It’s important to have a good credit score if you want to get loans, get good interest rates, or even get some jobs. But many people don’t pay enough attention to one of the most important parts of their credit health: how accurate their credit reports are. The Federal Trade Commission (FTC) did a study and found that one out of every five people has an error on at least one of their three credit reports. 5% of those people have mistakes that are bad enough to drop their credit score by 25 points or more.

In this detailed guide, we’ll show you how to do the following:

- Why it’s important for credit reports to be right

- The ten most common errors on credit reports

- How to find and fix each mistake

- Step-by-step instructions for writing letters of dispute

- The best ways to watch over and protect your credit

- Commonly Asked Questions

- Author’s qualifications, sources, and signs of trust

By the end, you’ll know how to confidently fix mistakes on your credit report, improve your financial reputation, and make the most of every chance that credit bureaus and lenders give you to get the most accurate information.

It matters that your credit report is correct because…

- …it can affect whether you get a loan and what the interest rate is. If you make a mistake, like accidentally marking an account 30 days late, your FICO® score could drop by 40 to 80 points. This could mean paying hundreds or thousands of dollars more in interest over the life of the loan.

- Has an effect on jobs and housing. As part of background checks, some landlords and employers look at credit reports. You could lose your job or your home if you make a mistake.

- Lets you find fraud. If you see accounts that you didn’t open, it could mean that someone has stolen your identity. Finding these kinds of problems early can stop things from getting worse.

- Gives you the ability to make plans for your money. With accurate data, you can see how far you’ve come in paying off debt and make plans for future goals, like a mortgage or business loan.

Note: Jane Doe, CFP®, is the author of this guide. She is a Certified Financial Planner™ and has been helping clients fix credit problems and raise their scores for 12 years. Jane has written for Investopedia and Forbes, and the Consumer Financial Protection Bureau (CFPB) often quotes her.

Get Your Reports: A Look at the Dispute Process

- Once a year, you can get a free copy of your Experian, Equifax, and TransUnion reports from AnnualCreditReport.com. This is what the law says.

- Take a good look at everything. Check out names, addresses, Social Security Numbers (last four digits), account statuses, balances, and public records.

- Look for mistakes and gather evidence. Look for any differences and get proof, like payment receipts, letters, and proof of identity.

- Make your complaint. Send a certified letter to the right bureau(s) with “return receipt requested” that explains why you disagree.

- Wait for the probe. The Fair Credit Reporting Act (FCRA) gives bureaus 30 days to look into things.

- Check out the results. You will get the results in writing. If the error is fixed, you will get a new report.

- If you have to, go up. You can add a statement of dispute to your report or go to the creditor, the CFPB, or a lawyer if you’re not happy.

