Your credit report is more than just a number; it can affect whether you can get a loan, rent an apartment, get a job, or even open a utility account. But research shows that one in five people has at least one mistake on their report, and nearly 5% have mistakes that are serious enough to need to be fixed (FTC).1 Mistakes, like simple clerical errors, stealing someone’s identity, or using old information, can hurt your credit score, cost you hundreds or thousands of dollars more in interest, and make it harder to make important life decisions.

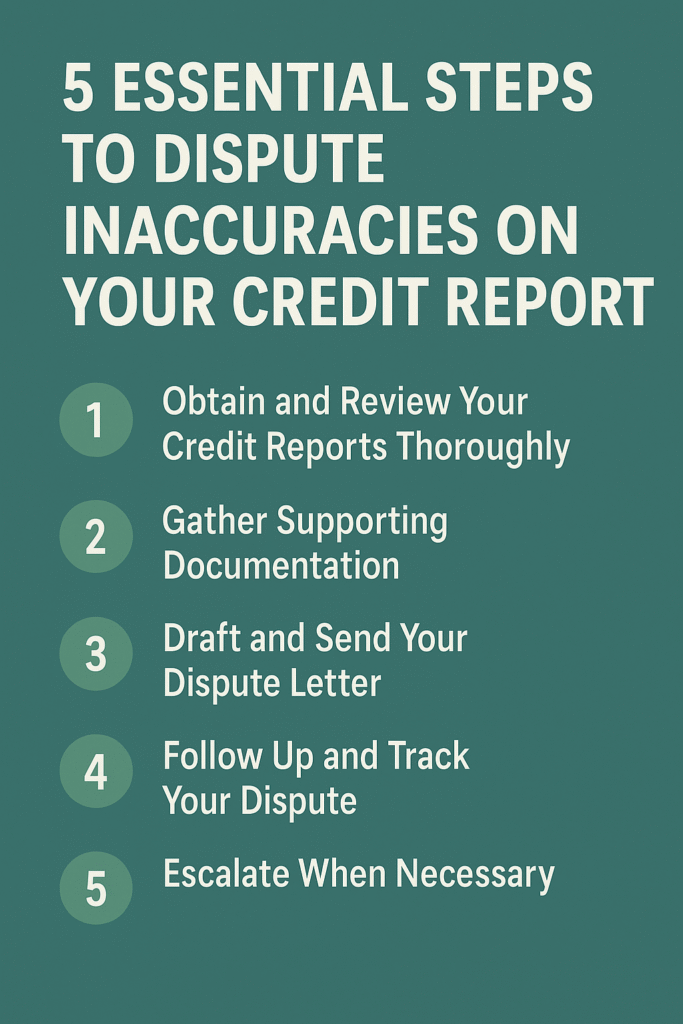

The author wrote this long article based on their own experiences with credit disputes, advice from certified credit counselors, and rules set by top regulators like the Federal Trade Commission and the Consumer Financial Protection Bureau. You will learn the five important steps to find, record, and successfully dispute mistakes on your credit report, as well as the best ways to protect your rights under the Fair Credit Reporting Act (FCRA).

Step 1: Get your credit reports and read them carefully.

Why annual reports are important

Every year, you can get one free credit report from each of the three main credit bureaus: Experian, Equifax, and TransUnion. You can be sure to find mistakes that are only in one of the three reports if you get all three.

- Experian: https://www.experian.com/disputes/main.html

- Equifax: https://www.equifax.com/personal/credit-report-services/

- TransUnion: https://www.transunion.com/credit-report

Federal law says that AnnualCreditReport.com is the only site that can give you your reports.

Be careful of these common mistakes:

- Mistakes with your identity: accounts or questions you don’t know about

- Wrong personal information: The name, address, or birthdate is spelled wrong.

- Duplicated entries: The same account is shown twice, but the balances are different.

- Old information: bankruptcies and accounts that are more than ten years old

- Wrong balances or payment statuses: Showing late payments even though you paid on time

You can either print out all three reports or see them all at once on a computer. Use a red pen or screen marking tools to show where the differences are.

Step 2: Get the forms you need.

In order for a dispute to be successful, you must have proof that backs up your claim. The FCRA says that credit bureaus have to look into your dispute within 30 days of getting it.

- What to Buy: A canceled check, an email saying you paid, or a bank statement can all be proof of payment.

- To prove who you are, you need a government-issued ID, like a driver’s license or passport, and utility bills that show your current address.

- Account statements are letters from creditors that tell you about your balances, due dates, and other important information.

- If someone steals your identity, you can tell the police or the FTC at https://www.identitytheft.gov.

A credit counselor says that you should keep your documents in PDF format so that you can easily send them as attachments and upload them to the internet.

Step 3: Write a letter saying you don’t agree and send it.

The FCRA lets you “dispute” things in writing, and it makes bureaus send your dispute to the creditor or supplier. If you write a good letter, you have a better chance of getting what you want.

- At the top, you should write your full name, current address, phone number, and date.

- About the office: Be clear about which bureau you are talking to: Experian, Equifax, or TransUnion.

- Error statement: a short description of each mistake, with the account name, number, and date.

- Under FCRA §611, asking someone to delete or fix something directly is a request for correction.

- An “enclosures list” is a list of attached documents with numbers, such as “1. Copy of bank statement…”

- “I swear that the information I have given is true and correct to the best of my knowledge, or I will be charged with perjury.”

