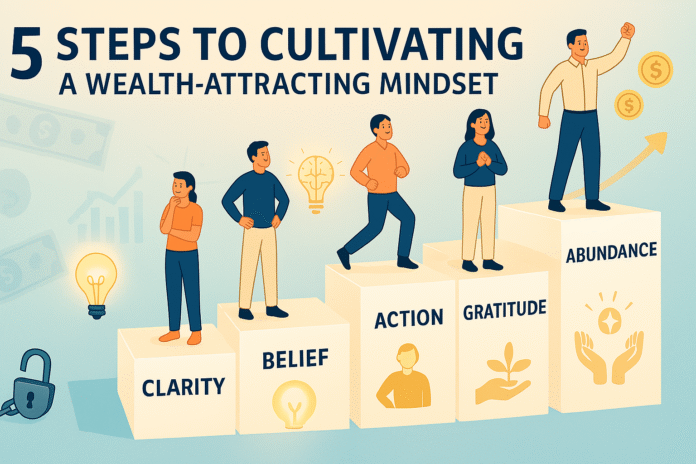

Having a wealth-attracting mindset doesn’t just mean making more money; it means changing how you think, feel, and act when it comes to your money. You can make your mind and emotions work for you by developing the right habits. This will lead to more money, better decisions, and long-term financial freedom. In this complete guide, we’ll look at five steps you can take to develop a wealth mindset. Along the way, you’ll learn about useful exercises, real-life examples, and daily habits that will not only motivate you but also help you build lasting financial wealth.

1. Beginning

A mindset that attracts wealth is more than just budget spreadsheets and investment portfolios. It’s about changing the way you think about money so that it becomes a way to get what you want instead of a source of stress all the time. A lot of people, even those who seem to be doing well with money, have limiting beliefs and a scarcity mindset that can get in the way of their financial progress. When you change how you think about money, you can see a world of plenty, creative chances, and smart money choices.

Your mindset is very important for financial success because your beliefs and attitudes affect what you do. If you think that only a few people can be rich or that money is always hard to come by, your choices will eventually show that. On the other hand, when you think of abundance, you give yourself the power to think bigger, take smart risks, and take advantage of chances that will help you build wealth. Every little thought and choice you make adds up over time, affecting both what you do and the direction your finances are going.

We will talk about the following in this article:

- Getting to know the Wealth Mindset: What it really means to have a mindset that draws in money and why it matters.

- Step 1: Get clear on your financial vision: How clear and vivid financial goals can motivate you to take action.

- Step 2: Change Your Limiting Beliefs About Money: Learn how to find and change beliefs that hold you back.

- Step 3: Develop an attitude of gratitude and abundance: How gratitude can help you move toward an abundance mindset.

- Step 4: Take Inspired Action Every Day: Make your mindset changes into daily actions you can take.

- Step 5: Learn from your mistakes and get stronger: See failures as chances to grow and stay motivated.

- Bonus Tips: Things you can do every day to help you think about money in a positive way and keep growing as a person.

- Conclusion and FAQs: A summary of the steps to take to gain lasting financial freedom and answers to common questions.

These practical tips will help you develop a positive, wealth-attracting mindset that will change both your financial decisions and your life, whether you’re just starting out on your financial journey or trying to get over money blocks that keep coming up. Let’s get started!

2. Getting to Know the Wealth Mindset

A mindset that attracts money is a way of being that affects every part of your financial life. You believe that you can create wealth, not just for yourself, but also as a moral and empowering force in the world around you.

What does it mean to have a mindset that attracts wealth?

- A belief in plenty: A wealth mindset is based on the belief that there are no limits to the opportunities that are available. This is very different from a scarcity mindset, which is all about fear of not having enough and focusing on what you can’t have.

- A belief in your own skills: Believing that you can learn, adapt, and make smart financial decisions is the first step to building wealth. This means trusting yourself and having faith in your ability to deal with problems.

- A Focus on Growth and Giving Back: A wealth mindset isn’t just about getting more money for yourself; it’s also about wanting to help your community grow and thrive. The idea is that you will have more chances to get rich if you help other people succeed.

