try savings apps that have built-in goal tracking:

- Qapital: Lets you set specific savings goals and see how you’re doing with them.

- YNAB and Mint: These two apps are best known for helping you make a budget, but they also let you set specific savings goals and track your progress toward them.

- High-Yield Savings Accounts: Some banks, like Ally or Marcus by Goldman Sachs, let you label or set aside money for different things.

In Real Life

Mark is a freelance graphic designer. Mark needed to save money for a new computer and a vacation, but he also needed to build an emergency fund. He was able to keep his goals separate and easy to see by making three separate savings “buckets” in his online banking system and setting up automatic small contributions to each one. The automated setup made sure that his income was divided up according to his priorities without him having to make changes all the time. As time went on, Mark’s habit of checking his progress regularly made him more motivated. He even gave more when his freelance income went up during busy times.

Benefits and More Motivation

When your savings goals match what you care about most:

- More Motivation: When you can see how far you’ve come toward a goal, it’s easier to say no to the urge to spend too much.

- Spending that is Important: You can make smart choices about where to put extra money or cut back on things you don’t need.

- Better Accountability: Having clear goals helps you judge your financial choices, which makes you more disciplined with your money.

Steps You Can Take

- Make a list of your goals: Make a simple chart or spreadsheet to write down your savings goals, including the amounts and deadlines.

- Make Sub-Accounts: If your bank lets you, make separate “buckets” for each of your savings goals.

- Automate with a goal: Set up automatic transfers that match your goal categories using your bank’s online portal or a special savings app.

- Picture Your Progress: Check your sub-accounts or the progress bars in your savings app on a regular basis to stay motivated.

Possible Problems and How to Fix Them

- Mistake: Not changing your goals when your situation changes.

- Solution: Set up a yearly or quarterly review to change your goals.

- A mistake is putting too much money into one goal and not enough into another.

- Solution: Make a budget that balances your savings and puts them in order of importance and need.

When you set savings goals that fit with your lifestyle and priorities, you create an automatic system that not only helps you build wealth but also keeps you focused on your goal of a stress-free and financially secure future. This personalized method gives each automated deposit a clear goal, turning your saving process into a series of steps that are meaningful and goal-oriented.

Tip #3: Use More Than One Way to Save Money Automatically

If you only use one way to save money, you might not be able to get the most out of your savings. You can use different automated methods to take advantage of every chance to save money by changing your approach. Let’s look at a few ways to save money and how using them all together can make your savings plan even better.

Split Direct Deposit

A lot of employers now let you choose how to split your paycheck between your checking and savings accounts. This is one of the easiest ways to make sure you save some of your money before you even have a chance to spend it. You could, for instance, set up your direct deposit so that 10% of your pay goes straight into a savings or investment account.

Apps for Rounding Up

When you use a round-up app, it “rounds up” every purchase you make to the nearest dollar and saves the difference. If you buy coffee for $2.65, the app rounds it up to $3.00 and puts the extra $0.35 in your savings. These small amounts may not seem like much at first, but they can add up to big savings over time without affecting your daily budget. Apps like Acorns and Qapital are great at giving you this option, so you can easily save a little money on every purchase.

Transfers of a Percentage of Your Paycheck

Setting a fixed percentage of your paycheck to be transferred automatically is another common way. For example, if you decide that 5% of your income should go straight to savings every payday, this percentage-based method will change as your income and budgeting needs change. This method is especially helpful if your income changes over time because it automatically adjusts your savings deposits to match your earnings.

The Good and Bad Points of Different Methods

Here is a table that shows the main points of these automated savings methods:

| Method | Pros | Cons |

|---|---|---|

| Direct Deposit Split | Easy to set up; money is saved before it gets to your checking account. | Not very flexible; depends on what the employer offers. |

| Round-Up Apps | Easy; saves money by adding up small amounts. | Savings may be small unless you use other strategies as well. |

| Paycheck Percentage | Changes automatically with your income; you can choose from a range of percentages. | Needs careful budgeting to avoid problems with cash flow in the short term. |

Using a Mix of Methods for the Best Results

Using more than one method together can help you save money faster. For instance, you could:

- Use Direct Deposit: This will automatically put a set percentage of your paycheck into a savings account.

- Use Round-Up Apps to save small amounts of money on every purchase.

- Add Scheduled Transfers: Boost your savings on certain days, like payday or when you review your budget each month.

This varied approach takes care of different parts of your spending life and makes a backup system that works even if one method doesn’t work one month. Instead of just using direct deposit, using round-up apps or other transfers along with it makes sure you take advantage of every chance to grow your wealth.