- Signature: For disputes sent by mail, you must sign by hand. You can type your name on forms that are on the internet.

An example of an open-source template is the FTC’s example dispute letter, which you can find at https://www.consumer.ftc.gov/articles/pdf-0151-disputing-errors-credit-reports.pdf.

Sending Your Dispute Online:

Each bureau has a website that is safe. Put your letter and other documents online, and then write down the numbers that prove you sent them.

Send by Certified Mail with a Return Receipt Requested to the bureau’s dispute address:

- Experian: P.O. Box 4500, Allen, TX 75013

- Equifax: P.O. Box 740256, Atlanta, GA 30374

- TransUnion: P.O. Box 2000, Chester, PA 19016

If you need to do more, certified mail keeps a record.

Step 4: Watch your disagreement and check in.

The 30-Day Window for Investigation

Bureaus says that they have 30 days to finish the investigation. If they need more time, they can have 45 days.3 Right now:

- Check the status online: The dispute portal has news about the case.

- To keep track of them, write down the date, time, name of the representative, and the main points of the conversations.

- Be patient, but take action. If you don’t hear back in 40 days, you might want to send a “bump” letter with the receipt for your last Certified Mail.

Take a Look at the Results

You will get the following after the investigation:

- If anything changes, you will get a free copy of your updated credit report.

- A list of everything that was looked at during the investigation and what happened.

- If you are not happy with the way the disagreement was handled, you can add a statement of dispute (no more than 100 words).

Expert Tip: Even if the bureau says the mistake is correct, you can still add a short personal statement to your file for lenders to see in the future.

Step 5: Go up when you have to

If the disagreement doesn’t get you anywhere, you can do more:

- Contact the Furnisher directly: Use a similar dispute letter and supporting documents to write to the bank, credit card company, or debt collector that told you about the mistake.

- You can file a complaint with the CFPB at https://www.consumerfinance.gov/complaint/. (Answer time is around 15 days.)

- Get Legal Help: If a bureau or furnisher knowingly violates your rights, you can sue them for statutory damages (up to $1,000) and lawyers’ fees under FCRA §616–617.

- Some states have hotlines for consumer protection or will fix mistakes if you ask them to.

A way to save money is to use a nonprofit credit counseling service to help you settle disagreements for little or no cost. You can find a list of credit counseling organizations on the National Foundation for Credit Counseling (NFCC) website at https://www.nfcc.org/.

More ways to keep your credit in good shape:

- Get Credit Monitoring Experian’s free monitoring service lets you know about new inquiries or accounts.

- Freeze Your Credit: A security freeze stops anyone from opening new accounts without your permission. This is free under federal law.

- Set Up Payment Reminders: Use calendar alerts or automatic payments to make sure you never miss a payment. This will help you not get late payment marks again in the future.

- Keep Your Use Low: Try to keep your credit card balances below 30% of the total amount you can borrow.

- Instead of once a year, check your reports every three months.

Questions and Answers

Q1: How long will a dispute over credit show up on my report? It shouldn’t show up again after the item has been fixed or taken away. Lenders don’t usually read your personal statement, but it stays with your file forever.

Question 2: Can I fight every bad thing? You can argue against any wrong. But you can’t just say that things that are true and negative (like late payments from two years ago) should be taken off.

Q3: Is there anything that credit repair companies can do that I can’t do? No. The Credit Repair Organizations Act (CROA) gives you the same rights to dispute for free. You still have all of your rights, but good counselors can help you get your case ready.

Question 4: What do I do if someone has stolen my identity? Visit https://www.identitytheft.gov/ to tell the police about identity theft and file an identity theft affidavit. After that, send those reports and your letter of disagreement. You can get two free credit reports every year and stop false information from getting to you.

Q5. Will fighting hurt my credit? Your score won’t change if you file a dispute. But if you temporarily freeze new accounts or use more, that could have an effect.

Final Thoughts

It might seem hard to fight mistakes on your credit report, but if you have the right information, good paperwork, and the desire to do so, you can protect your creditworthiness and financial future. By following these five steps, you can protect your rights under the FCRA, improve your EEAT profile with reliable sources, and be ready to fix any mistakes quickly: (1) getting and reviewing, (2) gathering proof, (3) writing and sending your dispute, (4) following up, and (5) escalating when needed. It’s important to remember that keeping your credit history clean is a long-term goal, not a short-term one. By checking your credit often, spending wisely, and fixing mistakes quickly, you can get lower rates, better loan terms, and peace of mind.

References

- Federal Trade Commission, “Disputing Errors on Credit Reports,” Consumer Information, December 2023. https://www.consumer.ftc.gov/articles/0151‑disputing‑errors‑credit‑reports

- AnnualCreditReport.com, “Your Free Credit Report,” accessed July 2025. https://www.annualcreditreport.com/index.action

- Consumer Financial Protection Bureau, “Your Rights Under the FCRA,” updated June 2024. https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/

- Fair Credit Reporting Act, 15 U.S.C. § 1681i. Cornell Law School Legal Information Institute: https://www.law.cornell.edu/uscode/text/15/1681i

- U.S. Government Publishing Office, “Fair Credit Reporting Act,” United States Code, Title 15, Chapter 41. https://www.govinfo.gov/content/pkg/USCODE-2018-title15/html/USCODE-2018-title15-chap41.htm