How Your Beliefs, Habits, and Attitudes Affect Your Money

Your mindset has a big impact on how you handle money. For instance:

- Making Choices: If you think that every dollar is hard-earned and hard to come by, you might put too much emphasis on being frugal at the expense of investing in your own growth or ways to make money without working. On the other hand, an abundance mindset gives you the confidence to invest and take smart risks.

- Resilience in emotions: A positive attitude toward money makes you more resilient. When you have money problems, you’re more likely to see them as chances to learn than as failures.

- Patterns of behavior: It’s easier to stick with habits like budgeting, saving, and investing when they come from a place of power instead of fear. When people think they can get rich, they are more likely to stick to their plans and take action.

The mindset of scarcity versus abundance

- Mindset of Scarcity: People with a scarcity mindset think that there aren’t enough resources. This can make people anxious, make them avoid risks, and make it hard for them to see chances. It could show up as saving money, putting off making investment decisions, or even doing things that hurt yourself.

- Mindset of abundance: People with an abundance mindset, on the other hand, believe that they can make and attract money. They think about the possibilities instead of the limits, stay flexible when things get tough, and are more open to new ideas and growth.

It’s important to know the differences between these things. Having a mindset that attracts wealth doesn’t mean ignoring reality; it means changing how you see things to see endless possibilities. This internal story affects the choices you make. When you accept abundance, your actions become more in line with your goals, creating a space where wealth and opportunities naturally flow.

3. Step 1: Get clear on what you want to do with your money.

A clear plan is the most important part of any successful financial plan. It’s easy to drift aimlessly and make decisions that are more reactive than strategic if you don’t have a clear vision. Creating a clear and detailed financial vision gives you a strong plan that motivates you and tells you what to do to make money.

Why It’s Important to Be Clear

When your money goals are clear and specific, you get the following benefits:

- What drives you: Clear goals remind you of what you’re working toward all the time, which keeps you motivated even when things get tough.

- Concentrate: When you know exactly where you want to be, it’s easier to ignore distractions and focus on the things that will help you reach your goals.

- Being responsible: When you have clear goals, you are more likely to keep track of your progress, see how well you are doing, and change your plans when you need to.

- Giving people power: A clear financial vision gives you a sense of control. When you plan for your future, you turn the vague idea of wealth into concrete steps you can take.

How to Make Your Financial Vision

- Picture Your Future:

- Daily Visualization: Take a few minutes every day to picture your life with a lot of money. Think about the way of life, the chances, and the safety that money can give you.

- Board of Vision: Use pictures, quotes, and symbols to make a picture of your goals. Put it somewhere you can see it every day.

- Write Down Your Goals:

- Goals that are clear: Instead of writing vague goals like “I want to be rich,” write specific ones like “I will have a net worth of $1 million by the time I turn 40” or “I want to save $20,000 for a down payment on a house in three years.”

- Short-Term vs. Long-Term: Put short-term wins together with long-term goals. For instance, short-term goals could be paying off debt or building up an emergency fund, while long-term goals could be saving for retirement or starting a business.

- Split It Up:

- Things you can do: When you know what you want to do, break it down into smaller, doable steps. Figure out how much you need to save each month and make a plan for how to do it every month if you want to save $20,000 in three years.

- A timeline and goals: Make a timeline that shows important dates. When you reach certain milestones, celebrate. This will help you remember how far you’ve come and give you more energy to keep going.

Clear vs. vague goals:

- Unclear Goal: “I want to be rich.”

- Clear goal: “I will get rich by saving 20% of my income every month, putting my money into a variety of investments, and reaching a net worth of $500,000 in the next 15 years.”

- Unclear Vision: “I want a life that is easy.”

- Clear Vision: “I see myself living in a beautiful home, going to at least three new places each year, and having enough passive income to pay for everything by the time I’m 45.”

Reflection Questions and Activities

- Write in your journal: For ten minutes, write about the financial goal you want to reach the most. Be as specific as you can. Tell us where you live, what kind of life you lead, and how your money affects your life and the lives of those around you.

