Beginning

You might sigh and say, “It seems impossible to save money,” as you look at your bank statement. Maybe every month you promise yourself that you’ll save more of your money, but that goal keeps getting harder to reach. Does this sound familiar? You’re not the only one if so. A lot of people, from college graduates and young adults to parents trying to make ends meet, have trouble with saving goals that are too vague or impossible to reach. What happened? Stress, lack of motivation, and the nagging feeling that financial independence is always just out of reach.

The truth is that unclear saving goals make things more confusing. You can’t track your progress, change your plan, or celebrate small wins without being specific. On the other hand, goals that are too big for your income or life situation will make you fail, which will make you tired and angry. But the answer is easier than you think. When you learn how to set realistic saving goals, you turn vague hopes into clear goals that motivate you to take action and keep going.

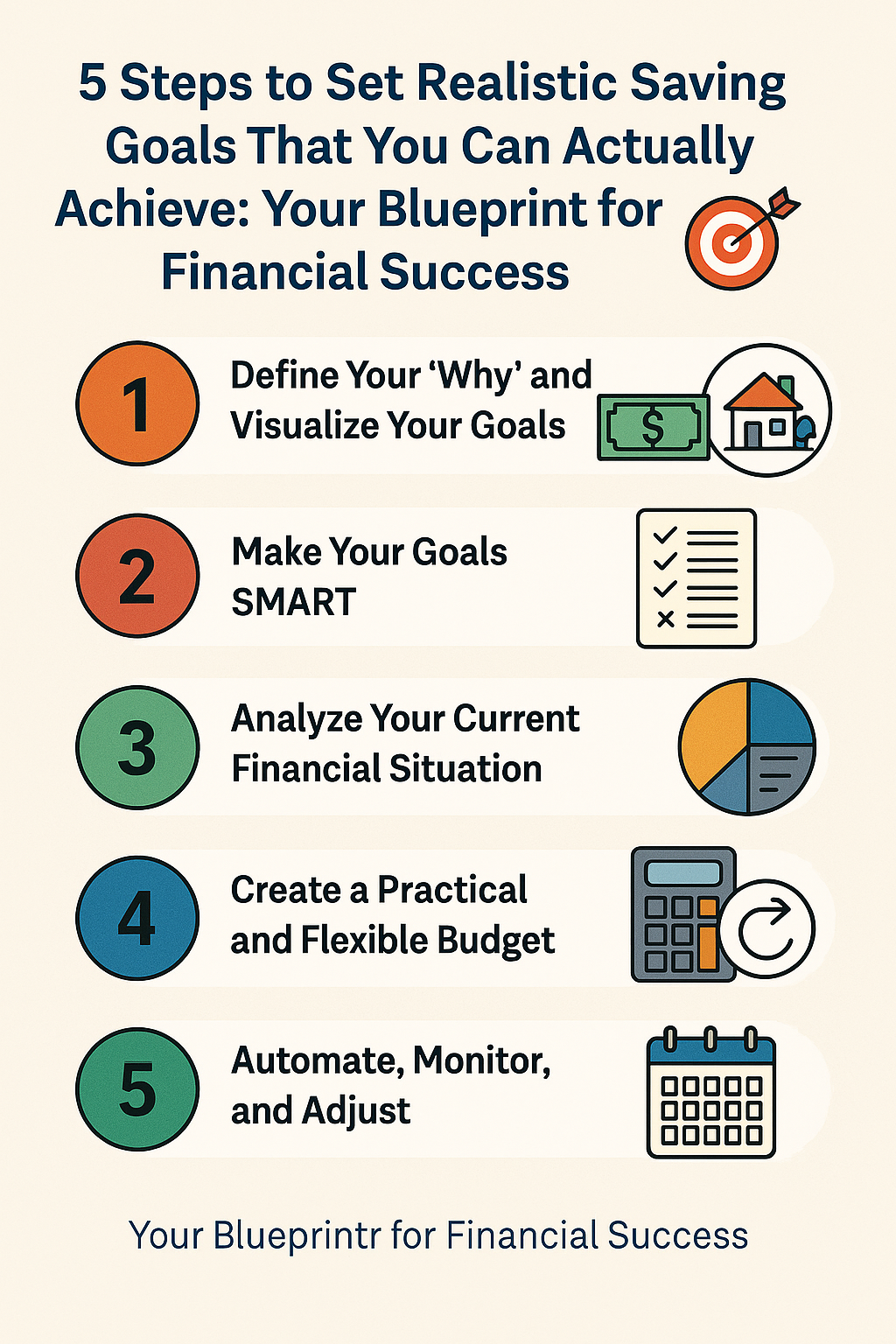

This complete guide, “5 Steps to Set Realistic Saving Goals That You Can Actually Achieve: Your Blueprint for Financial Success,” will show you how to:

- Get to the bottom of your financial goals.

