The type of 401(k) you choose can have a big impact on how much money you save for retirement. If you’re just starting out in your career or are well on your way to retirement, knowing the differences between Traditional and Roth 401(k) plans can help you get the most tax benefits and plan for a safe future. In this full guide, we will use simple analogies, examples, charts, and useful tips to show you the five main differences between these two types of retirement accounts. After you read this article, you will be better able to make a smart choice based on how much money you make, where you are in your career, and what you want to do when you retire.

1. Starting

Imagine this: you go to the grocery store with two coupons that will save you money. One coupon lets you save money at the register right now, which means your bill is lower today. You can also get the discount after you’ve picked out everything you need and are done shopping. But in the end, your total bill is lower and you don’t have to pay any extra tax. This is like having to pick between a Roth 401(k) and a Traditional 401(k). Each plan has its own pros and cons, depending on whether you want tax relief now or tax-free income in retirement.

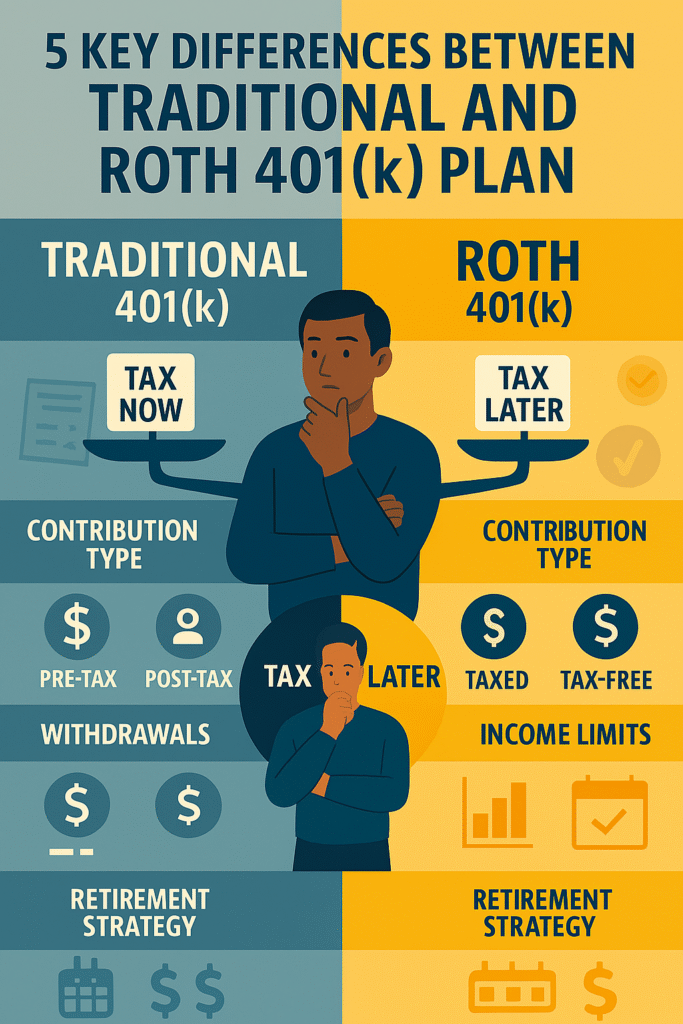

Your employer pays for a 401(k), which is a retirement savings account. It lets you save money for retirement and pay less in taxes at the same time. There are two main types: Roth and Traditional. When you put money into a Traditional 401(k), you do it before taxes, which lowers your taxable income right away. But when you retire, you will have to pay taxes on any money you take out. On the other hand, money that has already been taxed goes into a Roth 401(k). You won’t get a tax break right away, but when you retire, you can take money out without paying taxes on it.

It’s strange that so many people don’t fully get these important differences. This can make them make bad choices that could cost them thousands of dollars when they retire. This article will talk about five big differences between Traditional and Roth 401(k) plans:

- How taxes work on contributions and withdrawals

- Limits on who can get it and how much they can make

- Required Minimum Distributions (RMDs)

- How it will affect your next paycheck

- Rules and freedom for taking money out

The information in each section is meant to be easy for beginners to understand, but it also has enough for people who have been saving for retirement for a while. Let’s start our trip through the world of 401(k) planning and help you pick the plan or plans that will work best for you.