- Mapping Your Money: Make a plan for how you will handle your money. Write down the steps you need to take to reach your vision and any habits or obstacles that are getting in your way right now.

- Worksheet for Setting Goals: Use a worksheet to write down your short- and long-term goals, the steps you need to take to reach them, and the dates by which you need to reach each goal. Put these goals in order of importance and look at them once a week.

You set a strong base for all the steps that follow by making your financial vision clear. This clear picture not only makes you want to act, but it also helps you remember what you want to do when things are unclear. When your vision is clear and detailed, every financial choice you make is a step toward making that vision come true.

4. Step 2: Change the way you think about money

A lot of our money problems start in our heads. Limiting beliefs, which are deep-seated and often unconscious ideas about money, can ruin even the best-laid plans. These beliefs become self-fulfilling prophecies over time, which stops you from taking the inspired action you need to make money.

Common beliefs that hold people back when it comes to money

Some common beliefs that hold people back are:

- “It’s hard to get money.” This belief makes you think that money is hard to come by and makes you plan your finances based on fear.

- “I don’t deserve to be rich.” If you think you’re not good enough, you might miss out on chances that could make you rich.

- “People who are rich are greedy or dishonest.” This bad stereotype can keep you from wanting to be rich without you even knowing it, which can cause problems inside yourself.

- “I won’t ever be able to handle a lot of money.” This way of thinking keeps you stuck in a cycle of self-sabotage, where you don’t plan well enough for financial success.

Ways to Spot and Fight Limiting Beliefs

- Being aware of yourself:

- Start by thinking about how you first learned about money. What did your family, friends, or society tell you about money?

- Write down any bad thoughts you have about money. Over time, patterns will show what your most limiting beliefs are.

- Change the frame and the picture:

- Use affirmations that make you feel strong instead of negative statements. Instead of saying, “Money is hard to get,” say, “There is a lot of wealth out there, and I can attract it.”

- Say positive things to yourself every day. Say to yourself in front of a mirror, “I deserve to be financially abundant,” or “Every day, I am drawing wealth towards me.”

- Meditation and Work on Your Mindset:

- Do guided meditations that are all about abundance. Visualization exercises can help you change the way you talk to yourself from “not enough” to “plenty.”

- Use mindfulness techniques to notice negative thoughts as they happen and consciously replace them with more positive ones.

- Look for proof:

- Find examples in your own life or in the lives of other people that go against what you believe. Take note of how many people overcome tough situations to become successful.

- Read books, listen to podcasts, or talk to mentors about stories of people who have been successful.

Exercises You Can Do

- Writing in an affirmation journal: Every morning, write down or say a list of positive money affirmations. This practice strengthens a new, empowering story that replaces old, limiting beliefs over time.

- Restructuring the mind: Find a negative thought about money that keeps coming up, write down the opposite (positive) thought, and then repeat the positive thought until it feels natural.

- Questions for Reflection: Think about this: “What is one piece of evidence that goes against the idea that I’ll never be able to handle large amounts of money?” Write down your answer and think about it every week.

You can free yourself from the chains that keep you from having more money by changing the way you think about money. It takes time and consistent effort to change these beliefs, but each small change in how you think about money sets the stage for better financial decisions and a real sense of worthiness, which is necessary for attracting wealth.

5. Step 3: Learn to think about gratitude and abundance.

Being thankful can change your life and help you get rich. When you consciously value the things and chances that are already in your life, you make room for even more. When you think about abundance, you stop thinking about what you don’t have and start thinking about what you do have and what is yet to come.

How Being Thankful Can Help You Get Rich

- Changing Focus: Gratitude helps you see how much you have right now, even if it seems like a little. This change in focus naturally makes a positive feedback loop, where being grateful leads to even more chances.

- Increasing Energy: Being thankful sends out good energy that can not only make you feel better, but it can also help you make better financial decisions. Positive energy draws in chances and encourages creative thought.