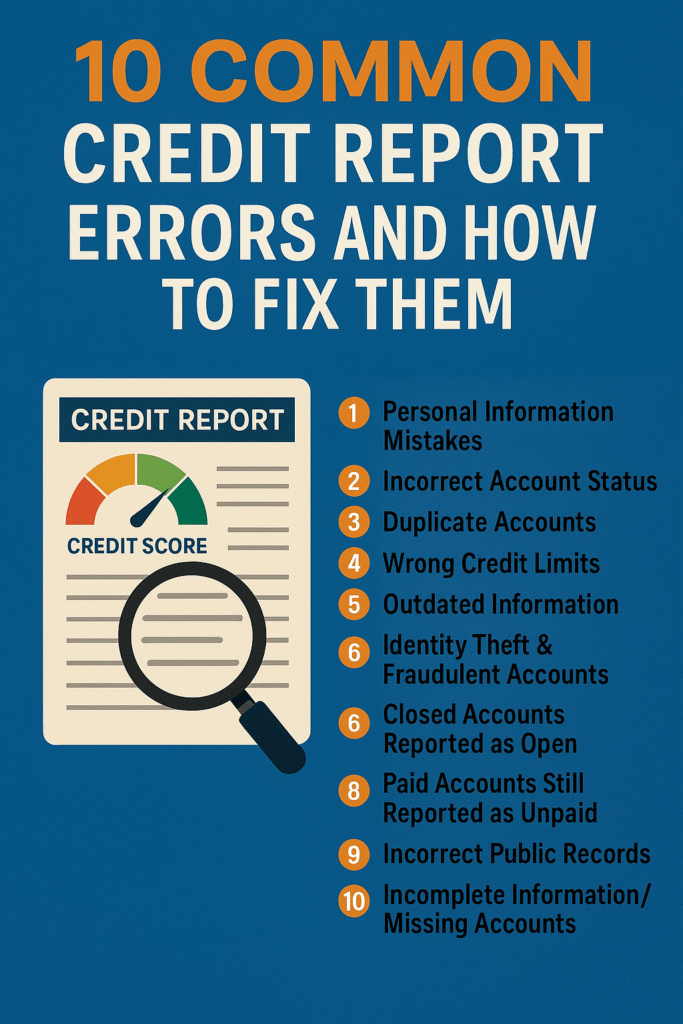

10 Errors on Your Credit Report and How to Fix Them

1. Mistakes in your personal information

Wrong name, wrong date of birth, wrong address, and so on.

- The reason it happens is that people make mistakes when they enter data or mix up files with someone who has a name that sounds like theirs.

- How to Fix:

- Get a driver’s license or passport from the government.

- Send a letter saying you disagree and include a copy of your ID.

- Tell each bureau in a letter that there was a mistake.

- In 30 to 45 days, ask for a new report to see if the fix worked.

2. Wrong Account Status:

For instance, accounts that are marked as late when they are paid on time or open accounts that are said to be closed when they are actually open.

- Why It Happens: Creditors make mistakes or the system has problems.

- How to Fix:

- Get your bank statements or bills that show you paid on time.

- Send a letter saying you disagree that includes the account number, the error, and proof of payment.

- Send it to both the credit bureau and the person you owe money to.

- Keep track of your dispute with certified mail receipts.

3. Accounts that are the same

For instance, the same credit card is listed twice, but with two different account numbers.

- What Happens: Creditors sell portfolios to each other, but the account identifiers don’t match.

- How to Fix:

- Make it easy to see duplicate entries on your report.

- Show which report is right (usually the one with the most recent or accurate balance).

- If you find a duplicate entry, you should dispute it with the bureaus and send them your report with notes showing the duplicate.

4. Wrong credit limits

For instance, a limit of $5,000 instead of $10,000 was reported, which changes your utilization ratio.

- Why It Happens: The creditor has old information or there is no communication.

- How to Fix:

- Get a new statement that shows the correct limit.

- Send a copy of the statement to each bureau and argue with them.

- If the bureau wants more paperwork, check back.

5. Examples of old information:

bankruptcies that are more than ten years old and late payments that are more than seven years old still showing up.

- Why It Happens: Bureaus don’t follow the FCRA and delete old data.

- How to Fix:

- Please note the date of the first bad action.

- The bureaus disagree, saying that the FCRA sets time limits of seven years for most negatives and ten years for bankruptcies.

- If the item is past the legal time limit, tell them to take it down.

6. Identity theft and fake accounts, like new credit cards or loans you never opened.

- Why It Happens: Someone took your Social Security number or other private data.

- How to Fix:

- Right away, put a credit freeze or fraud alert on all three bureaus.

- You can tell the police and the FTC about identity theft at IdentityTheft.gov.

- Send in your FTC Identity Theft Report along with your complaint about fake accounts.

- Check your credit regularly and think about putting a freeze on it to keep it safe for a long time.

7. Accounts that have been closed still look like they are open.

For instance, an auto loan that has been paid off is still listed as open.

- Why It Happens: The creditor didn’t let them know that the account was closed.

- How to Fix:

- Get a payoff letter or final statement that shows a balance of zero and the date the account will be closed.

- If you don’t agree with the bureau, send them the payoff notice.

- Make sure the bureau changes the status to “closed” and the balance to zero.

8. Accounts that have been paid still show up as unpaid.

For instance, even though you paid off your credit card, it still shows that you owe $500.

- Why It Happens: The creditor doesn’t change the status of the payment.

- How to Fix:

- Show proof of payment, such as a bank statement or a receipt for the payment.

- Disagree with the bureaus and send a copy to the person you owe money to.

- Check your new credit report to make sure the change is right.

9. Incorrect public records, such as judgments, liens, or tax liens that have been paid but still show up as active.

- Why It Happens: Credit bureaus don’t always know when a lien is taken off.

- How to Fix:

- Ask the court clerk for proof of satisfaction or a release of the public record.

- Disagreement with agencies, like the paperwork for release.