2. A Comparison of a Traditional 401(k) and a Roth 401(k)

Before we talk about the main differences, it’s important to know what each type of plan is.

What is a plan for a Traditional 401(k)?

When you put money into a Traditional 401(k), it comes from your paycheck before taxes are taken out. This means:

- Tax Benefits Now: The money you put in lowers your taxable income, which can help lower your current tax bill.

- Tax Withdrawals Later: You will have to pay taxes on the money you take out when you retire, just like you would on regular income.

What is a Roth 401(k)?

In a Roth 401(k), the opposite is true:

- Taxed Upfront: You put money into the account that has already been taxed, so it doesn’t lower your taxable income right now.

- No Taxes on Withdrawals: If you meet the requirements (usually being 59½ years old and having the account for at least five years), you can take money out of your account without paying taxes in retirement.

A chart that shows things side by side

| Feature | Traditional 401(k) | Roth 401(k) |

|---|---|---|

| Tax Treatment on Contribution | Pre-tax: lowers taxable income right away | After-tax: no tax break right away |

| Tax Treatment on Withdrawals | In retirement, they are taxed like regular income | If you meet the age 59½ and 5-year rule, they are tax-free |

| Income Limits for Contributions | There are no income limits for contributions | There are no income limits (unlike Roth IRAs) |

| Contributions from the employer | Always made before taxes | The employer match goes into a Traditional account |

| Required Minimum Distributions (RMDs) | RMDs start at the required age (73/75)* and stay in effect until the money is rolled over to a Roth IRA. | After 2024, new rules may lower RMDs. |

*Note: The law and the year you were born may change the age at which you must take RMDs.

Keep in mind that many employers offer both options, and in some cases, you can contribute to both. This flexibility lets you tailor your retirement savings plan to your own career goals and tax situation.

3. The first big difference is how taxes are applied to deposits and withdrawals.

One of the main differences between a Traditional 401(k) and a Roth 401(k) is how they handle taxes when you put money in or take money out.

Contributions to a traditional 401(k) are not taxed, but withdrawals are.

You put money into a Traditional 401(k) before taxes are taken out. This means that the contribution comes out of your gross income, which lowers your taxable income when you make the contribution. If you make $50,000 a year and put $6,000 into your Traditional 401(k), your taxable income for that year drops to $44,000. The first benefit is a lower tax bill.

But when you take the money out in retirement, you have to pay regular income tax on both the money you put in and the money you make from investments. This deferred taxation might help you if you think you will be in a lower tax bracket when you retire, but it is not guaranteed.

You can put money into a Roth 401(k) after taxes and take it out without paying taxes.

The money you put into a Roth 401(k), on the other hand, has already been taxed. This means that you won’t get a tax break when you make the contribution. But the best part comes later: you can take money out of your account without paying taxes when you retire. If you’ve already paid taxes on the money, you won’t have to pay them again, no matter how much it grows.

A Real-Life Example to Show the Difference

Alex and Jamie each put $6,000 a year into their 401(k) plans for 30 years. Let’s say they both have $500,000 in their accounts when they retire and earn about the same amount of interest.

- Alex’s Traditional 401(k):

- Contributions: $6,000 a year for 30 years

- The amount you have when you retire is $500,000.

- If Alex takes out the money and is in the 25% tax bracket, he will have to pay $125,000 in taxes, which will leave him with about $375,000.

- Jamie’s Roth 401(k) is an example of this:

- Payments: $6,000 a year for 30 years

- You will have $500,000 left when you retire.

- Jamie gets to keep the whole $500,000 because she doesn’t have to pay taxes on her withdrawals.

Short-term vs. long-term benefits

- Short-Term Benefit (Traditional 401(k)): You can lower your yearly tax bill right away, which is great if you’re in a high tax bracket right now.

- Roth 401(k) for the Future: You pay taxes up front, but after that, your money grows tax-free. This can be very helpful if you think you’ll be in the same or a higher tax bracket when you retire, or if you think tax rates will go up overall.