- Changing the connections in the brain: Studies have shown that practicing gratitude on a regular basis can change the way your brain works so that it focuses on good things and abundance. This can lower stress and make you more able to deal with problems.

Practices of Gratitude Every Day

- Writing in a gratitude journal:

- Every day, write down three things about your money that make you happy. These could be things like a steady paycheck, an unexpected bonus, or even a small savings goal you’ve reached.

- Think about how these blessings help you get closer to your bigger goal of having a lot of money.

- Daily Affirmations: Start your day with affirmations that show how much you value money. For instance, “I am thankful for the abundance in my life and welcome more wealth every day.”

- Mindful Moments: Take a few minutes each day to think about how much you have. Picture not just what you want to do, but also what you already have.

- Sharing Thanks: Talk to someone you trust about the good things in your life. Sharing your thanks with others can often make it stronger and help you keep an abundance mindset.

The Strength of Abundance Mindset

Having an abundance mindset doesn’t mean ignoring problems; it means knowing that there are always options, even when things are tough. When you think about having a lot:

- Chances arise: You are more willing to take risks, whether it’s a new business idea or a side job that could bring in extra money.

- Grows in confidence: Thinking about abundance instead of lack and fear boosts your confidence because it focuses on growth and potential.

- Resilience Grows: If you appreciate what you have, you are less likely to let setbacks get in your way. Every time you fail, you have a chance to learn and get better.

Exercises that help you be grateful

- Walk of Thanks: Every day, go for a walk and think about the things you’re thankful for, like the beauty of nature or the chances you see around you.

- Affirmations for Your Vision: Make a list of things you are thankful for that also fit with your vision. “I am thankful for my financial journey, and each step brings me closer to having a lot of money.”

- Jar of Thanks: Keep a jar where you can put notes about your daily financial successes, big and small. Reading these notes over time can help you feel more abundant and accomplished.

You can make a good place for wealth to grow by developing a mindset of gratitude and abundance. Being grateful can help you get over the mindset of scarcity, which not only changes how you think but also starts the actions that bring in money.

6. Step 4: Take action that is inspired and consistent

You can’t just think about getting rich; you have to take action to make your dreams come true. You can speed up your path to financial freedom by combining a strong, wealth-attracting mindset with consistent, inspired action. This step is about making the connection between thought and action.

Why taking action that is inspired is important

- Making ideas real: A great idea without action stays just that: an idea. Inspired action turns thoughts into real results.

- Making things happen: Every little thing you do, even if it seems small, adds up over time to make a wave of energy that pushes you forward.

- Getting over procrastination: Doing things on a regular basis helps you get over fear and put things off. When you actively work toward your goals, setbacks are just bumps in the road instead of dead ends.

How to Find and Act on Inspiration

- Make your tasks clear:

- Split your big money goals into daily, weekly, and monthly tasks. Set a monthly goal for how much you want to invest if you want to do it on a regular basis.

- Use planners, digital calendars, or productivity apps to plan and keep track of what you do.

- Put the most important actions first:

- Figure out which actions have the most effect on your money and do those first.

- Find the actions that give you the most rewards using the Pareto principle (80/20 rule).

- Get over your fear of failing:

- Understand that making mistakes is a normal part of learning. Every problem is a chance to improve your plan.

- Don’t just celebrate your results; celebrate your efforts too.

- Be responsible:

- Tell a trusted friend or mentor about your goals so they can help you stay on track.

- Get involved in a mastermind group or accountability circle that is all about making money.

Strategies that work to keep things consistent

- Make a list of things to do every day: Write down the one to three most important things you need to do every day to get closer to your financial goals. Put them in order of importance and check them off as you go.

- Check on how far you’ve come: Take some time at the end of each week to think about what you did and what problems you ran into. Change your plan based on this thought.

- Mindful Time Blocking: Set aside certain times each day just for planning your finances, doing research, or learning. This habit helps you develop a mindset of abundance.

Getting over procrastination and laziness

- Begin Small: If you feel like a big financial project is too much for you, break it down into small, doable steps. The hardest but most important part is often taking that first small step.