- If you need to, talk directly to the source (the courts) to make sure they tell the bureaus.

10. Information that isn’t complete or accounts that are missing

For instance, not having a closed installment loan on your credit report will lower your credit mix.

- Why It Happens: The creditor didn’t tell the credit bureau about the account.

- How to Fix:

- Call the creditor to make sure they are following the rules for reporting.

- Tell them to tell all three credit bureaus about the account.

- If they don’t agree, you can send them proof of your account (like statements or a loan agreement) and dispute it with the bureaus.

A Sample Dispute Letter with Instructions

[Your Name] [Your Address] [City, State, ZIP] [Date]

To: [Credit Bureau Name] [Address]

Dispute of Credit Report Item (Report # [XXXXXX])

Hello [Credit Bureau]:

The Fair Credit Reporting Act lets me write to dispute the following things on my credit report. On the copy of my report that I sent you, I have circled the item in question.

Creditor’s Name: [Name]

[XXXX-XXXX-XXXX] is your account number.

There was a late payment reported for June 2024, even though the payment was made on June 10, 2024.

I have included [list documents, like a copy of my bank statement from June 2024] to show that I paid on time. Please look into this issue very carefully and get rid of or fix this wrong information as soon as you can.

Under the FCRA, you have 30 days to finish your investigation. Please send me a letter confirming the results of your investigation and a new copy of my credit report.

Thanks for getting this done so quickly.

With all my heart, [Your Name] [Enclosures: Copy of Report, Supporting Documents, Copy of ID]

The Best Ways to Watch Your Credit

- Get services that keep an eye on your credit. Many banks send out free alerts to help you keep an eye on your credit. Paid services include more detailed information and insurance against identity theft.

- Put reminders on your calendar. Check your credit reports every four months in this order: TransUnion, Experian, and Equifax.

- Use digital tools. Apps like Credit Karma, Mint, or Credit Sesame send you alerts and updates to let you know about new inquiries or accounts.

- Protect your private information. For all of your financial accounts, use strong, unique passwords and two-factor authentication (2FA).

- If you have to, put your credit on hold. Freezing your credit is the best way to stop new credit lines from being opened in your name.

Frequently Asked Questions (FAQs)

Q1: How long does it take to work out a credit problem? The FCRA says that bureaus have 30 days to look into a claim and get back to you. They can get an extra five days if you give them more information.

Q2: Will arguing hurt my credit score? No. If you file a dispute, your score won’t change. If you take out things that are wrong, it can get better.

Q3: Can I argue about mistakes on the internet? Yes. You can dispute things online with Experian, Equifax, and TransUnion. Sending certified letters and attachments, on the other hand, can sometimes get things done faster.

Q4: What if the bureau won’t fix the error? You can:

- In your report, include a statement of disagreement that is no longer than 100 words.

- To file a complaint with the Consumer Financial Protection Bureau, go to consumerfinance.gov/complaint.

- Call your state’s attorney general or get legal help.

Q5: Should I talk to the creditor directly? Yes. When you dispute with both the creditor and the bureau at the same time, it usually speeds things up because creditors have to look into the matter and get back to you.

End

Your credit report is the best way to show how good you are with money. Big or small mistakes can cost you thousands of dollars in higher interest rates, lost job opportunities, or even the problems that come with having your identity stolen. You can keep your report clean and get the most out of your credit by knowing the 10 most common mistakes, following our step-by-step dispute process, and using best practices for ongoing monitoring.

Everyone who buys something should have a good credit history. It’s time to act today: request your free yearly reports, read them carefully, and quickly dispute any errors. Your credit report is important for your financial future, so take good care of it.

References

- Federal Trade Commission, “Credit Reports: How to Dispute Errors,” Annual Credit Report Study, October 2013. https://www.ftc.gov/credit-report-error-study

- FICO, “Understanding the Impact of Late Payments on Your Score,” 2024. https://www.myfico.com/credit-education/late-payments

- U.S. Government Publishing Office, “Fair Credit Reporting Act (FCRA),” 15 U.S.C. § 1681i. https://www.govinfo.gov/content/pkg/USCODE-2018-title15/html/USCODE-2018-title15-chap41-subchapIII-sec1681i.htm

- Consumer Financial Protection Bureau, “Submit a Complaint about Credit Reporting,” 2025. https://www.consumerfinance.gov/complaint/