Considering your current and future tax brackets

One important thing to think about is whether you think your tax rate will go up or down when you stop working. If you think you’ll be in a lower tax bracket when you retire, a Traditional 401(k) might be a better choice for you. You get a break right away and pay taxes later at a lower rate. A Roth 401(k) might save you more money in the long run, though, if you think that tax rates will go up or that your tax situation will stay the same (or even get worse) when you retire.

Visual Comparison: How it affects taxes and income

Picture a simple graph that shows

- X-Axis: Time (Years of Giving)

- Y-Axis: Account Balance (Value Before and After Taxes)

The tax on your Traditional 401(k) goes down when you retire. The growth of a Roth 401(k) is tax-free. The picture shows that a Roth 401(k) can have a much higher net retirement value, even if the growth is the same, as long as taxes are high in retirement.

How to handle this difference:

- Find out what tax bracket you’ll be in in the future: You can use online tax calculators to find out what your future tax bracket will be based on your current income, how much you expect it to grow, and your plans for retirement. Think about the good and bad things about tax deductions now and tax-free withdrawals later.

- Figure it out: Many online tools and financial advisors let you look at things side by side. Fill out the form to find out which type of 401(k)—Traditional or Roth—would be better for your retirement savings over the next 30 years.

- Consider a combination approach: Putting some of your money into both a Traditional and a Roth account can help protect you from not knowing what your taxes will be in the future.

When deciding which type of 401(k) plan is best for your finances, the most important thing to think about is how they are taxed differently.

4. Key Difference #2: Income limits

A common question about putting money into retirement accounts is whether there are limits on how much money you can make. This is one way that the rules for Traditional and Roth 401(k) plans are different from the rules for Individual Retirement Accounts (IRAs) that most people don’t know about.

Limits on income for traditional 401(k) plans

You can put as much money as you want into a Traditional 401(k). No matter how much you make, you can put money into your 401(k) up to the limits set by the IRS. This feature is especially useful for people who make a lot of money and may already be putting the most they can into their retirement accounts.

There are no income limits for a Roth 401(k).

There are income limits on who can contribute to a Roth IRA, but there are no income limits on who can contribute to a Roth 401(k). The Roth 401(k) is especially appealing to people with higher incomes who want to be able to take tax-free withdrawals in retirement but can’t put money directly into a Roth IRA.

Making things clear

A lot of people get the income limits for Roth IRAs and Roth 401(k) accounts mixed up. But Roth 401(k) plans don’t have income limits, so people with high incomes can still get the Roth tax treatment no matter how much they make.

Why This Matters

If you make a lot of money, you should think about this option because there are no income limits on Roth 401(k) contributions. It lets you customize your retirement portfolio more easily because it doesn’t have the limits that usually make it harder to invest in a Roth IRA.

A chart of income limits to help you see them

| Type of Plan | Income Limit for Contributions | How High Earners Contribute |

|---|---|---|

| Traditional 401(k) | None | You can put in as much money as you want, no matter how much you make. |

| Roth IRA | Yes (phases out at higher incomes) | High earners may be limited |

| Roth 401(k) | None | People who make a lot of money can put in the full amount. |

Helpful Hints

- For People Who Have a Lot of Money: No matter how much money you make, you can still get a Roth 401(k) if you want to use a Roth structure for its tax-free benefits in the future.

- Go over the plans you have: Check with your boss to see if they have both types. You might want to put money into a Roth 401(k) in addition to your traditional IRA if you already have one.

- Make a plan: Use the Roth 401(k)’s flexibility to lower your taxes when you retire. You might want to split your contributions even if you’ve already put all of your money into a Traditional 401(k). This way, you can take advantage of both tax-free withdrawals and tax-deferral.

A lot of workers like the Roth 401(k) because it doesn’t have any income limits. This is especially true for people who have a lot of money.

5. The third most important difference is Required Minimum Distributions (RMDs).

The rules for Required Minimum Distributions (RMDs) are another big difference between Roth and Traditional 401(k) plans. RMDs tell you when and how much money you need to take out of your retirement account when you turn a certain age.