An Example from Real Life

Think about Jenna, a freelance writer who doesn’t always make the same amount of money each month. Jenna set up a direct deposit so that 8% of her paycheck would go straight to her savings account for good-paying jobs. She also connected her debit card to a round-up app that automatically saved the extra money she spent every day. The round-up savings helped her get through tough months, showing that using more than one method can help you keep saving even when times are tough.

Changing How Often Automation Happens

You can choose how often your automated methods run. Here are some choices:

- Weekly Transfers: Make sure to make regular, smaller contributions to keep things moving.

- Transfers Every Two Weeks or Every Month: Make them fit with your pay cycle to make things easier.

- Real-Time Rounding: For apps that save your purchase right away.

By using all of these methods together, you make your automated savings plan as strong as it can be, making sure that every dollar is working as hard as it can without you having to do anything extra.

Tip 4: Look Over Your Plan and Make Changes as Needed

Even the best-planned automated savings plans need to be checked on from time to time. Things in life change all the time, including your income, expenses, and financial goals. Regular check-ins make sure that your automated system stays in line with your current situation and keeps your goals in mind.

The Importance of Periodic Reviews

Automated systems are great for making life less stressful, but they shouldn’t be permanent. You might find that your savings goals are no longer right for you or that your cash flow has changed unexpectedly if you don’t check in on them every so often. Regular reviews help you spot these changes early on, so you can change your contributions, move money around, or even stop transfers if you need to.

How to Plan Regular Reviews

- Set Calendar Reminders: Plan a review meeting once a month or once every three months. Mark the date on your digital calendar so you don’t forget to take the time to look over your finances without getting behind.

- Keep an Eye on Your Finances: If your salary goes up, your expenses go up, or you set new financial goals, make sure to change your automated contributions to reflect these changes.

- Use App Notifications: Many personal finance apps will let you know when your savings progress isn’t going as planned or when something strange happens. Use these features to stay ahead of the game.

Changes That Make Sense

A real-life example is when someone gets a raise. When your income goes up, it’s a good idea to think about saving more. For example, if you were saving 5% of your income before you got a raise, you might change that to 7% or 10% to match your new financial situation. On the other hand, if you have unexpected costs, you can temporarily lower your scheduled transfers until your cash flow returns to normal.

Tools to Help With Reviews

- Budgeting Apps: Mint, YNAB, and Personal Capital are all examples of apps that can help you keep track of your spending and report on changes in it. This makes it easier to see how well your automated savings plan is working.

- Spreadsheets: If you want to do things yourself, you can use a simple spreadsheet to keep track of your deposits and see how they compare to your financial goals.

Example Situation

Think about Tom, who set up automatic savings to help him build his emergency fund. Every three months, Tom looks over his bank statements, changes his automation settings, and raises the percentage of his contributions when his freelance income goes up. Tom has been able to stay on track with his goals thanks to this regular check-in, and he has also been able to be flexible when things are uncertain.

Regular reviews aren’t about keeping a close eye on your savings; they’re about making sure that the automated system still meets your needs. This method boosts confidence and lets you make small changes without having to start from scratch.

Tip #5: Set Up Automatic Transfers to High-Yield or Goal-Specific Accounts

It’s important to set up automatic savings, but where you put your money can have an even bigger impact on your overall financial growth. Instead of moving money to a basic savings account with low interest, think about setting up automatic deposits into high-yield savings accounts, money market accounts, or even accounts that are only for specific goals. This way, your money isn’t just sitting there; it’s working for you by growing over time.

The Benefits of High-Yield and Goal-Specific Accounts

- Higher Interest: High-yield savings accounts pay much more interest than regular savings accounts. This can lead to much higher returns over time, especially when they are compounded.

- Targeted Goals: You can set aside money for specific goals, like retirement, a down payment on a home, or an education fund, by using goal-specific accounts. Putting these funds aside from your regular spending money makes it less likely that you’ll use them.

- Tax Benefits: Some accounts, such as IRAs and Health Savings Accounts (HSAs), offer tax benefits that can help you save even more.

How to Put into Action

- Look into your choices: Find banks and other financial institutions that offer high-yield savings accounts with rates that are competitive. Ally, Marcus by Goldman Sachs, and Discover Bank are some online banks that always do well.

- Create automatic transfers: Set up your recurring transfers so that money goes straight into your high-yield or goal-specific accounts. You can choose where each automatic transfer should go in a lot of financial apps.

- Keep an eye on the growth: Use the account dashboards that your bank or financial app gives you to see how your savings grow over time. Using visual aids like progress bars or compounding calculators can help you figure out how much your current savings will be worth in the future.

Example from the Real World

Sara, who works in marketing, set up an automatic transfer of her savings into a high-yield online savings account that is only for her emergency fund. Her money grew faster because the interest rate was higher than in her regular savings account. She even opened a separate account for her long-term travel goals. Sara was able to save the most money by automating transfers into these special accounts. This also helped her keep her financial goals separate.