- Make small goals: Set small goals that you can start working on right away. Even a small win, like going over your bills for 10 minutes, can boost your confidence and help you reach bigger goals.

- Think about your “why”: Keep reminding yourself of why you are on this journey. Remembering your long-term goals can help you get through daily problems and short-term setbacks.

The difference between a wealth-attracting mindset and real financial success is taking consistent, inspired action. Every step you take, no matter how small, brings you closer to your dreams when you commit to doing measurable things every day.

7. Step 5: Learn from your mistakes and become stronger.

There are always problems on the way to getting rich. Resilience is what helps you get back on your feet after a setback or failure. To build resilience, you need to learn to see problems as lessons and chances to grow a lot.

Why Resilience Is Important for Building Wealth

- Believing in the Process: It’s not always easy to make money. Knowing that setbacks are a normal part of the journey can help you keep your perspective and keep going.

- Learning and Changing: Every failure or mistake gives you useful information that you can use to improve your plans and avoid making the same mistakes again in the future.

- Keeping up your motivation: When you become more resilient, you are less likely to let temporary problems get in your way. You see them as stepping stones instead of roadblocks.

Ways to Build Resilience

- Change how you think about setbacks:

- Instead of focusing on your mistakes, ask yourself, “What did I learn from this?”

- Write down your thoughts after each setback to figure out how it can help you move forward.

- Keep a Growth Mindset:

- See problems as chances to learn and get better.

- Use affirmations like “Every challenge is a chance to get stronger and smarter.”

- Build a network of people who will help you:

- Be around people who motivate you to get through tough times.

- Find mentors or groups where you can talk about your failures and celebrate your successes.

Exercises that you can do to build resilience

- Analysis of Setbacks: When things don’t go your way, take 15 minutes to think about what went wrong and make a plan to fix the problems that caused it.

- Journal of Resilience: Write in a journal every day or week about the problems you faced and how you solved them. This is a reminder of how strong you are and how much you can grow.

- Making a picture: Take a few minutes to picture yourself getting past problems and reaching your financial goals. This mental practice helps you get better at overcoming problems.

Staying motivated when things get tough

- Celebrate Recovery: Recognize and celebrate every time you learn something from a setback. This recognition makes you stronger emotionally.

- Look back at what worked in the past: When things get tough, think about how you handled them in the past. Think about how far you’ve come and the problems you’ve already solved.

- Learning all the time: Spend time on your own growth. Listen to podcasts, read books, or go to seminars that talk about how to be strong and get through hard times.

Building resilience doesn’t mean ignoring how hard setbacks are; it means getting stronger mentally so you can learn from them, change, and keep going. Every time you get through a challenge, you strengthen your ability to attract wealth and prepare yourself to deal with future problems with grace and determination.

8. Extra Tips: Daily Habits to Help You Think Like a Rich Person

In addition to the five main steps, doing things every day that help you think about attracting wealth can speed up your path to financial abundance. These small, regular rituals help you get your thoughts, feelings, and actions in line with your vision of wealth.

Daily Rituals That Work

- Writing in a journal: Every day, write for 10 to 15 minutes about your financial goals, the progress you’ve made, and any new ideas you’ve come up with. A gratitude journal that recognizes even the smallest financial wins can help you feel more positive and focused.

- Affirmations every day: Start your day with affirmations like “I attract wealth and abundance with every thought and action” or “My financial potential is limitless.” Saying these things over and over again helps you stay positive.

- Learning and Reading: Spend at least 15 minutes every day reading financial news, books on personal growth, or listening to a podcast about building wealth. Learning new things all the time keeps your mind sharp and full of life.

- Meditation or mindfulness: To clear your mind and focus your thoughts, try mindfulness or meditation. This practice helps you stay calm and clear-headed, which lets you make financial decisions with a clear mind and without stress.

- Good Effects: Be around people and media that make you feel good and inspire you. Staying in touch with positive people, whether it’s reading success stories, joining a supportive online community, or talking about ideas with people who think like you, helps you develop a wealth mindset.