401(k)s and RMDs that are normal

When you turn a certain age, you will have to take RMDs from your Traditional 401(k). Most people start taking RMDs at age 73, but some people may have to wait until age 75, depending on when they were born and changes in the law. This means that you have to start taking money out by that age, and the money you take out will be taxed like regular income.

Roth 401(k) accounts and the minimum distributions they must make

The rules for Roth 401(k)s are now different. Roth accounts used to have to follow the same RMD rules as Traditional 401(k)s. But starting in 2024, people who have Roth 401(k)s will have more choices. However, this could change if new laws are passed. One way to avoid RMDs while the account owner is still alive is to move money from a Roth 401(k) to a Roth IRA. This will let your money grow tax-free for a longer time because you won’t have to take required distributions.

A Possible Scenario

Let’s say Maria is an investor who has put a lot of money into her Roth 401(k). Maria is getting close to retirement and doesn’t want to have to take money out of her account because that could mess up her tax planning. Maria can avoid RMDs by moving her Roth 401(k) to a Roth IRA. This will let her grow her money without paying taxes on it and give her more control over when and how much she takes out of her retirement accounts.

RMD Comparison Table

| Type of Plan | RMD Requirement | Strategy to Avoid RMDs |

|---|---|---|

| Traditional 401(k) | You have to start taking required minimum distributions (RMDs) at age 73 (or 75, depending on the law). | Not applicable—withdrawals are required |

| Roth 401(k) | You have to take RMDs if you keep your money in a Roth 401(k). | If you don’t want to pay RMDs, move your money to a Roth IRA. |

Helpful Tips

- Plan ahead: As you get closer to retirement, take a look at your RMD options. If you have a Roth 401(k), you might want to think about whether rolling it over into a Roth IRA is a good idea for your overall financial plan.

- Get in touch with a financial advisor: RMD rules can be hard to understand, and they can change. You can get help from a financial advisor to figure out how to follow these rules and make a plan that works for you.

- Regularly check for changes to the law: Changes to tax laws that affect RMDs for both Traditional and Roth accounts could have an effect on your long-term plans, so stay up to date on them.

When planning for the long term, it’s important to know what RMDs are. You can have more money working for you in retirement if you do your RMDs right or even skip them (if you do a Roth rollover).

6. Key Difference #4: What it does to your current paycheck

The type of 401(k) you choose, whether it’s a Traditional or Roth, will affect your taxes in the future and how much money you take home right now.

Current Paycheck and Traditional 401(k)

Contributions to a Traditional 401(k) are made before taxes, so they lower your taxable income for the year. This means:

- Lower Taxable Income: Putting money into a Traditional 401(k) lowers the amount of money that is currently taxed.

- More Money in Your Paycheck Right Away: You get more money in your paycheck because you pay less in taxes. This is because your taxable income is lower.

If you put $500 a month into a Traditional 401(k), for example, your taxable income goes down, and your take-home pay may be a lot higher than if you had put money into a Roth 401(k).

Your Current Paycheck and a Roth 401(k)

After taxes are taken out, you put money into a Roth 401(k). This means

- No Immediate Tax Benefit: You still have to pay taxes on your income, so your take-home pay is a little lower because you’re giving money that has already been taxed.

- Future tax savings: Your current paycheck may be smaller, but qualified withdrawals in retirement are tax-free, which can be a big benefit over time.

A picture that shows how payroll changes things

Take a look at two pay stubs next to each other:

| Scenario | Type of Contribution | Amount of Contribution | Effect on Taxable Income | Effect on Take-Home Pay |

|---|---|---|---|---|

| Employee A | Traditional 401(k) | $500/month | Lowers taxable income by $500 | Take-home pay goes up because of a lower tax bill |

| Employee B | Roth 401(k) | $500/month | No reduction in taxable income | Lower take-home pay, but tax-free withdrawals later |

Things to think about at every stage of your career

- Younger workers: Younger workers might pick a Roth 401(k) because they pay less in taxes now and the tax-free growth later might be worth the small amount of money they give up now.

- People who make more money or are getting closer to retirement: People who pay a lot of taxes or are about to retire might find that putting money into a Traditional 401(k) helps them with their taxes right away. This might be a good way for them to make more money and improve their cash flow.