How to Put It Into Action

- Pick the Right Bank: Before signing up for a high-yield savings account, make sure to look at the fees, interest rates, and features of each account.

- Use technology to your advantage: Use financial calculators to figure out how much money you will save in the future. This can help you set goals that are possible.

- Make Your Goals Clear: Set a goal for how much you want to save in each account, and then change your automatic contributions to match that goal.

Bonus: Common Mistakes and How to Avoid Them

There are still problems to watch out for, even with a well-planned automated savings plan. Here are some common problems and ways to solve them:

Common Mistakes

- Too much automation: If you set up too many automated transfers without keeping an eye on your cash flow, you could run into liquidity problems.

- Not Paying Attention to Goals: It’s easy to forget why you’re saving if you don’t have clear goals, which can make you less motivated.

- No emergency buffer: If you rely too much on automation, you might miss out on opportunities if unexpected costs come up.

How to Stay Away from Them

- Stay Flexible: You should always have a small amount of extra cash in your checking account for emergencies.

- Regular Check-Ins: As Tip #4 says, set up regular reviews to improve your plan.

- Make a list of things that are most important: Use goal-based accounts to clearly separate your money so that you are less likely to use money that is set aside for certain things.

Useful Advice

- A list of things to do to avoid problems:

- Keep a running balance for things you need right away.

- Set up quarterly reviews of your spending and savings.

- If your financial situation changes, change the way your automated transfers work.

- Celebrate your progress and make small changes to your contributions.

You can make your automated savings system more stable and adaptable by being aware of these problems and taking steps to fix them. This will help it grow and stay stable over time.

Frequently Asked Questions

What if I don’t have a regular job?

If your income changes, you might want to save a percentage of it instead of a set amount. This way, you save more money when you make a lot of money, and you save less money when you don’t make as much. You can manage variability without having to do it yourself with automation apps that work on a percentage basis.

Can I set up automatic savings if I’m in debt?

Yes, you can. In fact, saving money automatically while paying off debt is a great idea. In these situations, you should first build up a small emergency fund (even $500 to $1,000). Once that is done, set up an automatic plan that divides your income between paying off debt and saving. It’s important to find a balance between paying off debt and saving money.

How often should I change my savings plan?

You should look over your savings plan at least once every three months or whenever something big happens in your life, like getting a new job, getting a raise, or having to pay for something big. Making regular changes to your plan makes sure it stays in line with your goals and the way things are financially.

Is it better to automate saving than to keep track of it by hand?

Automating your savings lowers the chance of making mistakes and helps you stay disciplined by taking away the urge to spend money you don’t see. But it’s important to do manual reviews from time to time to stay on track. A balanced approach works best when you use both automation and manual oversight.

Conclusion

Automated savings plans are a great way to build wealth without having to do much, lower your stress levels, and reach your financial goals faster. We have looked at five practical ways to set up an automated savings system that works for your lifestyle throughout this article.

- Start Small and Build Gradually: Make small contributions at first to make a habit that will last.

- Make sure your savings goals match your lifestyle and priorities. Make sure you know what your financial goals are and how to group them.

- Use More Than One Automated Savings Method: To get the most out of your savings, use direct deposits, round-up apps, and paycheck percentage transfers together.

- Review and Change Your Plan Often: Go over your savings plan every so often to make sure it still works.

- Set up automatic transfers to high-yield or goal-specific accounts. This will help your money grow faster and save you money on taxes.

By using these automated savings methods, you not only make it easier to manage your money, but you also give it a disciplined, stress-free place to grow. Even if you’re just starting out, automation will help you save money over time, giving you the freedom to reach your goals.

Keep in mind that getting to financial security is a long process, not a short one. Start with one tip today: set up your first automatic transfer. Then, over time, add the other tips to your daily life. If you stick with it, you’ll soon realize that saving money doesn’t take a lot of work; it just takes making smart, automatic choices.

Call to Action:

Pick one of these tips and start using it today to take control of your financial future. Let automation work for you so that every dollar counts toward a better future. You can start with a small amount or set up a direct deposit split.

More Information and Next Steps:

- Visual Aids: Think about making a savings growth chart or using an online compound interest calculator to see how small contributions add up over time.

- Join a Community: Get involved in online personal finance forums or social media groups where you can talk about how you’re doing and get more tips on how to automate your money.

- Learn More: Read more articles, listen to more podcasts, or watch more webinars about automated savings plans to keep improving your money skills.

Automated savings plans make it easy to reach financial stability in a world where many of us have trouble saving on a regular basis. Use automation to your advantage, check your goals often, and see your wealth grow, one automated transfer at a time.

Here’s to a safe, stress-free financial future! Happy saving!