- Use the SMART framework to turn your dreams into real goals.

- Do an honest check-up on your finances.

- Make a budget that is flexible and gives you power.

- For long-term success, automate, keep an eye on, and change your plan.

These steps will help you put into action good saving strategies, whether you want to save for retirement, an emergency fund, or just make saving easier. You’ll get a better idea of how to plan your personal finances, learn useful tips for managing your money, and learn how to get around common problems that even the best planners run into.

This method is best because it takes into account your unique situation. There are no one-size-fits-all solutions and no complicated financial terms. Just simple, useful advice that anyone can follow. Are you ready to change how you save? Let’s get started.

The Foundation: Why It’s Important to Set Realistic Goals

More than “Save More”

Think about how you might say to yourself, “I want to save more money,” and then expect that vague goal to make you do something. It doesn’t happen very often. Goals turn into wishful thinking if they aren’t specific. You can’t figure out how much to save, when to save it, or how to keep track of your progress. On the other hand, personal finance planning based on clear goals helps you stay on track, which makes it easier to keep moving toward financial independence.

Motivation and Speed

Setting realistic goals helps you stay motivated. Every time you reach a small goal, like putting ₹5,000 into your emergency fund, you feel a rush of happiness. This positive reinforcement helps you stick to your financial goals, encourages discipline, and keeps you on track. In behavioral economics, these small wins release dopamine, which makes saving money fun instead of a chore.

How to Avoid Burnout

Setting goals that are too high often doesn’t work. You might think you’re a failure and give up on your plan if you promise yourself you’ll save ₹50,000 every month but can only save ₹15,000. Instead, making smart financial goals that fit your income and way of life will help you make progress that lasts. You don’t get emotionally drained from trying to reach impossible goals.

The Strength of Clarity

Setting clear goals changes how you make money decisions every day. When you know you need ₹10,000 this month to plan for your retirement savings, you’ll think twice before buying things you don’t need. When you have specific financial goals, they help you decide how to spend your money and what to focus on, like paying off debt, investing, or saving for a trip.

The Psychology of Success

When you break big goals into smaller, more manageable pieces, you don’t feel as overwhelmed. Instead of a far-off goal of ₹1,000,000, think about reaching smaller goals every three months: ₹250,000 by March, ₹500,000 by June, and so on. Each milestone acts as a mental stepping stone, making it seem possible to reach your savings goals. Also, this kind of structure helps people avoid decision fatigue, which makes it easier to keep planning their finances.

In short, setting realistic goals is the most important part of saving money. They help you go from wanting to do something to actually doing it, making sure that your budgeting for savings isn’t just a theoretical exercise but a real way to get results.

Five Steps to Set Realistic Savings Goals

Step 1: Figure out your “why” and picture your goals.

What it means

The emotional core of every successful savings plan is your “why.” It’s the personal meaning that turns saving from a boring chore into something important. Even the best-made budgets can feel dead without a strong “why.”

Why It’s Important

A real, emotionally charged reason is what keeps you disciplined over time. When you feel like giving in to a temptation, like buying something online on a whim or getting an unexpected bill, your “why” will keep you on track and remind you why you chose this path. Research on setting goals shows that people who have strong emotional ties to their goals are 42% more likely to reach them.

Steps You Can Take

Think of specific goals

Write down all of your possible savings goals:

- A down payment on a house.

- Setting up an emergency fund that lasts for three to six months.

- Retirement savings.

- A dream vacation or more school.

Picture the Result

Imagine what it would be like to live in your new home without any rules from your landlord. Feel the relief of having a strong safety net in case of an emergency. Imagine traveling around Europe without having to worry about money.

Give emotional meaning

For each goal, write a short story about it. What problems does it solve? What emotions does reaching it bring up?

For example, “Having ₹500,000 in my emergency fund will let me sleep soundly, knowing that unexpected car repairs won’t mess up my finances.”

Useful Advice

- Make a vision board by gathering pictures of your goals, like the inside of your dream home, peaceful retirement scenes, and places you want to travel to.

- Write down your “why”: Every morning, spend five minutes writing about how your goals make you feel.

- Share and Commit: Talk about your goals with a friend or family member who will support you. Being responsible makes people more likely to follow through.

Things You Shouldn’t Do

- Too Many “Whys”: Limit your focus to 1 to 3 main goals. When you spread your energy across too many goals, it makes your work less effective.