Things you can do

- Check your budget: Look at what you need right now financially. A Roth 401(k) might be worth it if you don’t mind having a little less money in your pocket now and then. You can take money out of it without paying taxes in the future.

- Use online calculators: There are many calculators you can use to see how different contribution choices will change your monthly pay. You can use these tools to see how adding money to a Traditional or Roth 401(k) will affect your budget.

- Take another look at it over time: Things might not stay the same for you. As your income goes up or you get closer to retirement, you may want to change how much you give to better fit your changing tax situation.

If you know how your current contributions affect your take-home pay, you can decide whether to save money on taxes right away or wait until you can take money out without paying taxes.

7. Key Difference #5: There are rules and options for withdrawals.

The rules for taking money out of a 401(k) plan depend on whether it is a Traditional or Roth plan. These differences can make it harder to get cash when you need it, even in an emergency.

How to take money out of a Traditional 401(k)

- Fine for Taking Money Out Early: If you take money out of a Traditional 401(k) before you turn 59½, you usually have to pay a 10% early withdrawal penalty and regular income taxes on the money you took out.

- Taxing Withdrawals: Taxes will be taken out of your retirement account every time you take money out.

- No room for contributions: You can’t get back contributions without paying a fee, no matter what.

Ways to Take Money Out of a Roth 401(k)

- You can get to your contributions without paying a fee: You can take out your contributions (the money you put in) from a Roth 401(k) at any time, no matter how old you are, and you won’t have to pay taxes or fees. But there are rules about how the money you put in can grow.

- Tax-Free Qualified Withdrawals: You can’t take money out of the account without paying taxes until you are at least 59 and a half years old and have had the account for at least five years. This is known as the five-year rule.

- Getting paid ahead of time: If you take money out before you meet the requirements, you might have to pay taxes and a 10% penalty.

Example Case

Mark is an investor who needs to get money at 55 because he has an unexpected bill. Mark would have to pay regular income tax on any money he took out of a Traditional 401(k). He would also have to pay a 10% penalty. Mark can, on the other hand, take the money out of his Roth 401(k) without having to pay taxes or fees. But if he takes the money out early, he will have to pay taxes on the money he made.

Visual Aid: A table showing how flexible withdrawals are

| Feature | Traditional 401(k) | Roth 401(k) |

|---|---|---|

| Early Withdrawal Penalty | If you take money out before age 59½, you have to pay a 10% penalty and income tax. | You can take out contributions without penalty or tax, but if you don’t qualify, you have to pay a penalty and tax on your earnings. |

| Qualified Withdrawal | Taxable as regular income | Tax-free if the 5-year rule is met |

| Accessibility of Contributions | Contributions are not accessible without penalty | Contributions are always accessible tax-free |

Things to Think About

- Space for emergencies: You have some financial freedom because you can take out your own contributions from a Roth 401(k) without paying a penalty. But be careful; these are savings for retirement.

- The Five-Year Rule: Remember that you have to wait five years before you can take money out of a Roth 401(k) without paying taxes. If you want to retire early, this rule will change your mind.

Helpful Tips

- Plan your withdrawals ahead of time: Learn the rules and penalties for taking money out early so you don’t have to pay extra fees.

- Write down what you give: Keep a record of how much you’ve put in and how much you’ve made. If you need to use your contributions early, this can help.

- Be smart about withdrawals: A Roth 401(k) might give you more options if you think you’ll need money before you retire.

When making decisions, it’s important to think about the rules for withdrawals, especially if your retirement plans include plans for emergencies or early retirement.

8. When to Choose a Traditional or a Roth (A Guide to Making Choices)

You should think about your current financial situation, your plans for the future, and your overall retirement goals when deciding between a Traditional and Roth 401(k). Here is a guide to help you choose the best option for you.

Things to keep in mind for new investors

- Roth Might Be More Interesting:

- Lower Current Income: Younger workers usually pay less in taxes, so it doesn’t hurt as much to pay taxes on contributions now.

- Growth Without Taxes: Since your investments have decades to grow, it can be very helpful to be able to take money out of them without having to pay taxes in retirement.