Doing these things every day will add up over time, strengthening your commitment to a mindset that attracts wealth and keeping you on track with your vision of having a lot of money.

9. The end

To develop a mindset that attracts wealth, you need to go on a journey that begins with clarifying your financial vision, changing your limiting beliefs, practicing gratitude, taking consistent action, and becoming more resilient when things go wrong. These five steps create a complete plan that not only helps you make better financial choices, but also sets you on a path to building wealth that will last.

Every step of this journey helps you break down barriers and see the opportunities that lie ahead. When you get clear, you make a clear path to your dreams. You can remove internal barriers that stop you from moving forward by changing the way you think. Being thankful all the time gives you positive feedback, and taking inspired action every day makes your dreams come true. And finally, being strong means that no setback is the end of your journey; it’s just another step toward growth.

A mindset that attracts money is a strong tool. It changes how you think about money and how you live your life in general. When you think, act, and live in a way that is in line with abundance, problems become chances. It’s time to put these steps into action now. Over time, small, consistent changes will add up to a financially secure future that you deserve.

Today, take charge of your journey. Take a small step to get started. You could write down a few things you’re thankful for about your finances, clarify your financial vision, or challenge a limiting belief. You can create and keep a mindset that naturally draws in money and leads to long-term financial success by being dedicated, thinking about it, and taking action every day.

10. Section for Frequently Asked Questions

1. How long does it take to get a mindset that attracts money?

Getting a mindset that attracts wealth is a process, not a quick fix. For some people, noticeable changes may happen after a few months of regular practice, but deeper changes may take a year or more. The most important thing is to be consistent. Daily affirmations, journaling, and learning new things all add up over time, making lasting changes in how you think about money.

2. What if I have trouble with negative money thoughts?

A lot of people have negative thoughts about money, but they don’t have to stop you. First, figure out what beliefs are holding you back. Then, use cognitive restructuring, reflective journaling, and positive affirmations to change the way you think about those beliefs. A mentor or coach can also help you change the way you think about things by giving you advice and holding you accountable.

3. Can your way of thinking really affect your financial success?

Yes, for sure. Every choice you make is affected by how you think. If you think of yourself as having an abundance mindset, you are more open to new opportunities, better at dealing with setbacks, and more likely to take action on a regular basis. Changes in your money mindset that are positive have been linked to better financial planning, smarter investments, and better overall financial behavior. This shows that what you believe inside affects how well you do outside.

4. How do I keep going on my path to wealth?

Setting clear goals and celebrating small wins along the way can help you stay motivated. Make a vision board, write about your progress in a journal, and connect with other people who share your goals. Regularly thinking about your “why,” doing mindfulness exercises, and reflecting on your goals will help you stay committed and motivated, even when things get tough.

5. What daily habits help you have a good attitude about money?

There are a few daily habits that can help you develop a mindset that attracts wealth:

- Writing in a journal: Every day, write down your financial goals, what you’ve done, and what you’re thankful for.

- Affirmations: Say positive things to yourself about money and success.

- Learning: Spend some time every day reading or listening to things that will help you grow your money.

- Being aware: Meditation or mindfulness can help you relax and focus better.

- Putting positive things around you: Interact with people, groups, and media that encourage and support having a lot of money.

It takes time, effort, and determination to develop a mindset that attracts wealth. Each of these steps is meant to help you change the way you think about money, set clear goals, be thankful, take action every day, and be strong when things get tough. You’re not just learning how to think like a wealthy person by adding these steps and daily habits to your routine. You’re also making a path to long-term financial abundance. Accept the journey, celebrate every small win, and see how your mind changes into a strong magnet for wealth and opportunity.

The way you think about money is the first step to long-term financial success. When you think about abundance, every choice you make brings you closer to a better, more powerful future. You have the ability to make the financial future you want. Start today to develop a mindset that attracts wealth.

Start your journey with confidence, knowing that every step you take will bring you closer to the wealth you deserve. Now is the time to rewrite your wealth story in your mind.