- Goals that don’t have real emotional meaning, like “saving because I should,” are easy to give up on. Find real “whys” deep down.

Step 2: Make your goals SMART.

What it means

The SMART framework—Specific, Measurable, Achievable, Relevant, Time-Bound—gives you a way to turn big goals into plans that you can actually do. It is the most important part of a good goal-setting framework because it makes sure your goals are clear and doable.

Why It’s Important

Without SMART criteria, goals are vague, hard to track, and likely to change. Using SMART makes things clear, sets clear expectations, and makes it easier to keep track of your savings progress.

Steps you can take for each SMART part

Particular

Be clear about what you’re saving for and how much.

“Save for a house” is too vague.

“Save ₹1,800,000 for a 20% down payment on a ₹9,000,000 property in Karachi” is a specific example.

Able to be measured

Set clear goals and metrics.

For example, “Every month, put ₹30,000 into my home fund.”

Possible (Achievable)

Check to see if it’s possible given your budget, bills, and time frame.

If ₹30,000 a month isn’t possible, lower it to ₹20,000 and give yourself more time.

Important (Relevant)

Make sure that your financial planning steps and values are in line with this.

Put paying off your debt first if you want to be debt-free sooner than going on vacation.

Bound by Time

Make a clear deadline.

“Reach my down payment goal by December 31, 2027,” for example.

Advice

- Work backward: Start with the date you want to finish and divide the total by the number of months you have.

- Set interim milestones: Break big goals down into quarterly or half-year check-ins to keep track of progress and celebrate small wins.

- Use tools like calendar reminders, spreadsheet templates, or apps that help you keep track of your goals to see your milestones more clearly.

Things to Avoid Making Mistakes

- Unrealistic “A”: Thinking you can save more than you really can because you think your income will go up.

- Too Tight “T”: Setting deadlines that don’t take into account how life can change, like holidays, medical emergencies, or job changes.

Step 3: Look at your current financial situation

What it means

If you want to set realistic saving goals, you need to be honest about your money situation, including your income, expenses, and debts. This reality check shows you how much you can really save and stops you from making plans that don’t fit with reality.

Why It’s Important

Setting goals without knowing what they are is just guessing. To figure out how much you can consistently put toward your goals, you need to know how much money comes in and goes out of your cash flow. Not paying off debts or underestimating costs always leads to goals that are not realistic.

Steps You Can Take

Keep track of all your money

Write down every rupee you make, including your salary, money from side jobs, rental income, and dividends.

Keep track of all your costs

Keep track of all your spending for 30 to 60 days.

Put each cost into a group:

- Rent vs. entertainment: fixed vs. variable.

- Things you need vs. things you want (like groceries vs. streaming subscriptions).

Find out your net income

Take the total income and subtract the total expenses. Your surplus (or deficit) is the result. This number shows the most you can put toward paying off debt and saving each period.

Look over your debt obligations

Make a list of all your debts, including their balances, interest rates, and minimum payments.

Put high-interest debts at the top of your list because they eat away at your net income the fastest.

Tools to Help You Keep Track of Your Savings

- Budgeting Apps: Some examples are Mint, YNAB, and Personal Capital.

- Spreadsheets: Use Google Sheets or Excel to make your own trackers.

- Pen and Paper: A simple ledger will work if you want; the important thing is to be consistent.

Helpful Advice

- Automate capturing expenses by turning on transaction notifications or connecting your accounts to an app.

- Add “leakage” costs: Little, regular costs like coffee runs and app micro-transactions add up. Don’t forget about them.

- Be Honest: If you don’t take into account all the costs of living, your surplus estimate will be off, and your budget will lose its credibility.

Things You Shouldn’t Do

- Guessing Expenses: Making predictions based on memory or estimates instead of real data is not accurate.

- Not Planning for Seasonal Changes: Not planning for yearly costs like car insurance and holiday shopping can lead to unexpected cash flow problems.

- Not thinking about how debt affects you: Not making your minimum debt payments can cost you money and hurt your credit score, making it even harder to save.

Step 4: Make a budget that is useful and adaptable

What it means

A budget is not a prison for your money; it’s a plan for how to spend it so that it works toward your financial goals. It helps you make daily and monthly spending decisions based on your SMART goals and “why.”

Why It’s Important

Even if you have clear goals, they can fall short without a clear budget. A budget is like a map for your money. It tells you how much to spend, save, and invest each month, and it helps you deal with the unexpected things that happen in life.