Things to think about if you’re getting close to retirement

- Traditional Might Be Better:

- High Current Income: If you’re in a high tax bracket right now and think you’ll drop into a lower one when you retire, a Traditional 401(k) might be better for you because it lets you take money out right away.

- Immediate Tax Relief: Lowering your taxable income right now could help you save money when every dollar counts.

Thinking about what tax rates will be in the future

- If you think that tax rates will go up:

- The Roth 401(k) could be a good idea because it locks in the current tax rate and lets you take money out tax-free later. This protects you from having to pay more taxes in the future.

- If you believe your taxes will be lower when you stop working:

- If you don’t pay taxes on a traditional 401(k) until you take money out in retirement, you may end up paying less tax overall.

A Flowchart/Checklist to Help You Make Decisions

- Step 1: Check your current income tax bracket

- If your tax bracket is lower right now, choose Roth.

- If you make more money, Traditional might help you pay less in taxes right now.

- Step 2: Find out how much money you’ll make and how much you’ll have to pay in taxes in the future.

- Think about whether you want to save, spend, or see big changes in your income after you retire.

- Step 3: Decide what you want to do when you stop working.

- Do you want to be able to take money out without paying taxes (Roth) or do you want to get a tax break right away (Traditional)?

- Step 4: Consider dividing your contributions

- If you’re not sure, a mix of both can help you save money on taxes and give you more choices for retirement.

Real-World Use Cases

- First example: Emily is 28 years old and is just starting her career. She believes that her income will rise significantly. She picks the Roth 401(k) because she is in a low tax bracket right now and her money can grow tax-free for the next 40 years.

- Example 2: John is 50 years old, has a lot of money, and is about to retire. He picks the Traditional 401(k) because it lowers his taxes right away and he thinks his tax rate will be lower when he retires.

Helpful Tips

- Make your own guesses: In both cases, use retirement calculators to find out how much your accounts will be worth in the future.

- Talk to Experts: A financial advisor can help you figure out what the best choice is for your own finances.

- Be open-minded: Remember that you can change your plan as you go along. A lot of experts say to split your contributions if you’re still not sure.

This guide can help you pick the plan that works best for you by taking into account your current tax situation, your retirement goals, and what you expect to happen in the future.

9. Can you give to both?

The good news is that many employers let you put money into both a Roth 401(k) and a Traditional 401(k). This is called tax diversification, and it protects you from changes in taxes that may happen in the future.

How It Works

- Limits on contributions that are combined: The IRS says that you can only give a certain amount of money each year. This limit applies to all of your contributions to both accounts. For example, if you are under 50 in 2025, the limit could be $23,000.

- Tips for giving out: You might want to put 70% of your money into a Traditional 401(k) and 30% into a Roth 401(k) depending on your current tax situation and what you think will happen in the future.

- Consider the employer match: No matter what you choose, it’s important to remember that employer matching contributions usually only go into the Traditional 401(k) bucket.

Benefits of a Split Strategy

- Tax Flexibility: If you have both types of accounts, you can choose which ones to take money out of to control your taxable income in retirement.

- Taking care of risk: It keeps you safe from changes in tax laws or your own money situation that you can’t see coming.

- Growth and Deduction that are in balance: Some of your contributions will give you tax breaks right away, and you can also invest in another part for tax-free growth.

Helpful Advice

- Find a Split That Fits Your Needs: Look at what you need now and what you think you’ll need in the future. A good place to start is to try to get a 60/40 or 50/50 split.

- Watch it over time: As your income and taxes change, change how much you put into each account.

- Read your employer’s policy: Find out how your employer handles matching contributions, and then change your plan to get the most out of it.

Putting money into both kinds of accounts is a great way to prepare for the future while also getting tax breaks right away.

10. Frequently Asked Questions and Answers

Even with all the information that is available, there is still a lot of uncertainty. Here are some of the most common questions and mistakes people make about Traditional and Roth 401(k) plans:

“Roth Is Always Better” is a common mistake.

- The truth is: Even though tax-free withdrawals are nice, the Roth 401(k) isn’t always better for everyone than the Traditional 401(k). A Traditional 401(k) might be better for you if you pay a lot of taxes now but expect to pay less in retirement. This is because it gives you a tax break right away.

False belief 2: “The Roth 401(k) is Only for Young People”

- The truth is: Younger people often benefit from the tax-free growth of the Roth, but older investors might also choose to make Roth contributions to spread out their taxes, especially if they think tax rates will go up in the future.

My taxes are higher now, so I can’t afford the Roth.

- The truth is: Putting money into a Roth 401(k) might lower your take-home pay a little bit because you have to pay taxes on it right away. But even small amounts can grow without paying taxes over time. It’s important to strike a balance between the money you need right now and the money you can save on taxes in the future.

4. “I have to stick with a traditional account because my employer doesn’t offer a Roth 401(k).”

- Truth: Some employers may only give you one choice, but a lot of them give you both. Even if you only have one option, you can still plan your retirement well by looking into other accounts, such as an IRA.

Questions and Answers

- What is the simple difference between a Roth 401(k) and a Traditional 401(k)?

- Answer: A Traditional 401(k) lowers your taxable income now, so you won’t have to pay taxes on the money when you take it out. A Roth 401(k) doesn’t lower your taxable income now, but you won’t have to pay taxes on any qualified withdrawals you make in retirement.

- Can I change how much I put into my 401(k) between a Roth and a Traditional?

- Answer: Yes, many plans let you change how much you put into each type as long as you don’t go over the IRS’s overall contribution limit.

- Will the employer match be split between the two if I put money into both?

- Answer: The employer match usually goes into the Traditional 401(k) part, no matter what kind of contribution you make.

- Is one kind of account always better than the other?

- Answer: How well you do will depend on your future tax situation and your own financial goals. It’s a matter of whether you want to pay your taxes now or later.

- How often should I check my 401(k) plan?

- Answer: You should look over your plan at least once a year or whenever something big happens in your life, like getting a raise, changing jobs, or making plans for retirement.

- Can I switch my Traditional 401(k) to a Roth 401(k)?

- Answer: Yes, it is possible to convert through a Roth conversion process, but you will have to pay taxes on the amount that was converted. Talk to a financial advisor about how to change your money.

11. Last Thoughts

Choosing between a Traditional and a Roth 401(k) can be hard because it can have a big effect on how much money you save for retirement. In this article, we talked about the five main ways the two are different:

- How taxes are applied to deposits and withdrawals:

- You can get tax breaks right away with a regular 401(k), but you have to pay taxes on withdrawals.

- You have to pay taxes on the money you put into your Roth 401(k), but you won’t have to pay taxes on the money you take out when you retire.

- Limits on how much money you can make:

- Traditional and Roth 401(k)s do not have income limits, unlike Roth IRAs.

- This gives people who make a lot of money more options for Roth 401(k)s.

- Required Minimum Distributions (RMDs):

- RMDs must start at a certain age for traditional accounts.

- Roth 401(k)s are more flexible and may not have to pay RMDs. You can roll them over to Roth IRAs.

- Effect on Current Pay:

- Contributions that are traditional lower your taxable income right now.

- Roth contributions don’t, which could change your cash flow right now but might be better if your tax rate is low right now.

- Rules and freedom for taking money out:

- Traditional accounts charge taxes and fees for early withdrawals, but Roth accounts let you take out contributions without paying a fee, as long as you meet certain conditions.

Both plans are great ways to get ready for retirement. You should choose based on your current income, your expected future income, your career stage, and your overall retirement goals. Some investors even choose to split their contributions so they can take advantage of both tax situations. Using the right strategy can help you get the most out of your benefits. This will make sure that your retirement savings do a lot of work for you.

Call to Action

Take a look at your 401(k) plan options right now. Ask your HR department or a financial advisor you trust which plan or combination of plans is best for you. Change how much you give based on what you want to achieve and how you think taxes will affect you. If you make smart choices and check your plans often, you’ll be on your way to a safe and tax-efficient retirement.

Learn about these five key differences and then take action to make a retirement savings plan that will help you in the future. There is no one answer to the question of whether a Traditional or Roth 401(k) is better. It all depends on what works best for you right now and in the future. Have fun making plans, and here’s to a retirement with a lot of cash!