Steps You Can Take

Set aside money

Pay Yourself First: Think of putting money into savings as a necessary cost, like rent or utilities.

- Essentials include housing, utilities, groceries, insurance, and the least amount of debt payments.

- Optional: Going out to eat, having fun, and doing hobbies.

Pick a way to budget

- The 50/30/20 Rule says to put 50% of your after-tax income toward needs, 30% toward wants, and 20% toward savings or paying off debt.

- Zero-Based Budgeting: Give every rupee a job—income minus expenses equals zero.

- Envelope System: Take out cash for categories you choose and put it in labeled envelopes.

Find Areas to Cut Back

Look closely at your variable spending to see where you can make cuts. For example, you could cook your own meals instead of ordering takeout, renegotiate your subscriptions, or carpool to save gas.

Add some flexibility

Set aside 5–10% of your income for a “buffer” or “miscellaneous” category to cover unexpected costs without throwing off your plan.

Useful Advice

- Trial Period: Use your budget for a month and then make changes based on how you actually spend money.

- Get Everyone on Board: If you share money with a partner or family, make sure they all agree with the plan.

- Use visual aids: A simple spreadsheet with pie charts or bar graphs can make it easy to see how much you spend on what.

Things to Avoid Making Mistakes

- Too Tight Budgets: Big cuts can make people spend more than they planned.

- Ignoring Unusual Expenses: If you don’t plan for things like yearly insurance, vehicle maintenance, and gift-giving, they can throw your budget off.

- Rigid Mindset: Life changes, so be ready to change your budget as your income, goals, or priorities do.

Step 5: Set up automation, keep an eye on it, and make changes as needed.

What it means

The key to reaching your savings goals is to be consistent. You can reduce the amount of work you have to do by hand and the chance of making mistakes by automating your saving and budgeting. Regular checks help you stay on track with your SMART goals, and adjustments help you deal with the changes that life throws at you.

Why It’s Important

Plans that only depend on willpower will fail, no matter how good they are. Automation makes things easier; monitoring makes people responsible; and adjustment makes people strong. These strategies work together to create a saving machine that keeps going on its own.

Steps to Take

Transfers should be done automatically.

On payday, set up automatic transfers from your salary account to separate accounts for saving or investing. Think of this transfer as a bill you have to pay every month.

Use tools to keep track

Use apps or spreadsheets that update in real time to see how far you’ve come toward your SMART goals. Progress bars or charts that you can see make accomplishments real.

Check-Ins on a Regular Basis

Check your spending against your budget every week with micro-reviews.

Have monthly deep dives where you look at your actual savings compared to your goal, figure out why there are differences, and write down what you learned.

Celebrate Important Events

Recognize accomplishments, like saving ₹100,000 or sticking to a strict budget for three months in a row.

Small, cheap rewards like a favorite snack or a movie night encourage good behavior.

Make changes as needed

Changes in life, like getting a raise, changing jobs, or taking on new family duties. Every three months, go back over your SMART goals and budget. Change the numbers and deadlines to match what is going on in your life right now.

Useful Advice

- Visual Trackers: Using paper calendars with progress stickers or digital dashboards can make you more motivated.

- Accountability Partners: Give a trusted friend, family member, or financial coach monthly updates.

- “If-Then” Plans: Make plans for how to deal with problems ahead of time. For example, “If I miss a transfer, I’ll make a catch-up deposit within three days.”

Things You Shouldn’t Do

- “Set and Forget” Automation: Not paying attention to your plan until it’s too late to fix it.

- Overreacting to Small Changes: Markets and incomes go up and down; don’t make changes that hurt long-term stability.

- Not Celebrating Small Wins: Not celebrating small wins lowers morale and commitment.

Getting past common problems that make it hard to save money

Even the best-laid plans can run into problems. Here’s how to deal with five common problems:

Costs that come up out of the blue

Start by setting a goal for an emergency fund of ₹25,000 to ₹50,000. This “sinking fund” can be used to pay for car repairs, urgent home repairs, or medical bills without using up your long-term savings.

Not having enough discipline or drive

To fix this, set up a way to hold yourself accountable, like weekly check-ins with a friend, a public progress tracker on social media, or a private journal. Giving yourself small, non-monetary rewards (like your favorite dessert) for reaching small goals can give you new energy.

Too much to handle

Solution: Set small goals, like saving ₹200 a week, instead of big ones. This makes it easier on your mind and gives you chances to succeed more often.

Peer Pressure and Lifestyle Inflation

Solution: Keep going back to your “why” and plan social activities that are cheaper, like potluck dinners instead of going out to eat or free community events instead of expensive ones.

Going Off Course

The answer is to see problems as temporary. Look at what went wrong, change your budget or timeline, and make a new commitment right away. Keep in mind that persistence through imperfection often leads to momentum.

Questions and Answers (FAQs)

Q1: How many goals should I have for saving money at once? To stay on track, set 1 to 3 main goals and 1 to 2 smaller “wish list” goals. Having too many goals at once can make it harder to stay focused and budget.

Q2: What is the most important thing for someone who is just starting to save? Step 1 is to figure out your “why,” and Step 3 is to look at your current financial situation. These are the most important steps. Emotional commitment and a clear picture of reality are the first steps to good planning.

Q3: How often should I check my savings goals? Check in quickly once a week to make sure you’re following the rules about spending, and once a month to see how far you’ve come. Do a full audit every three months to change the SMART parameters and budgets to reflect changes in your life.

Q4: What if I don’t make enough money to save? Cut back on things you don’t need to spend money on, like streaming services, eating out, and buying things on impulse. Look into ways to make extra money, like freelancing or turning hobbies into cash. Even small amounts of money given every week add up to a lot over time.

Q5: Should you save for retirement or an emergency fund first? Before making long-term investments, always make sure you have an emergency fund that can cover 3 to 6 months of living expenses. This safety net keeps you from having to use your retirement accounts or take on high-interest debt when something goes wrong.

In conclusion

Setting realistic, achievable savings goals doesn’t mean denying yourself things; it gives you the power to take charge of your financial future. You can create a strong system that helps you reach your goals by figuring out a strong “why,” using the SMART framework, looking at your real cash flow, making a balanced budget, and using automation with regular checks.

These five steps give you a clear, flexible plan for achieving your goals, whether you want to own a home, have an unshakeable emergency fund, or retire comfortably. They take into account how unpredictable life can be, celebrate small wins, and encourage long-term discipline. Remember that your most important tools on this journey are your ability to stick with it, be flexible, and connect with others emotionally.

You have control over your money future. Identify one important goal, write a SMART plan, and set up your first automatic transfer today. You turn vague hopes into real accomplishments with every small step you take. Stick to your plan, make changes when you need to, and celebrate every step along the way. Now is the time to start making your plan for financial success.

Wow that was strange. I just wrote an really long comment

but after I clicked submit my comment didn’t show up.

Grrrr… well I’m not writing all that over again. Regardless, just wanted to say wonderful blog!

Very good article! We are linking to this great content on our

site. Keep up the good writing.

This is the right website for anyone who hopes to find out about this topic.

You realize a whole lot its almost hard to argue with you (not that I

personally will need to…HaHa). You definitely put a fresh spin on a topic which has been discussed for ages.

Great stuff, just excellent!

Hello, I log on to your blog daily. Your story-telling style is awesome, keep up the

good work!

When someone writes an piece of writing he/she keeps the idea of a user in his/her brain that how a user can understand it.

Thus that’s why this piece of writing is amazing.

Thanks!

บทความนี้ อ่านแล้วได้ความรู้เพิ่ม ครับ

ดิฉัน เพิ่งเจอข้อมูลเกี่ยวกับ ข้อมูลเพิ่มเติม

ดูต่อได้ที่ เล่นเกม betflik85 ได้เงินจริง

สำหรับใครกำลังหาเนื้อหาแบบนี้

มีการยกตัวอย่างที่เข้าใจง่าย

ขอบคุณที่แชร์ คอนเทนต์ดีๆ นี้

และอยากเห็นบทความดีๆ แบบนี้อีก

Hey I am so thrilled I found your web site, I really found you by mistake,

while I was researching on Askjeeve for something else, Anyways I am here now and would just like to say thanks for a tremendous post and a all round enjoyable blog (I also love the theme/design), I don’t have time to read through it

all at the minute but I have bookmarked it and also

added in your RSS feeds, so when I have time I will be back to read a lot

more, Please do keep up the superb work.

hello there and thank you for your information – I have definitely picked up anything new from right here.

I did however expertise some technical issues using this

site, as I experienced to reload the web site lots of times previous to I could get it to load correctly.

I had been wondering if your hosting is OK? Not that I’m complaining,

but slow loading instances times will often affect your placement in google and

could damage your high-quality score if ads and marketing with Adwords.

Anyway I’m adding this RSS to my email and could look out

for a lot more of your respective interesting content. Ensure that you update this again very soon.

Thanks for finally writing about > 5 Steps to Set Realistic Saving Goals

That You Can Actually Achieve – Finance Fundamentals zinnat02

Saved as a favorite, I really like your website!